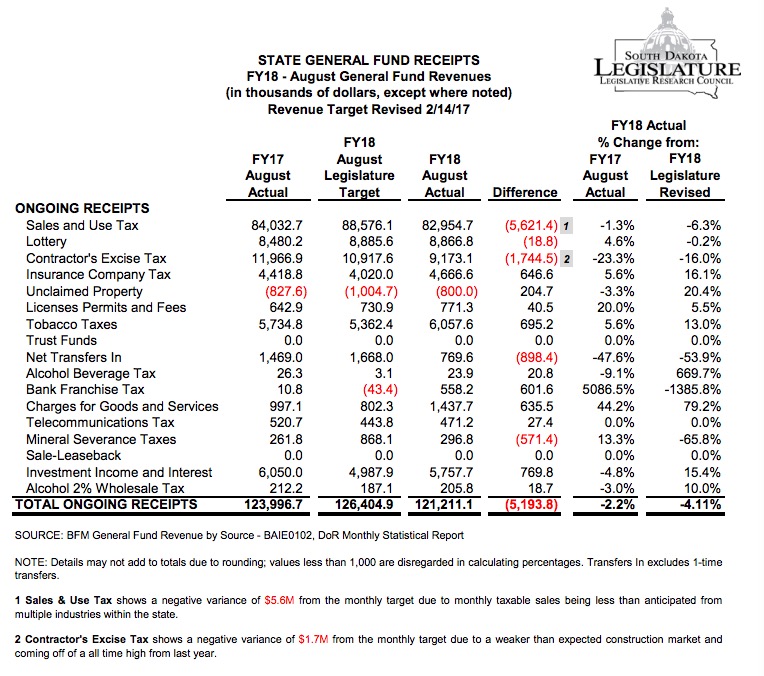

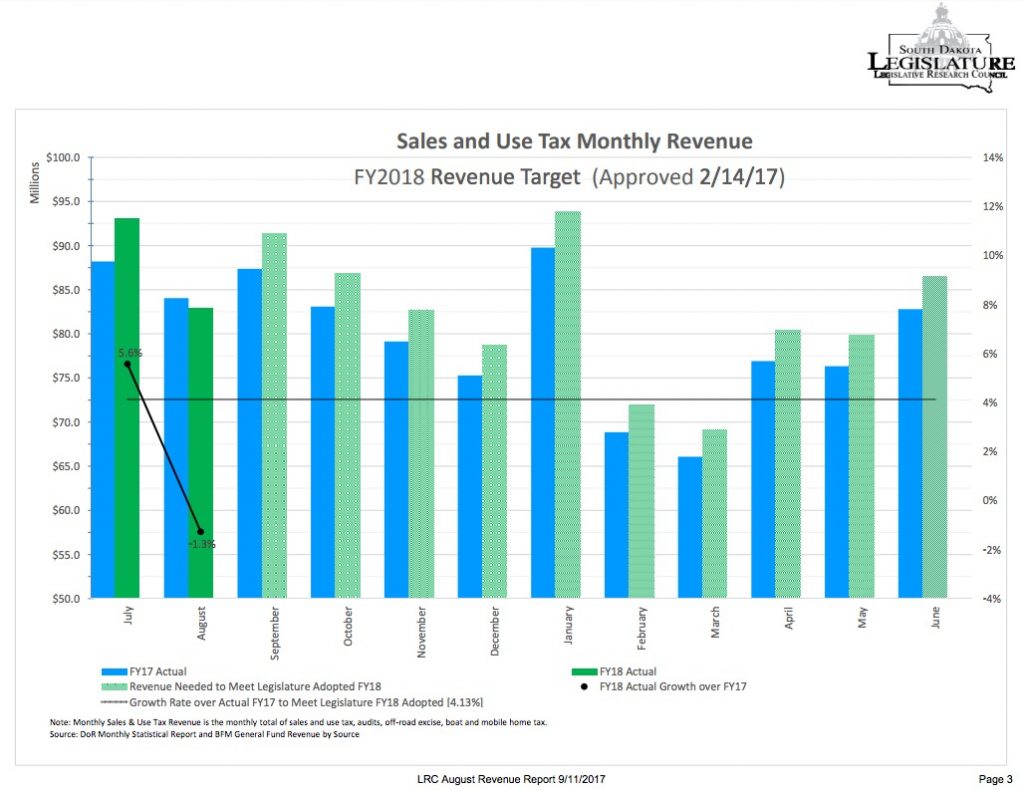

More people bought tattoos and tacky shirts in Sturgis last month, but Rally sales didn’t lift the rest of the state. According to the Legislative Research Council’s August revenue report, August sales tax receipts were down 1.3% from last year and 6.3% below the Legislature’s budget target.

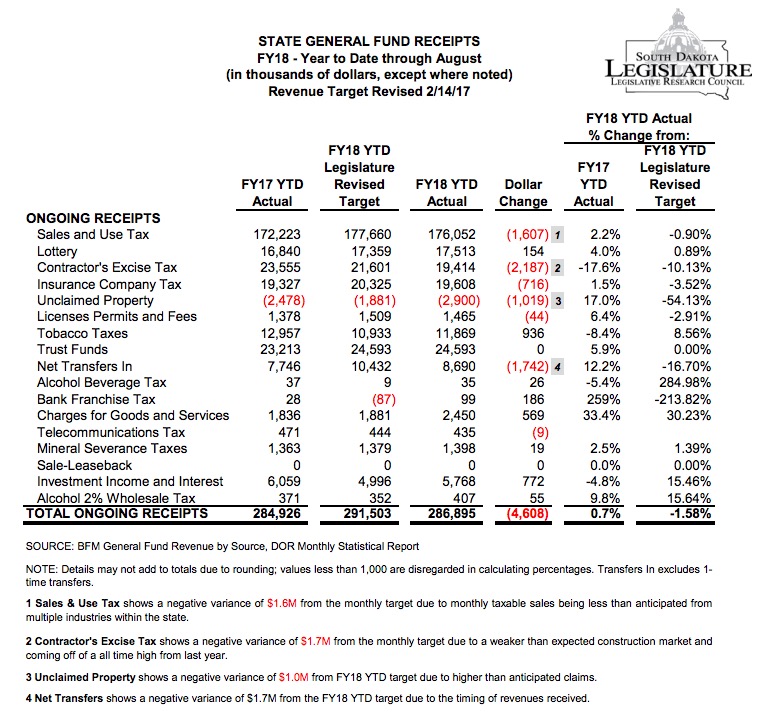

We collected $5.6 million less sales tax than the Legislature figured we needed. Luckily, we collected $4.0 million more in sales during our better-than-expected July, which leaves us mixed on sales tax for the first two months of the year: up 2.2% from last year but 0.90% below this year’s target.

Contractor’s excise tax was also off target. Over the last two months construction has underperformed last year’s all-time high and this year’s budget assumptions, leaving us with $2.2 million less in contractor’s excise tax than the Legislature budgeted for.

State alcohol taxes are a minor portion of the budget, less than half a million dollars a month, but it’s notable that wholesale alcohol collections dropped 3.0% and beverage tax collections dropped 9.1% in August compared to last year. The rest of us apparently watered down the Rally surge.

Two months in, total general fund receipts are down 1.58%—$4.6 million—below our budget target. If we stay on this drooping tax curve, the Legislature will have to plug a $28-million hole in the state budget.

Am I reading this correctly? If tax receipts are down 1.3% from last year, and are 6.3% short of legislative projections, does that mean the Legislature projected 5% growth? What flavor of Trump Kool-aid are they drinking in Pierre? Good grief, we are experiencing the worst farm commodity prices in at least a generation and these economic masterminds are telling us happy times are here again.

Kristi Noem would be proud.

Nick, your math appears to be on the mark for August. The August figures indicate the Legislature budgeted based on an expectation that this August would bring 5.4% more sales tax than last August. But divide the year-to-date figures for expectation over last year actual, and you get an assumption of 3.2% growth for the first two months of FY2018.

Does this mean the Legislative Kool-aid was spiked with 60 proof vodka rather than 190 proof Everclear?

That’s ok. We’ll just cut education funding to make up the difference in revenues from expected. We know that companies love coming to states with low investments in education funding.

We are around 28th among states in per capita and median household income, so the mentality that we don’t have the resources to fund education like other states is bunk.

https://en.wikipedia.org/wiki/List_of_U.S._states_by_income

Depending upon a regressive sales tax as the primary means to fund state government will continue to be a losing proposition. I don’t know if our state leaders have noticed, but the ag economy is in the dumps with little hope of a large turnaround in the near future.

Also, when middle class incomes are stagnant, sales tax revenues are likely to be stagnant, as the middle class drives the spending that the sales tax growth depends upon. The upper income earners which have prospered and continue to benefit most by our economy pay less in sales tax in proportion to their income. It should be a surprise to no one that our sales tax revenues lag when the middle class and lower earners are experiencing stagnant real wage growth. The state has chosen to let high earners pay less than their proportionate share of the costs to maintain our state government and education funding. As Dr. Phil would say, “How’s that workin’ out for ya?”

The message in this data for the GOP Party is it needs to dish out more corporate welfare. Maybe Foxconn can come to South Dakota and we can just hand over our state reserves to the company in exchange for the promise of some jobs. We can probably find a way to make work comp completely unavailable to injured workers, if corporations want us to. And heck, any corporation that needs to train its workers – we’ll pay for that too. In the race to the bottom we will not be outbid.

I’m all about a progressive tax structure, Darin. Capture the wealth where it is, give the middle and lower earners a chance to catch up. Even if state income tax is a non-starter, we can make sales tax fairer by dropping food and maybe clothing, à la Minnesota, and setting higher rates on luxury items and services.

Hey, could we make a progressive property tax?

How would this aggressive property tax work, Mr. H? Would not owners of property just divide them into ever smaller chunks for tax purposes? If you aggregate them all up into a total for, say, a hypothetical fellow named “Mr. Stan”, then “Mr. Stan” just might, or maybe has, put different properties in different names of different legal entities.

I’m just askin…but I am curious how that might work.

Clever word game, Grudz. To actual policy:

The idea of progressive taxation is to charge higher marginal rates to reflect the relative burden that higher-income taxpayers can bear.

So suppose I have my one average house assessed at $200K (rounding up) while this figmentary Mr. Stan has a mansion assessed at $800K. Mr. Stan also has a swanky second home assessed at $500K.

A progressive taxation scheme would start off by taxing the second home at a higher levy than either of our first homes… and South Dakota does that! Our first homes—our principal residences, the addresses from which we register to vote (yes, the owner-occupied classification statutes, including SDCL 10-13-39 cite voting residency statute, SDCL 12-1-4!)—are taxed for school funding at $3.372 per $1000. Assuming the second home is classified as “other”, the levy is $6.978 per $1000. So in a way, the higher levy on a second home is like a higher marginal property tax on the multi-home luxury afforded by Mr. Stan’s hypothetical wealth.

Thus, in a way, a progressive property tax would work like that portion of South Dakota’s existing property tax system. A bunch of Kneip/Wollman liberals must have written that.

I could suggest we go further and create brackets for progressive property tax levies. Suppose we start at the median home value in South Dakota—or at least Sioux Falls—$200K as of Q2 2017. Half the houses in the neighborhood are worth that much or less. Cool. Set the school mill levy for the first $200K of assessed value on owner-occupied homes at $3.372. On the first $200K of value of our main residences, Mr. Stan and I each pay $674.40.

But wealthy Mr. Stan can support a far bigger house. He can also support a progressively higher tax bill. We could set a school mill levy on the next $800K of assessed home value at $4.500. Whereas five regular folks each owning a $200K house would pay a combined $3,372 on their combined $1M of residential property, Mr. Stan will pay ($3.372 x 200 + $4.50 x 800 =) $4,274 on his $1M of mansion. We could add another bracket for assessed value above $1M, because holy buckets! who needs more than a million bucks worth of house?!

We could take a look at assessed values and calculate progressive levies that not only make up for our lagging sales tax receipts but lower our food tax rate to zero. Are you game, Grudz?

All that math about levies and such just confuses an old man like me. I suppose the legislatures and people have to pass a law bill every year after they have valuations and such, but that’s all just mumbo jumbo math.

I guess I was suggesting that if “Mr. Stan” were to put house number 2 in the name of a hypothetical corporation, perhaps named after an ancient religious king or whoever, would not Mr. Stan only be taxed on his first house and the corporation only be taxed as a first house, not a fancy second mansion? Or if a fellow owned, say, a couple hundred acres out in the woods worth X, could not that fellow break it into a half dozen holdings, with no fences of course, owned by different shell companies and avoid the higher, more aggressive property tax?

I’m just thinking of ways people might try and get around this. We need to plug those loopholes if you bring it as a Blog Bill, to sit aside grudznick’s Blog Bill #1 to require the legislatures to put all the spectator pay and spa stays on the web.

A house placed in the name of a shell corporation might not be able to qualify for owner-occupied status. Given that owner-occupied depends on residency as defined by voter registration, since a corporation can’t register to vote, it can’t occupy a house as its primary—i.e., voting—residence.

But I agree that shell corporations, like shell PACs, can get by with all sorts of monkeyshines. A healthy progressive tax structure would recognize and stymie those monkeyshines by treating people as people and corporations as legal fictions subject to higher tax rates.

Maybe shell games like that are the real reason for declining revenues rather than more people buying things online. Maybe more rich guys are finding more ways to hide their riches from taxation in South Dakota.

Whatever plan Cory were able to implement, the hypothetical “Mr. Stan” would be clever enough to circumvent, no doubt Grudz.

I remember early in the “owner occupied” era of SD property tax collection a prominent citizen of Hosmer, SD claimed two owner occupied homes, one in Hosmer and another at a lake in another county. He was caught and prosecuted. This was over 20 years ago and in an era when computers were not as connected and programs not sophisticated as today.

We have been operating under a graduated property tax for well over 20 years. Establishing a system where the first $100,000 of OO value paid a lower rate than OO value over $100,000 is simply a matter of writing a few lines of computer code. We already change mill levies on a yearly basis.

I’m always a bit startled when I come back to SD and buy groceries and see the 7% extra I’m paying for them. Gas is always more expensive in SD also. Lowering the high tax rate on food or eliminating it altogether I’m sure would stimulate the economy some.

Even the Dayton Trust Fund is in SD, Cory.

Ror, I’m not afraid of any hypothetical tax dodgers. I’ll be happy to challenge the real ones with my policymaking. Bring ’em on!

Jenny, add a tax on Dayton’s money to my budget plan. Minnesota will save us yet! :-D