Radical right-wing Representative Trish Ladner (R-30/Hot Springs) and Senator Jessica Castleberry (R-35/Rapid City) are trying to keep taxes down for their West River ranching constituents. Alarmed by the pending soil table update, Ladner and Castleberry are reviving a 2016 proposal to assessment grazing land as noncropland.

In 2016, Democratic then-Senator Jim Peterson (D-4/Revillo) offered Senate Bill 4, which would have assigned the lower noncropland assessment to “any agricultural land that has been seeded to perennial vegetation for at least thirty years and is used for animal grazing or left unharvested, or is a native grassland….” Remarkably able to notice this Democratic idea through their Republican mental fog, Ladner and Castleberry propose reducing the qualifying grass time to twenty years. For landowners who misrepresent their land use or sneak in some crops without telling the county director of equalization, Peterson proposed a penalty of two dollars per thousand dollars of taxable valuation; Ladner and Castleberry change that penalty to four years’ worth of the difference between noncropland and cropland assessments on the land in question.

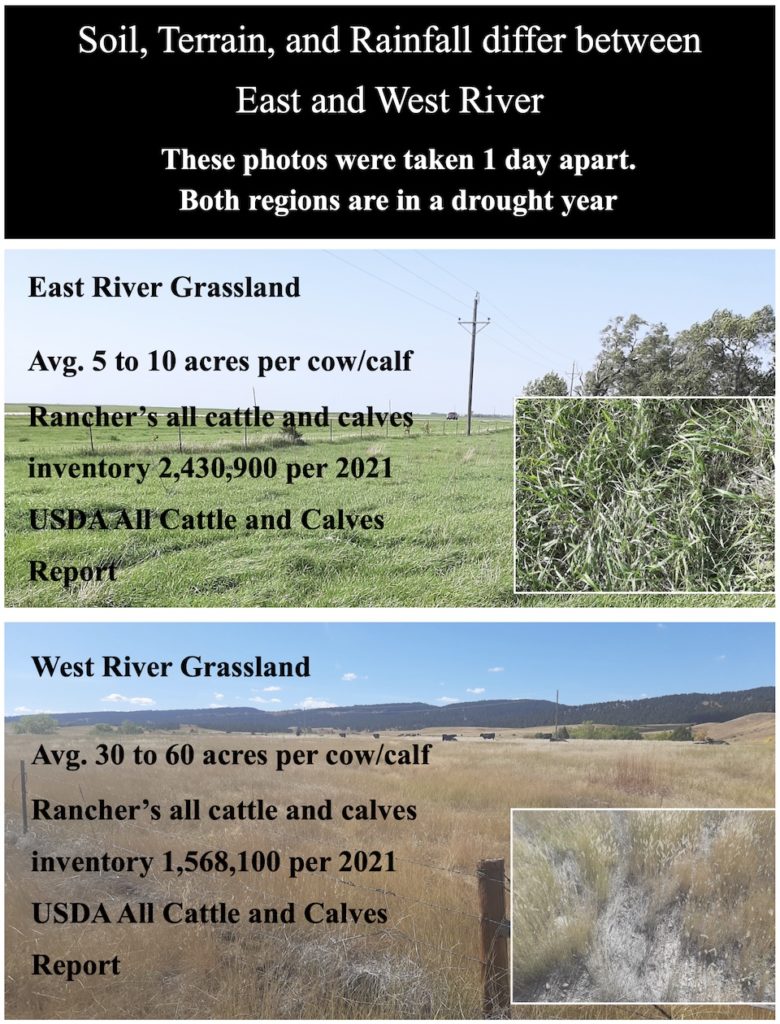

Ladner and Castleberry note that dusty West River rangeland is only a sixth as productive as lush East River pastures:

Now simply designating grassland as noncropland doesn’t resolve this economic discrepancy: Ladner and Castleberry’s draft bill doesn’t distinguish West River from East River. They’ll still need the soil tables and precipitation records and historical sales figures to recognize the lower productivity of West River land.

But that sixfold productivity difference leads me back to my same conclusion: why tax food producers based on the amount of property they hold? Why not just tax ranchers directly on their income? If a beef producer clears $50,000 this year, what does the state care if that wealth came from running cattle on 4,000 acres in sight of Bear Butte or cramming them into some cramped, smelly feedlot on Highway 81? The producer made $50K: take 2% and be done. That would be a lot simpler than Ladner and Castleberry’s scheme of creating another distinction in land categorization and continuing to factor in soil type and rain and historical sales figures.

One has to hat-tip to the stockgroaners – working harder to get another subsidy than working on the spread.

Would it be less expensive making the ranchers government employees than to pay / forgo their subsidies / tax breaks?

Precision fermentation cannot arrive soon enough to usher out this stranded industry and business model.

Simple taxes are almost always better taxes. Cory’s income tax model is better than the convoluted ag property tax scheme. Better yet, tax the revenue. Period. Taxing the revenue removes the accounting gimmicks and games of ‘depreciation’, loses’, ‘carry-forward’, etc. Freedom! Freedom to do what one wants with ones revenue, after taxes, without playing games and gimmicks. A revenue-based tax rate would be very low, yet, almost inescapable,

Typically, income taxes are NOT a substitute for property taxes but are additional tax. So there would still need to be an equitable property taxation system. Using the productive capacity of ag land would still be the nest way to evaluate its relative worth. It’s like the difference in value between a bare residential lot and one that is fully developed, or even closer, a bare industrially zoned lot with little to no infrastructure and one with a built and fully operable factory in place with immediate rail access.

If livestock grazing is the key to preventing wildfires why is ranch country still suffering from near daily high even extreme grassland fire danger indices? Domestic livestock have contributed to catastrophic wildfire conditions and Republican welfare ranchers are the real ecoterrorists who hate subsidies unless they benefit from them.

Had Sen. Tim Johnson been successful in passing S. 3310 as a part of the doomed Omnibus Wilderness Bill the land burned by the Cottonwood and Wolf fires would have been placed within the stewardship of Badlands National Park and much, if not all, of the federal land scorched by the Cottonwood Fire would have been burned off prescriptively in increments instead of being managed by some careless rancher or passing motorist.

After the Soviet Union fell Republicans began their war on the environment in 1991 substituting a new Green Scare for the old Red Scare. Today, only 3 percent of the Earth’s surface remains untouched by human development and a sixth mass extinction is underway. Republicans are scared of the 30×30 public lands initiative.

Clear the second growth conifers and eastern red cedar then restore aspen and oak habitat, prescribe burns, begin extensive Pleistocene rewilding using bison and cervids, empower tribes, lease private land for wildlife corridors, turn feral horses from BLM pastures onto other public land to control exotic grasses and buy out the welfare ranchers Tony Dean warned us about.

Let’s remember who is and has been in power for around 5 decades in So. Dak! The SD GOP has the voters convinced they operate in their best interests; but, this ‘operation’ of theirs concerning taxation

is bent on obscuring their ineptitude to be fair and balanced toward the whole spectrum of ctizens-favoring those with more money to keep and make more money while convincing voters that the other party seeking to govern will tax them more. Meanwhile, they use ‘fees’, favoritism and coercion to run their show of authority. Taxing food, medicine, diapers heavier than they do the riches deposited for

“safekeeping” in our state by world-wide grifters, even drug lords and terrorists in all secrecy. Lying,

meanwhile, about a government that will be full of sunshine and openess and freedom for all.

Next time you order a steak or a hamburger consider the enormous costs to ranchers involved to produce that fine piece of grass fed, well vaccinated burnt flesh. Until you are in the shoes of what it takes to run and maintain a cattle ranching operation…large or small, one has no standing to comment.

What’s next, factor the income of commercial businesses or even residential property owners’ income as an additional factor to assess property taxes so that the officials running things can throw away individuals hard working tax dollars to special interests. Don’t turn your thoughts to this because government is addicted to money…their own and getting everyone else’s.

Here’s a simple fix. Get rid of real estate property taxes all together and start taxing income based upon ones income…a flat % scale no exemptions no exceptions. I bet wages increase for workers and corporations will have the desire to make less, huh. I’ve always stood by the moral principle, we all do better when we all do better.

Until constituents stand out and dont just talk about it to put a stop to tax increases and or inflated revised tax formulas there’s always going to be complaints by the masses with the well supported sense of being treated unfairly whether laws are put in place or not.

I pay property taxes on my home that are wholly unrelated to the income it provides me — none.

O, thanks for bringing that up. Ranchers homes and all other structures are assessed and taxed with the same formula as residential homes-stryctures.

I strongly believe commercial propert is over taxed and should be formulated as any other structure.

If ranchers and farmers are taxed on their income generated on their property so should commercial and home based businesses.

Well…we’ve publically subsidized stockgrowers in the East and West River since statehood. We progressively stole lands from the tribesdepriving them of the ability to become stockgrowers, taking all the potentially productive grasslands in the Rosebud country, the Northwest and Cheyenne strip, chopped up the other reservations by implementing “severalality” which reduced Indian lands to micro properties, declared prairie land on Reservations “surplus” especially if drained by “live water, and turned the greatest hard grass prairie on the continent to dust by overgrazing huge herds of imported, English owned, Texas cattle before opening it for “settlement” through speculation and exploitation by “settlers” who plowed it, proved up, and sold it off. Much of the ground has gone back and forth between stockgrowing and being plowed horizon to horizon by out of state “wheat farmers” with ten year leases. Every enterprise on that West River grass has been subsisized by federal farm programs and state tax policies. It’s land that responds very productively to conservation. Visit the National Grasslands or the LaCreek Refuge south of Martin.

Yvonne says– Ranchers homes and all other structures are assessed and taxed with the same formula as residential homes-stryctures.

Unless that is a recent phenomenon, it is not true. My neighbor has 120 acres with a 30 year newer house and 3 outbuildings, all which give him ag status over my 10 acres with no outbuildings and no ag status. Unless he lied to me which I doubt, I’m paying a little more that twice what he pays in property taxes.

Cibvet. First, to be considered as ag property…the land must be 40 plus acres and other factors must apply. You have 10 acres. Hence your land is assessed based on market value. This 10 acre fight has been at odds with property owners and the director of equalization office for years. That dog wont hunt anymore. You are stuck with that determination.

Second, you base your bald assertion on hearsay from your neighbor?

Contact your county director of equalization office to explain to you the difference between why your property without any structures is valued the way it is from that of your neughbors 120 acre ag land and structures built on it. You will then find out what I said is correct.

Educate yourself and know the facts before you present an assertion based on hearsay.

OK, what are the tax benefits of farming, of ranching? I’m sure there are just a few? It would be nice to have a simple tax system, I’m retired and still pay through the nose at tax time. Mostly for insurance if the feds check me out. It would be nice to spend say an hour and turn in the form. Just think of all the people who would be unemployed if it was that simple.

Really no need to educate myself when you are wrong. If structures are valued the same on property, he would pay more with more buildings and a 30 year newer and 900square foot larger house.. You must be a farmer or rancher to repeat your fallacy. I know what I am stuck with and ag property structures are assessed differently in spite of your condescending reply.