We haven’t seen any sign in Donald Trump’s still-incomplete tax plan of Hillary Clinton’s really good idea of a standard deduction for small businesses. But we have heard that Trump wants to nearly double the standard deduction for individual taxpayers. I thought that plank sounded like a great idea, until I read that the Kristi Noem-endorsed Republican tax proposal calls for eliminating the personal exemption:

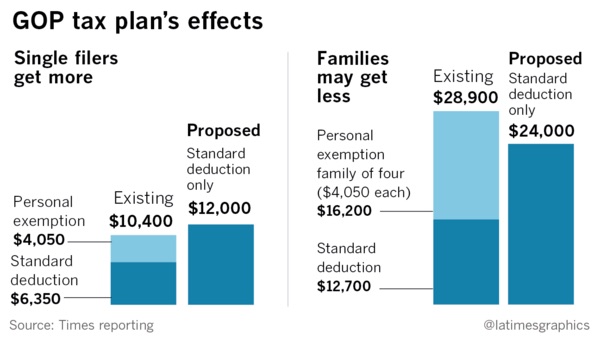

Under existing tax law, a married couple with two children can combine the $12,700 standard deduction and $16,200 in personal and dependent exemptions to shield $28,900 from federal income tax. Under the Republican plan, that same couple would be able to shield just $24,000.

“Increasing the standard deduction and losing the personal exemption is a trade-off that might work for single filers with no kids,” said Howard Gleckman, a senior fellow at the nonpartisan Tax Policy Center. “It doesn’t work at all for a single filer with two kids. They’d be worse off” [Jim Puzzanghera, “Why the GOP Tax Plan’s Big Boost in the Standard Deduction Won’t Be a Winner for Some Average Americans,” Los Angeles Times, 2017.09.28].

Again, Kristi Noem, aren’t we supposed to be focusing on average Americans?

Next year, under current law, the three Heidelbergers in my average household get to keep $24,850 tax-free, $12,700 from standard deduction, $12,150 from three personal exemptions. Pass the Trump plan, Kristi, and you drop our tax-free total to $24,000, subjecting $850 more to federal income tax.

How much more we’ll pay on that $850 depends on what bracket we reach this year. But under current law, we’ll pay 10% on the first $18,650 of our taxable income. If Noem votes for the Trump plan, we’ll pay at least $85 on the extra money Kristi and Donald would tax.

But the Noem/Trump tax plan would raise everybody’s lowest tax rate from 10% to 12%. So suppose our taxable income last year was $15,000. Under Noem/Trump, our taxable income goes up to $15,850, and we pay 12% instead of 10% on that money. Noem/Trump would thus raise our 1040 Line 44 tax from $1,500 to $1,902.

Luckily, Noem/Trump also raises the child tax credit from $1,000 to $1,500. That change would drop our Line 56 tax by $500, back to $1,402. The additional tax burden from the loss of each personal exemption and the higher 12% bottom bracket tax rate is roughly equal to the extra $500 credit for each child, so families with more kids than we have but similar income will see a similar net tax cut of around $100.

But Noem/Trump sneaks a long-term drag on the little guy by changing how the IRS indexes tax rates and brackets. The tax proposal adopts a different, slower-growing measure of inflation. The Tax Policy Center assumes that change will make the standard deduction, the tax bracket boundaries, and other indexed items grow 0.25 percentage points more slowly each year, meaning credits decline in value and more income will end up being taxed in higher brackets compared to current law. Just the slower growth of the standard deduction means that within ten years, Noem/Trump will be taking back $50 of the $100 tax break they might be giving me.

And while they give my family $100 to $50 more each year (and I’m not banking on that money until Noem and Trump finally write down their full plan), they are giving folks in the top 20% an average cut 139 times larger than that. Plus, while my tax cut goes down over the next decade, the average tax cut for the top 20% doubles by 2027.

I’ll be happy to get any dribble of the Noem/Trump gravy… but remember: you, me, and the rest of the bottom 40% of taxpayers get only 5.2% of that gravy, while to the top 20% of taxpayers get 74.5%.

Cory, you need to look at this tax cut from a big picture point of view instead of down in the weeds because you glossed over the big ticket items here. :-) You have not done justice yet to Trump’s plan to help the beleaguered 1%.

The cost estimates that I have seen for Trump’s tax cut range from $2-$5 trillion dollars over ten years. If you assume that Trump’s plan increases the debt by $3 trillion over ten years, and if you divide by the current US population of approximately 325 million people, Trump is foisting debt of $9,230 onto every man, woman and child in this country. Your household cost is thus not plus or minus $100. Your household cost is approximately $27,500! But Trump is nice enough to put it on your tab so that your children and grandchildren can help pay for it.

Now the millionaires and billionaires get a piece of that debt as well some might argue. But the 400 wealthiest Americans get an average tax cut of $5.5 million each from Trump’s plan so they can probably afford the $9,230 in per capita debt. For you and your family, and me and my family, Trump wants to borrow a bunch of money in our name and use it to give tax cuts to the rich. So, no, you don’t have $100 riding on the outcome of this fight. You have $27,500 riding on it.

“As democracy is perfected, the office of president represents, more and more closely, the inner soul of the people. On some great and glorious day the plain folks of the land will reach their heart’s desire at last and the White House will be adorned by a downright moron.” — H. L. Mencken

Yes, it’s true, newspaperman H.L. Mencken wrote these words that were published by the Baltimore Evening Sun on 26 July 1920. The words were written 97 years ago, coming true in 2017.

Simple chart shows winners and losers of Drumpf’s tax giveaway to the very top.

https://1.bp.blogspot.com/-Oe7cO4bXfcs/WdAca1NAjjI/AAAAAAABq8Q/NNI4VWDf77IJsqTkO1p1btB3kQ0fTqPXwCLcBGAs/s1600/tax%2Bproposal.png

http://www.reuters.com/article/us-usa-economy-taxes/u-s-treasury-chief-says-planned-tax-cuts-will-not-benefit-wealthy-idUSKCN1C61EG?feedType=RSS&feedName=newsOne&google_editors_picks=true

Munchkin sez tax cuts won’t benefit wealthy. Oh, boy. Where does one find these …..uh…people?

Darin, I agree that our analysis of the Noem/Trump should include increased debt right alongside the specific impacts on specific taxpayers. The benefits of the meager $100 to $50 that my family might get must be weighed against the burden of having to pick up the tab of Noem/Trump’s free-riding years from now. That’s another reason we shouldn’t resort to tax cuts and deficit spending for stimulus unless the situation is dire. I am willing to forgo the minuscule tax cut I calculate above in favor of continuing to fund CHIP, FEMA, and other vital federal programs. I see no compelling economic reason to transfer so much wealth up the ladder to the luxuriating 1%.

Republicant tax cuts never produce or result in economic growth – so says the republican who created the myth.

Arguing details over “their myth” concedes the issue. Challenge the issue. Defeat the myth.

https://www.washingtonpost.com/news/posteverything/wp/2017/09/28/i-helped-create-the-gop-tax-myth-trump-is-wrong-tax-cuts-dont-equal-growth/?utm_term=.193d541fb628

The only thing left that the repubicants are able to do is lie about cutting taxes. No big ideas. No great initiatives.

https://www.washingtonpost.com/opinions/the-only-thing-the-republican-party-knows-how-to-do/2017/10/01/50b33d18-a54f-11e7-b14f-f41773cd5a14_story.html?utm_term=.0504cd0f5008