Last updated on 2015-11-13

The Blue Ribbon Task Force on Teachers and Students offers a couple of helpful charts to illustrate the hole we’ve dug for our state funding of K-12 education:

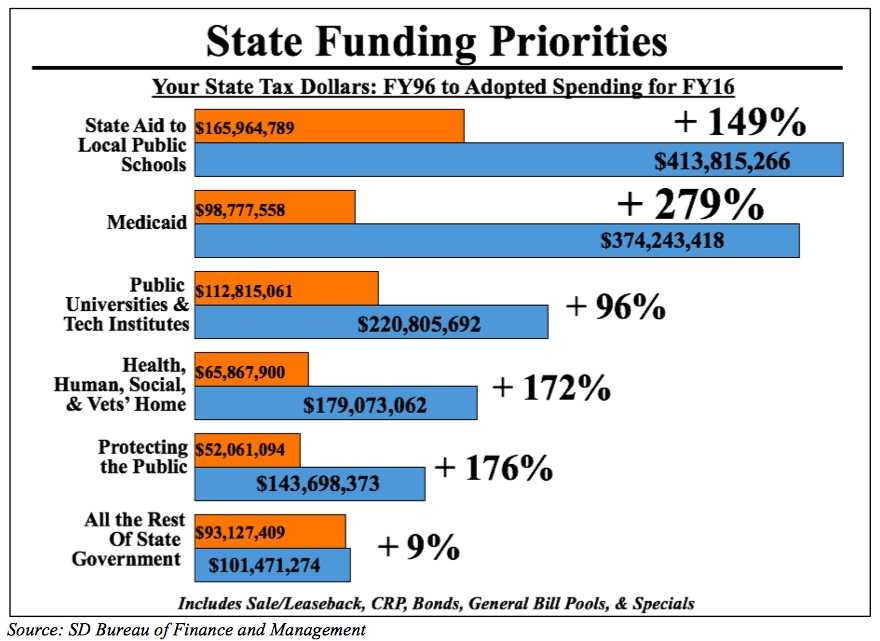

The first chart shows that since FY1996, back around the time we changed the K-12 funding formula, we’ve increased state aid to education 149%. Mash all of the general fund items listed above together, and you’ll see that we’ve increased overall state spending by 143%. So we have increased out support for K-12 at slightly better than our overall budget growth, and we’ve continued to spend more on K-12 than on any other budget category.

That said, we’ve found the political will to increase funding for three other budget areas at even faster rates. Over the last twenty years, we’ve boosted Medicaid 279%, public protection by 176%, and social services by 172%.

The Blue Ribboneers phrase the differential oddly, as if it just happened:

Over the past 20 years, the state has had to face a variety of budgetary issues. State funding for K-12 schools has increased 149% over that period. That number could have been larger, but the increase in the state Medicaid budget of 279% over that same period has limited the revenue available for all other priorities, including education.

Because of the twenty year growth trend in Medicaid, the share of the State’s General Fund budget has decreased even though the amount of money given to schools through the per student allocation has increased [Blue Ribbon Task Force on Teachers and Students, final report, 2015.11.11, pp. 9–10].

Medicaid doesn’t just come and eat up revenue on its own. Medicaid, like funding for K-12, college, and cops, is a budget choice made by legislators, like those on the Blue Ribbon panel, and the Governor who convened this panel. Medicaid didn’t limit the revenue available; legislators and the Governor did.

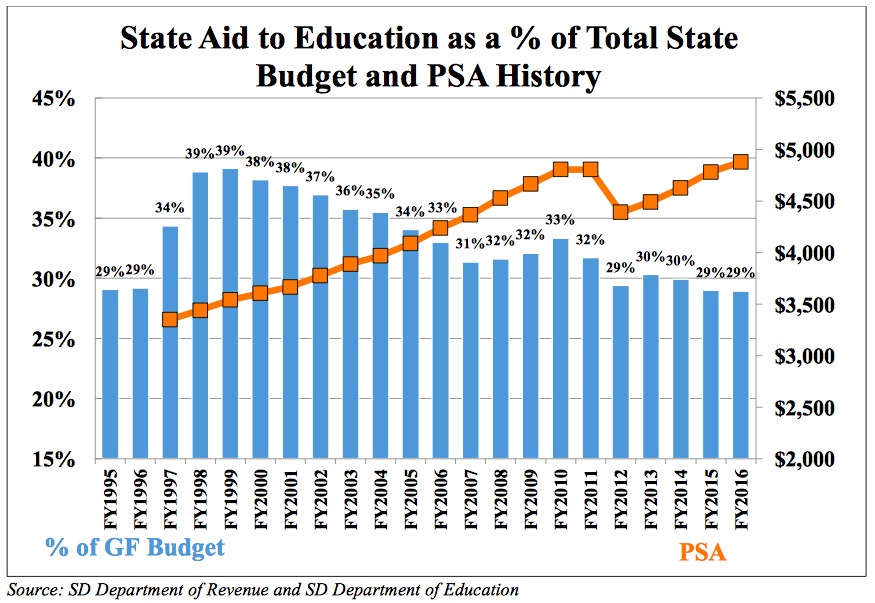

Hold that while we look at the next chart, showing that even as the dollar figure we put toward K-12 funding went up, K-12 education’s share of the state budget has dwindled back to the pre-formula-reform lows of the mid-1990s:

Governor Bill Janklow and the mid-1990s K-12 formula reform apparently boosted K-12 funding to 39% of the state general fund. Governors Mike Rounds and Dennis Daugaard let that share (i.e., indicator of the priority we place on K-12 education) slide back to 29%.

Nothing says we had to spend 279% more on Medicaid over the last two decades, no more than anything says Governor Daugaard has to expand Medicaid now under the Affordable Care Act (well, other than human decency… but hey! we’re talking budget, not morality). We could easily have prioritized K-12 by $75 million more while increasing Medicaid, public protection, and social services not quite as much:

| Budget Area | FY1996 | FY2016 | Wishful 2016 | Actual Increase | Wishful Increase |

| K-12 State Aid | $165,964,789 | $413,815,266 | $488,815,266 | 149.34% | 194.53% |

| Medicaid | $98,777,558 | $374,243,418 | $333,974,181 | 278.87% | 238.11% |

| Higher Ed | $112,815,061 | $220,805,692 | $220,805,692 | 95.72% | 95.72% |

| Social Services | $65,867,900 | $179,073,062 | $159,804,492 | 171.87% | 142.61% |

| Protect Public | $52,061,094 | $143,698,373 | $128,236,180 | 176.02% | 146.32% |

| Rest of State Govt | $93,127,409 | $101,471,274 | $101,471,274 | 8.96% | 8.96% |

| Total | $588,613,811 | $1,433,107,085 | $1,433,107,085 | 143.47% | 143.47% |

DFP Full Analysis of Blue Ribbon K-12 Panel Final Report:

- Most Important Blue Ribbon Finding: South Dakota Must Raise Teacher Pay

- Crunching Blue Ribbon Numbers: Change K-12 Funding from Per-Student to Per-Teacher

- Blue Ribbon: Stuck on Sales Tax

- Blue Ribboneers Call Plan “Package” Not “Menu”

- What the Blue Ribboneers Didn’t Say

- Blue Ribbon: Blame Medicaid for Stymied K-12 Funding?

$75 million in adjusted budget priorities, spread out over twenty years, would have produced the revenue necessary to support $8,000 more in teacher pay while still supporting above-average growth in Medicaid spending and growth in social services and public protection even with the overall growth in state spending.

None of this historical perspective on budget choices argues that we shouldn’t make the hard choices necessary now to pay our teachers regionally competitive wages. If anything, this historical perspective makes the case for action now all the more compelling. Failure to prioritize K-12 education in the past has dug us into a big teacher shortage hole. Failure to reprioritize K-12 education now will only dig that hole deeper.

That percentage increase in state dollars for K-12 education is a bit misleading since the school aid funding formula adopted in the mid-1990s was meant to funnel property tax relief through the funding formula. The primary goal with that formula was not funding PSA. The big increase in the mid- to late-1990s was property tax reduction money, not money for education, as is evident in the very tiny PSA increases throughout that period.

It’s important to not be misled by Republican “double counting” of money. In the case of education, the Republicans delivered property tax relief at the cost of teacher salaries and programs for students. The Medicaid issue is totally separate.

One part of the solution may be to revisit the exemptions to sales tax. The legislature had a summer study just a few years ago to see if they could come up with a list of things that should lose their exemptions. Out of hundreds of exemptions they came up with a list of two or three.

Without a comparison of sales tax collections and of real estate tax collections (which were incidentally frozen for part of those years), but there has been hundreds of millions or probably billions of new construction in those 20 years; there is no way that that the “Blue Ribbon Education Panel” has a leg to stand on. Since they want to blame it on medicaid, somebody better call the whaaambulance. In the past 20 years, the share of medical costs coming from our GDP has nearly doubled. Please correct me if I am wrong, but couldn’t the governor fix this with one fell swoop of accepting the Federal medicaid program.

Anyone know who wrote that “Final Report?” I bet it didn’t have any input for the public, or teachers. Anyone bother to do a “Minority Report?”

Donald, I’ve heard no mention of a minority report coming. The report claims to have consensus on its 29 policy recommendations.

Lanny is absoultely right here What a cop out, also watched the Gov on tv.Does this guy have a clue whats going on around him.

Gentlemen and ladies, I don’t think you will hear the real “blurting eff” until the BluRT-F report ends up in a budget or a plan. They are probably planning. I have confidence there will be plenty of blurting eff to come.

Mr. Pay, when not focusing on the nuclear waste herring, is right on track with his ideas about tax exemptions. Do not exempt you from taxes that you want to put on me.