The trial of the week takes place in Pierre Thursday and Friday, July 7 and 8, when Judge Mark Barnett hears the payday lenders’ latest effort to take away our right to vote. Former Lederman bailbondsman, now Texas resident Bradley Thuringer gets two days to clog the Hughes County Court docket with his bogus lawsuit to remove Initiated Measure 21, the real 36% rate cap, from our ballot.

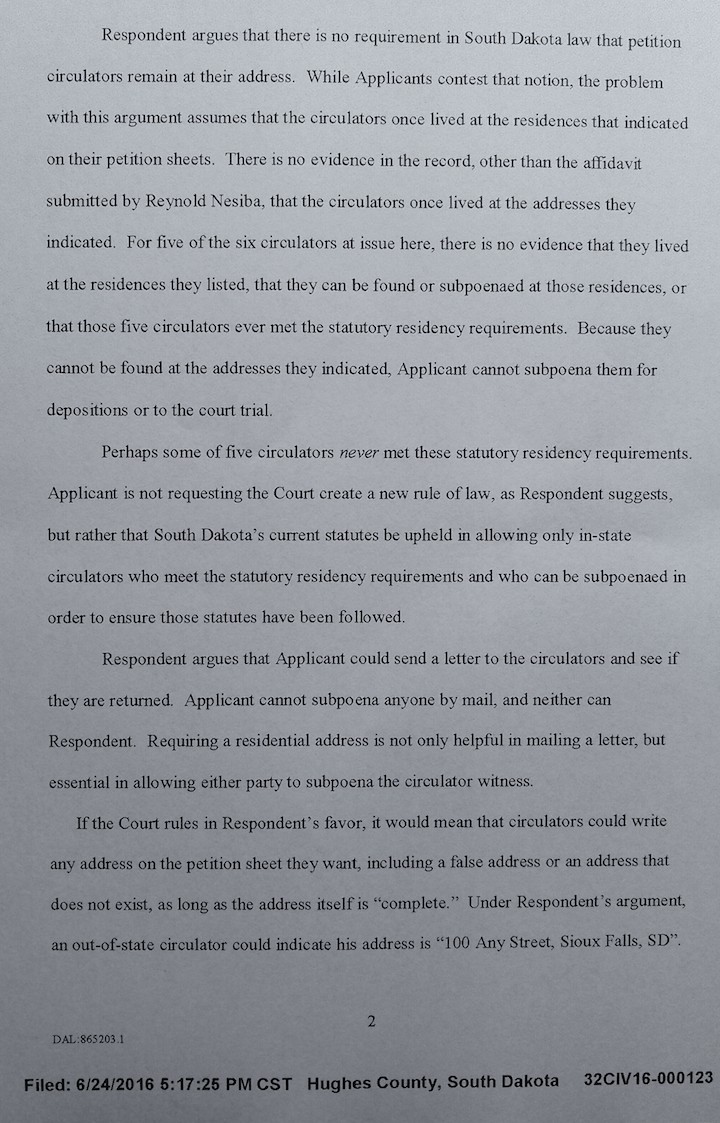

I have laid out five clear criteria GUC must meet to prove their primary claim, that 2,658 signatures on the IM 21 petition are invalid because the six petition circulators who collected them do not live at the residences they wrote on their circulators’ oaths. An argument filed on June 24 by GOP lawyer Sara Frankenstein on behalf of Thuringer and the payday lenders’ ballot question committee Give Us Credit South Dakota (GUC) shows that the plaintiffs still fail to meet those criteria and their burden of proof. Consider this laughable page of legal inadequacy:

GUC acknowledges that one of the circulators it is challenging, IM 21 sponsor Reynold Nesiba, has submitted an affidavit establishing his continued residence in South Dakota. GUC whines that the other five challenged circulators cannot be found and thus “perhaps… never met” the statutory residency requirements for circulators.

When plaintiffs bring a perhaps to court, they lose. When plaintiffs are lazier than a blogger, they lose: I can find every one of the five remaining petitioners, and I don’t have millions of dollars in profits at stake.

Frankenstein invokes the 2014 Clayton Walker case, in which the U.S. Senate hopeful filled his petition with fake names and addresses. That case adds no weight to GUC’s claims: GUC has made no claim that IM 21 circulators have falsified the names and addresses of signers. GUC has not established that the circulator addresses are fake. Walker’s nominating petition was tossed based on solid evidence of fakery, and Walker ultimately pled guilty.

But fact and burden of proof won’t stop payday lenders from pouring their bottomless legal funds into bad arguments. On page 6 of the June 24 reply, Frankenstein makes explicit GUC’s topsy-turvy reading of law: “Respondent must provide evidence indicating that the circulators in fact live where they said they did.”

If that standard were valid, I could write a Post-It note to the court about the payday lenders’ sketchy Amendment U petition reading, “Prove it!”, and without any further effort, I could force the payday lenders to spend thousands of dollars proving that all of their lying, mostly out-of-state mercenary circulators somehow technically met the residency requirements when they did Rod Aycox’s bidding last fall. If Judge Barnett does not laugh Frankenstein and GUC out of court, my Post-It notes are ready.

Hard to believe the court takes this joke seriously enough to provide them a platform to spread falsehoods.

Meanwhile, our state examiner has decreed that the owners of “payday lending stores, title loan shops, and other cash advance businesses” can be kept secret. If Thuringer wins this payday lender lawsuit, it’s yet more proof of the collusion and corruption in this state.

Eve, Mike, I will say that I’m a bit nervous having Attorney General Jackley’s office representing the good guys against the payday lenders. I also get faintly queasy at having former Republican AG Mark Barnett sitting in the judge’s chair on this case.

It’s in good hands.

Wonder what these proceedings cost, though? Getting my affidavit notarized yesterday cost the state £65.

Fortunately, the Brexit lowered the dollar cost of that Scottish notary seal, right, Steve?

And hey, send DFP a copy of that affidavit! Please!