…and Sports Betting a Progressive Tax?

The Legislative Research Council doesn’t think sports betting in Deadwood will be a big moneymaker. In a fiscal note issued Thursday, LRC estimates that the proposed constitutional amendment to legalize sports gambling in Deadwood would generate just $185,000 in new tax revenue, $78K of which would go to the state general fund:

The legalization of sports betting in Deadwood is estimated to generate a total of $184,678 in new tax revenue in FY2022, which would be distributed as follows:

- State General Fund: $77,975

- Tourism Promotion Fund: $65,663

- Lawrence County: $16,416

- City of Deadwood: $8,208

- Municipals in Lawrence County: $8,208

- School Districts in Lawrence County: $8,208

- Total Sports Betting Revenue: $ 184,678 [Legislative Research Council, fiscal note to proposed initiated amendment to legalize sports wagering in Deadwood, submitted to SOS 2018.12.20]

Here’s where the fifty-word limit on fiscal notes (LRC used 49 words, eight dollar figures, and “FY2022,” a debate over whose numberhood or wordhood I hope will dominate the comment section) makes the fiscal note frustratingly uninformative. Sure, LRC gives us some digits, but we don’t get any way to check their work. How many people does LRC figure will come bet on football and fútbol in Deadwood? How much will they bet on each sport? Will there be any trade-off, sports betting drawing people away from craps and keno?

That’s the big reason my meta-initiative (see Section 7!) would repeal the fifty-word limit from the LRC fiscal notes on initiatives: I want voters to have more information that matters about the issues on the ballot. When the LRC issues a fiscal note, it should be able to issue a full report, a multi-page Issue Memorandum offering a complete look at its methodology and data sources. That’s far too complicated a document to place on the ballot, but it’s an easy document to post online and maybe even include in the official ballot question pamphlet.

Knowing that the LRC thinks the Deadwood sports betting amendment would bring in $185,000 is helpful; knowing how the LRC figured that amount would be far more enlightening.

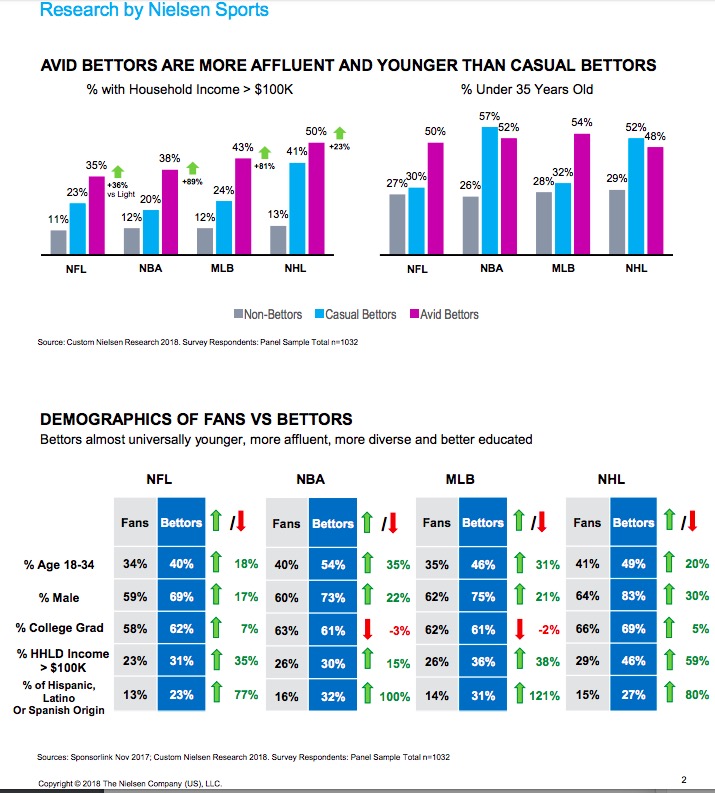

Related Demographics: While this information might not affect the fiscal note, it might be interesting for voters to know the demographics of the folks who would put out that sports betting revenue for us. Jay Masurekar, who heads Cleveland-baed KeyBanc’s gaming, internet, and travel services division, says sports betting is a progressive tax:

Interestingly, investment banker Masurekar says sports gambling typically attracts a well-educated, high-income and predominantly male group of bettors. “It’s a relatively progressive tax; it’s not a tax on low-income people,” he says.

Nonetheless, anti-gambling advocate Rob Walgate says that he worries that sports gambling will be another drain on society. “Sports gambling isn’t going to help Ohio grow and prosper,” he says. “It’s just going to give people more opportunities to throw their money away” [Aaron Marshall, “What Does Legalized Sports Gambling Mean for Central Ohio?” Columbus CEO, 2018.10.01].

At the American Gaming Association’s behest, the Nielsen Company collected data this year showing the sports bettors tend to be richer and younger than the non-betting population and richer, younger, maler, and more Hispanic (!) than regular sports fans.

Yes, I am. 😁

A $185,000 in new tax revenue, BFD. Cory, you’re a number crunching animal, how much revenue would be added if sales tax was being collected on advertising in print, on radio, television and the internet?

Nice graphs

Nice estimates

However the 3-4 bookies in Aberdeen could bring that amount in during March madness

Mean8ng it’s a suit and tie study Not accurate

Mr. Rayo Ex, I am sure that Mr. H will crunch up those numbers and he would tell you it is several dozen million dollars, after looking it up on the legislatures’ websites and re-doing the math and such. But the internets are a service you buy because you want it, and you probably should be taxed on it and soon won’t be able to be if the legislatures have their way, but the advertising is jammed down our maws and we need to tax those fellows who do that. We need to tax the people who advertise exactly how we tax us moms and pops who buy donuts or steaks and taters at your local stores.

It’s just too much sin. We already allow enough sin-laden gambling. To allow for any more sin is just too much.

I shouldn’t be forced into having my whole community saturated with such sin.

But it’s not so much about my community, it’s about me. Me me me me me me me, and how much more pure and then other people.

I mind the time when the state was going to raise teacher pay by X amount of dollars with a new tax and their guesstimates of revenue (before it was ever collected) were waaaayyyyyyyy off. I imagine they are being too optimistic here, as well.

Alas and alack, this is South Dakota after all.

I would be very interested to know

How biased the LRC is to begin with

If you want the statistics you can make

The statistics

In a “cash” industry such as this and currently illegal its impossible to measure the skin in the game

March madness, football playoffs and regular season basketball could be millions for this state NOT 185,000. Ridiculous waste of time and money with the LRC

Follow the money to see what gambling family will get the money for their establishments. The state gets the problems while the families get the rewards. Sounds pretty trumpian to me.

El Rayo, I noticed Wednesday that the estimated tax exemptions for FY2020 include $35.64M in sales tax revenue we could get from advertising.

We could also raise $918M from an honest income tax that would charge 80% of SD households less than 3% and would also capture income from gambling.

T, when you talk about the money the Aberdeen bookies make (really? we have those?), are you talking about the total money they handle or the x% the state could claim by taxing their activity?

Based on current stats pulled from the SD Commission on Gaming for all gaming revenues over the past 12 months I would calculate that the $185k estimate is probably too high. https://dor.sd.gov/Gaming/Industry_Statistics/

Deadwood gaming only produces about $10 million in taxes every year and adding sports book would only add a tiny portion to that revenue. To get $185k in tax revenue you would need just over $2million in win if the tax rate stayed at 9%, the same rate all gaming revenues are taxed at. In order to get $2 million in actual win you would need a sports betting handle of nearly $69 million dollars if you figure sports betting hold at an average of 3%.

That amount of handle just won’t be there when you consider all the competition for sports betting via online wagering and local bookies. Those options just won’t disappear.

Thanks for that useful analysis, Tim A. Indeed, why would Aberdeen bookies close up shop just because sports betting is legal in Deadwood? Folks aren’t going to drive all the way to Deadwood just to bet on the World Cup when they can do so from the comfort of their own homes with a simple call to their local Aberdeen bookie (whom I really need to meet and do a podcast with). Would it be safe to assume that sports betting in Deadwood under this amendment wouldn’t make Deadwood any more of a destination but would simply be side entertainment for the gamblers who are already coming to town to put most of their money into the other games?

CAH, precisely, Sports bettors won’t be flocking to Deadwood b/c of sports betting. It will be a nice amenity to enjoy while in Deadwood. If sports betting is marketed correctly as a regulated gaming option in a safe environment I think it will do OK.

Who knows what sort of unscrupulous behavior takes place when dealing with a local bookie.

Forward thinking SD lawmakers could allow Off Site Betting parlors in the biggest towns, which would be run through Deadwood casinos. Deadwood would get the taxes and do the hardest work involved. Setting the line. If the line is off, money is wasted. In sports betting it doesn’t matter who wins, it matters that bets are equal on both teams. The profit is from the vigorish aka the fee paid to bet. *There are companies like Kenny White who set the lines with proprietary algorithms and sell the info to casinos. There are also insurance companies who will insure a casino against catastrophic losses during a betting cycle. These costs may or may not have been considered by the LRC

Mr. Lansing, since you do not live in South Dakota you probably don’t understand that the vig is not the only thing the Deadwoods want. They want people to stay in the hotels that are closing and eat in the restaurants and get haircuts in the salons, for if you were to visit you would see a town dying for lack of soup chefs and barbers and hotel clerks.

grudznick … Vegas was beginning to decline, also. Then they legalized marijuana and you can hardly find a room, anymore. The LA Times reports that the destinations for people moving out of CA are – Northern Californians are moving to Texas and Southern Californians are moving to Vegas.

Why on earth, Mr. Lansing, would Northern Californians move to Texas? The ready supply of illegal demon weed being snuck over the border, or the chiles rellenos filled with asadero and the cheap, watery beers?

It’s said that Texas has good paying jobs and a low cost of living. Northern CA is very expensive. Much to the dismay of the once prevalent Texas sh*t-kicker, most of the new comers are Democrats. They move to the cities which are already strongly liberal. Texas will soon be a blue state as seen when our next President (Beto O’Rourke) nearly defeated Ted Cruz.

There’s weed everywhere and it doesn’t come over the border. Pain pills and heroin come over the border. Marijuana is too bulky to smuggle and readily grown legally in at least 25 states.

We in CO don’t think much of Texas or their food. We prefer New Mexico, which is authentic and the food isn’t covered with gloppy melted cheese.

If we have to tax those who throw their money away to balance the budget, then we do not have a good enough economy to support a state budget or south Dakota values is an oxymoron.

Here in the newer Dakota, we like cheese and meat. Mmmm…meat, with gravy and taters. Soon there will be big feasting and grudznick hopes you all fill your bellies.

Grudzie … There’s nothing new about Dakota. Merry Christmas to you and your family. Next time I’m in Rapid I’ll meet you at Tally’s for breakfast. I’ll be the one lurking in the back not Roger (who’s birthday is today).

Roger E, I’ll take two positions here:

Yes, ideally, we should build an economy with sufficiently diverse and productive industries paying sufficient and moral wages to all workers to support an honest three-legged tax system with a solid and progressive income tax that would reduce our current out-size dependence on regressive sales and property taxes. We would still tax vices but focus the resulting revenues on education and treatment to reduce those vices rather than basing funding for important state institutions on continued vice.

Absent such good economy and good investment, if we are going to open the door to less savory industries, we’d better make sure we tax the crap out of them and get enough money to hold us over until we come to our (Democratic) senses.

Yeah yeah yeah, but there is already a limited amount of sin which our state allows. Why should we allow more sin so that casinos and casino-like companies can exploit and encourage more sin?

Never mind that this is about ME (not my/our community), and how much more morally pure I am then all of YOU, while you answer my insincere, shallow, near pea-brained question.

Kurt Evans for 2020 Governor! He’s my guy !!!

We all just need a little more Kurt Evans in our lives.

“Adam” writes:

There’s no election for South Dakota governor in 2020.

I knew he was watching. You can’t hide from Kurt Evans, and Kurt Evans knows no restraint when it comes to Kurt Evans hunny pots.

The man knows no restraint. Just look at him!

“Adam” writes:

That’s very nearly the opposite of the truth.

Evans has distinguished himself every time he has appeared on the ballot by running the most restrained campaign.

We could petition for an amendment taking us back to the pre-Kneip era of two-year terms for the governor. Making the governor run each time with legislators could be fun. The proceeds from Deadwood sports betting might just about pay for the extra ink on the ballots.

Mr. Evans, to stand a better chance, needs to announce in 2020 and put grudznick, even if dead, on the ballot with him. 2022 is the YOLT. The Year Of Libertarian Takeover. A huge of am I of Mr. Evans.

It’s not about sin

It’s about revenue and money

There is no correlation

And no one answered you Adam because

It’s bait