Those sneaky payday lenders! I spend a day incommunicado on another project, and they get their flunkies to file their challenge to Initiated Measure 21, the real 36% rate cap that would put a serious crimp on their loan-sharking.

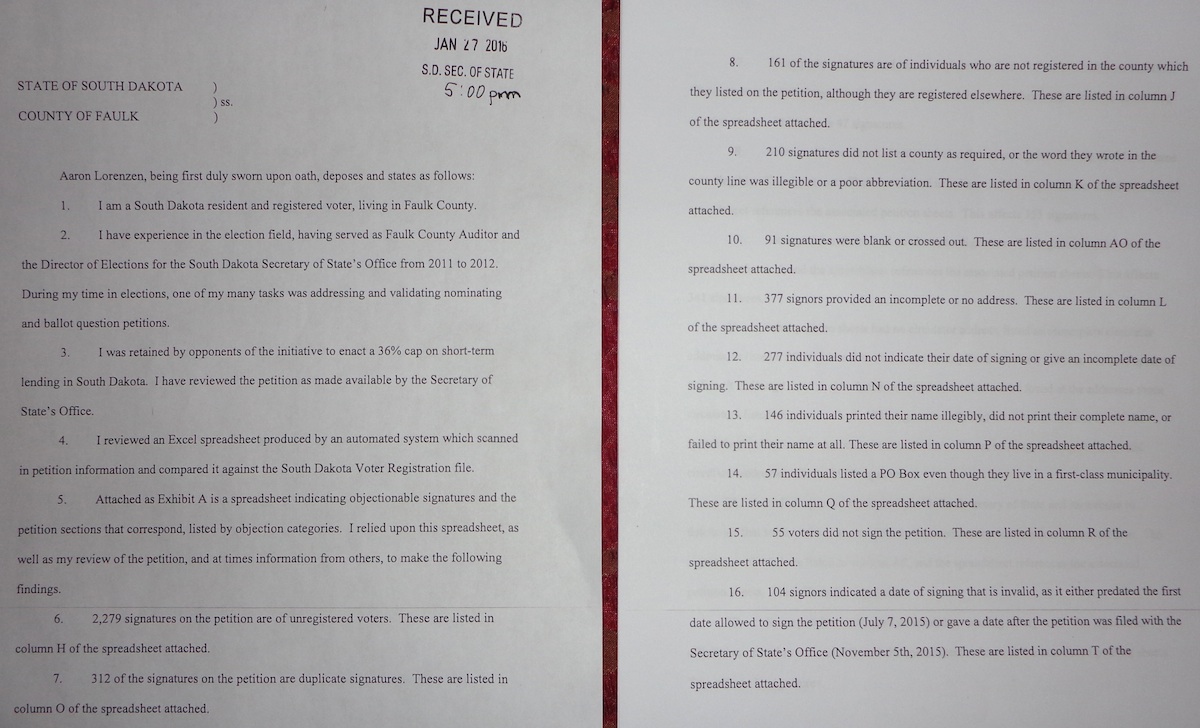

Actually, if you check out the date/timestamp, Aaron Lorenzen and Craig S. Olson slipped their petition challenge under the door right at closing time yesterday, January 27, at 5 p.m., that absolute last minute before the challenge deadline:

Aaron Lorenzen bailed out of Jason Gant’s corrupt Secretary of State’s office in in summer 2012, just like Gant flunky Pat Powers, when beleaguered Secretary Gant realized he needed to hire some experienced election officials to bail him out. Lorenzen now appears to work in rural video surveillance in Faulkton, complete with a website designed by BPro, a company that provided Gant’s office and Republican campaigns with tech services. Craig S. Olson has one of those cursedly unGooglable names, but a Craig S. Olson who lives on Dakota Avenue in Sioux Falls circulated the fake 18% rate cap petition last fall, and apparently wanted to take another swing at fouling his fellow South Dakotans’ effort to protect their neighbors from usury.

Olson and Lorenzen both swing and miss. The real 36% rate cap circulators submitted 20,800 signatures. Secretary Krebs calculated 19,936 submitted signatures and 17,222 valid signatures. That 13.61% error rate is the best for any ballot measure effort in 2015… largely because the dedicated volunteers working for 36% rate cap sponsors Steven Hildebrand, Steve Hickey, and Reynold Nesiba actually gave a darn about the issue and circulated their petitions with integrity.

Lorenzen and Olson try to stretch that error rate to 38.16%. Lorenzen identifies 7,607 “objectionable” signatures on the real 36% rate cap petition, leaving only 12,329 valid signatures, 1,542 fewer than the required 13,871 signatures.

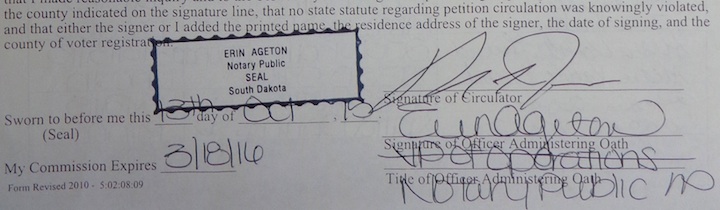

The largest single line item in Lorenzon’s catalog of objectionables is Point #27 in his affidavit, citing 3,429 signatures on sheets on which “verification dates were obstructed by the notary seal and therefore unreadable.”

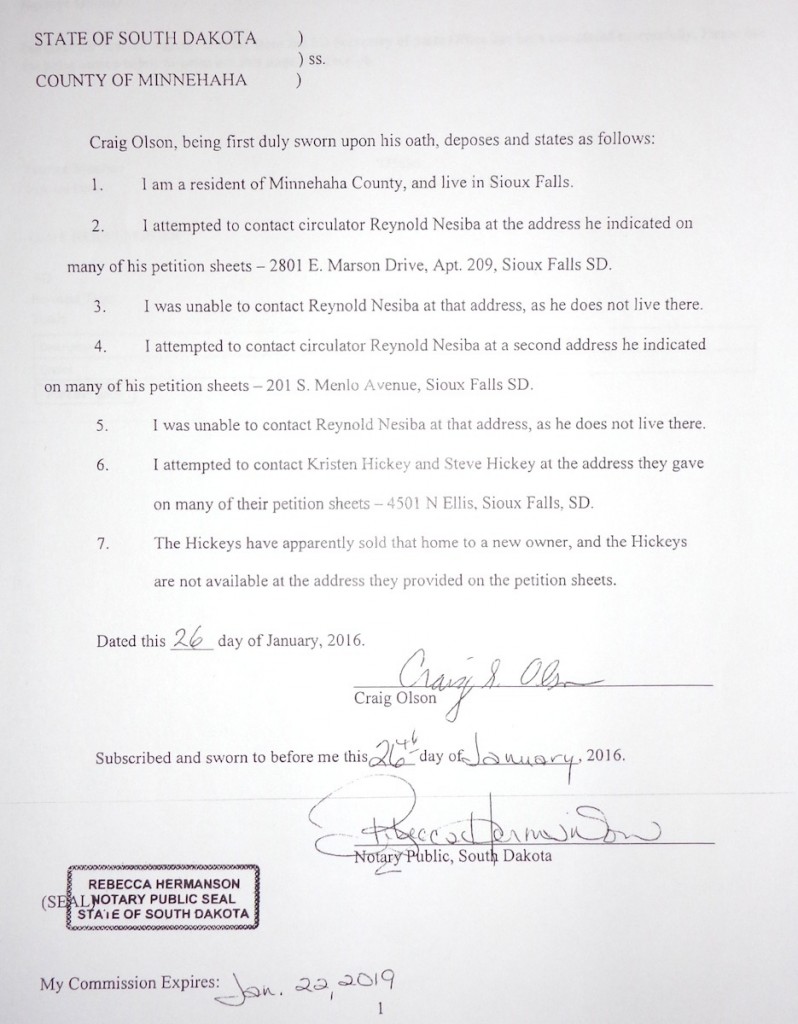

What, like this?

Or like this?

I could go there, fellas, on probably half of the petition sheets sitting in the Secretary of State’s office right now. You and I and anybody who’s carried a petition knows there’s no neat place for the notary seal. It’s designed that way. The notary seal really ought to cover some of the circulator’s ink so we know the circulator didn’t try to write over that seal after the notary stamped that document.

This seal-obstruction challenge, 45% of Lorenzen’s objection, is silly. Throw just this one argument out (and the Secretary and the courts will), and the IM 21 petition bounces right back above the minimum by 1,887 signatures.

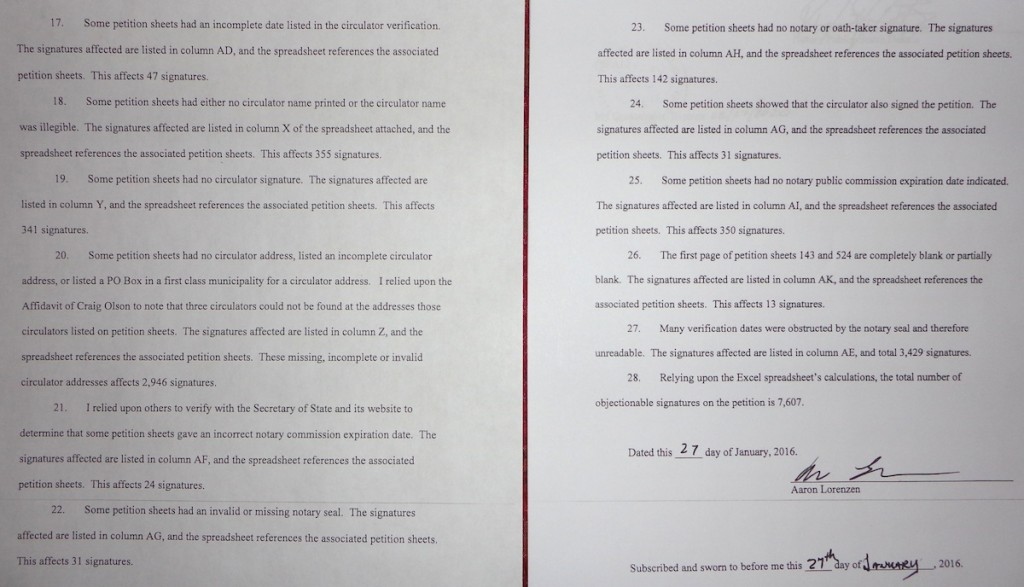

The next biggest whopper (yup, both meanings) is Lorenzen’s attempt to disqualify 2,946 signatures on the basis of Olson’s claim that he went knocking on circulator’s doors (that’s what I told you the payday lenders were doing last week) and did not find Reynold Nesiba, Steve Hickey, or Kristen Hickey at the addresses they listed on sheets they circulated. Lorenzen alleges other bad addresses (including P.O. boxes, which are acceptable for signers from towns smaller than 5,000 but not for any circulators), but the Nesiba and Hickey addresses are the only ones evidenced in these affidavits.

Hey, fellas—people do move. Everybody knows that Steve Hickey is studying in Scotland. Nesiba is still professing at Augustana. If the residence addresses they put on their petitions were accurate at the time they got those petitions notarized, then Olson’s January door-knocking results mean nothing. Olson needs to get in his time machine, go back to the notarization date (if he can read it under that blasted notary obstruction! Oh, woe!), and knock and see if Doc Brown or the Morlocks answer.

I don’t know how many signatures Hickey, Hickey, and Nesiba collected, but if they account for half of those challenged circulator addresses, then Lorenzen loses nearly 1,500 of those challenges, and all the rest of the Lorenzen/Olson objections basically affirm Secretary Krebs’s calculation of valid signatures.

The only people with an interest in keeping you, South Dakota, from having the opportunity to vote on the real 36% rate cap are the payday lenders who fear they can’t make an honest case and win an honest vote. Secretary Krebs and her team will now spend a week or so in the middle of a busy Session and preparations for April’s municipal and school board elections scrolling through the payday lenders’ spaghetti to verify that not nearly enough of it will stick to the wall.

That Mr. Nesiba fellow has been involved in many past shady dealings that have failed. Is he not the gentlemen that tried to repeal the thing where they gave back sales tax on food money to poor people a number of years back? I think for a professed libby it is hideous to try and repeal a government giveback of taxes to poor people. I wouldn’t be surprised if he hasn’t moved to Sioux City and is teaching French Math at Briar Cliff.

Wow. True pigs. Who are these people? This is likely fraud on integrity of petition process and perhaps krebs should sue for declaratory judgement or suitable remedy to protect the viability of her very office. They are pissing all over the constitutionally created bastion of democracy for dirty money. Ug!

Thanks Cory, you nailed it. I hope after closer scrutiny the SOS announces a higher number of valid signatures than before. Though I’m a student away at school my residence remains the same SD address I’ve always had. Sorry there was no one there to answer the door on the day they came knocking. Same story for Reynold. Oh the gall of these people who brought in illegals out of state circulators to challenge where we reside.

Curious who in the opposition retained these guys because the opposing committee’s finance report says nothing raised or spent.

Which committee, Steve? Maybe we’ll see the expenses on Lisa Furlong’s year-end report, for which we are still waiting.

The nice thing about this challenge is that it doesn’t require any expense on the part of the sponsors, at least not yet. On the off chance that Secretary Krebs would buy this pile of hooey, then the IM 21 sponsors would have to lawyer up and challenge the challenge. But the payday lenders are proving they have money to burn on frivolous challenges, just to sow confusion and fear.

SDns for unFair Lending committee, Kenneke

Professor Nesiba was out of the country teaching an interim class during January. I suppose it would be easy to plan your knocking around the time that someone is out of country.

Ah, those guys! Koenecke and Abraham in Pierre. There are two benign explanations for those guys’ zero-raised, zero-spent year-end report:

It is worth noting that Koenecke and Abraham’s filings for their “Committee for Regulated Lending” don’t say which ballot measure they are supporting or opposing. One would think they would have declared that by now.

I wonder: suppose the funding for the challenge came from some outside source, like straight from North American Title Loans, without coordination with any ballot question committee. Would that challenge have to be reported as an in-kind contribution to some ballot question committee?

Gruz,

Shut thy mouth when you know not what you speak of. Doc was working on a reduction of the sales tax on food, a reduction to 0%. Go eat your taters you goober, as you rarely have any sort of constructive input on this, or any other local blog.

Sorry to be late on joining this thread. Mr. Olson’s 5th point is utterly false. I did live at S. Marson Drive until I moved to Menlo Ave. in late September. No one left voice mails on my office phone or my mobile phone. Thus, they don’t seem to have looked for me with much diligence. I do live at 201 S. Menlo Ave. I closed on that property on September 21 and moved in a few days later. My lease was up on Marson at the end of September.

Grudznick may have forgotten that a majority of both houses of the legislature and this governor agreed with me. They repealed the failed food tax refund program. It was expensive, burdensome to apply for, and failed to return much money to citizens. The program was successful, politically, but only as an argument for continuing the sales tax on food–a tax that citizens in none of our surrounding states pay.

I should have noted in my comment above I was teaching a course on the Political Economy of Thailand in Thailand from January 4th through the 28th. Nevertheless, my residence was and is 201 S. Menlo Ave.

lol ….. “goober” :)

Reynold let me know if you ever get to minervas for lunch.

Thanks for that clarification, Reynold! I’m surprised at Craig Olson. He demonstrated great diligence in collecting signatures for the fake 18% rate cap and for the Glodt amendment. I’m surprised he couldn’t work harder to track you down and avoid making false allegations.

dollar loan helped me out when my car broke down. why you goin after them?

Kris, are you telling a true story? Your casual drive-by one-liners cast doubt on your veracity.

I am “targeting” this affidavit from the payday lenders’ dupes because it is without merit. Since you don’t dispute my analysis of Lorenzen’s and Olson’s contentions and instead choose to try pulling us away from the main theme, I take it your fear my irrefutable conclusion.

But I’ll address your distraction as well: Dollar Loan Center takes advantage of vulnerable in desperate situations. You might have gotten a better deal by getting a loan (or a ride!) from family or friends. Their business model is based on amoral exploitation, not concern for their fellow man. Don’t be fooled, Kris.

hard times and no $ and they helped. family broke and pops in prison.

I’m sorry to hear that. You need to find better friends, save up some money… and start communciating in complete sentences.

But let’s be clear: Dollar Loan Center didn’t “help”. They engaged in a business transaction that profited them at your expense. And your story reinforces my point: they wouldn’t have made any money off you if you hadn’t been in a desperate situation of which they could take advantage.

Ms. Kris, you are making very poor decisions. The robber barons aim their wares at people like you. Even ol’ grudznick when he’s at his hungriest does not take out loans from payday loan sharks for my gravy taters. Because that would be just plain stupid of me.

So Mr. Quinlivan, did you learn anything in “Liberal Economics 101?” Doc. Nesiba failed to reduce the sales tax on food to zero and he helped to eliminate a refund to poor people for this tax. Both of these things would seem to be in the opposite direction of the interests to which you both seem to ascribe.

Grade: Fail and fail.

dude they gave me $ to fix my ride so I could werk. All good now. I pay them all of my loan in 4 months.

Let’s assume someone needed $500 to fix their vehicle. They head over to Dollar Loan Center to obtain a short term loan, and with fees and interest their effective APR (based upon the disclosures on their website at this very minute) will be 363.01%. That means if you held that $500 loan the entire 12 months you would end up paying just under $1400 in interest charges in addition to the original $500… so a grand total of $1900!

But if you “only” need that loan for 4 months you’re in luck! After four months you will only have paid $427 in interest in addition to the original $500 (total $927). Yep… Dollar Loan Center sure helped out!

The best part is that the rates shown on their website are representative… so you might actually pay more. The average payday loan is something above 600% APR so who knows what the total might be.

Disgusting! If you have a credit card with a very high 25% APR that same $500 would cost you $26 in interest charges over that same four month timeframe. This is why financial education is so important, because with predators telling you they are “helping out” you never know the real story.

Thank you, Craig, for that useful, practical explanation of how the payday lenders trick desperate folks like Kris. If we had more financial education like that in middle school and high school, we might not need to cap interest rates. (But then where do we find the time to cram all the things we want into a high school curriculum?)