The Legislative Research Council presented three issue memoranda to the Legislature’s Executive Board during its meeting yesterday. Among them was this review of federal handouts to South Dakota. Here in Trumpistan, we receive $1,755 from Washington for every man, woman, and child to keep our state running:

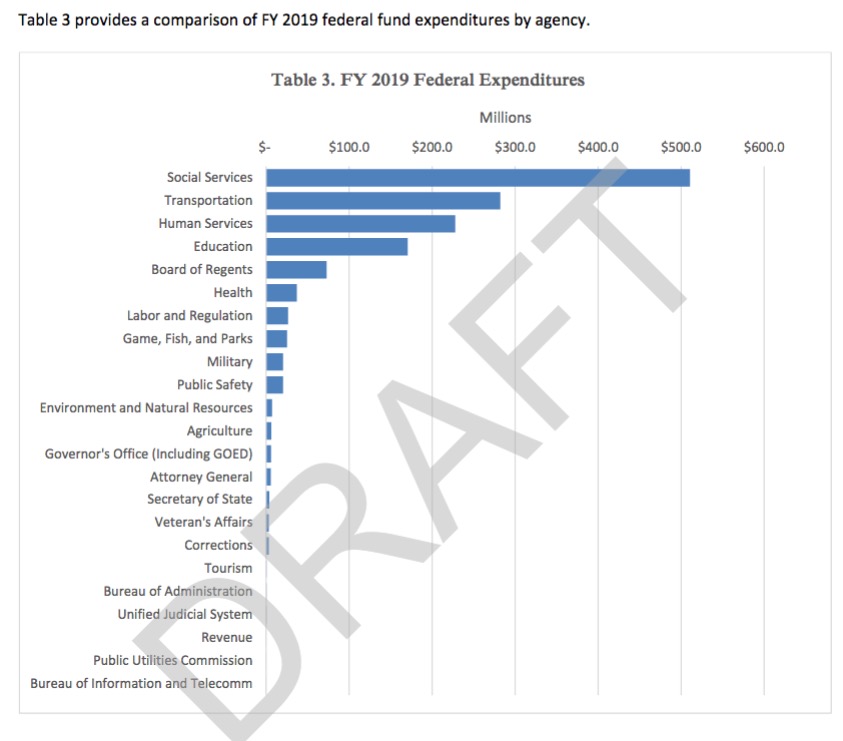

According to an analysis completed by the Federal Funds Information for States (FFIS), in Federal Fiscal Year 2018, total grants for South Dakota were approximately $1,755 per capita. Total grants awarded came to approximately $1.5 billion. Medicaid accounted for $637 million or 36% of the federal funding awarded, while the remaining $1.11 billion was used for services such as Social Services ($244 million), Transportation ($405 million), Education ($240 million), Health ($120 million), and other services ($126 million) [Legislative Research Council, Issue Memorandum: “Federal Grant Funds Received by the State,” presented to Executive Board 2019.11.19].

Notice that the lion’s share of that money goes to the Department of Social Services, which thus has plenty of fiscal wiggle room to do things like spend $1.4 million on a ridiculous and mispackaged anti-meth campaign.

LRC went looking for instances where we’ve bought into a program thanks to a federal grant but now have shoulder the burden with our own tax dollars (which I would view as a model of the federal government encouraging self-sufficiency but which I suspect certain conservative squawkers in Pierre will use as an excuse to oppose applying for any more socialist assistance from Washington). LRC found the following:

Plant and Animal Disease, Pest Control, and Animal Care (DOA) – Due to a reduction in in federal funds, $35,000 in general funds was used to offset annual program cost. Total expenditures for the grant in FY 2018 totaled $150,308.

State Mediation Grants (DOA) – Due to a reduction in federal funds, this mandatory program had a shortfall of $48,300 and a new funding source has yet to be identified. Total expenditures for the grant in FY 2018 totaled $122,215.

Cooperative Forestry Assistance (DOA) – Due to a reduction in federal funds, in FY 2018 the Legislature appropriated $181,480 in ongoing general funds. Total expenditures for the grant in FY 2018 totaled $3,012,562.

Performance Partnership Grants (DOA) – Due to a reduction in federal funds $100,000 in general funds was used to offset the shortfall. Total expenditures for the grant in FY 2018 totaled $499,322.

Statewide Longitudinal Data Systems (DOE) -Due to the completion of a 5-year Federal grant, $624,770 in general funds were used to continue the project.

Byrne Grant (DOC) – Due to reductions in the availability of Byrne Grant dollars from the Department of Public Safety (DPS), the legislature approved $72,422 in general funds to continue the DOC PREP program for inmates becoming eligible for release. An additional $66,324 in general funds was also approved to continue funding of a Restrictive Housing Cultural Mentor at the state penitentiary [LRC, 2019.11.19].

The $1,128,296 of state cash backfilling federal grants is still only 82% of the money Governor Noem is paying Minneapolis ad whizzes to say We’re on Meth™.

LRC notes that South Dakota has no formal oversight process for federal grants. The issue memorandum gives examples of grant review committees in Delaware, Texas, and Utah. It wouldn’t hurt for our legislators to spend a little more time not just our applications to spend federal dollars but all of the contracts state government issues to spend the billions so hastily appropriated by our Legislature.

Details, details…

- The terribly unwieldy, unprintable 31-page spreadsheet included with this issue memorandum indicates that we spent $1.103M in FY2018 and $1.192M in FY2019 in federal Gaining Early Awareness and Readiness for Undergraduate Programs grant money. That’s GEAR UP… and we spent less of Uncle Sam’s money each year on American Indian education than we’re willing to spend of our own money this fiscal year on bad meth ads.

This is further evidence of legislative incompetence and total lack of executive oversight.

Federal grants (at least the competitive ones, as opposed to “formula grants,” typically have an end date. Grants aren’t forever!

Some federal grants are designed to help grantees establish programs which the grantees themselves will operate using other funds. That’s why it’s not uncommon to see the federal commitment share decrease from a high percentage in the beginning and gradually decrease in succeeding years until the grant period expires and the grantee assumes 100% of the program cost.

Last year, I submitted my thoughts on legislative oversight of executive agency programs (as opposed to executive agency expenses and financial transactions). There may be discussion or even a bill submitted in the upcoming legislative session. Cory wrote a blog post about it at the time. See: https://dakotafreepress.com/2018/12/14/wyland-proposes-new-legislative-committee-to-fill-oversight-gap-that-let-gear-up-go-bad/

If you take their money, out of staters have rights to comment on how it’s spent.

– In total, 10 states are so-called donor states, meaning they pay more in taxes to the federal government than they receive back in funding for, say, Medicaid or public education. North Dakota, Illinois, New Hampshire, Washington state, Nebraska and Colorado round out the list.

– Among the top four, the negative balance ranges from $1,792 per capita in New York to a whopping $4,000 in Connecticut, according to a new report by the Rockefeller Institute of Government. Put another way, residents in Connecticut receive just 74 cents back for every $1 they pay in federal taxes. What the report shows is, when you divide up the receipts, certain states win and certain states lose.

https://www.governing.com/week-in-finance/gov-taxpayers-10-states-give-more-feds-than-get-back.html?AMP

Porter:

At the risk of veering off-topic:

Yes, there are donor states and non-donor states. However, it’s not a zero-sum game. Annual $1 trillion budget deficits and a $23 trillion national debt are testament to that. The deficits and debt are a bipartisan problem that have persisted over decades. I tell my Democratic friends that the clock didn’t start in January, 2017; I tell my Republican friends that the clock didn’t start in January, 2009.

Be specific as to what you’re alluding to, Mr. Weiland. Coloradoan’s send more money to Washington than we get back and South Dakota gets back much more money from Washington than they send in. Cory says it’s over $1700 per citizen, not per taxpayer but even babies get that much. I’ve no reason to doubt Cory’s numbers.

Perhaps, as a high level Republican in SD, you can address why your state brags about having “lower taxes than almost anywhere else” when you gladly take my money (instead of taxing yourself) to pay your own way? Doesn’t that seem unfair to you?

Indeed, Michael, I’m surprised that anyone would be surprised that federal grants give way to state funding. The feds use their purse to encourage states to try certain beneficial programs, with the hope that we’ll realize those benefits are worth our investment.

I don’t think a discussion of other states’ federal income tax payments and receipts is off-topic; such figures may help us put South Dakota’s reliance on federal grants in perspective.

MoneyRates.com tells me that South Dakota paid $3.7 billion in federal income tax in 2018, or about $4,200 per person (including little babies and other non-taxpayers). So those federal grants represent getting 40% of our income tax back.

That’s different math from that being used to make the balance-of-payments map cited by Porter’s source.

Cory, sir. CO is a blue state and I’d say the majority doesn’t mind a bit paying more because we realize all we have and the tourist attracting things we buy come from taxation. CO is the number one economy in America and it costs a little more to be able to do business here. It’s worth it, by the way. What Washington chooses to do with the extra we pay is Washington’s business.

Mostly I’m just sticking a wheat straw up grudz’s nose, since he knows little except to blame “out of staters” for SD’s domestic hurdles.

Porter wins DFP today. BOOM!

😆😆😆😆😆

Porter, the people of Minnesota agree with you on state taxes. They recognize that investing more of their wealth in public goods and services makes everyone’s quality of life better than what they would achieve if they just fended for themselves.

But note that the question of how much we choose to invest in state taxes is distinct from the question of the balance of federal payments. Related to, but distinct from.

I had to sit through many an Appropriation Committee meetings, which is where there is some legislative oversight during budgeting. The bigger programs get looked at, but I’m not sure the legislature has the ability to do much real oversight.

Oversight gets done in South Dakota in a more decentralized way. I know a lot of transportation planning is done, and there are actually public hearings. For environmental programs there are MOUs developed and signed at the agency/board level. There are periodic reviews of programs for air and water quality, solid waste, hazardous waste, and maybe others. The public can be involved in those reviews through hearings and comment. I know most federal K-12 education funds come with fairly strict requirements that get oversight at the district level. When federal education funds go only through the state, I’m not sure. I would assume the Board of Regents or individual universities handle most of the oversight for higher ed.

There’s an interesting challenge, Donald. I can easily imagine being a legislator, wanting to sound hawkish on budget matters, and calling for more oversight. GEAR UP showed that we certainly need more oversight, but I wonder: do we need more layers of oversight, additional committees and rules, or do we just need to return to a multi-party system of government that rips up the good old boy network and replaces unsupervised cronies with honest, watchful officials doing the job already provided for in statute?