Julie Frye-Mueller says her proposed initiated constitutional amendment to add $1.50 tax to every trip you make to Hy-Vee would completely replace property tax:

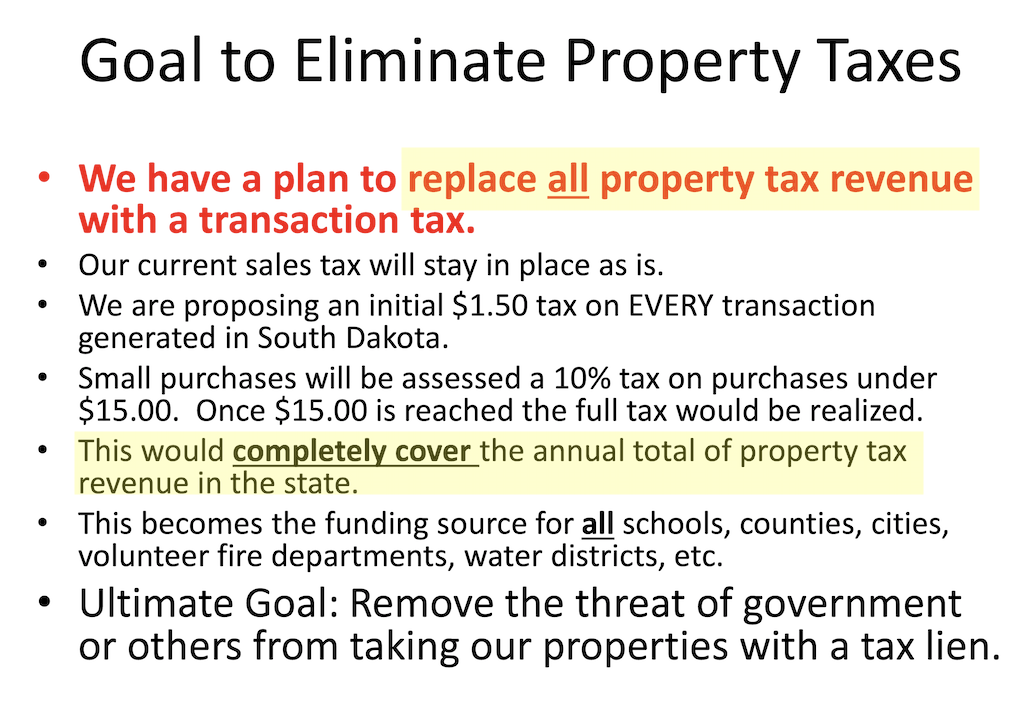

The newest proposal pitched to the task force this month would add a flat $1.50 tax on transactions of $15 or greater, and add a tax of 10% on smaller transactions. The new tax, said former state Sen. Julie Frye-Mueller, R-Rapid City, would replace property taxes entirely by generating $1.75 billion in revenue [Makenzie Huber, “From Property to Purchases: Task Force Considering Fundamental Tax Shift to Reduce Homeowner Burden,” South Dakota Searchlight, 2025.07.28].

Frye-Mueller’s own slides presented to the Legislature’s interim property tax task force on July 17 claim that the retail transaction tax would “replace all property tax revenue”:

Frye-Mueller’s claim is ridiculous. Let’s do some math:

According to the South Dakota Department of Revenue, schools, counties, and other taxing districts collected $1,788,932,192 in property taxes in 2024.

Raising an equivalent amount by taxing each retail transaction at $1.50 would require ($1.79B/$1.50 = ) 1,292,621,462 retail transactions.

The Census Bureau estimates 924,669 people lived in South Dakota in 2024.

To engage in enough retail transactions to make the proposed $1.50 shopping tax replace property tax, every South Dakotan, man, woman, and child, would have to go to the store and buy something 1,290 times a year, 108 times each month, or 25 times each week.

Drive Research says the average consumer makes six trips to the grocery store each month.

Wallet Hub reports that in 2023, monthly per capita consumer spending in South Dakota was $527. Even if we bought all of that $15 at a time in separate trips to stores, that would only be 35 retail transactions per month.

Assuming every man, woman, and child in South Dakota sustained that rate of notably inefficient purchasing (and assuming we never hopped across the border to make some of those purchases in Sioux City, Fargo, or Minneapolis), 35 retail transactions a month taxed at $1.50 a pop in 2024 would have produced $582,541,470, less than 33% of the revenue raised by property tax in 2024.

In other words, even with a couple of unlikely assumptions breaking in Frye-Mueller’s favor, replacing property tax with her retail transaction tax would cut school and county funds by two thirds.

That shortfall would get worse every year.

According to DOR’s figures, property tax collections increased 4.53% each year from 2015 to 2024.

According to the Census Bureau, South Dakota’s population grew 1.01% each year from 2020 to 2024.

If Frye-Mueller’s amendment gets on the ballot and voters approve it in 2026, it would take effect July 1, 2027. In its first year (and I’m going to slop over the math of refactoring these figures to split increases over the fiscal year and just assume we work with flat numbers through the calendar year), the retail transaction tax would raise $600 million, less than 30% of the $2.043 billion we can expect from property tax.

The proposed amendment caps increases to the retail tax at five cents per year. (The amendment actually sets the cap at “the lesser of five cents or an amount estimated to provide the moneys necessary to replace the revenue foregone from the prohibition on real property taxes,” but the replacement amount will always exceed the amount that a five-cent increase will produce.) So the retail transaction tax could increase by 3.33% in its first year, but the nickel boost produces a diminishing percentage increase over time—less than 3% by 2032, 2% by 2048….

Factor all of that in, and after ten years, in 2037, if the Legislature can muster two-thirds majorities every year to raise the tax the max every year, the retail transaction tax will be $2.00. In 2037, the retail transaction tax would raise less than 28% of expected property tax revenue. By 2047, the retail transaction tax will raise less than 25% of expected property tax revenue. By 2077, after 50 years, the retail transaction tax will collect less than 15% of expected property tax revenue.

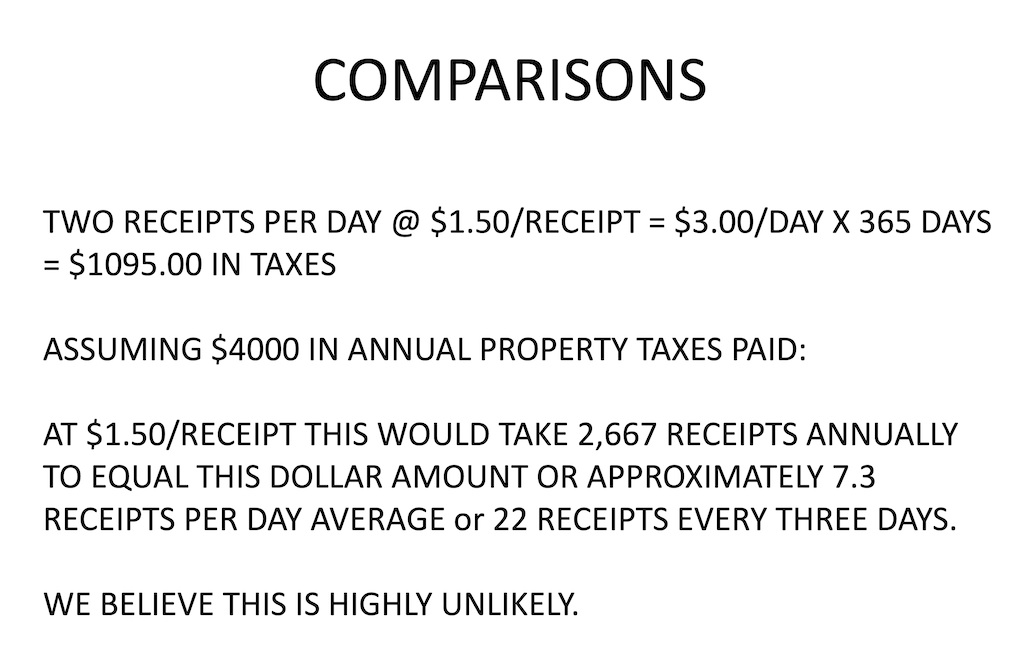

Frye-Mueller’s own slides agree that typical household spending frequency would produce only $1,095 in retail transaction taxes, far less than her guesstimated $4,000 in annual property taxes per household:

“Highly unlikely”—try arithmetically and economically impossible.

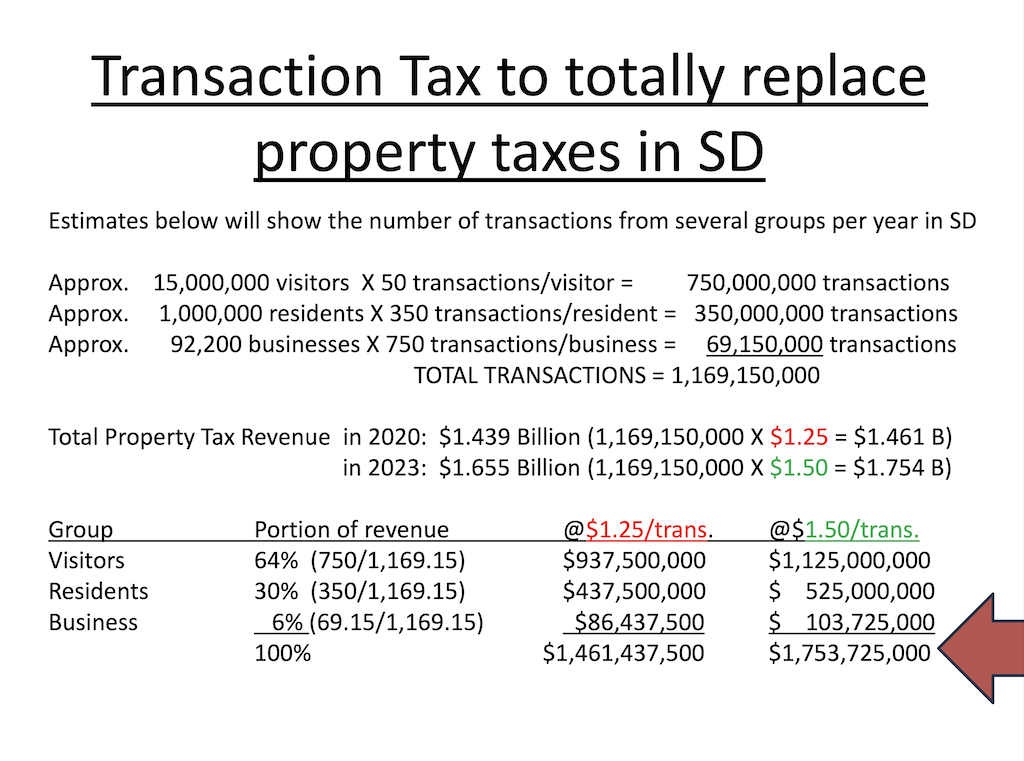

Yet Frye-Mueller whips up some fantasy math in which 15 million visitors to South Dakota will cover the shortfall:

15 million visitors—that number is legit! The state Department of Tourism reports 14.9 million visitors spent $5.09 billion in South Dakota in 2024. However, the Department of Tourism says only 21% of that visitor spending was retail. The $1.1 billion in reported visitor retail spending would translate into $72 in retail spending per visitor. Even if each visitor splits that $72 into five separate retail transactions, that’s only a tenth of the 50 transactions per visitor that Frye-Mueller postulates.

Even if we allow Frye-Mueller to apply the retail transaction tax to everything visitors buy—retail goods, restaurant meals, transportation, lodging, four-wheeler and boat rental, motel rooms and vacation homes—visitors last year averaged $342 in spending per person. At best, that’s 23 $15 purchases, which taxed at $1.50 a pop would produce $34.50, which multiplied by 15 million visitors would produce $509 million, which added to the $583 million in retail transaction tax we locals pay would still leave us $698 million short of what property tax provides.

None of these numbers show a tax of $1.50 on every retail transaction coming anywhere close to completely replacing the annual revenue from property tax. Frye-Mueller isn’t out to replace property tax dollar for dollar; her plan will decimate school and county budgets.

Since leaving home for college 22 years ago. I’ve almost always lived in a single room living space. So I have no concept, or future plan, of owning property. What’s the root of the obsession these property owners have fir this issue? How much is based on greed? My perception is thus is mainly coming from people who own property that’s above average costwise.

grudznick appreciates your math, and think you do it far better than Ms. Frye-Mueller, especially for an out-of-stater.

1. Who gets to come up with the formulas to distribute the money to the counties, cities, school districts, townships, and all the other taxing districts? This will be a nightmare and I assume it will be the legislator who gets to come up with the formulas. I see rural SD losing as a majority of the legislators live in urban areas.

2. I see this as being a big negative to small businesses, especially in small towns across SD. A lot of small businesses in small town survive on small purchases. I see people trying to keep the transaction tax to a minimum by making large purchases when they go to a big city, verses making several small purchases in their hometown small businesses.

… grudz is still breathing? Hadn’t thought of him in a ‘coon’s age.