Governor Dennis Daugaard gets to tootle one more basic management achievement: publishing the state’s Comprehensive Annual Financial Report before New Year’s Day for the third year in a row. After leaping ahead from January 22, 2016, for the FY 2015 CAFR to December 30, 2016, for the FY2016 edition, the Bureau of Finance and management has published a day earlier each of the last two years. If Kristi Noem and subsequent governors can keep increasing efficiency at the current rate, then by the 23rd century, we should be able to get the annual financial report before the fiscal year is done.

Governor Daugaard chooses these three points as highlights:

- The State’s total net position increased by $293.3 million.

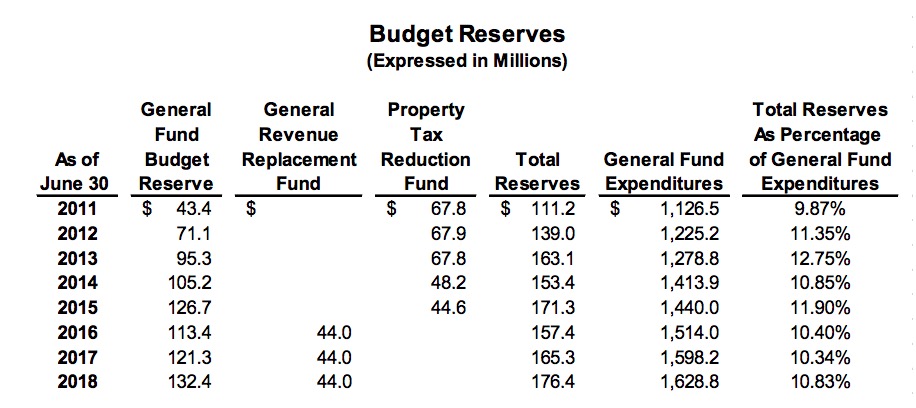

- The combined ending balance of the General Fund Budget Reserve and the General Revenue Replacement Fund was $176.4 million, an increase of $11.1 million.

- The State has maintained its AAA public issuer rating from Standard & Poor’s, Fitch Ratings, and Moody’s for the past two consecutive fiscal years. This represents the highest rating possible from all three bond rating agencies [Governor Dennis Daugaaard’s office, press release, 2018.12.28].

The CAFR itself summarizes growth in reserves and the general fund from 2011 to 2018. In his first seven years, Governor Daugaard and his compliant Republican Legislature increased the total state reserves by 59% and general fund spending by 45%:

Annual inflation over the past seven years has averaged 1.55%, meaning prices should double every 45 years. Daugaard’s annual increases in reserves have averaged 6.81%, which would make reserves double every decade; his annual spending increases have averaged 5.41%, which would make state spending double every 13 years.

If Kristi Noem and subsequent governors capped reserve and spending growth at the recent average inflation rate, then by the 23rd century, our state reserves would be 42.9 billion and our general fund expenditures would be $26.9 trillion. But at Daugaard’s rates, by the 23rd century, we’ll be sitting on $28.6 quadrillion while spending $23.7 quintillion a year.