The Rapid City School Board wanted to collect another six million dollars each year for five years to maintain current staff and and programs. Rapid City voters rejected that request. The Rapid City School Board is thus reversing a funding position and raiding capital outlay to free up four million dollars to raise teacher pay:

Jim Hansen, president of the Rapid City Board of Education, said the budget move represents a change in direction.

“The teachers are our strongest asset in the community,” he said. “We have to do something for them” [Seth Tupper, “Budget Tactic Frees Up $4 Million for Teachers,” Rapid City Journal, 2015.07.25].

Certain head-in-the-sand legislators who defend Pierre’s chronic neglect of K-12 funding will point to this capital-outlay shift and say, “See? Local districts set teacher pay, not us! Local districts have all the freedom and funding they need to pay teachers whatever they want! It’s their choice!”

But “choice,” says Sophie, never happens in a vacuum. Choice has consequences:

[Hansen] added that the use of capital outlay funds for general-fund expenses is “not a sustainable fix” because it means less money will be available for building needs.

“The effects on buildings and other expenses will happen immediately,” Hansen said. “We have 31 properties that we have to take care of.”

Jackie Waldie, a former teacher who runs a 718-member Facebook group called Reviving Rapid City Schools, said the budget shift is a consequence of voters’ June rejection of a property-tax increase to pay for schools. The budget crisis is causing school leaders to prioritize and make sacrifices, Waldie said, and she’s glad the board is temporarily sacrificing buildings in favor of teachers [Tupper, 2015.07.25].

I can’t guess how many walls will go unpainted, thermostats not fixed, or computers not replaced. But we can try to guess the salary impact for teachers. Waldie says the four million could translate into “multiple thousands of dollars in raises for each Rapid City teacher. But recall that Superintendent Tim Mitchell said losing the six-million-dollar opt out would require cutting 85 staff. If those were all teachers, and if the intent of the capital-outlay shift is to preserve those 85 jobs, then keeping those 85 teachers at the average district salary of $41,562 (and that’s from FY2014) would take $3.53 million. If the remaining $470,000 is applied to salary increases for the 890 teachers in the district, then every teacher gets another $530.

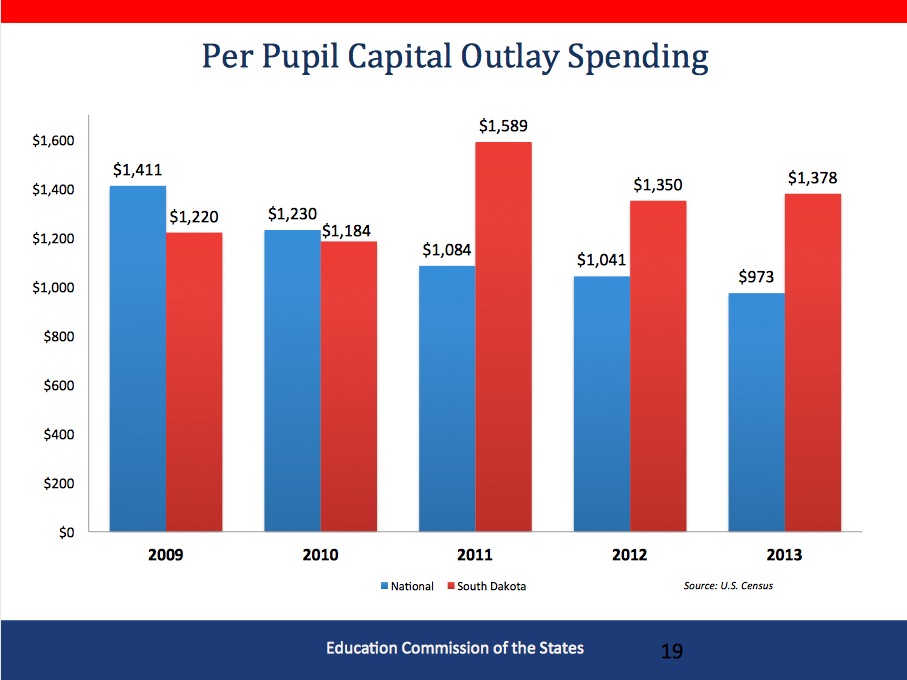

In its first formal hearing, the Governor’s Blue Ribbon K-12 panel heard from education expert Michael Griffith that South Dakota K-12 schools spend 41% more on capital outlay per student than the national average.

Multiplied by 130,000 students, that’s $52 million. Divided among 9,200 teachers, that’s a $5,700 increase in teacher pay, which would raise us from last in the nation to a tie with New Mexico for 43rd… and still leave us $1,000 behind North Dakota, $7,000 behind Minnesota, and $9,000 behind Wyoming, which continues to raid Rapid City’s teacher pool.

The capital outlay shift may move Rapid City toward more competitive teacher pay, but it won’t get Rapid City to parity with Wyoming, and as board president Hansen said, it’s not sustainable. Take money from capital outlay, and your district will give up buildings and equipment.

Shifting money from Capital Outlay will just give legislators an excuse to put tighter restrictions on the spending of those funds.

I don’t think they can legally do that

Robbing from Peter to pay Paul. At least there is recognition that Paul needs a human wage, or at least an increase in that direction.

In 2009 and 2010 we spent less than average on capital outlay. So did we catch up or way overspend by replacing a wall that was not maintained properly?

I don’t believe it is legal to transfer capital outlay funds to general funds to increase teacher pay. There are certain things you can use capital outlay money for but it will be interesting to find out what the state law will let them use that money for. Nothing like being between a rock and a hard place.

Cory, I’m glad you are keeping up the pressure on the legislature by showing the real, human cost of their inaction on school buildings, teachers, equipment, maintenance, students, families, etc. Their fiscal games may please ALEC and their Koch owners, but the pain they’re causing is inexcusable.

We’ve got to keep our attention on the facts of the situation, Deb. Real numbers, real choices, real impacts for kids, teachers, parents, and communities.

What Deb and Cory said – reality rather than BS.

People need to read. Of course schools are barred from using earmarked cap outlay funds for gen fund expenses such as a salary increase. The law does permit use of cap outlay for certain limited expenses and allows a district to apply the savings as they deem necessary.

Of course it’s unsustainable. So was the status quo.

Yes. Mr. Curt is right. The money went for allowable things. Then the money that would have gone for those things was shifted to pay raises for teachers. I hope the good ones get more.

When I was on the RC school board we could not legally transfer funds between capital outlay and the general fund, but shifting of certain expenses between the funds to save money was allowed. That’s one of the reasons RC school board took over the busing of students. I know they did loosen the reigns on capital outlay in the early 2000s, and maybe since, so that creates more opportunities for shifting. I’m not a fan of this, because, like the opt-out, it’s a band-aide over the real problem, which is a deadbeat state government.

I gave to agree with Greg. I don’t think you can use Capitol Outlay funds in that way

I think you can, Owen.

Sheesh. Look at SDCL 13-16-6. Honestly.

My Rapid City math tells me that 13-16-6 is minus 9.

They did it. Maybe somebody else knows more than some of us about CapitAl Outlay funds.

Owen, Greg, Rapid City’s shift is legal. From Tupper’s article:

Curt refers us to the proper statute, SDCL 13-16-6, which indeed sunsets in 2018. The shift is thus neither legally nor practically.

But the slide from Griffith’s Blue Ribbon presentation poses an as yet unanswered question: Are our schools overspending on buildings and equipment compared to the rest of the nation? Have other states discovered savings in those areas that we have not?

Indeed, Mr. H. I, too, read the actual article from the journalist, Mr. Tupper. It is good when the journalists are providing accurate information.

It is a good question and one that the BLURT-F will no doubt study hard. Do we have too many reserved parking spaces in overbuilt concrete pads? Do we put fancy picture windows in administrative offices when no windows would be just fine? Do we build LEED Gold buildings when they won’t pay themselves off for 83 years according to most estimates and LEED Bronze would be just fine?

Questions like that are what the BLURT-F is all about.

Here is something else to consider. When you shift expenses from one budgett to another you are actually taxing Ina whole different manner. In the general fund budget ag, owner occupied and all pay a respective mill levy. In capital outlay it’s basically a straight across the board tax. In my district ag is 76% of taxbase, owner occupied 13% commercial 11%.. since general fund mill levies are different for each classification, general fund revenue comes in at approximately 60% ag 23%commercial 17% owner occupied. By switching those expenses to capital outlay, revenue is generated 76%ag 13%owner occupied, 11% commercial. Essentially changing who pays the tax. It is basically an opt out without being called one.