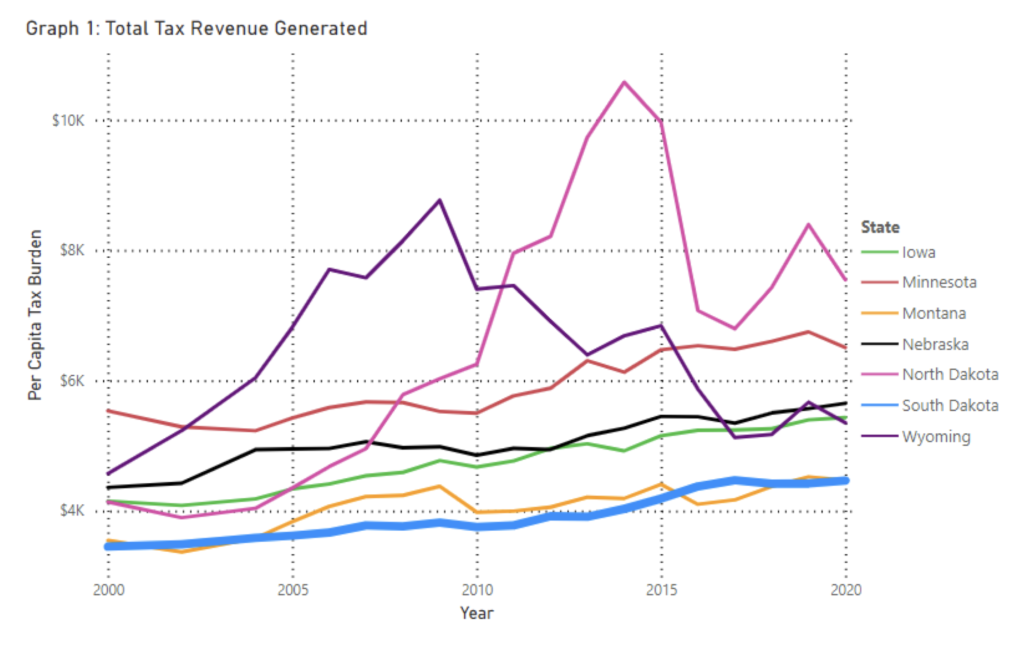

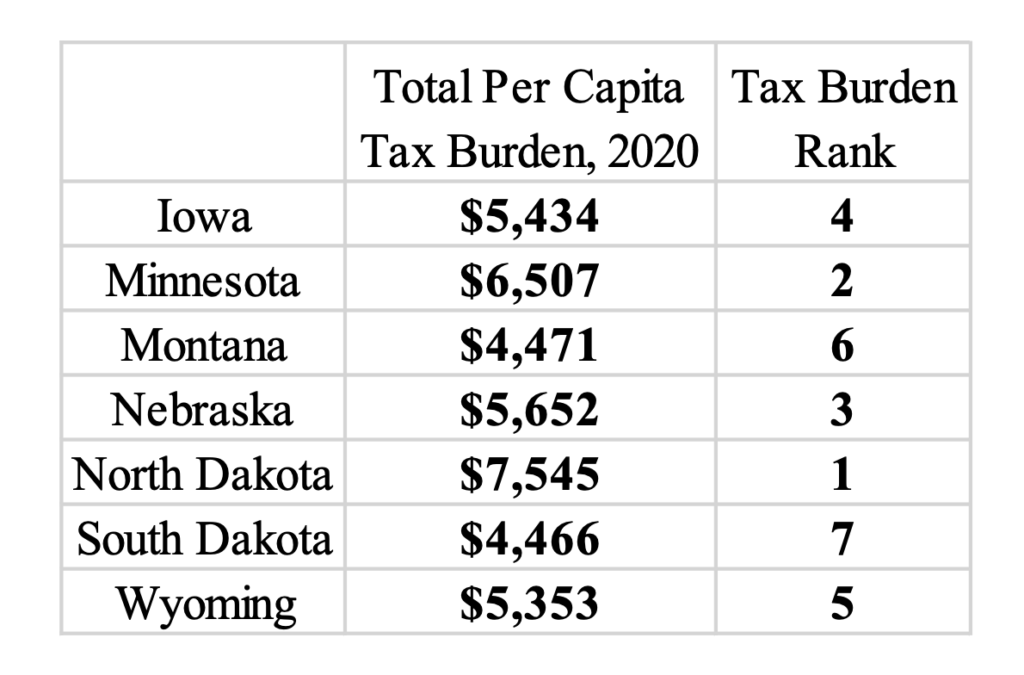

The Legislative Research Council reinforces the point I made last week that, yes, taxes are low in South Dakota. An August 7 research memo to the Legislature’s Executive Board shows that South Dakota has the lowest per-capita state and local tax burden in the septa-state region. We beat Montana by $5:

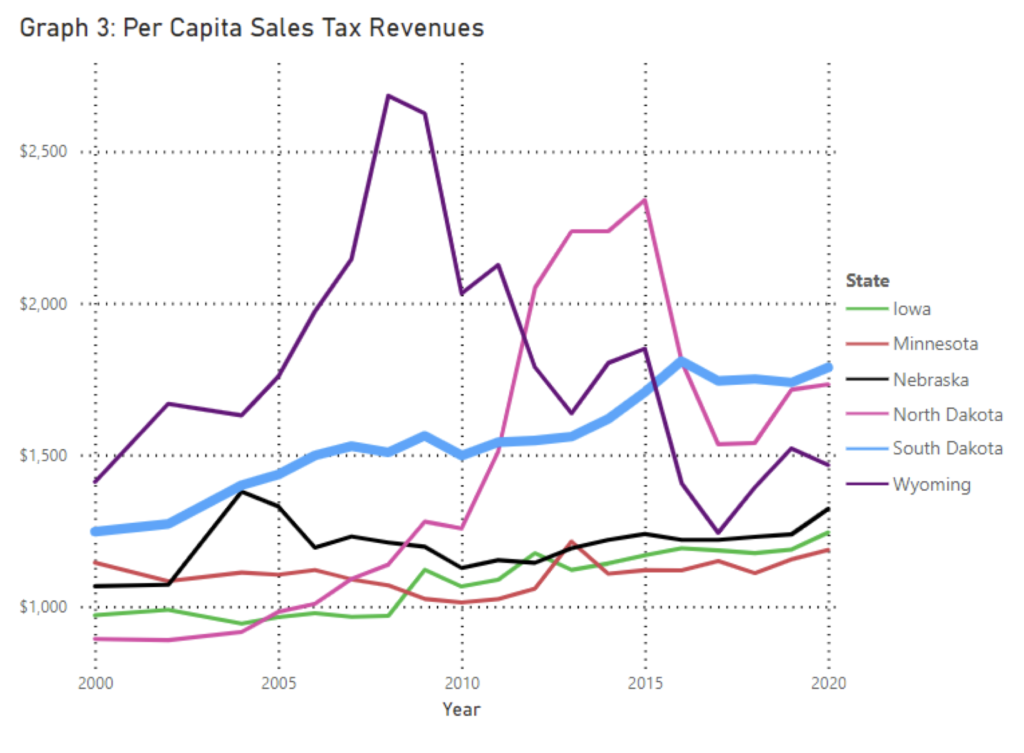

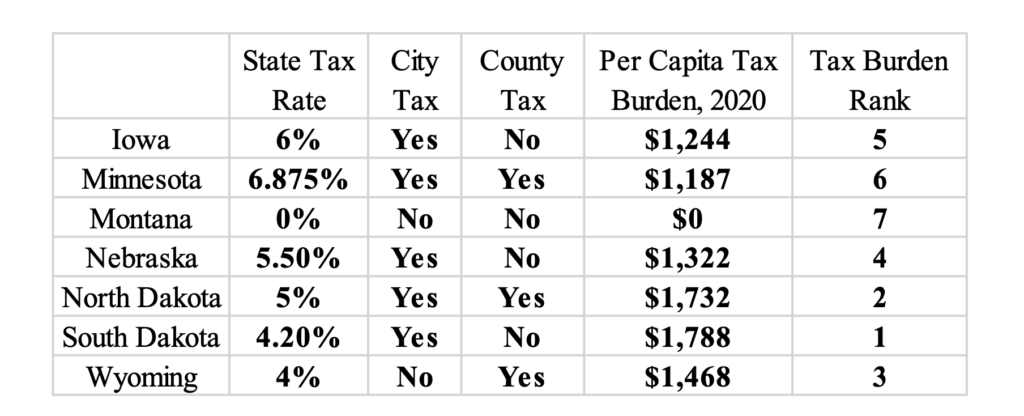

But South Dakotans feel a greater tax burden when they go to the grocery store, as they pay more per capita in sales tax than any of their neighbors:

We achieve that high sales tax burden by being the only state in the region that taxes food. (Maybe we should do something about that.) Montana gets by without any sales tax.

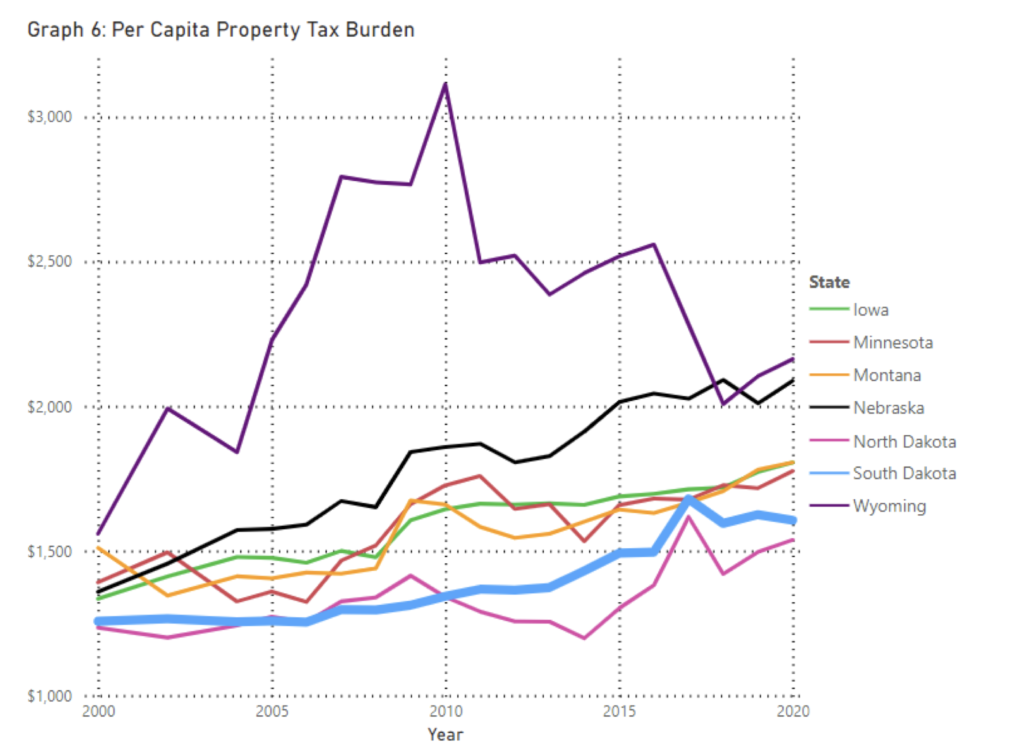

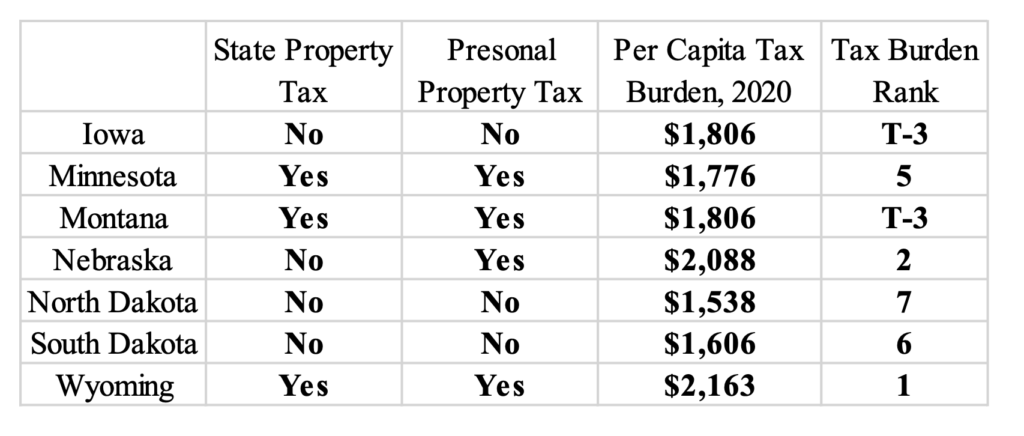

We do keep property taxes relatively low. Over the past two decades, we’ve tangled with North Dakota for the lowest per-capita property tax burden:

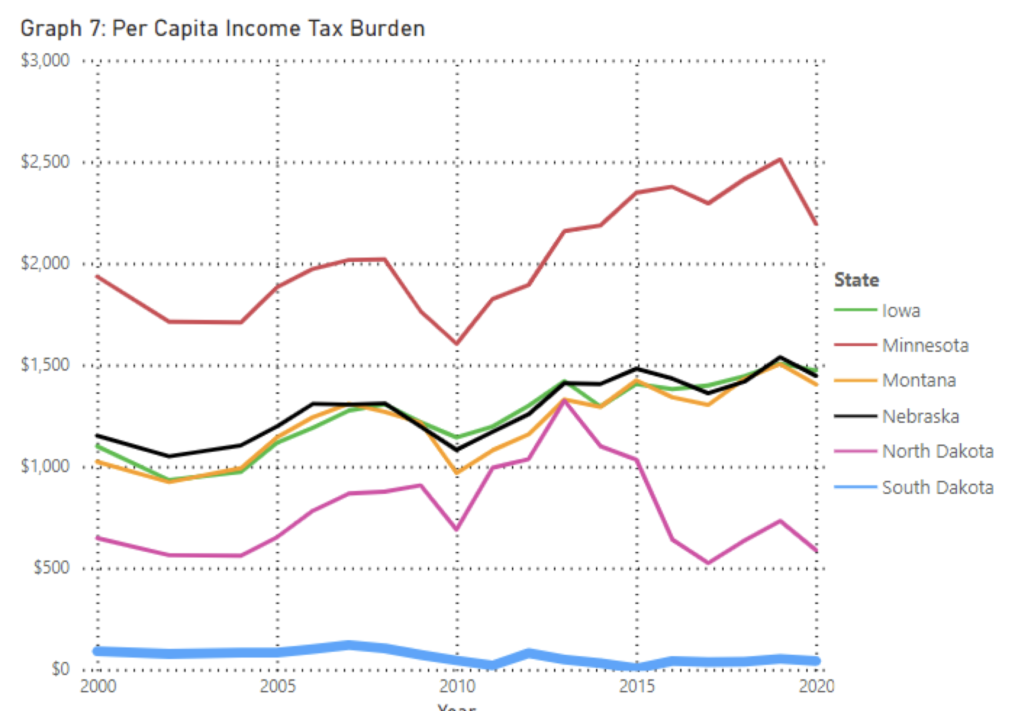

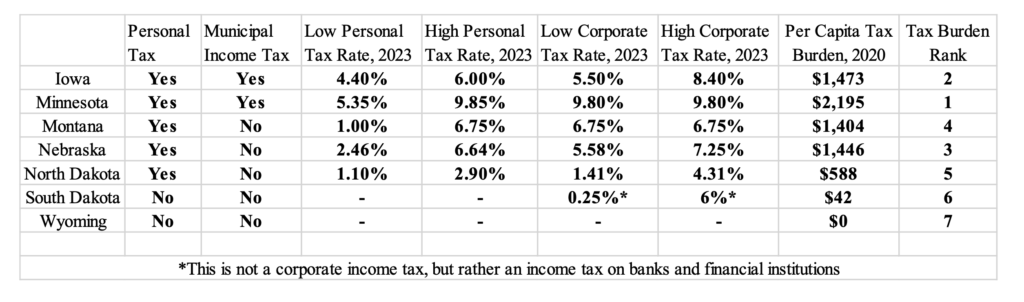

Our meager income taxes on banks and financial institutions amount to only $42 per capita:

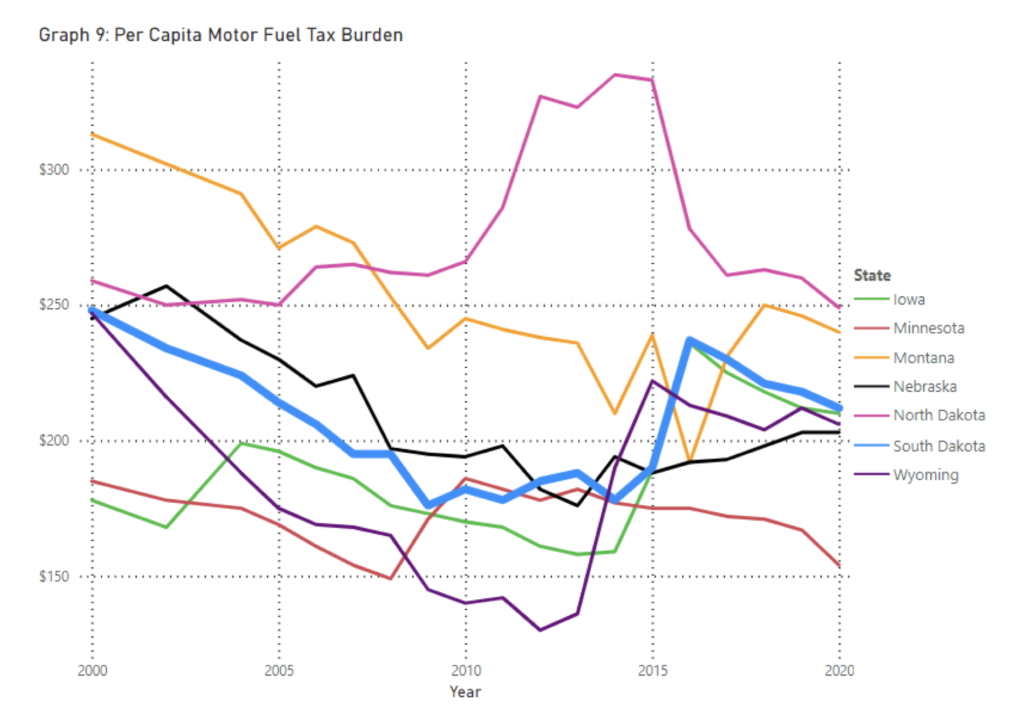

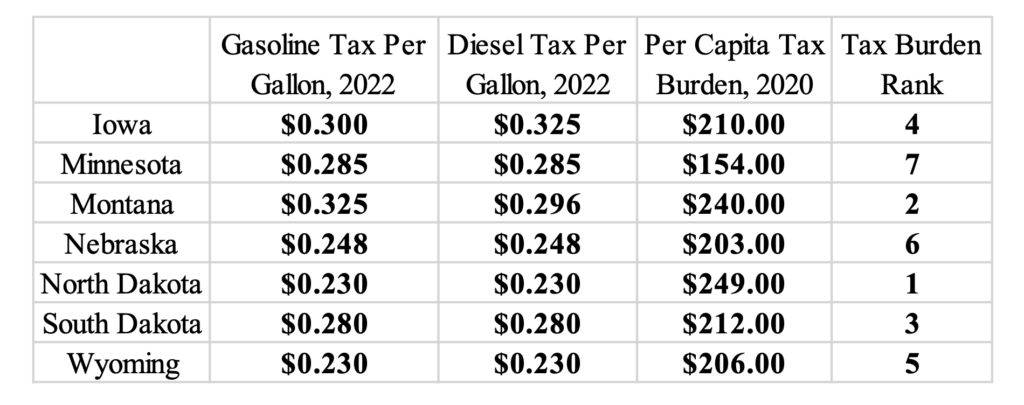

South Dakota’s gasoline tax is a half-penny less than Minnesota’s, but per capita, South Dakotans pay nearly 38% more in gasoline tax each year, because, LRC speculates, South Dakotans have to drive farther to get to whatever they need than do their more urban Minnesota neighbors.

The LRC advocates no changes in this Issue Memorandum; the Legislature’s researchers simply offer the data to inform tax-policymaking during the next Session.

Great analysis! Thanks for undertaking and sharing.

The lowest tax burden helps explain why everything in South Dakota with lasting value was built with Federal money. That’s money that we BLUE states paid in taxes and is being given to South Dakota to help pay its bills. Why does SD need help paying its bills? Because it has the lowest tax burden.

Isn’t that just “poor mouthing” yourself with your hand out to beg at the same time?

Presonal property tax?

North Dakota brought in over $7 billion dollars in tax revenue last year, not including local and municipal taxes. I think the Bakken Oil Fields have a lot to do with why the state brings in the most tax revenue of all the surrounding states in the region. Cory’s first graph shows North Dakota leads in generating the most tax revenue in the region. That is a good thing for the state and its citizens. The oil fields are a great generator of revenue for the state of North Dakota. Any state like Montana or North Dakota that have high in-demand natural resources are always going to outpace states like South Dakota that do not have or mine those resources. These mined resources are some of the largest tax revenue generators. They generate electricity and they generate the state tax coffers. South Dakota does not have anything like that and South Dakota does not even come close to neighboring Montana and North Dakota with the huge billion dollar reserve funds both states are currently sitting on. Can you imagine the INTEREST ALONE those billion dollars funds make each year in those states?

Dear Cory;

South Dakota in general may have the lowest Property Taxes compared to other states, but the real truth lies in County Property Tax rates. Pennington County rates the highest in Property Tax rate among counties. When the Central area and Eastern area need more revenue within the county, it mearly raises the rate in the Black Hills area. Those of us that live in the Black Hills area call it the Tree Tax (we’re paying a tax to view the trees – whether our view is fantastic or piss-poor). Perhaps the Legislative Research Council could produce some real numbers to show just what’s really going down with the Pennington County Commissioners in South Dakota. regarding Property Taxes.

Looks like SD was overpaid a tad during the Covid money grab. https://kbhbradio.com/feds-say-state-overpaid-36-million-in-unemployment-benefits-during-pandemic/

South Dakota does have wind and solar along with geo thermal. Just doesn’t have a government that will work to develope these natural clean resources.

North Dakota and Montana can skim off the interest in millions of dollars of the billion dollar reserve accounts both states sit on due to the taxing of oil and coal.

All Mammal. One wonders how al the “extra” federal UI dollars were stolen, when early on in the pandemic, Mrs. Noem DECLINED to accept the extra UI dollars to begin with? https://thehill.com/homenews/state-watch/512177-south-dakota-declines-unemployment-aid-from-trump-executive-orders/

I remember wondering as I received my already double to SD UI benefits from MN + the extra Fed. $300/wk, how the SD unemployed were making it.

When Republicans seized a large legislative majority in the late 1930’s they did away with an income tax put into effect by Peter Norbeck. The income tax was reinstated during WWII bu Governor Bushfield but abolished once again in 1946. Kniep came within a single vote of reinstating the state income tax in the 1970’s. It is not that we could not reinstate an income tax. Both Parties have done so in the past. We are now choosing not to gore the wealthy man’s ox.

Mr. Umphfres, as a fellow who pays a pretty penny in Tree Tax, I can assure you that you have no idea how property taxes are set. And the Nodakians, they all pay out the nose for an income tax on top of all that oil money their grubbing government soaks up. The flat tax or the consumption tax are the fairest of the taxes.

The great flaw is in how the tax burden is distributed. At lower levels of income, the SD tax burden is likely higher than surrounding states, and it’s a shame that the LRC doesn’t go beyond a per capita analysis. Comparing the burden for those under the median income to those above would be informative but too much of a political minefield for the LRC I suppose

The Council of Research for the Legislatures, Mr. jakc, is known for providing incorrect information to those in the legislatures they don’t like, such as Ms. Frye-Mueller, and skewing results to favor those fellows who used to be in charge and are perhaps still in charge behind the scenes. Mark down grudznick’s words and I will point you to them again, when the political beasts that drive the oxen-cart of the Council steer them in a partisan direction. Sometimes, even, depending on the fellow you approach in the Council, you can find a very liberal slant on items. There was once a fellow, poorly dressed by most accounts, who would write you a paper on whatever you wanted for a song and a dance.

grudznichts – Fourteen times in the last six weeks you’ve made comments about people “behind the scenes”. Are you okay? Being continuously paranoid will put you in a coffin so fast it’ll make your head spin.

PS – As predicted. I think Edwin has left the building. ☹️

Mr. Lansing, just because grudznick might be paranoid doesn’t mean they’re not watching me and you.

grudz

sad, but not surprising I suppose

R.I.P grudz

Okay, the data is in. Thanks Cory. The data calls for semi-annual shopping trips to Costco in Billings, in conjunction with low cost flights in an out

Grudznick, I wish that we would levy the flat tax — without income limits — for Social Security. Even you flat-tax-is-fair conservatives (with and without common sense) cap the income of the “fair” flat taxes we have.

I may even be able to get behind the idea of a flat tax IF a minimum guaranteed income level were established to ensure that basic need spending was not disproportionately, regressively, making it harder for our fellow man. Taxation that does not factor in the concept of disposable income is immoral.

Grudznick..I am not on your page..I think you premise is absurd. The State, other States, or National Democratic is not investing money in the Arnold’s “sell the farm deal” to an Out of State dairy.

Mr. O, I appreciate your comments.

Mr. Blundt, I apologize for any misconstruing.