When Dollar Loan Center reopened in Sioux Falls and Rapid City in July to offer shady one-week loans, I was worried that payday predator Chuck Brennan was exploiting a new Legislative loophole in the 36% interest rate cap that we voters slam-dunkingly approved last November. My worries were apparently unfounded.

The South Dakota Division of Banking announced yesterday that it is shutting down Dollar Loan Center:

Director Bret Afdahl said, “Based upon a recent examination of Dollar Loan Center, the Division of Banking issued a cease and desist order and order to revoke all money lending licenses held by Dollar Loan Center due to lending practices in violation of South Dakota money lending laws” [SD Division of Banking, press release, 2017.09.13].

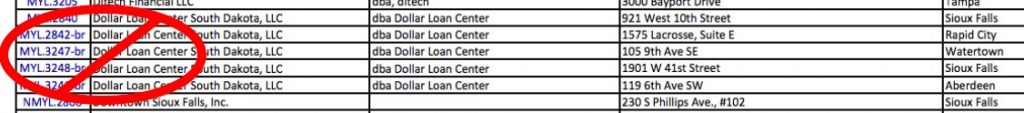

The Division of Banking has thus far providing no details on the legal analysis supporting this revocation. The division’s list of lending licenses as of September 1 showed five licenses held by Dollar Loan Center South Dakota LLC: two held in Sioux Falls and Rapid City since July 2010 and three issued for sites in Sioux Falls, Watertown, and Aberdeen in June 2017; like all current lending licenses, those five were to expire at the end of this year.

Brennan says his company “disagrees with the Division of Banking’s decision and will pursue its available legal remedies….” The folks who brought us the 36% rate cap and helped push Brennan’s predatory lending out of South Dakota are promoting an event discussing the rate cap and lending options. “Life After 36%: A Faith-Based Response to the New Lending Crisis” happens Thursday, September 28, at 7 p.m. at the former Life Church Building at 1117 West 11th Street:

This event will feature Dr. Nathan Hitchcock, professor of church history and theology at Sioux Falls Seminary, who will present a biblically informed perspective on lending. In addition, Sara Nelson-Pallmeyer of Exodus Lending, a Minneapolis non-profit that lends money at no interest caught up in payday loans, will share the blueprints for building a viable payday loan alternative. Attendees will hear a legislative update and receive relevant resources to be part of the next chapter in the drive for fair lending [Facebook event page, downloaded 2017.09.14].

Notice the difference: the 36% rate cap sponsors stick around in South Dakota and help folks find solutions, while Chuck Brennan throws a snit-fit, then tries to skirt the law.

Here’s the nitty gritty. http://dlr.sd.gov/news/releases17/nr091317_dollar_loan_center_order.pdf

From that order:

1. SD Div of Banking finds late fees account for 90.22% of total Dollar Loan Center income.

2. Dollar Loan Center loans illegal and borrowers are not obligated to pay back the principle or fees.

Brennan’s model found to be a debt trap created to be profitable only by gouging the poor and elderly.

Not clear to me at this moment what the fines will be based on these numbers of loans. Each violation is a Class 1 misdemeanor, up to $2000 fine. If the number is 309 loans, the max fine is: $618,000. Maybe I’m way off, it’s hard to tell from the order the number of violating loans. Either way, there is a decent fine, and well-deserved.

Brennan will fight it for sure. Maybe he’ll get an injunction for a time on the ruling. The time it took for the Div. of Banking to issue this ruling gives me confidence they did it very carefully knowing a court will ultimately decide.

Notice also today there was another ruling against another payday lender in SD>>> http://dlr.sd.gov/news/releases17/nr091417_cash_n_go_order.pdf

I don’t particularly like greedy people either, and this Brennan seems shady and greedy, but I’m still not totally sure why laws need to be passed protecting people from high interest loans.

Everything we buy has a mark-up of some sort, why should loaned money be any different? Adults are presumed to have the mental capacity to understand the contracts they sign. If people are unable to afford their bills or the other things in life they want, shouldn’t they be able to sign any contract they feel is acceptable under the circumstances? I don’t think any lender should get away with hiding the true details of a contract, but that’s general contract law anyway.

Maybe I am making a connection out of nothing, but this seems to me to be pretty similar to the weak arguments against casinos I hear from time to time. We gotta protect people from their own frivolous decisions through legislation now ? Lame. Oh no, some sad, impressionable person threw their money away because they made bad decisions and signed a contract with high interest rates!? Oh no, some sad, impressionable person threw their money away at the casino!? Why should we base our public policy on the weakest links?

In my opinion, too many people feel like they need to “protect” other people who aren’t asking for any protecting.

It’s an intentionally defective financial product marketed to the financially desperate and financially unsophisticated. It took me a good while to get my head around what was really going on in the loan model and I’m not financially unsophisticated. It took smart lawyers to sort through these products and help us figure out a way to regulate them without negatively effecting legitimate small loans.

It’s the poverty industry and they prey on your grandmas social security check. They sell their products as one thing, a short-term loan, when the model is based on you flipping the loan an average of 8 times and taking 300 days to pay it off. They are sold on deception to the desperate and 80 million a year is siphoned off SD poor and elder in fees on these loans. This means they go in for a short-term fix and their problems quickly become far worse. This means landlords don’t get paid because the payday lender hassles the borrower and the little they have goes to the lender not the landlord.

We incentive businesses we want in our state to help our citizens with good jobs, good services and to bring in dollars to our communities. The state has an interest as well in getting rid of the poverty profiteers who bilk millions from the poor and those dollars leave the state.

Is it wrong to mark up a medicine to the suffering people who need it most? In the same way it is wrong to lend to the poor at exorbitant interest rates. It is not true there are so many defaults it justifies the higher cost. These loans are simply paid off my the borrower going across the street to another lender to pay off the previous loan.

Glad to see Black Hills Credit Union is buying the Dollar Loan Center complex in Sioux Falls. They offer $500 short term loans at 18% interest.

All responsible lenders should follow their example. Every biz owner knows there are some products you make money on and some you don’t. But you still sell the products that aren’t moneymakers because people need them. Banking should be no different. There are other loans to make money on and lenders should give back to the community by also offering loans that aren’t moneymakers – like these small dollar loans to the poor.

Like I said, I don’t like or agree with greedy people who are trying to take advantage of anybody, but I don’t see these borrowers as victims. However, I think treating them like victims perpetuates the attitude of entitlement that too many Americans already have. A contract is void if a person lacks the mental capacity to understand its terms, and that seems like a well-reasoned law to protect real “victims.” If a person understands the terms of a contract and it turns out they made a bad deal, that is their problem – just ask those smart lawyers.

And yes, I can see the response coming – “It is their problem to start with but it becomes everybody’s problem when their poverty costs the state so much money so the state has to get involved, etc., etc., etc.” To me, the two major problems with this “protect the taxpayers from the poor” argument are: 1) there are more efficient ways to help the needy and protect the helpless than to go on a narrow and overly-specific crusade against lenders who only exist because the demand for their product exists; and 2) the rules all seem to be set arbitrarily – people can put themselves into poverty a million different ways, and legislating morality in lending sounds a little bit crummy to me.

Ryan … You are correct. “A contract is void if a person lacks the mental capacity to understand its terms.” But you forgot one addendum. “A contract is void if a person lacks the mental capacity to understand its terms AND it’s implications.” SoDak voters have said that these loans have implications that many don’t understand. It’s probably hard for you to grasp that everyone isn’t as intelligent as yourself but try to have compassion for those that got bound up by Brennan’s life long career in loan sharking.

Ryan, I get your point. I suppose there are just things that we as a society say cannot be bought: we do not allow the sale of (non-prescription) narcotics; we do not allow the sale of sex; we do not allow the sale of loans over 36%. We draw lines on what is and is not OK to market. Anything on our “banned” list potentially exposes some level of hypocrisy in the context of other banning and allowances.

On a similar tangent, President Trump is asking our USA Supreme Court to allow religious hospitals to post a sign out front saying, “Due To Our Beliefs We Refuse To Treat Queers and Muslims!!”

I understand what Lansing and O are saying. I understand that the legislation passed and this is the rule. What I’m saying is I disagree with it on principle. I’m saying it is arbitrary and treats adults like children who need protecting. Obviously, the voters voted for it, so South Dakotans want help deciding what a fair contract is, but like I said, I simply disagree that this law is a good thing.

And Lansing, you don’t know anything about me or my ability to grasp sympathetic concepts. I have compassion for real victims of all sorts of calamities. I don’t have compassion for people who repeatedly sign contracts that they claim are unfair. I wonder if there is a study out there that shows the percentage of loans that were made to unique borrowers. I would guess, with admittedly no basis whatsoever, that about 75% of business was from repeat customers. If I am anywhere close, it would seem to me that whether you want to consider the terms or the implications of the contract, these borrowers knew what they were doing, and they did it anyway, because they either made poor decisions or had nowhere else to go for money. I’m just not as quick to buy into this recent notion that everyone is a victim if something doesn’t go their way. This doesn’t fix the problem of people not understanding contracts, because almost all contracts are confusing to people if they don’t have experience interpreting them. This also doesn’t fix the problem of granny not having grocery money. It doesn’t prevent people from outspending their means. It doesn’t fix anything except a very narrow problem of seeing those stupid dollar loan signs all over town. So, it’s not a “compassion” argument, it’s a practicality and principle argument.

Ryan is right, you can’t legislate morality. Or can you?

Banning abortion won’t stop people from getting them. There is always money to be made, and I wonder if there is a study out there that says about 75% of the abortion business is from repeat customers that never learn.

If you’re the Ryan I think you are and you used to post under Ryan Deplorable, I have a knowledge base on what you think and what you’re all about. Are you him?

I’ve never posted under any name other than just plain ol Ryan.

Pleasure to make your acquaintance, Ryan. Your comments are well thought out and make a lot of sense. Looking forward to more.

What Mr. Hickey really means is that he needs to save these stupid people from themselves. His god wants him to.

Mr. Lansing, what if they are a gay, Islamic hospital? Seems like posting a sign like that would just put them right out of business.

Maybe this illustration (though not completely on task) will help those struggling to understand. Think of the payday lending as a bait-and-switch: They *pretend* to offer a quick fix, but the reality is they are luring people into a quagmire when their panic leads them to do things that almost ensure a bad outcome. The terms are complex and full of fine print; they are actually *designed* to catch the desperate, distraught and under duress who need money (ever have a sick child, in desperate need of mediation? Big Pharma, like Martin Skrelli, are creating more in that pinch all the time). Just like those who fall for the telephone scam, payday lending is aggressively-designed: “you need it, you need it now,” and the pressure is on where many if not most think they have to take a loan, any loan now, without contemplation and careful consideration. Only later do most find out the repayment terms are almost impossible to meet, so they have to take out *another* loan to repay the first – and the pattern repeats. Telephone scams are illegal, even though the argument can be made that it’s people’s own darned fault that they fell for it…. Price-gouging after a storm historically has been illegal (when people desperately need something in a time of distress). The drive-by roofer scamming folks after a hail storm – in price and/or flat-out disappearing with the cash – is pretty much the same thing. I hope this poorly written reply helps people understand.

Community Organizing Works!!

Community regulators should take a page from the con artists’ play book. Criminals use social networks and social events like church gatherings to sell their scams. They fund sports events and donate to charities. (Sound like Chuckie Brennan?) Regulators need to be present online as well as at these same physical venues with their message of how to spot a fraud, how to verify that an investment offer is licensed, and how to get in touch with regulators. If communities cannot or will not do this, then they should fund consumer organizations to do the job for them.

Simply telling consumers caveat emptor with no further outreach or enforcement is a not acceptable. Hometown regulators can empower consumers to be a part of the solution to financial frauds, including digital fraud.

MrsGr.’s points align with what the general public apparently thinks about these types of loans, but I think the analogies fall flat. Telephone scams are illegal because the scammers are committed fraud in the inducement, which means they are telling lies in order to get a person to part with their money. These scams are illegal whether it is in person or over the phone. Her own comment proves that the people who are seen as “victims” of payday lending are making their decision to take out the loans “without contemplation and careful consideration.” This does not make them victims – this means they made poor decisions of their own free will. I think the comparison to price gouging in a disaster is closer, but still not close enough. We aren’t talking about a company that offers a product year-round at a certain price and then increases that price when something bad happens in order to take advantage. We’re talking about a business model that operates because there is a certain percentage of the population who either doesn’t want to or can’t use other traditional sourcing of funding. I agree a lot of people end up taking out new loans to pay off old loans because they signed up for something they couldn’t pay for, but that shows a lack of personal accountability, not any wrongdoing on the part of the lender. If somebody shows me evidence of these lenders misrepresenting the terms of the loan, I’ll react to that, but so far it is just about the interest rates, and I can’t agree with legislating voluntary contractual rights related to otherwise legal transactions.

Is it possible that this legislation is intended to protect potential lenders? If the potential lender erroneously is led to believe that he, she or it, can earn huge (e.g. 1,000%) interest on a loan, even though even the principal might not be repaid at all in case of default, perhaps that lender is the “victim” that these limitations are intended to protect?