Also on the Legislative Executive Board’s agenda tomorrow is a report and FY2019 budget request from the South Dakota Investment Council, the folks who manage the South Dakota Retirement System pension fund and other far smaller state trust funds.

In FY2017, the Legislature budgeted $16.5 million for the Investment Council, all which comes from its own funds, not the stage general fund. The Investment Council spent only $10.2 million, with most of the surplus in unused investment performance incentives. 31.25 FTEs received $4.83 million in salaries, and average of $155,000 per council employee. Since 2013, the council has set a salary target of 70% of cost-of-living-adjusted median industry pay for investment experts, which isn’t enough to recruit top talent but gives us a shot at cultivating and keeping talented local analysts.

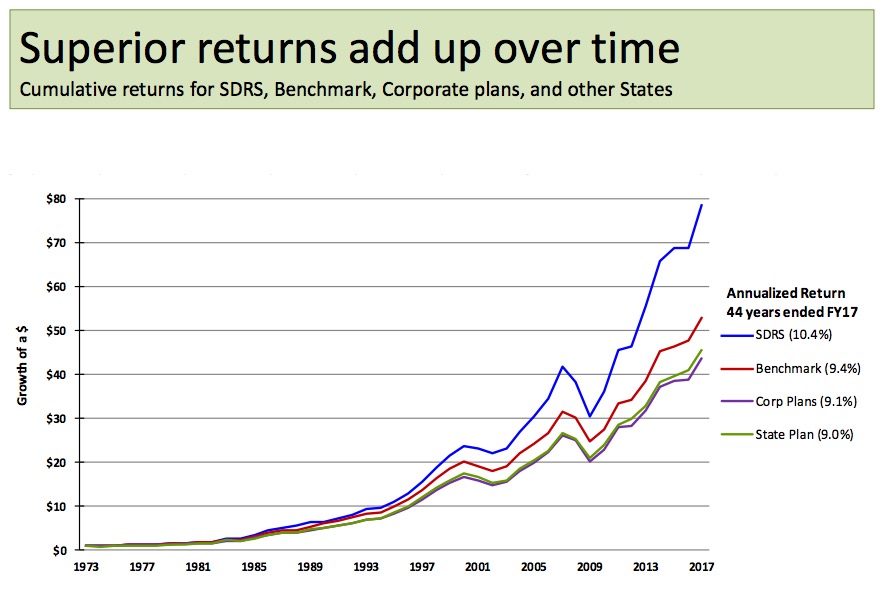

These underpaid experts got the job done for South Dakota’s pensioners in FY2017, delivering South Dakota Retirement System returns of 13.81%, beating the 9.05% four-year annualized return and the recession-sandbagged 6.47% ten-year annualized return. A dollar invested in 1973 in the state pension plans (the Legislature formed SDRS by consolidating six retirement plans in 1974) is now worth almost $80.

SDRS now holds $11.632 billion in assets. The Investment Council holds a total of $14.207 billion in assets. Management fees eat up 0.34% of that amount, compared to a benchmark of 0.68%. Just by keeping management fees at half the going rate, the Investment Council saves us $48 million a year. That annual efficiency alone would cover Investment Council salaries for almost nine years.

The Legislature budgeted the Investment Council a 4.7% pay increase this year. The Investment Council is asking for a 3.68% increase in pay in FY2019.

Total S & P return for the last 12 months has been 16.04%. Long term average return has been 11.54% https://ycharts.com/indicators/sandp_500_12_month_total_return

What?! SDIC undershot a major market return?

With this kind of money in the bank, why did the Legislature have to raise the retirement age last July? You’d think this well-performing system would make people feel safe enough to keep working longer if they can (and many do these days).

Mr. Price, I realize Robbinsdale is not the same sort of mecca of financial high-browedness as is Aberdeen, so low-brows like you and I will have to wait for Mr. H to explain it to us.

So let me get this right. We have a total of $ 25.839 billion in assets, that is set aside in reserves? And that we have the potential, based on recent performances, to obtain a yearly return of 13+% on all of that? Is that right? Because, if that is case, we have a total of $ 3.36 billion that we are adding to our reserves each year based on the 13+% figure. And, if you factor in that inflation is less than 2% annually, then we have roughly a 11+% yearly return beyond growth demands of the initial intended purposes of all of the reserves, which could be touched without interfering with the integrity of the reserves themselves and their initial purposes, right? And this “11%” would be the equivalent of $ 2.86 billion, which would more than fund state government versus our current tax systems, would it not? So why do we have any state taxes? And especially, why did we increase the sales tax to pay for teacher pay increases, when we have such annual yields from the enormous reserves we have in hand?

I had always thought that one of the main reasons that the Republicans in Pierre were always reluctant to touch reserves to fund new programs, or balance the state budget, was because they dreamed of some day having a reserve so big that the annual interest yield itself would fund state government without any need for any state taxes, but if I have my figures right, then we are already there, aren’t we?

What don’t I understand here? I mean, I realize that some of these reserves have specifically dedicated purposes, but if their annual return is greater than inflation, how is the integrity of their dedication compromised if we use some of the excess to fund state government overall?

Holy cattle, John Claussen, Sr. Maybe you should run for gov? I like the way you interpreted all that.

JKC, what assets are you counting to reach $25.839B? Over the past five years, South Dakota has held its budget reserve in the $135M–$170M range, with the July 2017 reserve at about $165M.

If we have $2.86 billion in easy returns to use for our budget, I’m more than happy to start paring away sales tax and other regressive funding mechanisms. (Free tuition at Regental campuses for residents!)

Cory, my $ 25.839B figure comes from adding the 11.632B and the 14.207B figures that you mentioned in your second to last paragraph. Or, is the 11.632 a part of the 14.207 figure? This is why I posed my ideas in the form of a question, because there could be something fundamentally wrong with my assessment. Is there something I am missing here?

And as far as the actual reserve funds ($ 165M), are not those the actual reserve funds that the legislature has direct access to, if wanted, without any greater legalities involved in tapping into them? As oppose to retirement funds, which are protected funds…

But if I am on to something here, we do have to keep in mind that annual returns will not always be 13%. They could be less and there maybe federal laws which prevent us from touching some of these reserves for other purposes, like the retirement fund.

If my memory serves me right, Heidepriem during the 2010 gubernatorial race often talked about the billions the state had in reserve funds. So are these the billions he was talking about?

It seems to me, that if we can’t tax the rich in this state, at least we could work to stop taxing the middle class, the working poor, and the poor in this state. If my understanding of these figures is right, that is…..

John, I am just now reading this article and I doubt you will see my reply, but in the event of future readers the $11B are the SDRS assets which are included in the overarching $14B the SDIC manages. That $11B has the sole purpose of funding state employees’ retirement pensions. The other $3B include the state’s checking account, and various assets the state technically owns that are not included in the 13% return figure as they are geared more toward highly liquid, low risk, low return investments. Hope this helps.