Representative Jon Hansen and a majority of his fellow House Republicans signaled Monday that, like Democrats, they are sick of South Dakota’s tax on food. Perhaps they could persuade their Senate colleagues to support the next effort at food tax relief by pointing out that South Dakotans in general may be sicker because of our tax on food.

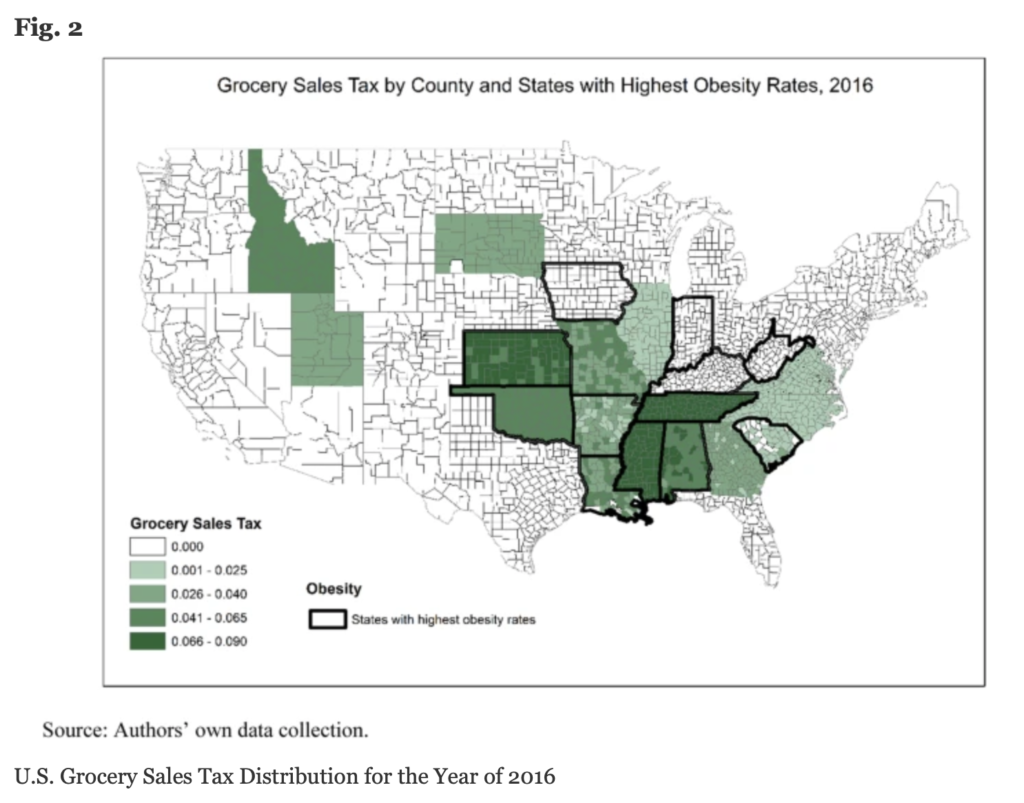

A Twitter friend shares this February 2021 study from the University of Kentucky Department of Agricultural Economics finds that counties in the sixteen states that tax grocery foods have higher rates of obesity and diabetes.

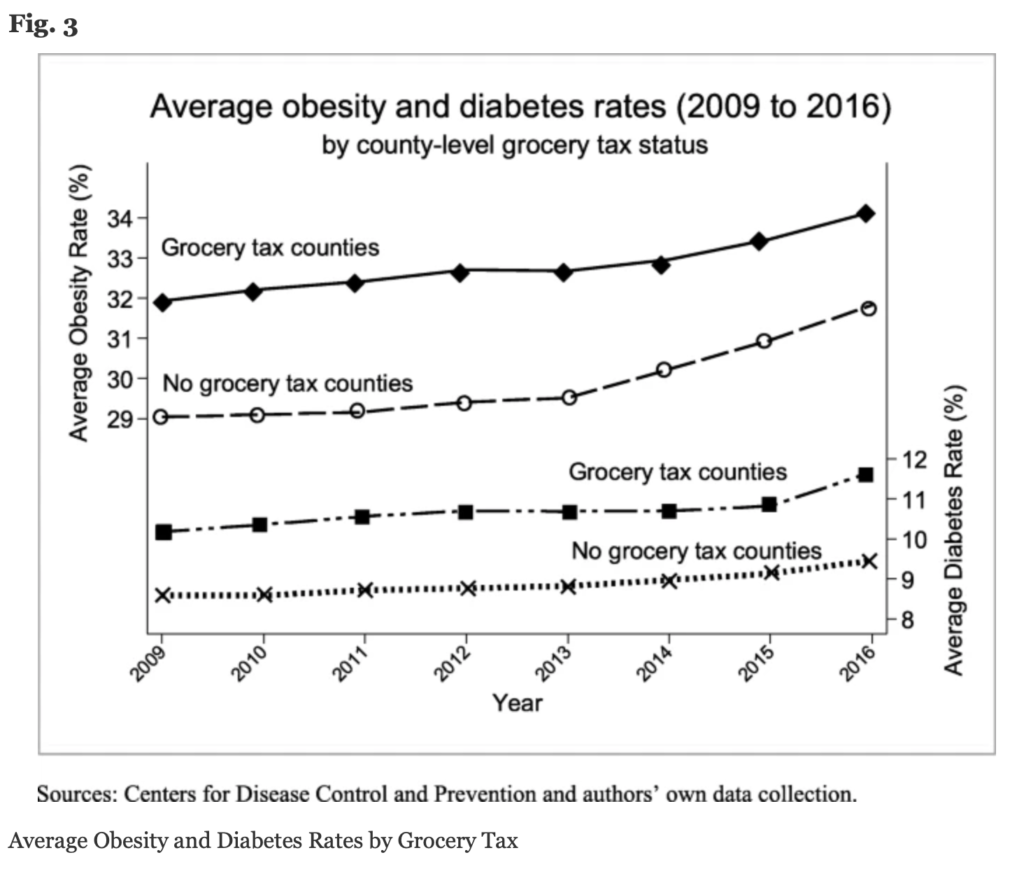

The researchers found that, over their survey period from 2009 to 2016, obesity and diabetes generally increased, but the rates of both maladies are consistently higher in counties that tax grocery foods:

Now you might think that a tax on food would make folks eat less food and that we ought to be worried about hunger, not obesity. However, the authors hypothesize that taxing grocery foods the same as restaurant foods makes restaurant food, particularly fast food, more cost-competitive:

Grocery taxes can affect the odds of eating at home versus dining out through changing the relative effective prices (tax included price) of grocery and restaurant foods. Compared with states such as New York where restaurant foods are taxed while grocery foods are tax exempt, taxing both grocery and restaurant foods in states like Alabama creates more of a disincentive to eat at home [9]. For the poorest segment of the population, fast food restaurants become their primary option as a substitute for grocery foods because fast food restaurants are both more accessible [10, 11] and cheaper [12]. In particular, two recent empirical studies show that grocery taxes reduced U.S. consumers’ grocery food expenditures and increased restaurant food expenditure, and restaurant food sales taxes increased U.S. consumers’ grocery food expenditures [13, 14]. Therefore, the substitution from grocery food to fast food in response to taxing groceries may increase the odds of unhealthy outcomes since there is evidence that consumption of fast food affects a person’s risk of becoming both obese [15] and diabetic [16].

Unlike soda or fat taxes, grocery taxes apply to thousands of grocery items and may effectively change consumers’ grocery food choices. Though not all grocery foods are healthy, reduced consumption of fruits and vegetables may induce obesity [17] and diabetes [18], and food-at-home is widely considered healthier than food-away-from-home. Therefore, we hypothesize that health outcomes are negatively correlated with grocery taxes [Wang et al., 2021.02.13].

When your fruit and vegetable intake consists of the ketchup and pickles on a McDouble, your body will lose a step. But when we make groceries cost more with sales tax, we increase the likelihood that folks living on tight budgets will fill their tummies and their kids’ tummies from the Dollar Menu than from the produce aisle.

That bargain ends up costing counties and states more than what they make on their food taxes. Based on estimates that diabetes and obesity may create additional annual treatment costs of around $1,900 per patient, the researchers estimate that every dollar we raise in grocery taxes costs us $1.90 in health burdens just from obesity and diabetes.

Translation: the Republican Senators and Governor who think we can’t afford to lower our tax on groceries have it backwards. Taxing groceries leads us to spend more as a community on health burdens and leaves us with less to spend on other public projects.

Cory

Of course, with freight added, the price of the same items in Sioux Falls are less expensive(less sales tax) than the same item in Redfield. So there is that too.

90% (total guess) of ‘food’ in grocery stores is junk, packaged stuff.

Remove sales tax for fresh/raw food at least.

ok now do a map of (il)literacy and obesity!

my guess is, it would look identical to the above map.

i think it’s correlation and not causation – people who neglect their health in favor of frequent fast food and giant sodas are typically not super concerned with 3-50 extra cents of tax added to their order. they are choosing the right now benefit of salt, sugar, and fat over the long-term benefits of moderation and attention to dietary details.

if a person wants to, he or she could easily get a week’s worth of fruit, veggies, and decent grains for like $100. produce is CRAZY cheap when you think about it. under 50 cents a pound for bananas!?!? that’s bananas, man! berries and melons and spinaches as far as the eye can see, for much less than the cost of a combo meal at the drive through. maybe a very tiny percentage of food choices are based on sales tax, but ultimately people eat what they want and make excuses later. i’m not any different, and i support the repeal of sales tax on groceries, i’m just saying the reduction in sales tax will not equate to a reduction of binge eating junk food.

American food policy is a tragedy. Taxation is the tip of the iceberg of how we misuse food, the supply chains, and access to and waste of that food. I believe you would find in those nations that do not tax food policies that also address the other elements of bad food policy.

If this is really about ensuring access to quality food for our population — especially our poor population — then let that be the discussion. I feel that part of the current Republican acceptance of a food tax cut is to only to undermine the Governor’s budget and the “rival” Republican faction.

Monsanto owns the world seed bank and produces most items on our shelves- including food. Cheap meals in boxes are packed with preservatives so we are basically feeding our kids petroleum. Between pseudo-food and fluoridated drinking water calcifying the brain’s pineal gland (turning the third eye into stone) no wonder trying to get people excited about anything of import is like trying to excite prozac-induced coma patients.

The Nordic Diet is belatedly in the news. Why the delay?? Those of us with Nordic forebears know these folks live for ever.

https://www.sciencedirect.com/science/article/pii/S0261561421005963?via%3Dihub

I’m amazed, but not surprised, that SDSU didn’t figure this out generations ago. But alas, SDSU does little to nothing for us.

https://www.sciencedaily.com/releases/2022/03/220308102754.htm

You mean the Gipper was wrong about ketchup not being a vegetable?

sx123 I really appreciate your comment about eliminating taxes on healthy foods. Makes total sense. Then why not legalize medicinal and recreational marijuana and increase those taxes beyond what groceries are now taxed. I have no research to base this on but when one experiences the munchies maybe it could encourage healthy choices. Fat chance though huh.

e4s, Janet, Fat chance indeed.

that should be, Yes Janet…Fat Chance indeed.