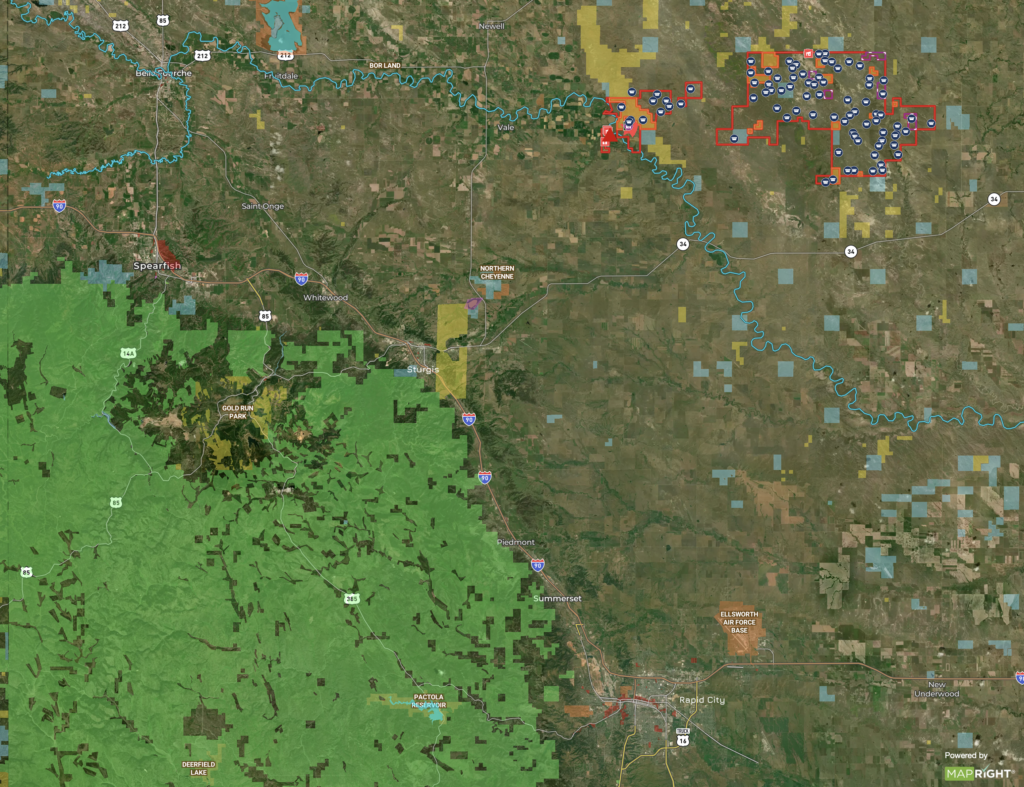

One of the richer men in South Dakota is trying to get out of South Dakota. 2009 lottery winner Neal Wanless has been trying to sell his 65-square-mile Meade County ranch since 2020.

65 square miles—that’s 19% bigger than Rapid City, which is 54.77 square miles. That’s 59% the size of Custer State Park, which is 71,000 acres, or 111 square miles. That’s 1.8% of Meade County, which is 3,471 square miles, the largest county in South Dakota.

Sure, the ranch has shops and barns and a couple houses that are too darned big, but look at all that open space, as far from any busy road as you can get in South Dakota. Imagine the bison preserve a guy (or a gal) could build on that land, or the shooting range, or the mountain bike trails, or all three. I could just put up a cabin near the confluence of Nine Mile Creek and the Belle Fourche River, write every morning, then go out biking on the open plains chasing the thousand wild horses… if only blogging and biking could pay the $111,706 annual property tax.

But somehow, at his offering price of $41.15 million, Wanless got no takers. So after two years of trying, Wanless has dropped his ask to $37.5 million.

But wait: why would Wanless, who took an $88.5 million lump-sum payment after taxes out of a $232-million Powerball jackpot thirteen years ago, wander away from all that wonder for any price?

As to why Wanless is selling the property, [Hall and Hall agent Robb] Nelson cites a lack of use, telling KELOLAND News that Wanless “married a gal from Canada,” and that they spend much of their time between British Columbia and a property they own in Arizona [Jacob Newton, “Powerball Winner Looking for Buyer of South Dakota Ranch,” KELO-TV, 2022.05.11].

Wait a minute—South Dakota rags-to-riches ranch kid gets a whole bunch of money, and prefers to live in Arizona, which has a state income tax, and British Columbia, which has provincial income tax, national sales tax, single-payer health care, and all sorts of other socialism? Wanless explained his preference for those far-flung taxing locales over low-tax South Dakota when he put the Bismarck Trail Ranch on the market in 2020:

Mr. Wanless, 34, said he is selling because he and his new wife, Jody Gilson Wanless, are spending more time at her family’s cattle ranch in Canada’s British Columbia. They also recently purchased a house in Arizona, where they plan to spend the winters. “I like the South Dakota winters, but I don’t like the wind,” he said [Katherine Clarke, “South Dakota Cowboy Who Won $232.1 Million Powerball Lists $41.15 Million Ranch,” Wall Street Journal, 2020.09.02].

Wind?! Well, that blows away the argument that South Dakota is super-attractive to the super-wealthy… that and the fact that no millionaires have swooped in to buy this spectacular property.

It’s highly curious that you and an interested party found Mr. Wanless’ plight poignant this morning.

Plight? Ah yes, terrible situation. How will he ever cope?

Is it to be sold as a single unit or will they sell it off in parcels to local ranchers who can’t afford or don’t want that big a place?

It’s easy, for instance, you’d have to pay me to live there. It’s about as out of the way as you can get in America. Isn’t their a new right wing Posse Comitatus or something that would like to remove themselves from society? Except for the occasional bombing of course. Any restaurants in Mud Butte? On the other hand attending Sturgis every year at Covid central would be good. Maybe Willis Johnson? Oh rats that’s another article, sorry.

$20 says every well on that parcel is contaminated with nitrates and heavy metal oxides.

Nearly a century of residue from Black Hills Mining District affects millions of cubic yards of riparian habitat all the way to the Gulf of Mexico. Although the Oahe Dam was completed in 1962 sequestering most of the silt the soils of the Belle Fourche and Cheyenne Rivers are inculcated with arsenic at levels that have killed cattle.

Endangered pallid sturgeon, paddlefish, catfish and most other organisms cope with lethal levels of mercury throughout the South Dakota portion of the Missouri River.

I’m sure Mr Wanless felt great loyalty to his home state at one time. But he was young and foolish when he received that lottery money, and things have changed for him. Had he been more mature at the time he may have got the hell out as soon as possible. Over recent years we have seen how the quality of life in the state has been driven downward making it nearly impossible to live here. Everything of any value to a family has been damaged by the republican domination.

I used to drive Hwy 34 to Bismarck a lot (100 mph out there is not uncommon. No other cars.) The Belle Fouche River crossing is sublime. It’s color and summer temperature like warm skim milk, lovely wading, prolly from all the grey shale. Always wondered what was upstream of there. Could be Kristi’s next big thing, Trump’s Greenland!

Wouldn’t be surprised if driving those 65 mile cattle roads/trails turn to impassible gumbo, five inches thick on tires, after a rain. The Sat Photo seems to show original scarification evidence on the ranch from NW to SE, created, some geologists theorize, by massive flooding from rapid, multiple Ice Age ice cap melting events as a result of global climate changes. Flood flows went AROUND and over the existing and rising Black Hills, crustal warping responding to weight of the ice relief, headed to the Gulf of Mexico. Same thing is evident in the Badlands.

Mine tailings poisoning is real but likely confined to Whitewood and Elk Creek bottoms and a few others all the way along to the confluence with the Cheyenne River to the Missouri River. If there is any water out there on the Bismarck Trail, or if anything will grow the Saudis will buy it like they have done in the Southwest. https://www.theguardian.com/us-news/2019/mar/25/california-water-drought-scarce-saudi-arabia

“Alfalfa farms shocking waste of resource” California university economist.

https://www.csmonitor.com/Environment/2016/0328/Why-Saudi-Arabia-bought-14-000-acres-of-US-farm-land

Heck, Kristi hasn’t been luxury vacationing on the taxpayers dollar in the kingdom yet?

Well…if I read my map right, the place is up there on eight mile creek near the border with Butte County. Also has property on the Belle further west. wouldn’t doubt if the kids on that ranch went to Newell for school and the good Voc Ag program there (the Stud Ram show is in Newell every year)..lonely but nothing like living in the Zeona country north of Maurine. Within an hour (the way folks drive out there) you’re dancing at the Rancher in St. Onge or drinking in the Old Style. You’re just around the corner from the bar in Union Center where Senator Cammack has his shop and the Rhoden Rangers do their drinking. The buyer won’t hurt for company. People are sociable out there. Mr. Wanless isn’t the only high plains settler to be driven off by the wind.

Folks forget that 140 years ago pilgrims “settled” in rural South Dakota – not for love – for the best opportunity of the moment.

Those moments passed. Tens of, if not hundreds of thousands went west in the 1930s. The outward migration from rural South Dakota continues today.

Wanless saw better opportunity. Congratulate Wanless for growing up.

The ranch should revert to uses noted by Cory — or the Buffalo Commons.

A state without an income tax is offensive. Can you imagine Norway and Sweden with no income tax?

The fact that if you drink water or eat anything in South Dakota, you must pay Noem’s treasury should get every Libertarian and Democrat and Independent chomping at the bit to repeal the food sales tax. You know the saying , why are we paying a sales tax to eat or drink?

If the Democrats ever grew some balls, the answer is to abolish the sales tax on food, drink and clothing, and put a small income tax of 2% for high income folks and 1% for middle income people. Increase the tax on trust funds too.

So the answer is in 2024 put the food and water and clothing sales tax repeal on the ballot!

Will we need 51% or 60% to pass this and make this Law.?

It does not involve raising taxes. Actually, you would be cutting taxes! So 51% could kill the sales tax on food and clothing. The Republicans and Democrats won’t do it. We can do it!

So the state budget gets cut by what 200 million or so by cutting the sales tax. No big deal. Any 3rd grader can balance the budget, it will just be smaller by 200M.

The lie that Republican Party wants smaller government is a myth, a total lie. Cut their money! Give the far right Legislature less money then.

Cutting the sales tax on food and clothing would pass with the People’s vote.

The comments about the state sales tax on food are off base. Our sales tax in SD is small compared to many other states. I find the over-use of property tax as a much bigger burden on residents of our state. If and that’s a big “if” we were to add an income tax I would much rather see it go towards property tax relief rather than repealing any state sales tax.

Scott, property tax relief might help Wanless sell his ranch—that $112K annual tax bill is a lot. But the rich folks who can afford to buy such an enormous parcel of land won’t notice either that property tax bill or the tax on their groceries… and the rich folks who can afford such expenses can also afford to pay their fair share for the roads and schools and police and other services that make civilized life for such remote rural dwellers possible.

By the way, while Scott’s claim that our sales tax is lower than a majority of other states’ is correct, our tax on groceries is larger than the tax on groceries than the 0% tax applied to groceries in 38 states. Six of the states that tax groceries at least temper the unfairness of taxing basic provisions and apply a lower rate than their sales tax on other items, and in each of those states, that special rate is lower than South Dakota’s 4.5%. Alabama and Hawaii charge the same tax on groceries as on other sales, but their rate is only 4%. So there are only three states—Idaho, Kansas, and Mississippi—that charge people more to eat than South Dakota does.

But the larger point is that rich folks like Wanless don’t take our “Move here for low taxes!” pitch seriously. Arizona has a state income tax. It has a state sales tax of 5.6%. Canada’s taxes are higher all around. But those are the places Wanless would rather spend his time. Our low sales tax isn’t helping our economic development.

Nick, there’s no indication on the realtor’s listing that the seller wants to break up the property. The realtor does note that “the owner currently leases most of the grazing out as well as the production agriculture.” So I would assume right there that the ranch generates income that can cover taxes and mortgage (though can you produce much out there besides hay?) We’ve got big investors snapping up houses to turn into rental properties; you’d think out of that investor class there might be some subset who’d be willing to diversify their portfolios and acquire some ranch land to generate income. But I’d need some expert farmers and ranchers to do some deeper math to tell me if the $37.5M Wanless is asking for this ranch would give an investor the same income opportunity as spending the same amount of money on 125 $300K houses and renting to 300 families at $1,000 a month. (That’s $3.6M gross per year; figure how much it would take to manage those 300 rentals and pay the property taxes, then figure out how much one can make renting 40K acres to a smaller number of adjoining ranchers.)

I would be curious to get a count of adjoining ranchers and find out how many would be interested in acquiring their own pieces of the Wanless ranch. Wanless is selling is land for $900 an acre. Hall and Hall list the 12,669-acre Majestic Ranch near Burke for $28M, over $2,200 per acre, and the 3,621-acre Crazy Hole Creek Ranch near Winner for $9.95M, nearly $2,750 per acre. LandandFarn.com lists some smaller ranchable parcels in Meade County: the low cost is $1,500/acre for some land up by Faith; an 1,160-acre plot closer to Box Elder is going for $2,000 an acre. A couple places near Sturgis are going for $10K and $14.5K per acre. Realtor.com shows a couple of 10K+-acre ranches along Arpan Road northeast of Belle Fourche going for $1,680 and $1,140 per acre. A 1,455-acre lot just a mile west of Nisland on Highway 212 is going for $2,230 an acre.

Given those listings, it looks to me as if 40 ranchers could go in together and get themselves each an extra thousand acres for a lower rate than any nearby land. But how much land does each rancher have to add to his property to make the acquisition worthwhile? Is it safer and cheaper for them just to lease land and stay flexible in their operations?