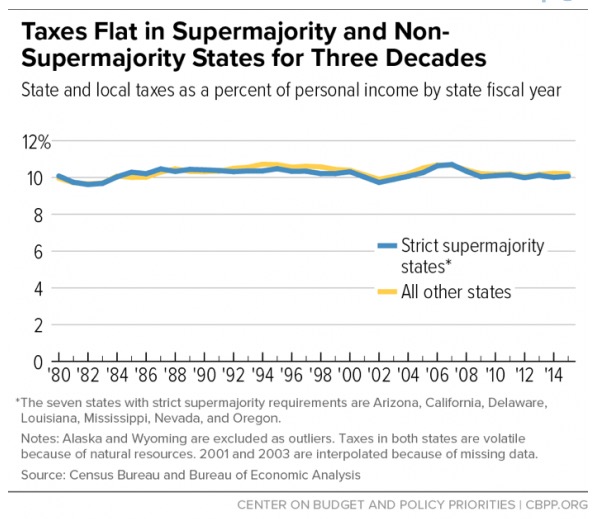

Speaking of taxes, my morning Governing newsletter says that supermajority requirements like South Dakota’s don’t really affect tax rates:

A total of 14 states impose some kind of supermajority requirement — two-thirds, three-fourths or three-fifths of the legislature — to raise taxes and revenue. But while supermajority requirements can be daunting for minority parties, there’s no evidence that they substantially change a state’s tax policy one way or the other.

The prevailing argument for supermajorities is that they keep taxes low. The evidence doesn’t necessarily bear that out. California, for instance, has a supermajority requirement and has some of the highest income tax rates in the country.

What’s more, research from the progressive-leaning Center on Budget and Policy Priorities (CBPP) has found no long-term average difference in tax rates between states with supermajority requirements and states with no such requirements [Liz Farmer, “Do Supermajorities Really Stop Tax Hikes?” Governing, 2018.07.20].

Dusty Johnson will attest to this thesis: he argued during primary (with apparent success) that our constitutional requirement of a two-thirds vote for any tax hike didn’t stop Shantel Krebs and her Republican Legislative colleagues from soaking South Dakotans with voting for and passing lots of tax hikes.

Of course, we should note that South Dakota’s two-thirds requirement is far from absolute:

However, these two sections of the constitution do not affect the creation or elimination of exemptions from a tax. For example, all goods and services are subject to a sales or use tax unless specifically exempted by the Legislature. A simple majority vote is all that is required to add or eliminate an exemption for the sales tax. In addition, license fees and user fees do not come under the definition of a tax and are not covered by these two sections of the constitution. Consequently, the Legislature can create a fee or increase a fee and, as long as it goes to the state general fund for appropriation by the general appropriation bill, the Legislature can do so with a simple majority vote. These sections of the constitution also do not apply to local governments; therefore, a bill to allow a local government to establish or increase a tax or fee would not require a two-thirds vote to be approved by the Legislature. For example, a bill to allow municipalities to increase their municipal sales tax rate would need only a simple majority to be approved by the Legislature [Legislative Research Council, Issue Memorandum 96-29, 1996.11.20, p. 4].

Mileage may vary from state to state, but the supermajority requirement appears to be more posturing than efficacious policymaking.

I find it interesting, that the two times in the last 38 years, that state taxation creeped up (based on this graph), was during the tenure of Republican two-term presidents (Reagan and Bush43).

This most likely means that as Republican administrations cut federal programs to “save money and hopefully cut federal taxes,” that it is then left to the states to pick up the slack…. Which is quite interesting too, because I didn’t know that the GOP’s love for “states’ rights” also meant giving the states the opportunity to pick up the slack, or, better yet, to do the Feds work for them…

#CuttingFederalSpendingRaisesStateTaxes

Ding, ding, ding, JKC! Republicans starve social services, states try to fill the gap. Trump sees them doing that and expands the war on the poor by punishing sensible investing states by cutting the SALT deduction.

It’s not the Federal Government’s job to pay for States.

I find it hilarious that Cory is not happy “rich” people don’t get a salt deduction.

(A) My original point entirely withstands Jason’s distractions. (I need a keyboard shortcut for that almost always appropriate response.)

(B) I find it sad that for the sake of argument, Jason here supports double taxation and opposes a tax deduction for local taxpayers whose higher local tax payments make up for the failure of the federal government to provide sufficient services.