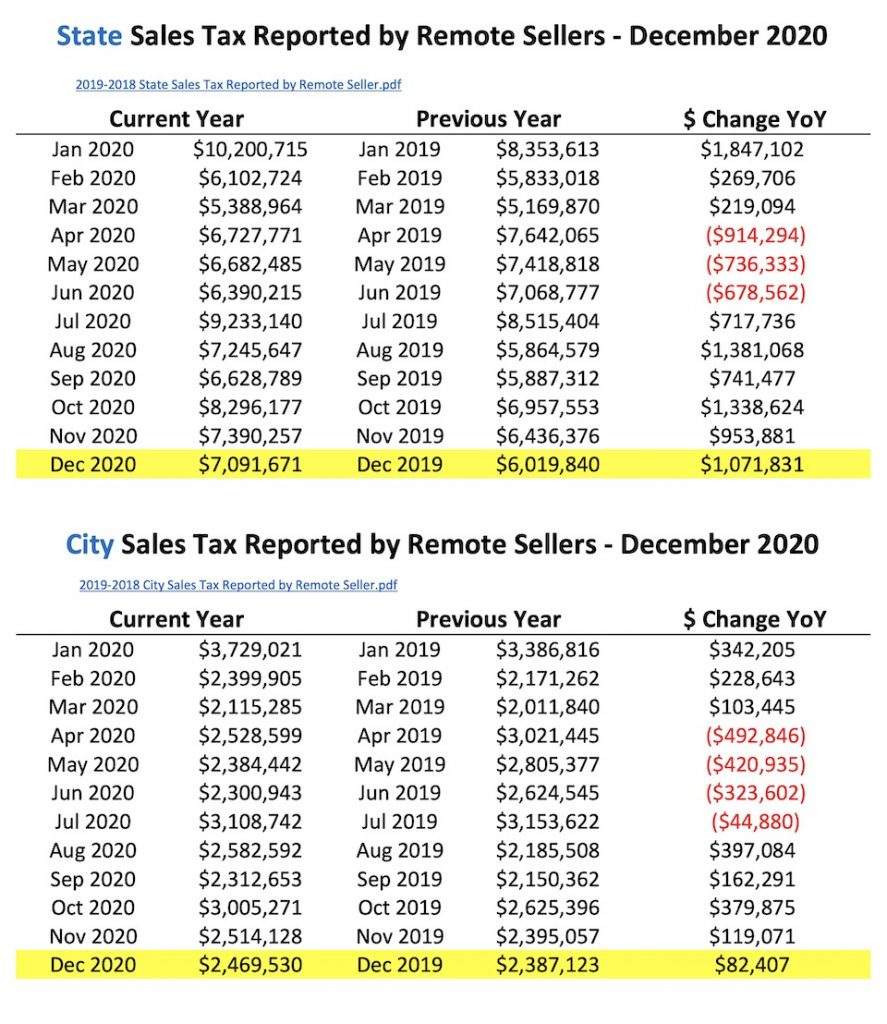

In news you might expect, the Department of Revenue says that remote sellers reported $6.2 million more in sales tax to South Dakota than they did in 2019. Remote sellers collected $87.4 million in state sales tax for us in 2020. That’s 7.1% more than the $81.2 million collected in 2019.

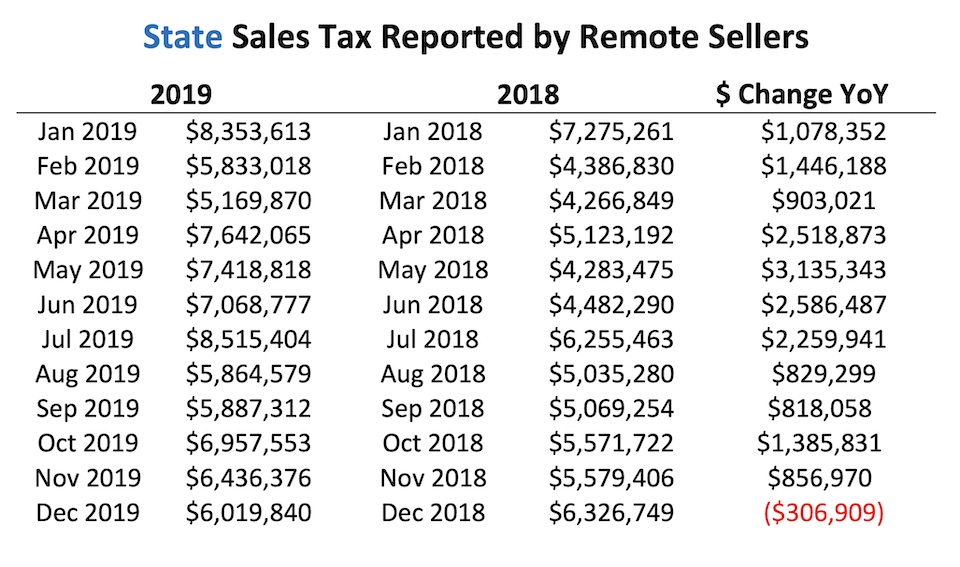

I say we might expect growth in remote sellers’ sales tax since, back in July, Revenue figures showed strong growth in online taxable sales compared to 2019, and since, back in November, we saw lots of shoppers stay home and scratch their anti-Christian consumerism itches online. But it turns out that 2020’s remote-seller sales tax growth was much lower than 2019’s:

Remote sellers’ state sales tax collections in 2019 jumped 21.6% over the 2018 collections. And in April, May, and June of 2020, when sellers would have reported sales tax collected from the first three months of the coronavirus pandemic, the amounts collected dropped by 13.6%, 11.0%, and 10.6%, respectively, over the corresponding months in 2019.

Think about that: at the beginning of the pandemic, when there was a new and sizable portion of the South Dakota consumer population who did not want to go shopping in Sioux Falls or Rapid City or Aberdeen and who would logically have been much more inclined to order stuff online, South Dakotans spent less online than they did in the happy-go-lucky days of the before-time.

I don’t have an explanation for that; I invite readers to offer their own armchair speculations.

I’m guessing that remote sellers were not submitting there money in a timely manor during the start of the pandemic. They started catching up in mid to late summer. Thus the drop in reported revenue during the early months of the pandemic.

I’m surprised that sales only rose 7.1% over 2019. Delivery people I know indicated they have been busier than ever.

I would be interested to know total retail sales month-by-month compared to online sales. Also, do we see the effect of stimulus checks starting in May/June?

Interesting suggestion, Scott. Would there have been factors affecting remote sellers’ ability to report in a timely manner at the start of the pandemic that weren’t affecting our in-state sellers?

Curt, my recollection is that the bulk of the stimulus payments reached consumers and goosed spending in April and May, which should thus inflate the sales tax revenues reported in May and June.

Curt, when I check the DOR stats page, I don’t see a listing giving the actual collections reported each month, but the state taxable sales reported each month show the following percentage changes from 2019:

Jan: 8.9%

Feb: 5.2%

Mar: 6.8%

Apr: 6.0%

May: –1.2%

Jun: 1.5%

Jul: 10.3%

Aug: 11.9%

Sep: 13.8%

Oct: 19.6%

Nov: 4.8%

Dec: not available yet

Those figures would lag one month just like the remote sellers’ data: January’s figures show what happened the previous December. In-state sales only shrank in one month, but we see a clear weakening of in-state taxable sales in May and June, coinciding with the declines in remote sellers’ reported tax collections.

Thanks for the research, Cory. More to chew on there. It could be argued that the stimulus payments were even more vital to the SD economy than we may have realized. Another anomaly appears to have occurred in the Oct-Nov data – why would the growth in Oct be the greatest and Nov among the least?