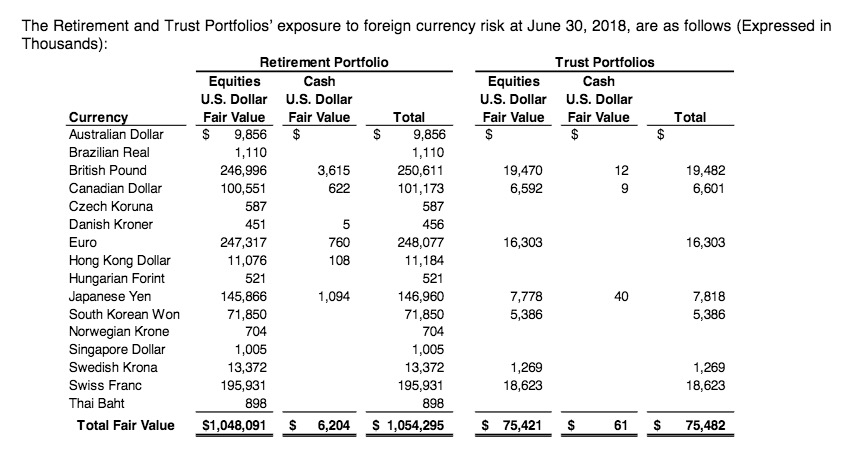

If you care to take your investment cues from South Dakota state government, here are the foreign currencies South Dakota’s retirement and trust portfolios prefer:

Over a quarter billion in British pounds, another quarter billion-plus in euros, over $200M in Swiss francs, and over $150M in Japanese yen. Our friends the Canadians also make the nine-figure club, just cracking $100M in our retirement portfolio and some small change in our trust portfolios.

That $512K in Hungarian forints might give us pause—they’ve been acting kinda fascist lately. Maybe we should shift our holdings there to someone nicer, like maybe our friends to the south, as a goodwill gesture. The Mexican peso is up this month….

I will caveat that I dont know too much about this, but with the Fed increasing rates wouldn’t it make more sense to hold more US dollars?

At the risk of exposing my own ignorance I ask, why are these South Dakota/ US based funds holding foreign currencies at all? Please explain. They aren’t speculating in the foreign exchange markets are they?

The legislatures need to investigate this.

Why aren’t we investing in a country that’s $21 trillion in debt and lead by a president that has a history of declaring bankruptcy?

Farmers will tell you the US dollar has risen in the past few years.

What farmers will tell that is a good thing?

“The yuan exchange rate has potential to appreciate against the US dollar in the medium term if the Chinese economy can achieve high-quality development and grow at medium speed, said Liu Shijin, a member of the People’s Bank of China’s Monetary Policy Committee, Yicai.com reported.” Looks like the currency futures on the Yuan were a good pick at this time. The dollar needs to be weaker in order to further international trade, for things like the ag products that our one trick pony economy depends on here, funny how that works.

Jason shows his ignorance about exchange rates. Jerry is right a weak dollar is good for exports and since agriculture is the leading American exporting industry a rising US dollar hurts US farmers.

Nick,

Read my post slowly. I made the post because I know farmers have been hurt by the rising dollar.

I suppose Nick thinks you shouldn’t own a currency when it is rising…..