Treasury Secretary Janet Yellen said during her Senate confirmation hearing last week that we can’t afford not to incur more debt to fight coronavirus and the pandemic recession:

“The interest burden of the debt as a share of (gross domestic product) is no higher now than it was before the financial crisis in 2008, in spite of the fact that our debt has escalated,” Yellen said. “To avoid doing what we need to do now to address the pandemic and the economic damage that it is causing would likely leave us in a worse place … than taking the steps that are necessary and doing that through deficit finance.”

Federal government interest payments are now nearly $600 billion annually, but historically low global interest rates have kept them roughly stable as a share of the country’s economic output since the 1990s [Howard Schneider, “Yellen’s Call to ‘Act Big’ Reflects Long Re-Think on Big Government Debt,” Reuters, 2021.01.21].

After voting for spending measures that led to a record 3.1-trillion-dollar deficit in Fiscal Year 2020, Senator John Thune continues to warble his concerns about the national debt:

Coming on top of the more than $3.5 trillion borrowed in large part to fund the coronavirus response last year, “when do we hit the point where the thing starts to collapse? That’s what really concerns me and nobody is talking about it really in either party anymore,” Senator John Thune, a South Dakota Republican, said at Yellen’s hearing [Schneider, 2021.01.21].

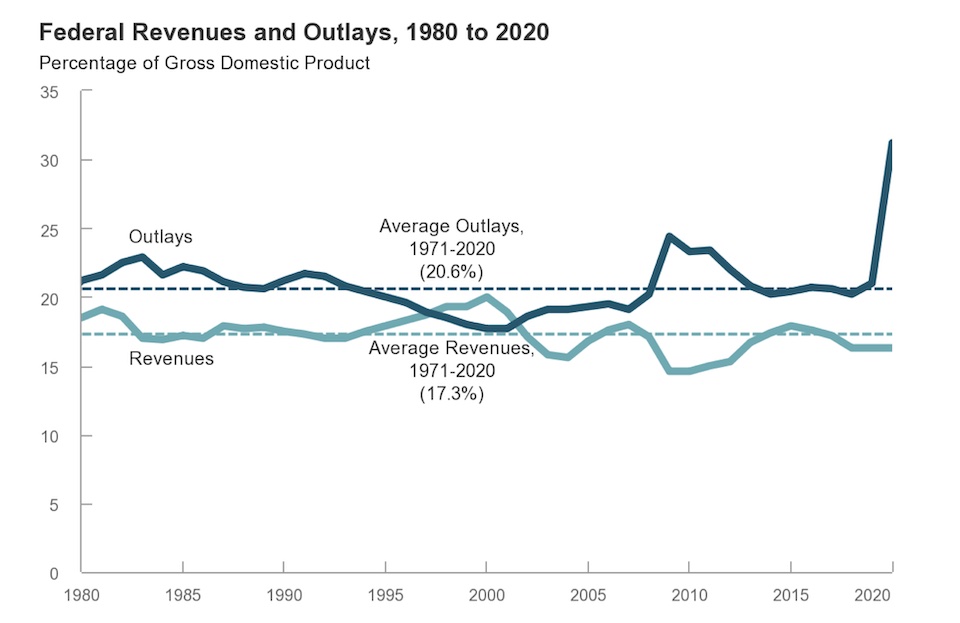

Business major Thune isn’t known for reliable fiscal forecasts. Three years ago, he told WNAX that the tax cuts for the rich that he helped pass would pay for themselves. But even before the pandemic recession contributed to a 1.27% decrease in federal receipts in FY2020 (the first decrease since FY 2009, amidst the last recession), federal receipts increased only 0.41% in FY2018 and 4.03% in FY2019. Those growth rates are significantly below the 6.18% annual growth in federal receipts seen from FY1969 through FY2017 and the 6.30% seen from FY2010 through FY2017 [see Table 1.1]. Federal receipts also lagged as a percentage of GDP, indicating that the while the economy grew pre-pandemic, Thune’s tax cuts left federal receipts in the lurch:

Investors putting their business degrees and economic sense to more consistent use continue to tell us that Thune’s concerns about the national debt are misplaced:

…investors in the federal debt, a wide range of market-focused economists and officials in the Biden administration have a firm response: Don’t worry about it right now.

The debt poses no imminent danger to U.S. finances, they say, so the more pressing concern should be jump-starting the economy to avoid the type of sluggish recovery that persisted for years following the Great Recession.

…More than a decade of historically low rates, coupled with surging demand for safe investments like U.S. Treasury bonds, ensure that Biden can probably spend as much as he wants to revive the pandemic-battered economy and concentrate on the debt later, despite new alarms being raised by Republicans in particular.

…“Next year there will be a lot of focus on the debt and deficit, but let’s get through this now,” JPMorgan Chase CEO Jamie Dimon told reporters earlier this month. “We’re still in the middle of Covid, which is still killing 4,000 people a day” [Victoria Guida, “Wall Street Shrugs at Washington’s Debt Pileup,” Politico, 2021.01.26].

Even free marketeers may come to the rational conclusion that the best place to invest their money right now is in public works:

“There’s a lot of discussion about how the U.S. should not borrow, should not engage in fiscal stimulus for fear of seeing interest rates rise too much,” he said. “But in practice, typically what you see is that as debt-to-GDP has risen, you’ve seen interest rates fall.”

That dynamic has been happening, he said, because expectations for economic growth have been lower, giving investors fewer attractive options of where to put their money and coinciding with a large increase in savings around the world.

Meanwhile, an aging population has increased demand for safe assets like U.S. government bonds as pension funds and insurance companies serve a larger population of people more likely to need payouts in the near term.

Those factors suggest that directing investor money toward financing government spending won’t necessarily be diverting funds for other purposes and could be put to better use.

“If in fact there is a surplus of investable funds around the world, why not make use of it to finance public investment?” said Lou Crandall, chief economist at Wrightson ICAP [Guida, 2021.01.26].

Lighten up, Senator Thune. The debt you’ve helped create during your sixteen years in Washington has not created any of the destruction about which you’ve warned. Right now, investing big in pandemic response, economic stimulus, and infrastructure will produce both short-term and long-term benefits for the American economy that far outweigh your flimsy deficit concerns.

Surprise, surprise, the pubs are now talking about the debt. Who could see that coming?

You never have to wonder where Johnboy stands on any issue. Just google “GOP Daily Talking Points” and you will have your answer. Nothing but a pretty boy in an empty suit. It is disgusting to know that your representative, the son of a genuine WW II war hero, hides under his desk at the thought of an ugly tweet. Thune and Rounds, spineless cowards both!

I don’t like debt. Sometimes it’s necessary, and a little debt is not a problem, but large debt, as Donald Trump’s business failures should have taught us, shouldn’t be the norm. When you have national challenges, like this pandemic and its economic fallout, debt may be the only way to address the problems. What problem is solved by using debt to favor campaign donors and the elite? That’s the question that Thune needs to address.

Thune is not proposing anything to deal with the debt, and when it should be addressed. It’s kind of how Thune has always operated. He throws a lot of “I’m very concerned about….” phrases out there and has nothing to offer.

Let me suggest a path for Thune, if he really thinks debt is a problem. Suggest some solutions to deficits and debt. Here are three suggestions to begin:

(1) completely dismantle the tax cuts to corporations and the wealthy that he supported and reinstate an estate tax. In fact go even farther by vastly increasing the tax on the wealthy.

(2) Is Ellsworth Air Force Base really necessary? Close it. In fact close a lot of bases.

(3) A lot of tax dollars are used to clean up after corporations pollute. Re-institute “polluter pays” provisions of the Superfund Act.

Jonboy just hasn’t figured out a way to get in and grift something for himself.

Donald Pay – If you don’t like debt – you don’t like money. ALL money is – is an IOU. That is ALL it is. Or is it only that you don’t like that OTHER PEOPLE are holding more IOUs ($$$) to you? Because THAT is exactly what the “bonds” that finance the “debt” (printing of money – literally) is what that “debt” figure represents. A bond is a contract for receipt of a certain amount of OTHER PEOPLES’ DEBT (money) at some future date.

This is how monetary systems actually work and far too many people have NO IDEA that money = debt. They think that money is exactly the OPPOSITE to what it actually is. Money does NOT equal wealth. Wealth is a surplus of ACTUAL material goods and resources, NOT the “promise” of it at some future time, which is what money (debt) is.

Marlboro Barbie’s thoughts on fiscal responsibility circa 2010 are somewhat revealing….

https://www.thune.senate.gov/public/index.cfm/2010/1/press-release-8ac3f33d-f421-4bd0-b1b4-6d2d0e27a726

The lad did not seem as concerned when taxcuts for the wealthy led to record deficits under drumpf the lying liar’s lying liar..

Last updated: January 28, 2021, 14:39 GMT

United States

Coronavirus Cases:

26,168,285

Deaths:

439,533

4101 counted bodies yesterday, the 27th.

Richard Shriever, Sure, I agree that there is a debt aspect to money. That’s why managing fiscal cycles and fiscal discipline is important. Debt brings a certain level of uncertainty. Generally, that uncertainty is kept fairly low. A certain amount of reasonable surety, not totally based on faith, but on well-founded practice, including the rule of law and measures to keep the value of the money reasonably stable, enter in. But that reasonable surety can break down, and with it the value of debt/money is undermined. It’s always a complicated balance and it really depends on trust in the whole system. If people aren’t seeing some sort of discipline some will start distrusting the value of the debt/money. If enough people feel that way, there are consequences.

mike from iowa’s link brings up the point that Thune has always had fiscal policy 180 degrees wrong at every turn. Imagine how deep and long the Great Recession would have been had Thune’s ideas back then been followed. Thune would have manufactured a ten year Great Depression. Thune’s business degree is about as useful as wet toilet paper. Flush it and forget it.

Great link mfi, weathervane Vladimir Thune, the most worthless of worthless in the senate, but he’s tall.

State Bank in South Dakota? It works well in No Dakota.

The quality of the economic debate reflects the 2 to 1 for Trump and his failed policies.

Simple idea—- Elect Democrats every Monday, 52 times a year!

Call it Ultra Democratic Group, it can be a 501-c-4, everyone can be called Senator or Governor, and it will only be dedicated to doing great nonprofit ultra prospering ideas in South Dakota! No debates or political squabbles, no laws, no taxation. Just Ultra Projects.

The great thing about this is—- Democrats would get used to seeing Democrats ELECTED every Monday, like clockwork, 52 weeks a year, easy!

Let’s do a BOLD thing for South Dakota, it’ll be fun!

SD20%NW, A State Bank would be a good idea if there was competent and honest eadership. That is not the case in SD. You can see the difference in how the two states dealt with the nuclear waste borehole issue. North Dakota was serious about protecting the state. Even after the initial danger was over, they studied how they were going to deal with subsequent efforts and enacted protections for the state at the behest of local governments and citizens. South Dakota leadership simply caved, tried to secretly foist it on local communities, tried to browbeat local officials, and then left themselves open to renewed nuclear waste dumps. If there is corruption involved, they’re on it. Now think how much more corrupt they would be using the power of a state bank. Noem is already using state revenue to corrupt local zoning processes, and now she and the corrupt Republicans want to do away with zoning altogether.

So, no. You don’t want to give these corrupt officials any more things to corrupt.

Gosh Jerry, the state Bank they love so much in North Dakota was put in place by socialists. You can’t have that in South Dakota. Kristi wouldn’t like it.

Richard Schriever, while money may be “debt”, it is not the “debt” that is a utility bill, required loan payment, etc. Or do I misunderstand money?

The Nonpartisan League in North Dakota had some socialists, but it was mostly a rural-based progressive movement within the Republican Party. It was strongly anti-corporation, especially focusing on the out-of-state corporate entities that had a stranglehold on the ag economy. That’s why banking, grain-trading and railroads were a major focus.

Last updated: January 29, 2021, 13:54 GMT

United States

Coronavirus Cases:

26,340,631

Deaths:

443,794

3862 bodies accounted for yesterday. Makes over 12k bodies in just three days of reckless abandon and incompetency on drumpf/noem body count.

Last updated: February 01, 2021, 15:58 GMT

United States

Coronavirus Cases:

26,771,042

Deaths:

452,332

1875 bodies given up to body count Sunday January 3st.