—What’s the difference between Cory Heidelberger and Al Novstrup?

—They both may raise your taxes, but Cory at least will be honest about it.

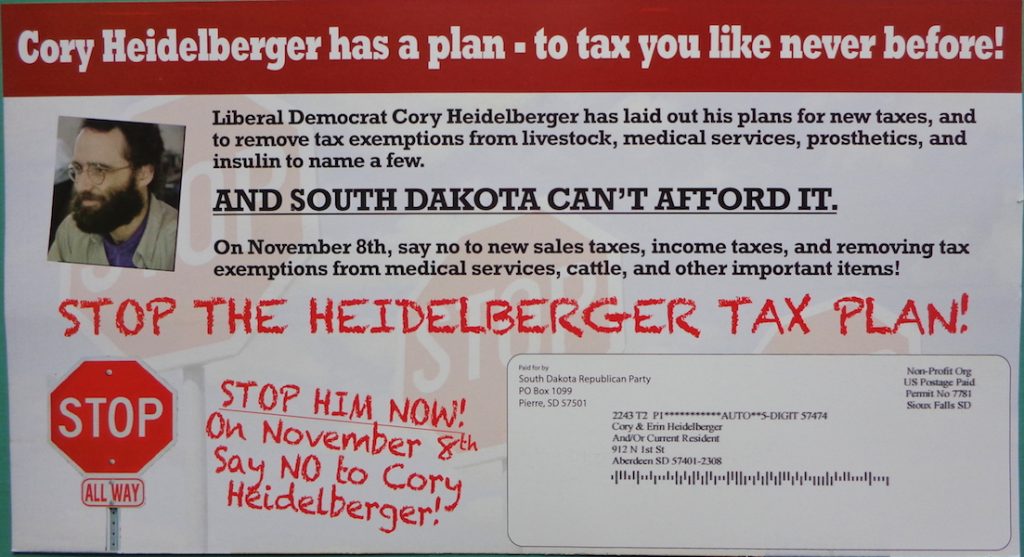

Dana Ferguson said in August that the Republicans didn’t have to worry about District 3. The South Dakota Republican Party apparently disagrees. They’re so worried that seven-term incumbent Al Novstrup can’t hold onto his son’s Senate seat that for the second week in a row, the SDGOP has spent good money filling District 3 mailboxes with a negative attack on Al’s challenger, little old Democratic me.

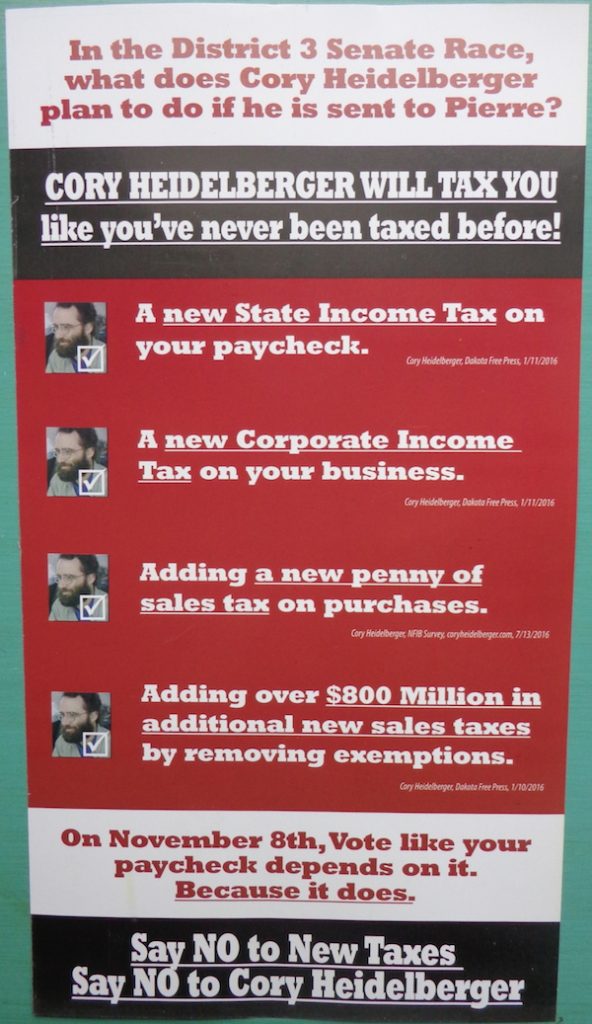

The SDGOP continues to do me the favor of running a fifteen-year-old picture that shows me with a much healthier hairline than I have now. They also flatter me by assiduously reading my blog. They do break out a lot of exclamation points and the Crayon Font of Doom, but hey, this time, they’re attacking on policy. Yum yum! Let’s take a look.

First, before we get into particulars, let me be clear: Yes, on occasions when folks have said, “Holy cow! We don’t have enough money to pay for schools and roads and other public needs!” I’ve responded by suggesting that we may need to raise taxes. I did it last year when I supported the move to increase taxes to pay for road repairs. So did 99% of participants in the 2015 Chamber of Commerce Business Caucus. So did Al Novstrup, who voted for 2015 Senate Bill 1 to raise road taxes by $85 million.

I supported new taxes (along with tax reform) again this year when Governor Daugaard asked us to raise teacher pay by raising sales tax. So did Al Novstrup, who voted for 2016 House Bill 1182 to raise sales tax by $107 million.

Al Novstrup votes for two huge, historic tax increases in a row, yet his party sends out a postcard telling voters that I’m the one coming for their wallets? Puh-lease!

The SDGOP imputes to me four proposed tax increases: a state income tax, a corporate income tax, an additional penny sales tax, and repeal of sales tax exemptions (which the Republicans don’t call new taxes when they repeal exemptions, but hey, off we go!). For evidence, they cite (lazily, without titles for easier searching) three blog posts and one campaign website post in which I shared my responses to the NFIB candidate survey. Interestingly, all three of the blog posts were actually bill proposals based on reader suggestions last winter. So to call those proposals the “Heidelberger Tax Plan” discredits the public input that generated those ideas.

But let’s look at each proposal, with links to the original articles:

- State personal income tax: Throughout my blogging career, I have consistently argued that taxing income more fairly and effectively raises revenue than taxing property or sales. It works at the federal level; it works in 43 other states; it could work in South Dakota. And as I have said multiple times, including in the comment section under the article cited, I would support implementing progressive income taxes in a revenue-neutral fashion, with new income tax revenue replacing regressive sales tax and property tax revenue.

- State corporate income tax: South Dakota already taxes banks and financial corporations. Why discriminate against those corporations? Why not tax all corporations in a similar fashion on the wealth they create rather than on their property? The corporate income tax proposal the postcard cites also offered fairness to small community banks by lowering the current bank franchise tax rate on their first $400 million in net income and imposing progressive rates on higher income.

- Cutting sales tax exemptions: Instead of picking favorites, why not apply sales tax more uniformly? And if we are going to keep any breaks in the sales tax code, why not give the first, biggest break to South Dakotans buying food and clothing? The Republicans fail to note that the exemption repeal they cite also called for setting the tax rate on food and clothing to zero, thus reducing your taxes at Hy-Vee and Penney’s by $170 million.

- “Adding a new penny of sales tax“: Here the Republicans get truly deceptive. NFIB asked candidates if the favor or oppose “Authorizing counties to levy up to a 1% sales and use tax on top of all the sales taxes currently authorized by the state and the city.” I said favor, because, like Al Novstrup, I believe in local control, but unlike Al Novstrup and his party, I don’t believe in treating counties like black sheep and denying them the same taxing authority we grant to cities. Allowing counties to tax sales would let them derive revenue from the alcohol sales that cause a big portion of county expenses.

These tax policies are all negotiable. They are all part of a larger concern I have that taxes in our state be fair.

And unlike Al, who hid his intention to raise sales tax this year until the moment he voted and now wants voters to forget his record of raising taxes, I’ll be straight with you and invite an honest conversation about state tax policy.

The taxman cometh? Ha! He’s already here. I’m just offering to replace him with an honest, fairer taxman.

Who knew District 3 Senate seat was the lone seat that allows that Senator to raise taxes singlehandedly. Dictator Cory Obama has a nice ring to it. I can see why uneducated wingnuts would be terrified.

ps Cory is coming for your bikes, too. Gonna take ’em all. No more ride by shootings for you.

I think it’s a swell picture, Mr. H. Did you think maybe they are just trying to annoy you for their own entertainment?

If they were just to annoy Cory they would have spelled his name wrong. No. This is just business.

The thing here is; This is politics – 7 word sentence politics. Meanwhile, what you’re talking about Corey, is governance. Governance is confusing to many voters. They don’t want to hear about it. It makes their head(s) hurt. They don’t like things that make their head(s) hurt. They won’t vote for a pain in the head.

The above is the campaign theory that has succeeded in SD Republican dominance for many cycles now.

I am not in your district, Cory, but I hope that you win.

I’m going to vote early at the courthouse. Can you imagine the lines on election day with all of the people ahead of you trying to read all of the ballot issues? There will be long lines still outside the polling places at closing time. Of the 10 ballot issues I’m voting yes on 5 and no on 5.

I had missed Dana Ferguson’s expert analysis of the Dist 3 race – that insight of hers based on now one entire year of observing SD politics.

Is it some unwritten rule that a Republican policy statement MUST fit on a bumper sticker?

Richard hit the nail on the head (no pun intended) People don’t like governing and the politics that comes with it.

The best way I have heard it put, elections is like hiring a contractor for replacing the roof on your house. Let’s hire you to do the job, get it done and don’t bore us with the details.

So they pick an old picture that makes Cory look like a 60s hippie liberal with round glasses even. Dirty pool, not representative of him today, although many of his policy positions are quite far to the left. It’s such a different world now, but if I had a campaign manager hat I would say copy first, but then delete all the old posts from Madville Times and maybe even more when musing and fun posts could too easily be taken out of context. We all want to be able to change, grow, reinvent ourselves but it’s getting harder when every darn thing we do could be held against us for a lifetime. It’s also a reason why posting anonymously makes a lot of sense.

Once again the republicans pull the tax and spend Democrat ruse just as they do with each and every election cycle.

What you never hear them talk about in their 40 year domination of state government is that republicans are responsible for every tax and fee increase imposed on its citizens. Every one of them!!!

It is the same thing on the national political scene, they conflate ‘tax and spend Democrats’ with a fairer tax system.

Powers at the Dump Site follows lock step with this republican ruse never taking responsibility for when his republican state government starts taxing and feeing us to death. They simply tell the lie ‘Democrats raised your taxes’

Cory, your campaign needs to put your above comments into a simple message and send it to every District 3 voter.

Mike, I’m not coming for your bikes. However, I will entertain a state program to ensure every citizen has a bike and has bike lanes on which to use them. :-)

Roger, good idea. The blog post is for the heavy readers (which, apparently, includes the SDGOP—hi, guys!). I’ll distill it into some lighter comment for my next campaign newsletter.

Thanks, Timoteo! You must have some long-lost cousins in District 3—call them and tell them to vote for me!

Not a rule, Loren… but a darn good campaign strategy!

Hap, that’s the Pat Powers blog strategy. I knew the risk of having 12K+ blog posts online before I announced my campaign. I chose to maintain my archive… because gosh darn it, there’s a lot of fun stuff to read here, including your voluminous comments!

Again, that’s the difference between Republicans and me: I’m not afraid to lay my ideas out and have an honest discussion.

C.H.what did you expect they would do.They are with out sin and like to cast the first stone at people,I thought he learned but guess not.

Taliban beard!

That the state GOP is spending so much money on half-page postcards and daily newspaper ads against Cory is another way of showing some folks are walking around with wet pants. As a couple of commenters have noted, they seem like they cannot use a photo of Cory with beard of the kind that Islamic State nationals sport often enough, a stroke of propaganda brilliance in the world of Pat Powers, which has the IQ level of an earthworm colony. As for the distortions and contrived misrepresentations of Cory’s statements of platform, they can be used against him only when processed through the dishonesty mill. Among the literate electorate, the ploy is obvious and shows the kind of malice-based thinking of those who are frightened by Cory. And to the sentient voters, this is the same kind of thinking that gave South Dakota the EB- 5 and Gear Up fords and embezzlements. The big question is how many educated voters District 3 can muster or how many might be subject to education.

Moses, I entirely expected these attacks in some form or another. The only surprise for me is that, apparently, I’m beating Al so badly, the state GOP had to launch its attacks four weeks before the election in a desperate bid to save the seat.

David, we can only hope their malice-based campaign backfires and wins me votes from all the young whiskered folks. Big beards are in… or so I see around town. Of course, having never been a slave to fashion, I generally only sport the big beard in winter, when it does me some good out on the icy trails… or when I’m driving the reindeer.

*<0:-{)}

I was not alert enough to check the auto-correct. That should be “frauds”, not “fords.” Although I’ve owned a couple of Fords in my lifetime that bordered on automotive fraud.

All this beard talk is moot. I, for one, think Mr. Novstrup the elder would look outstanding with a beard, for I am sure his beardline matches his thick dark hairline. If Almanzo wanted to he could probably grow out a beard just like Mr. H’s Unabomber look between now and the election.

I am wondering, does Mr. H or perhaps do the District 3 Democrats For Mr. H have plans for some Anti-Novstrup literature?

@cah: On one hand you say you ” believe in local control” and “don’t believe in treating counties like black sheep and denying them the same taxing authority we grant to cities”. Yet on the other hand you advocate removing or reducing property taxes, (a uniquely local tax) and implementing a state run income tax to replace those revenues. So exactly what are you advocating as you straddle this fence? Why should voters in District 3 vote for a candidate who can’t elucidate his tax policy?

Mr. H has a cult-like following that wants to remove the property tax that goes to counties and replace it with a state tax that will leave the counties high and dry. This is part of a bipartisan plan to crush county government, I think, in favor of bigger government controlled purses.

In the question “why not give the first, biggest break to South Dakotans buying food and clothing?”, I recommend this instead: why not give the first, biggest break to South Dakotans buying food and utilities? Utilities, starting with home heating bills, should be the next priority after food. Say it with me, folks, “Food and utilities!” “Food and utilities!” “Food and utilities!” If you need more explanation, I would be glad to discuss further.

Fence? Wow, nice reach, Coyote. If you listened to any candidate appearances, you’d understand that I am far more clear about which side of pretty much every fence I stand on with voters than Novstrup is. Just last week, Al bragged about how he didn’t tell anyone his position on the sales tax for education until he voted. You knew where I stood on it at least a month earlier. Straddle much?

On local control: if that’s really your concern and not just a point for the sake of argument to get away from the fact that I’ve neatly disposed of any advantage Al might claim from this postcard, I would suggest that we can find ways to preserve local control in the context of income tax just as we do in the context of property tax and sales tax. But are much farther away from having to work out those details than we are from the GOP’s resistance to letting counties have more control over their revenues by allowing them to tax sales (maybe just alcohol!) if they choose, or letting counties set their levies at what the voters will bear instead of denying counties that control and forcing levy caps on them. Local control under the SDGOP is a convenient slogan, if not a farce. You can’t hang me on that issue without indicting the Republicans for whom you think you are providing an advantageous voting issue.

Cathy, I am very open to the discussion of where best to relieve South Dakotans of our regressive tax burden.

Grudz, I have no cult.

What’s the crisis about a State Income Tax? Have you “fear ninnies” ever lived with one? It’s fully deductible from an itemized Federal tax liability.

“Taxpayers who itemize deductions can deduct state and local taxes they paid during the year. These taxes can include state and local income taxes or state and local sales taxes, but not both. To claim your state or local tax deduction on your 1040.com return, just add the Taxes You Paid screen”

@Porter Lansing: “It’s fully deductible from an itemized Federal tax liability.”

Jeebus! That’s only true if you can take advantage of that deduction. Currently only 30% of tax payers itemize their tax returns. In South Dakota the number is even lower at about 19%, the rest taking the standard deduction. The fact that state income taxes are deductible is a feature of the tax system that only people in the higher brackets take advantage of. Even if someone in the 15% bracket itemizes, the deduction would be less advantageous for that taxpayer than say someone in the 39.6% bracket due to the lower marginal rate being assessed.

Itemizing state income taxes as well as mortgage interest is over sold. Eliminating these deductions would make the income tax more progressive and affect the wealthy the most. For all their bluster about making the income tax system more progressive, why is it we don’t see this reform being offered up by the Democrats?

Mortgage interest aka “white welfare” is the biggest give away to the middle class in USA. It was invented to buy votes for Republicans. The standard deduction has a built in mediation to cover any state taxes AND those filing 1040EZ almost always get all their state income taxes refunded (which is about a hundred extra bucks coming back). State income tax has huge upside for a state and no burden on it’s taxpayers … especially if property taxes are lowered or eliminated.

@Porter Lansing: “especially if property taxes are lowered or eliminated.”

Name one state that has eliminated property taxes with an income tax. In fact name one state that doesn’t have property taxes. This simple fact remains, government isn’t interested in taxation neutrality. Give them a new source of revenues and they’ll spend that and more. New York and New Jersey, two of the states with the highest median property taxes, are also the states with the highest income taxes.

Middle class? You must mean upper class. The mortgage interest deduction is a giveaway to the realty business and purchasers of expensive homes and second homes. Remove the deduction of mortgage interest and you would see the value of expensive homes drop like a rock,

State personal income tax: Throughout my blogging career, I have consistently argued that taxing income more fairly and effectively raises revenue than taxing property or sales. It works at the federal level; it works in 43 other states; it could work in South Dakota. And as I have said multiple times, including in the comment section under the article cited, I would support implementing progressive income taxes in a revenue-neutral fashion, with new income tax revenue replacing regressive sales tax and property tax revenue.

~ I’ve read enough of your opinions to know that an argument with you is boring to the readers and means little in persuasion.

~ I mean middle class. You know, the people who own homes and get to deduct the interest while renters get nothing. That’s equitable tax policy? That’s middle class welfare by any definition.

@Coyote … That’s Mr. Heidelberger’s proposal from his above post.

Wait, Coyote, let’s be perfectly clear: you’re saying that if Clinton, Williams, and Hawks came out in support of doing away with the itemizable deductions for state and local taxes and mortgage interest, you would not blast them for proposing higher taxes?

The fact that other states haven’t given dollar-for-dollar reductions in property and/or sales tax in exchange for more progressive income tax does not change the fact that what I’m advocating is a good idea. Your complaint only says it’s darned hard to get legislatures to implement that idea. You could say that if it’s darned hard to implement such an idea, then the SDGOP attack on me is even weaker, since they are fretting about something that I would have to work really, really hard to pass… and since my energy is likely to be taken up in my first term with fighting for K-12 education, voter rights, and anti-corruption measures, I probably won’t have much time to wrassle with my GOP colleagues over revolutionary tax reform.

Not that I mind a good wrassle….

I’ve heard the Coyote argument against the income tax many times from Republicans. It still doesn’t make any sense. The conclusion that adding an income tax means that total taxation must rise is asinine. In other words, their argument is we can’t have fair taxation because that will necessarily mean more taxation. Uhhh No, it just means we can have more fair taxation and less regressive taxation.

The legislature is loathe to raise property taxes and the sales tax and rightfully so. They would be loathe to raise the income tax if we had one. Having a fair tax system does not preclude it from being a relatively low tax system.

These straw man arguments are tiresome. Wealthy folks in the GOP in SD are very happy not to pay their fair share and they will be darned if they are going to allow the system that favors them to be changed.