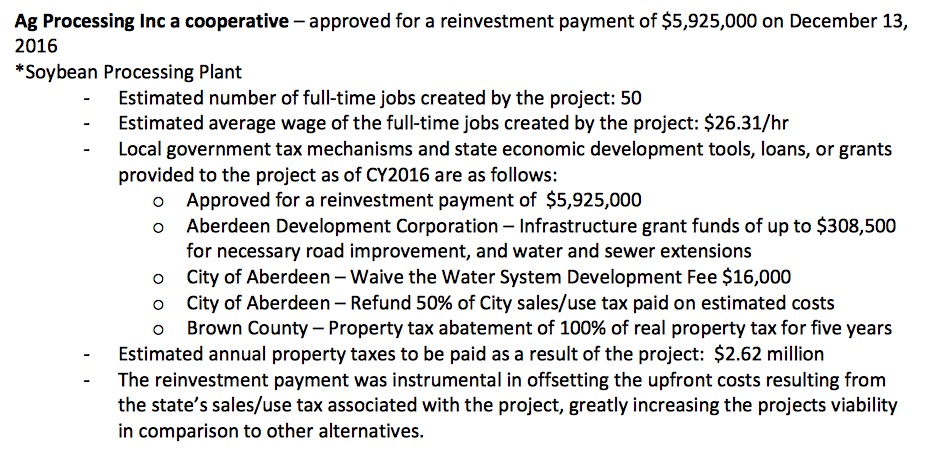

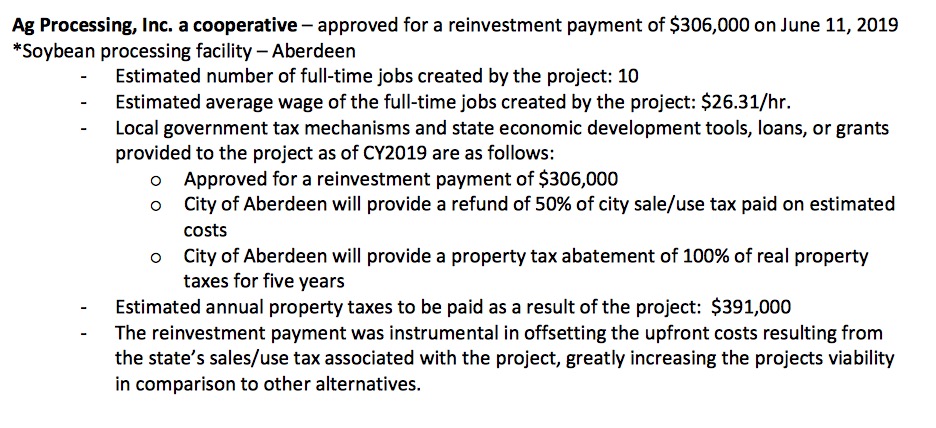

Joint Appropriations received a reminder Monday of how much we’re paying Ag Processing Inc. (AGP) to open its big soybean plant here in Aberdeen. The Board of Economic Development included this list of corporate welfare payments handed out since 2013 to participants in the free market who apparently couldn’t have struck it rich without help from government. AGP has two entries, showing sales tax rebates of $5,925,000 from the state in December 2016 and $306,000 in June 2019. But that’s not all….

The City of Aberdeen waived AGP’s water fee. The Aberdeen Development Corporation spotted AGP over $300K for their infrastructure. And the city and Brown County are not collecting property tax on the biggest building project in the county for five years.

I have to ask: why don’t we extend similar deals to the 50 or 60 new full-time workers who will come to Aberdeen to work for AGP? Why don’t we pay for every new resident’s water and sewer hookups and give them five-year holidays from property tax?

I support a “Yes, let’s do it!” answer to both questions in your final paragraph.

Consider all the TIF’s that Aberdeen has allowed, especially for all the new housing developments. Where does the tax money come from to build and maintain the infrastructure for all this new development? Imagine the damage to roads caused by all this construction and the truckloads of beans to the bean plant. People comment that the streets in Aberdeen are in the poorest condition that people can remember.

You just can not keep giving tax breaks. The longer you put off maintenance, the more it costs, so when it comes to streets, the odds are the city will never catch up with maintenance.

Scott, I agree on what you’re saying about the streets: last winter really took a toll on them. But since our new mayor prefers that people solve their own problems without government intervening, we should probably get used to buying our own asphalt.

Tax breaks do catch up with us. Residents and small businesses have to pay full freight for their public services, and we are as vital to the local economy as the big employers who rely on our labor and commerce. Debbo and I would love to see some consistency in tax breaks: either everyone should get them, or no one should get them. Given the need to maintain infrastructure and basic services, we may have to lean toward “no one should get them.”

It occurs to me that saying AGP doesn’t have to pay taxes for five years is kind of like saying AGP doesn’t have to follow the speed limit for five years. In how many other situations do we exempt members of the community from following the law?