We all know that higher tobacco taxes reduce smoking. But the threat of tobacco taxes increase smoking… or at least the purchase of smokes?

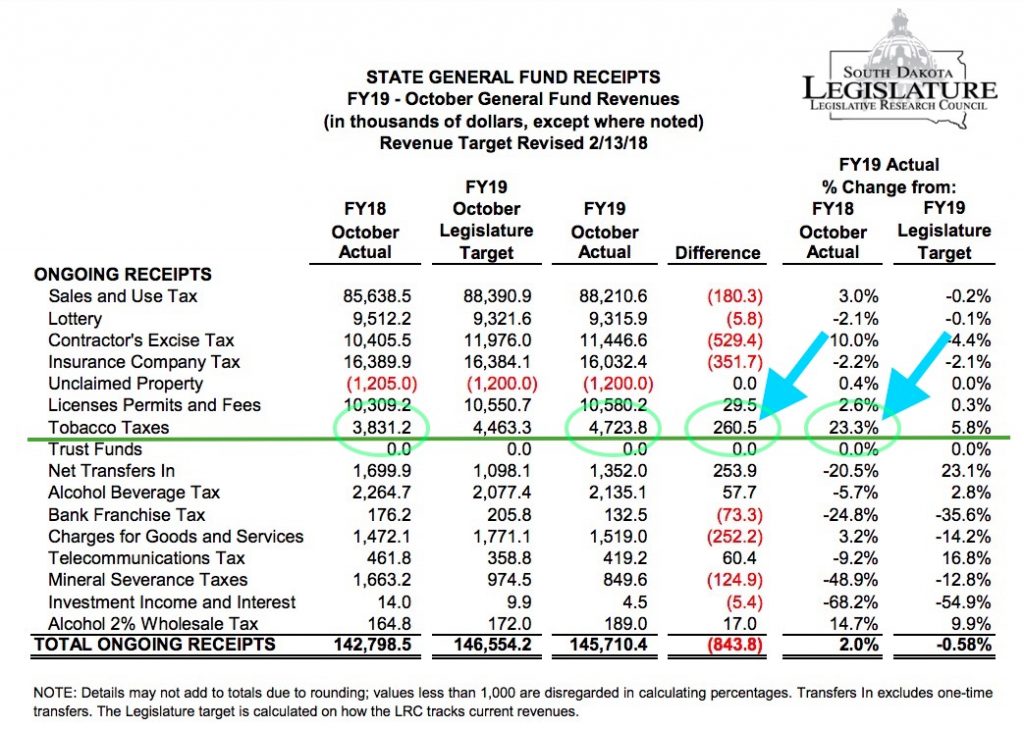

The Legislative Research Council’s October revenue report shows that tobacco tax revenues surged in October by over 23% compared to October 2017:

$890K more in tobacco taxes in one month? Let’s see, divide that by $1.53 per pack, and that’s 595,000 more packs, or 11.7 million more cigarettes sold last month than the previous October. (I’m trying to keep it simple, but if you’d like to try guessing how much was cigarettes and how much was chew, the comment section is open!) Do that math on the total October revenue and multiply by the average price+tax of $6.01… in October, South Dakotans and guests spent $18.6 million on tobacco in this state last month, compared to $15.0 million in October 2017.

That 3.6-million-dollar surge came as Altria/Philip Morris poured six million dollars into deterring us from raising the tobacco tax another buck to fund our vo-techs via Initiated Measure 25. Anybody who walked into a South Dakota gas station knew that somebody was trying to raise the tobacco tax. Might smokers have freaked out and stocked up, just in case a price hike was coming?

Tobacco tax collections were down in July (5.5%), August (8.1%), and September (26.3%). Tobacco tax collections for Fiscal Year 2018 (which ended June 30) were down 4.7% from FY 2017, Tobacco tax collections have dropped an average of 1.43% over the last ten budget years, sign that the buck-a-pack tobacco tax hike we passed in 2006 did what we expected: lowered smoking.

A sudden 23.3% increase in tobacco revenues thus indicates a consumer trend bucking recent history and invites us to identify the cause. I suggest all the publicity about a possible tobacco tax hike, even though it wouldn’t have kicked in until July 2019, drive a spike in tobacco sales. If November tobacco revenues show a sudden drop, we can speculate that people are burning through their October IM25-fear stash before heading back to the smoke shop. If November tobacco revenues continue October’s trend, we can speculate that the five days before the election saw a smoke shop panic or that some phenomenon other than the now failed IM 25 is driving more tobacco purchases in South Dakota.

Bonus Hypothetical Math! The decrease in tobacco tax revenues has accelerated in recent years: since FY2014, the last year when tobacco revenues went up, the average annual decline in tobacco tax revenues has been 2.33%.

Now for some magic math: if the last buck-a-pack tax hike led to the current rates of decline in annual tobacco revenues, let’s assume the additional buck-a-pack would have priced people out of smoking at twice those rates of decline. Working from the rates of decline of the past four years, IM 25 would have ceased to generate revenue for the vo-techs by 2030. Under the more conservative ten-year revenue decline rate, IM 25’s revenue boost would have disappeared by 2036.