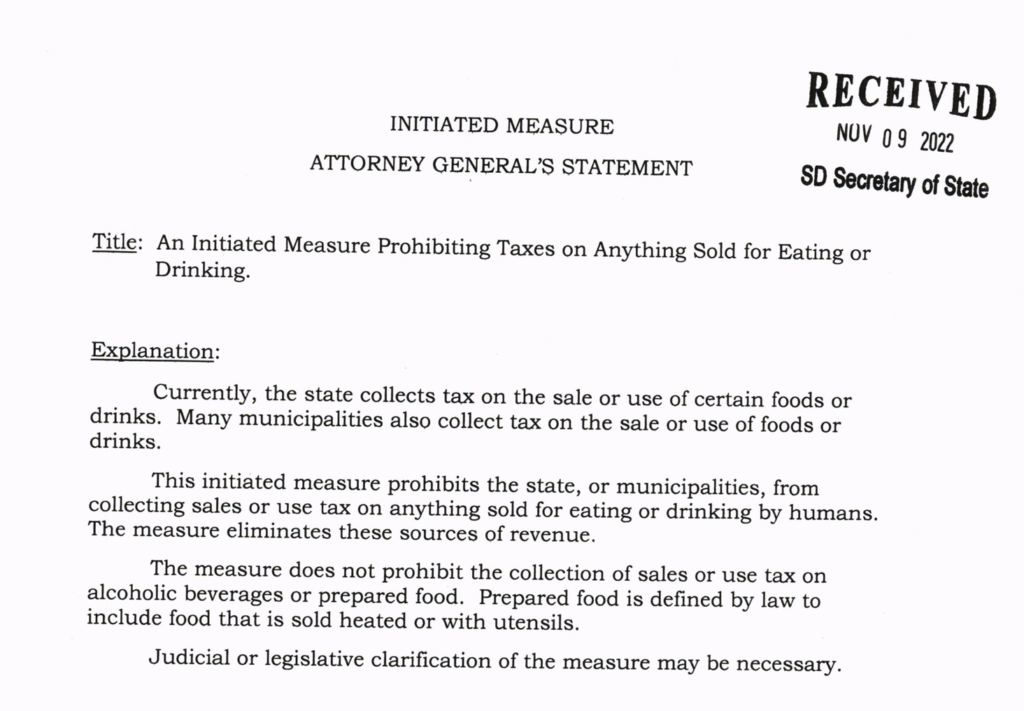

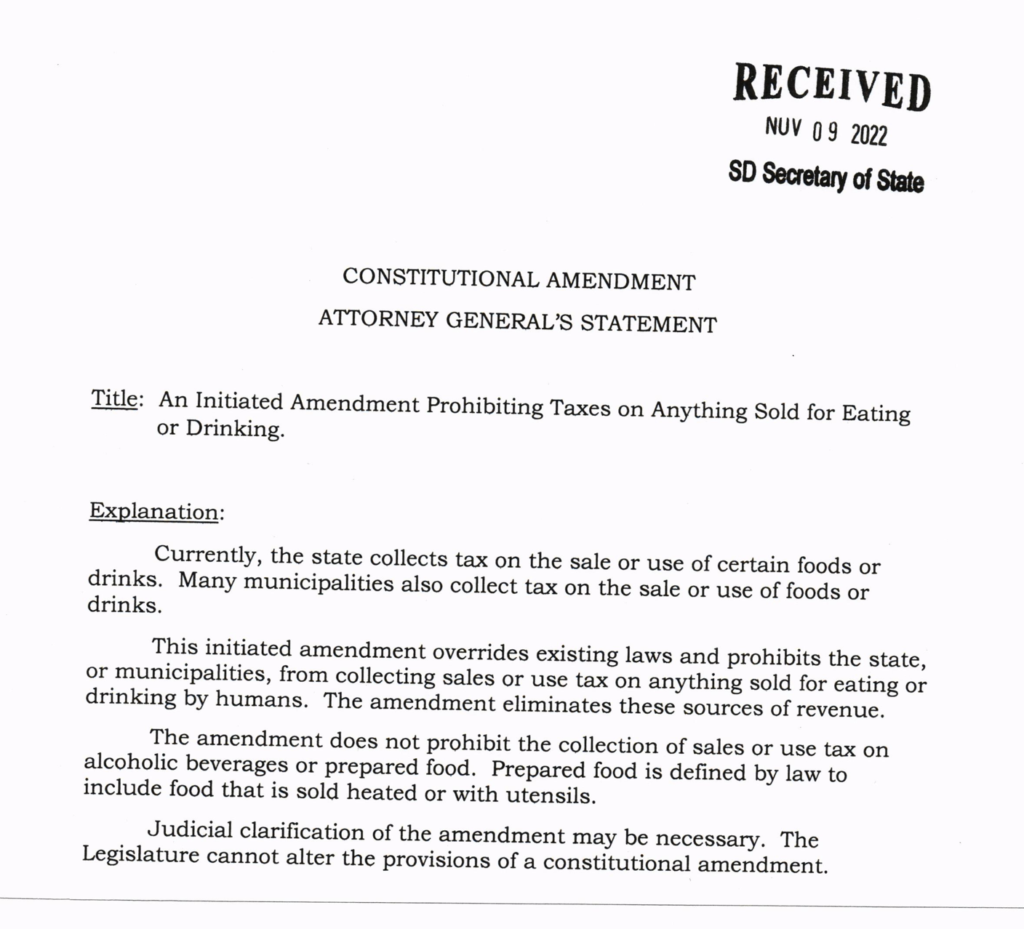

Last month, Attorney General Mark Vargo issued draft explanations of two initiatives proposing to repeal South Dakota’s sales tax on food. The Attorney General’s drafts incorrectly assert that the constitutional amendment and initiative law proposed by ballot question committee Dakotans for Health would prevent the state and municipalities from taxing food.

Three of the six comments submitted during the ten-day public comment period pointed out this error. But yesterday, Attorney General Vargo issued his final explanations unchanged, still asserting that the amendment and the statute apply to cities as well as the state.

Rapid City lawyer James Leach, who provides legal guidance to Dakotans for Health, pointed out that the Attorney General’s explanations contradict the Legislative Research Council’s finding in its fiscal notes that the proposed initiatives apply only to the state:

With respect, the LRC is correct. Neither proposal affects municipalities’ ability to tax food and drink. Both measures say that “the state may not tax” (emphasis added) food and drink. The State’s power to tax food and drink comes from SDCL 10-45 and 10-46. Municipalities’ power to tax food and drink has a separate source: SDCL 10-52-2.

The word “State” and the word “municipalities” have plain, common, ordinary meanings. Prohibiting the State from taxing food and drink does not limit municipalities’ ability to do so [James D. Leach, comment submitted to A.G. Mark Vargo, 2022.10.25].

Two eager readers of this blog, Richard Schreiver of Lennox and Dale Christensen of Watertown, submitted similar comments. Schreiver added, “When legislators (and the people are acting as legislators when they vote on these issues at the polls) write laws they include language that specifies which governmental divisions or subdivisions of the state that law affects. Examples: SDCL 1-25-1, SDCL 1-27-1.1, and SDCL 1-27-20.”

Representative Lana Greenfield (R-Old 2/Doland) submits a comment that has nothing to do with the Attorney General’s explanation. Instead, Rep. Greenfield irrelevantly states that she only wants to exempt “foods with nutritional value” from sales tax. “It is senseless,” says Rep. Greenfield, ” to exempt soda, chips, and candy from sales tax.”

It’s funny to see Republican Rep. Greenfield propose using taxes to socially engineer people’s eating habits. It’s also funny to see Rep. Greenfield miss the point of this public comment period. Rep. Greenfield should know better: she voted for 2021 Senate Bill 123, which created this largely frivolous 20-day delay in the initiative process, so she should know that the law calls for comment on the attorney general’s explanation, not on the initiative itself. The Attorney General has no power to rewrite the initiative; his explanation cannot include any suggestions for alternative initiatives.

One Dennis Lutterman submits a similarly irrelevant comment—again, not irrelevant to the broader public policy discussion, but irrelevant to the specific legal parameters created by Greenfield and the Legislature for this public comment process—urging us to keep taxing food, because it makes people eat better and prevents the election of Democrats, the implementation of an income tax, and the loss of South Dakota’s low-tax/no-tax marketing advantage:

Keep the tax. It works. Look around, you will see that most people are eating better than they should.

I can look ahead and see the future here. Without a tax on food, there will come a budget shortfall. Our political governor will be one of the many Republicans getting blamed for it. Democrats will get elected. They will propose an income tax and get it. South Dakota will lose its main selling point for the future.

I will be moving to a no income tax state [Dennis Lutterman, comment submitted to A.G. Vargo, received 2022.11.04].

Like Representative Greenfield, Lutterman expresses debatable policy points (though I would like to see evidence to his assertion that the current tax on all food drives anyone to eat better; if anything, a tax making all food cost more only drives more consumption of cheaper, less healthy food…although maybe Lutterman believes eating better means eating less), but they have nothing to do with the content of the Attorney General’s explanation of the proposed initiatives, which is all the law allows the A.G. to consider in this process.

Public comments were due November 4. Stacy Kooistra, the city attorney for Sioux Falls, chimed in late on November 8. Kooistra endorsed the Attorney General’s misreading of the proposals and said the City of Sioux Falls wanted the A.G.’s explanation to tell voters that removing sales tax from food “will significantly impact both our general fund and capital fund, which will likely result in the reduction of services and capital investments.” Kooistra said the City of Sioux Falls “believes that the impact will be even greater on South Dakota’s smaller communities, due to their sales tax bases being far less diversified.” Koositra said the city presumes “there will be a fiscal note” that will inform the voters of “the total impact to the state and municipalities”… but that fiscal note already came out three weeks ago and indicated no fiscal impact to Sioux Falls or any other municipality, since the LRC concluded “Municipalities could still tax anything sold for eating or drinking by humans.”

Petition circulators are required to provide people who sign their petitions with both the Attorney General’s explanation and the Legislative Research Council’s fiscal note. The state cannot require petitioners to hand out contradictory information. These two agencies need to reconcile their differences. More to the point, A.G. Vargo needs to read the exact language of the proposed initiatives, the way the LRC did, and tell petition signers and voters that these measures affect only the state, not municipalities.

If a lawsuit is filed can the courts step in and issue a clarification?

So if I am understanding this correctly, South Dakota replaced an incompetent, killer attorney general with one who is just incompetent?

Nick, yes, that seems inevitable.

Perhaps Vargo’s office has concluded that the term “state” as used in this provision encompasses a municipality as simply one part or subdivision of a state. In another context, for example, to prove a violation of a plaintiff’s civil rights the plaintiff must prove the defendant’s act constituted “state action.” Actions by any government unit within a state, including a municipality, would qualify as state action.

https://www.law.cornell.edu/wex/state_action_requirement#:~:text=The%20state%20action%20requirement%20refers,rather%20than%20a%20private%20actor.

Perhaps it is in that sense that the AG deems taxation by a municipality to to be taxation by the state. The “state,” as used in this proposed law, is simply a label that includes all aspects of government within that state’s political boundaries.

Since as attoerney Leach points out common usuage can give different meanings to the terms “state” and “municipality,” however, it would seem that Nick’s judicial solution to defining the “state” for purposes of this amendment will be necessary. Does this amendment mean that no South Dakota governmental, i.e. “state,” entity may tax food, or does the provision’s failure to explicitly list municipalities, cities, towns, counties, et al, nor identify any particular taxing statutes, mean cities, towns, counties, et al, are excluded from this restriction? It would seem Vargo’s office may have concluded the former by reading the proposed amendment broadly.

I’m not convinced this is nearly as cut and dry as Cory suggests. If the state legislature is constitutionally prohibited from taxing food, can it authorize municipalities to tax food? Under “Dillon’s Rule,” municipalities “possess only those powers conferred upon them by the Legislature.” Olesen v Town of Hurley, 2004 SD 136, p15. If the legislature constitutionally lacks the power to tax food, then it could not confer that power to another.

An argument can be made either way, but it is inaccurate to say that Vargo obviously got this wrong.

Fair point, Kyle. We need A.G. Vargo to say whether that’s the principle on which he bases his explanation.

But I can tell you from personal experience that Jim Leach is a pretty good lawyer. If “state” included “municipalities” in this context, he’d say so.

Nick, BCB, we’ve had litigation over AG explanations before, usually from folks trying to delay the circulation of petitions or obtain an explanation that favors their position on the proposed initiative. If Dakotans for Health sues over this explanation, the trial would be different: it would be the first time I can recall that the complainant would be asking the court to resolve a debate about the meaning and scope of the initiative itself.

Crucial to that argument is the fact that the LRC and the AG have come to opposite conclusions. There is no statutory process for resolving such disagreement; we’ve got to go to court for an answer.

20 years ago I watched US Attorney Mark Vargo collude with one of the most venal people ever to sit on the Federal Bench, US District Judge Richard Battey, to deprive a citizen of SoDak and a member of the Oglala Sioux Tribe of a jury trial.

Alwx White Plume planted hemp two years in succession on sovereign land outside the USA. Two years in succession, paramilitary organizations in mercenary employ of the USA destroyed his crops.

At this point, in 2002, Battey and Vargo got together and injoined White Plume, arranging a conviction without trial and an 18-month prison gig if he touched a hemp seed or allowed same to be within his purview. The charge would have been “contempt of court,” plenty of which I assume White Plume owns.

I think Vargo is just plain incompetent, giving him the benefit of the doubt on being malicious.

The best option frankly may be for Dakotans for Health to revise its proposed Amendment to remove any ambiguity that might need to be sorted out by our courts. That would probably take less time and less money than a lawsuit trying to resolve the question. The whole issue might also be moot by the end of the legislative session.

Mr. H, you should never compare the Council for Research of the Legislatures competency against anybody, for anybody will always win. Young Mr. Krause seems saner than most on this issue. It is all moot anyway, since the legislatures will act on this lickity spit.

Ugly, Kyle, but true: either way, the Attorney General has created a situation that may delay the launch of a food-tax-repeal petition drive by months. If D4H makes the revision you suggest, it has to go back to square one and submit that language to the LRC for review, then to AG for a new explanation.

The Legislature might moot the issue, but I’m not convinced Gov. Noem will back it and get Schoenbeck and the Senate GOP on board.

Mr. H, you fail to fully understand the level of horse trading that can go on in the lobbies and the back offices of the floors of the government. I am sure that Mr. Schoenbeck and Ms. Noem have their full staffs working up a series of moves which will play out during the sessions. Many balls will be tossed, and hand feints will be galore.