Last updated on 2015-07-16

The usury industry appears to be mobilizing more resources to fight the proposed ballot initiative to cap interest rates at 36% and box predatory payday lenders out of South Dakota.

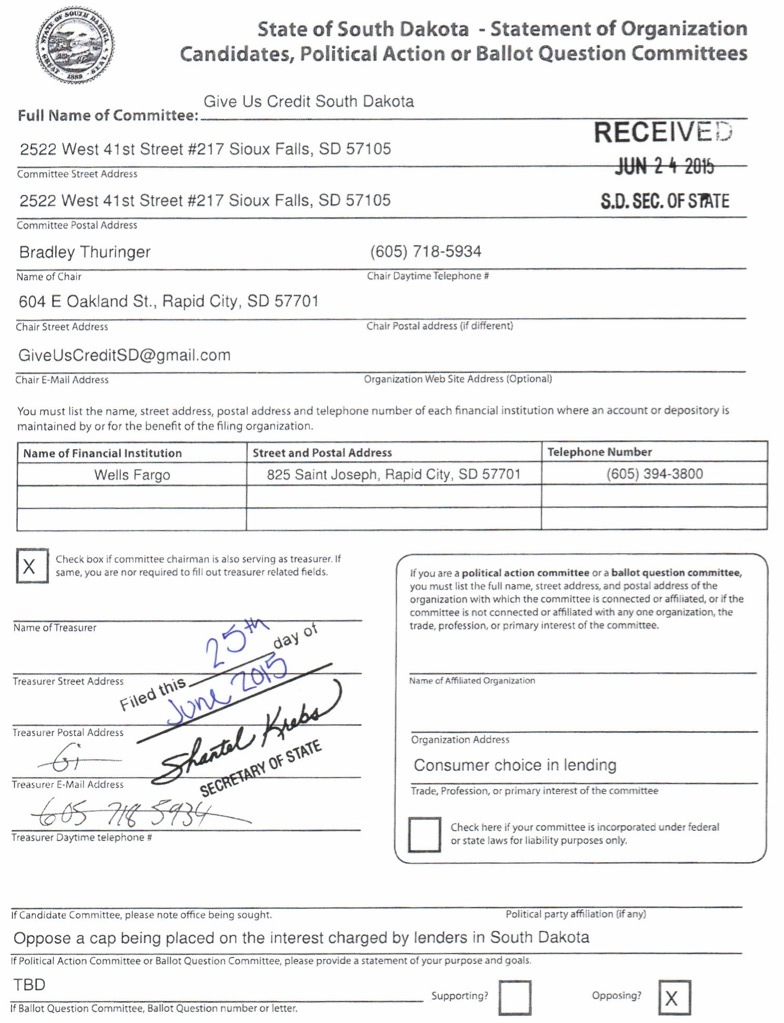

On June 24, Bradley Thuringer of Rapid City filed a statement of organization with Secretary of State Shantel Krebs to create “Give Us Credit South Dakota,” a ballot question committee to “oppose a cap being place on interest charged by lenders in South Dakota.” The committee address is a box at the West 41st St. UPS Store in Sioux Falls, but the committee chair’s address and phone number match what the Googles associate with a Thuringer Consulting Internet marketing service in Rapid City. LinkedIn includes a profile for a Bradley Thuringer of Rapid City who has done IT/SEO for various Black Hills customers. If these dots connect, Give Us Credit SD may be the online propaganda arm of the payday lenders’ effort to keep their mitts in our mayo jars.

Thuringer joins Pierre lender-lobbyists Brett Koenecke and Doug Abraham in formally opposing the interest-rate cap. Koenecke and Abraham formed Committee for Regulated Lending in April.

Thuringer might have two ballot measures to oppose.

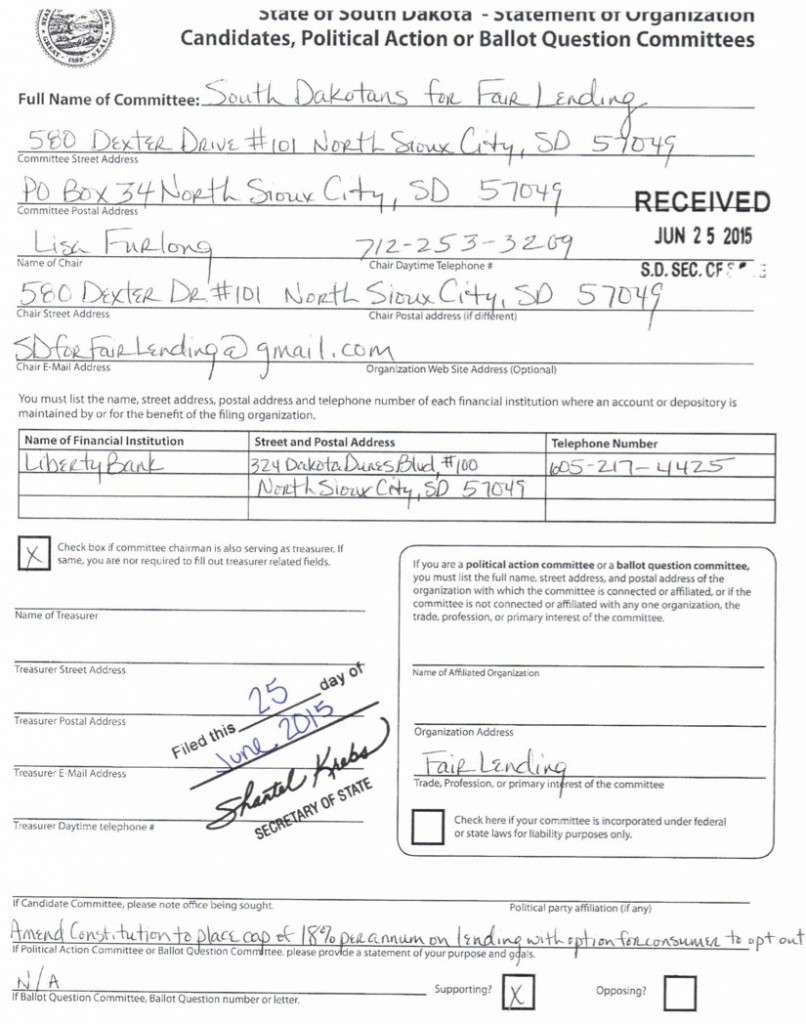

On June 25, Secretary Krebs received another statement of organization, from Lisa Furlong of North Sioux City, to form “South Dakotans for Fair Lending.” The only online pings I find on Lisa Furlong suggest she manages accounts for PC Connection in North Sioux City. Furlong’s committee is not formed in support of or opposition to the 36% interest rate cap initiative proposed by South Dakotans for Responsible Lending (ah, do you feel the confusion coming?). Furlong is supporting an as-yet unpublished, unannounced constitutional amendment “to place cap of 18% per annum on lending with option for consumer to opt out.”

Hmmm… so in a couple months, we could have two groups with similar names asking folks on the street, “Would you like to sign a petition to cap interest rates?” That could confuse voters, couldn’t it?

That confusion is exactly what payday lenders sowed in Missouri to fight an interest-rate-cap initiative in 2012:

A Republican lobbyist submitted what appears to have been a decoy initiative to the Missouri Secretary of State that, to the casual reader, closely resembled the original measure to cap loans at 36 percent. It proposed to cap loans at 14 percent, but stated that the limit would be void if the borrower signed a contract to pay a higher rate — in other words, it wouldn’t change anything. A second initiative submitted by the same lobbyist, Jewell Patek, would have made any measure to cap loan interest rates unlawful. Patek declined to comment.

MECO [Missourians for Equal Credit Opportunity] spent at least $800,000 pushing the rival initiatives with its own crew of signature gatherers, according to the group’s state filings. It was an effective tactic, said Gerth, of the St. Louis congregations group. People became confused about which was the “real” petition or assumed they had signed the 36 percent cap petition when they had not, he and others who worked on the effort said [Paul Kiel, “The Payday Playbook: How High Cost Lenders Fight to Stay Legal,” ProPublica, 2013.08.02].

Watch your six, Steve and Steve: the payday lenders may be coming up behind you with a decoy petition!

Brett Koenecke was a lobbyist for TransCanada for many years and is now associated with the Dakota Access pipeline. Brett’s being associated with the usury industry comes as no surprise.

I would be so much happier if the pay day loan capping people would provide another source that people could borrow from at say 36%. If the original petition should happen to pan out, it’s only one head of the hydra.

It’s a damn dirty business, but someone will do it! $$$$

http://thinkprogress.org/economy/2015/07/10/3679141/scott-walker-payday-loan-expansion/

By way of comparison,here is what Wisconsin wingnuts shoved into budget w/o debate as a favor to payday lenders (and large campaign contributors). Walker is gonna declare his Potus run in a couple days. Chances are he will sign this.

mike from iowa,

I’m not sure this is wingnut-driven. It’s more crony capitalist-driven by an industry that pours lots of money into the Republican Party in Wisconsin. This is one issue where Walker might actually do the right thing, as evangelical Christian groups hate the payday lending industry almost as much as progressives.

As for an alternative, I don’t know why churches don’t develop their own banking institutions to lend money at reasonable rates to low income folks.

Glad you checked in,Donald Pay. I enjoy tour Wisconsin perspective. I hope you are right about Walker,but I’m guessing he won’t buck congress(his own). How did this tool ever get elected???

The cream rises to the top. The slime, usurious lenders, sink to the bottom. They need to be drained off.

Check this story on a crooked payday loan group that was shut down

http://www.kansas.com/news/nation-world/national/article26711185.html

Mike, that Wisconsin payday lender bill sounds like a disaster. Letting loan sharks also handle tax advice and sell annuities that customers don’t understand is a terrible idea. Could a Walker presidential run survive that bill? Let’s hope for that continued Hickey-church opposition kicking in and keeping Walker’s signature off that bad bill.

WR: two crooks create fake loans, put innocent non-buyers on the hook, and have the resources to settle for $54 million? We should scared of such well-funded unscrupulousness.

Our South Dakota petitioners need to be on high alert. They also need to gather as many signatures this month and next, hoping that fair season comes before Furlong gets her decoy petition out in public. If anyone sees that decoy petition, get a photo of the sheet and the circulator, and ask who is paying the circulator!

People who use pay day lenders are making very poor decisions. We cannot legislate away stupidity for there are innumerable other things they can do. Let the laws of nature weed out the weak.

We know that grudz’s, but isn’t it logical and humane to protect vulnerable members of our society?

Yup, Grudz, how could anybody anticipate somebody keeping pet rattlesnakes and then getting bit and rushed to a hospital in Sioux Falls?