Watertown mayor-elect Sarah Caron takes her new post Monday and is promising city staff a “clean slate“:

Caron said she doesn’t plan to make any staff changes at City Hall.

“I know there have been some rumors that I am going to come in and clean house,” she said, “but that’s not true. Everybody will start with a clean slate. My expectations will be communicated clearly, and everybody will be expected to meet them. I want everybody to feel comfortable telling me what their concerns are” [Roger Whittle, “Mayor-Elect Sarah Caron to Take over Reins Starting Monday,” Watertown Public Opinion, 2017.06.27].

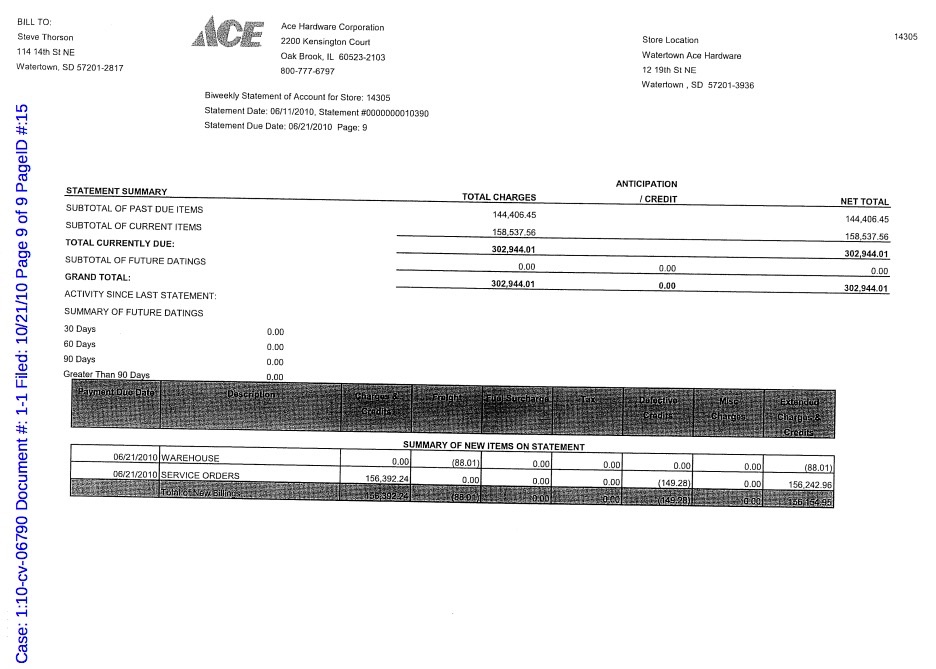

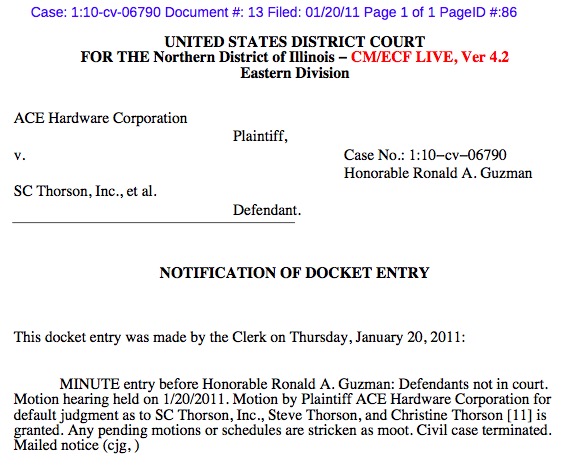

The man she beat, outgoing mayor Steve Thorson, will get a cleaner slate, of sorts. As reported first and only on this blog last week, Thorson has two federal tax liens against him for almost $83,000 owed to the IRS for the 2006–2008 tax years. In addition, in 2011, the Northern District of Illinois, Eastern Division, of the U.S. District Court granted Ace Hardware a civil judgment of $302,944.01 for Thorson’s failure (or, technically, the failure of his corporate shell SC Thorson Inc.) to pay for merchandise and services received under his contract to run an Ace Hardware store in Watertown between 2006 and 2010 and to satisfy guarantees made personally by Thorson and his wife Christine.

My check of the case documents on PACER indicates that Thorson never formally contested Ace’s complaint, and Judge Ronald A. Guzman granted Ace’s motion for default judgment on January 20, 2011.

Tax liens and civil judgments are really bad for credit scores… but not for long! On Saturday, Equifax, Transunion, and Experian will start following new rules for including tax liens and civil judgments in calculating our credit scores:

More identifying information: New judgments and liens won’t go on credit reports unless they have a Social Security number or birthdate to go with the consumer’s name and address.

Frequent updates: The bureaus will check for updates or new records at least once every 90 days.Scrubbing old data: The bureaus will begin to remove previous entries that don’t meet the new standards.

The changes could affect about half of tax liens and almost all civil judgments now on reports, according to the Consumer Data Industry Association, a trade group representing the three major U.S. credit bureaus [Bev O’Shea, “Will Your Score Soar with Credit Report Changes?” Atlanta Journal Constitution, 2017.06.28].

Credit scores may bump up 10 to 40 points for affected consumers.

Why are the credit scorers making this change now? The industry is trying to spin the move as an action taken out of the goodness of their hearts, but the new rules come at least in part thanks to the Consumer Financial Protection Bureau:

Consumers can thank the CFPB, though anyone who wishes to do so might want to hurry because the agency is not a favorite of the new president.

…Before going, however, the CFPB did send a message to the three major credit bureaus for mistreating consumers. The CFPB has documented more than 186,000 consumer complaints about credit reporting and credit scores since July 2011, the most of any subject they handled.

Most of the griping was because of the nonchalant attitude credit bureaus had about mistakes on credit reports. Consumers felt like the bureaus didn’t take them seriously, even if they presented overwhelming proof that the information on reports was inaccurate.

The CFPB, which has been hounding the credit reporting industry for nearly six years on the subject, said things are improving.

“Because of our work, important improvements are being made,” CFPB Director Richard Cordray said in a statement. “Much more work needs to be done, but our corrective actions are leading to positive changes that are benefiting consumers all over the country” [Bill Fay, “CFPB’s Deal with Credit Bureaus Could Raise 12 Million Scores,” Debt.org, 2017.04.04].

The CFPB has been a regular target of SDGOP spin blogger Pat Powers. Powers’s patron, SDGOP chairman Dan Lederman, used his partisan Rushmore PAC to pour significant resources into a desperate last-week effort to save Thorson’s supposedly non-partisan reëlection campaign.

Steve Thorson, you need to think about your choice of political friends. Not only did you throw in with a PAC whose partisan caterwauling appears to have been counterproductive in your campaign, but your out-of-town pals are also trying to undermine the federal agency that may well be helping you clean up your credit report just as you reënter the private sector and maybe go looking for a loan to start a new business.

Cory, are you into unicorns and magic; thinking a GOP’er would give any credit to an Obama thing?

You know me, Vance: I believe in no unicorns or magic. I know full well the Republicans we’re discussing here won’t admit that they are working against their own guy’s best interest. But even if they’ll never change their minds, I expect them to have to cling to their fantasies against the sound of my reminders of their baloney and our laughter thereat. :-D

Having once worked for several years for the pre-employment background screening division of a major credit bureau, I am completely in favor of the CFPB action here even though it means that some irresponsible scum like Thorson will be able to catch a break. Since I had paralegal training, I was responsible for writing reports on any criminal and civil records found, including federal records and bankruptcies, and the federal records often had no identifying information other than the name and, sometimes, a middle initial.

There was often no way to know for sure if the record really belonged to the person we were screening, and chances were, if it was a common or fairly common name (which happened quite often), it was NOT the person. Nevertheless, per company policy, we included the record in the person’s background report.

The bureau covered itself by including a caveat disclaimer, stating that there was no clear and solid evidence that the record belonged to the individual and for the employer to use caution in making any decisions based on that record. That was it. The company felt no other obligation to try to do even any basic research to find out if it really was the person or not. We know that people lost jobs or employment opportunities because of such false or inaccurate information on their background reports, but my employer’s blasé attitude about it mirrored its parent company’s blasé attitude about bureau mistakes, even after shelling out millions of dollars in judgments against them for such mistakes and inaccuracies.

So, to have someone like Thorson who, on the one hand, is a member of the party that screams about personal responsibility (unless it applies to them, of course, PR Is for the other party and the little people, not them) and that rails against anything that may benefit the average person if it causes a corporation even slight inconvenience, be a financially irresponsible scum that then benefits from that which they vote and rail against, is infuriating.

Good perspective from experience, Laurisa. I agree that for something as increasingly impactful as credit scores, we should require the scorers to triple- and quadruple-check their documentation to make sure they are ascribing the right information to the right person. I try to be that careful: when I was first presented the information that Thorson had those tax liens and that civil judgment, I didn’t publish until I found the documents themselves and could check them against other identifying information.

And you’re right on the principle that it’s better than several irresponsible scum escape punishment than that one innocent person be harmed by the system.