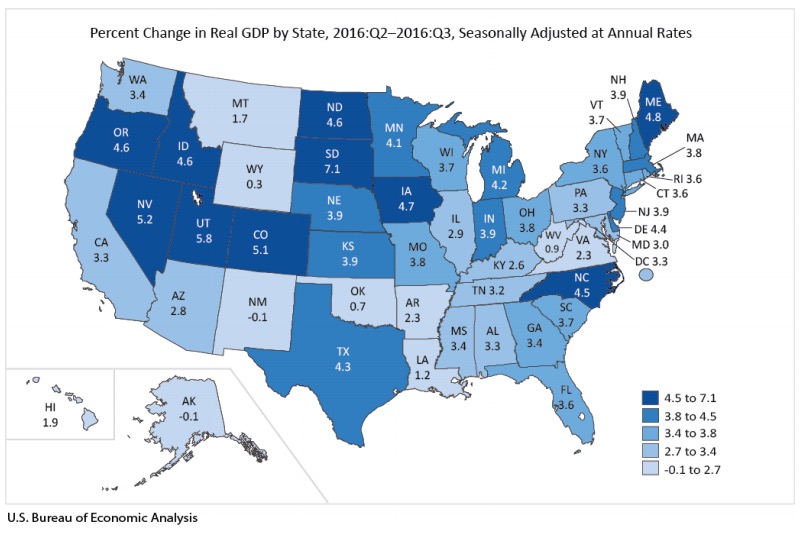

Your economic puzzle for the day comes from the Bureau of Economic Analysis, which finds that, in the third quarter of 2016, South Dakota had the fastest growing economy in the nation:

So how does South Dakota grow its economy twice as fast as the national rate but still see limp sales tax revenues that undershoot last year’s budget projections by $55 million?

The problem, according to BEA data, is that our GDP gain is all relative. Our Q3 2016 GDP is actually down 0.3% from Q3 2015. We saw declines in GDP of 9.8% in Q1 and 1.0% in Q2, so as of Q3, we were still in the hole for the year.

Even with low crop prices, agriculture still generated 2.01 percentage points of our Q3 gain, followed by finance and insurance with 1.69 points, wholesale trade at 0.75, durable-goods manufacturing at 0.40, and government (ah, sweet government!) at 0.39. Real estate/rentals and educational services sandbagged us a bit, posting the only sector declines (0.12 and 0.02 points, respectively).

Wait until tax revenues take a further big hit in tourism. http://www.frommers.com/tips/miscellaneous/the-travel-press-is-reporting-the-trump-slump-a-devastating-drop-in-tourism-to-the-united-states

Catch this hit from republican’s:

Jobs

A total of 52,166 jobs, with income of $1.4 billion, were sustained by the

visitor economy in South Dakota last year.

Visitor-supported employment represents 9.5% of all employment in the

state of South Dakota.

The unemployment rate in South Dakota was 2.7% in 2015. Without

tourism jobs, the unemployment rate would have been 14.2%.

These are 2015 numbers. Daugaard and his legislators should be dancing in the street with the prospects of the upcoming non tourist season. Tanks a lot you business titans.

And the “Trump Slump” in tourism couldn’t be impacted by the strong dollar which costs international tourists more to come and play in the US? You’d expect Frommers, which specializes in travel guides, to pick up on that fact but the article seems to be more inclined to engage in “anti-Trumpism” opining and blame the drop off on some ginned up solidarity between groups of international tourists.

http://www.marketplace.org/2015/12/17/economy/strong-dollar-tourism

The real point is nobody should react too firmly to quarterly information except to discern trends.

If farm income was up with such low farm prices, then the farmers emptied the bin by selling off old corn to make bills. This is not sustainable to keep selling more than they raised. So next year the growth may be down more than now which means that the sales tax revenue will be down worse next year unless the farm prices go up significantly. Tighten your belts now.

I would assume that also thriving big farms are also taking advantage of crop insurance subsidies that they don’t really need. (oh boy, I’m ready for the comments on this one).

But, come on people, we know this does happen.

Yeah, Frommers is just wrong on this. We will see plenty of tourists, nothing to see here. We will not be sad, it will be terrific, geesh. If the reason is a strong dollar instead of our new Draconian laws, then what will we do about these numbers? Still the same stuff, but with a different screwing of the sales tax base and loss of jobs.

Jobs

A total of 52,166 jobs, with income of $1.4 billion, were sustained by the

visitor economy in South Dakota last year.

Visitor-supported employment represents 9.5% of all employment in the

state of South Dakota.

The unemployment rate in South Dakota was 2.7% in 2015. Without

tourism jobs, the unemployment rate would have been 14.2%.

Ruh oh Coyote, looks like it is still on your boy. https://www.poundsterlinglive.com/eurusd/6280-meat-of-dollar-rally-is-behind-us-eur-usd-to-rise-says-abn-amro

Roger,

Not necessarily. Q3 and Q4 are always extremely volatile because of the timing of harvest. If corn/bean/flowers are taken out of the field in Q3 one year and Q4 the next, there is big volatility.

Because Ag is so big in our state and the aforementioned volatility only because of September-Octoberharvest timing, I wish they would statistically normalize ag income between Q3 and Q4 so we at least could better see what happened not only in the non-ag sector but overall.

Is any of this growth accountable to the new money invested in to communities for education from last year?

It is no doubt all French Math.

Troy, get a grip, the ag business is in the crapper and has been for sometime. It is important, but not that important in the big picture of the state’s economy. Beef today https://www.ams.usda.gov/mnreports/lsddcbs.pdf

https://www.barchart.com/futures/grains Yep, all good in Troy land.

When a state is at the bottom of the GDP (GSP) per square mile list – national trends tend to drive its up and down quarterly fluctuations far more than its own state policies.

Sadly, half of SD probably thinks Donald Trump made South Dakota great again in Q3 of 2016.

Here’s an idea, not sure if many of you can actually handle it, but here it is: diversify SD’s economy.

So, now that we all know how real economies of scale [economic engines] are built, we start focusing on diversifying by bringing more manufacturing and higher tech etc business to SD.

We need to bring in what we don’t have. Sort of like how all the new Black Hills micro-breweries, premium coffee roasters, restaurants, and food trucks did in the last few years. It’s not part of SD heritage to have these things, but it is part of becoming a modern American economy. Diversified economies attract more educated people to move to a place, and that in turn attracts employers.

SD needs a new philosophy on economic development.

O, that’s a really good question. The teacher pay raises wouldn’t have kicked in full force until September, so they wouldn’t have had much of a chance to boost Q3 data. The areas where I would think higher pay would show up—retail and real estate—didn’t show big gains. And remember, we’re talking about maybe $60 million in new wages out of a $48-billion state economy—that’s only a bit better than one-tenth of 1% of GDP. So even in Q4, I wouldn’t expect the teacher pay raise to drive a big GDP boost.

Besides, whatever the teachers are doing with their money, the downward trend in sales show by the sales tax numbers appears to be overwhelming any positive effect.