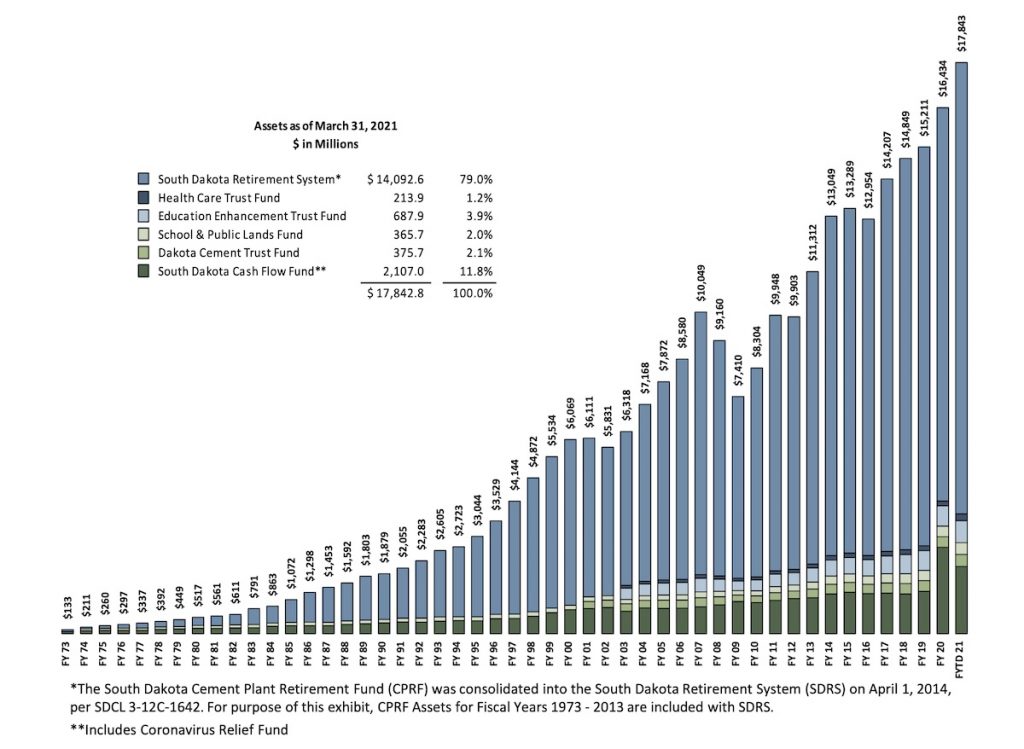

South Dakota’s public investment funds haven’t gotten sick from coronavirus. They actually benefited from catching coronavirus relief funds:

See that green chunk at the bottom of the bars? That’s the state Cash Flow Fund. The coronavirus relief dollars from Uncle Sam that Governor Noem socked away in that fund to earn interest for planes and Republican consultants helped keep the state’s total investment portfolio growing last year and are still providing a bigger-than-historically-normal boost to our asset total.

Even without the coronavirus cash, the South Dakota Investment Council is outperforming its usually good work. In its report to the Legislature’s Executive Board last week, SDIC estimated an 18.7% return on the South Dakota Retirement System investments and 14% to 16% return on our trust funds. Compare that to a 10% average return from 1973 through 2018 and to the 30% market crash at the onset of the pandemic that the Investment Council thought would stick as a permanent correction, and it appears we’re making like bandits.

And like so much other important work in South Dakota, we get these valuable returns by refusing to fully invest in the labor that produces them. The SDIC’s report explained that the council’s target salary for our state investors is 70% of cost-of-living-adjusted median pay for the investment industry. The discount our best state investment officers suffer may be even larger “as industry pay for top quartile performers can be double the median.” SDIC says we can’t muster the scratch to recruit “veteran high-performers from elsewhere,” so SDIC relies on building its team “by training cream of crop local University graduates” and hoping they’ll stick around for the “15 to 20 years” it takes “to fully develop seasoned talent.” The 30% discount is a couple steps up from past compensation; SDIC evidently was paying some investment staff 50% of the industry median, but that “led to difficulties.”

South Dakota thus bets its pensions and trust funds on the premise that it can convince smart young investors to sacrifice 30% of their earning power during the first third or half of their careers for the sake of the debatable advantages of living in rural South Dakota.

Our state investment funds are surviving coronavirus. How long can they continue surviving our undervaluing of talent?

[Wow: that comment thread went completely off-topic. Let’s reset. South Dakota Investment Council: high returns, low pay…]

Like Cory, skilled investment councilors stay in SD because they want “to make a difference”.

Good for them and great for the Noem administration’s bragging rights.

I’m not part of the SDIC and know nothing about the program, but have heard grousing about the excessive bonus that the legislature pays out to SDIC whether performances are up or down. Just wondering if it is gossip or if it is true.

The SDIC has been good to my brother throughout the years. It was set up when South Dakota was liberal, just saying..

I’ll just toss my money in a Vanguard and enjoy the minimal fees, thanks.

And that desire to serve the public in the place we love bridges a lot of that pay gap… but ultimately, we can’t count on it as a basis for long-term sustainability. Counting on talent to sacrifice economic opportunity for local civic spirit will always result in less talent available and less success than we could have had otherwise.

Compensation for the SD investment council should mirror capitalism. They should earn more when the council’s fund beats the market. The council should earn less and not receive bonuses when the fund fails to beat the market.

It ain’t rocket science.

Mr. cibvet, it is known.

Well…they generally do a very good job of riding the market….they diversify and cover most sectors…as I recall this Investment Council concept came about when Dick Kneip combined teacher retirement funds with state employee retirement and added some loose investment cash being squandered by various departments..I think the Cement Plant also had money in it at conception. Dave Volk was involved with its management for years and did a good job.

“Great news! Cleveland clinic study of 52,238 employees shows unvaccinated people who have had COVID 19 have no difference in re-infection rate than people who had COVID 19 and who took the vaccine.” — Rand Paul

Since the downturn in in 2008 it has been harder to loose money than make it in the markets. SDIC’s rate of return is below what some investors, including me, have been racking up over that time. But I take some risks that SDIC will not. For example, I invested in clean energy funds and lost money for years, That investment was more a statement of principle than a desire to make money. But then, boom, clean energy took off. Hey, I’m not complaining. The goal of the SDIC is not to make a killing in the markets, however, or to take risks. They do a great job of making steady money and not losing it all in downturns.

Johnny One Note may have left out some pertinent info from Cleveland Clinic study such as…..

Over 99% Hospitalized 2021 COVID Patients Unvaccinated

By Carolyn Crist

hand with iv

May 13, 2021 — A new study found that more than 99% of patients hospitalized with COVID-19 during the first four months of 2021 weren’t fully vaccinated.

The Cleveland Clinic, which released the data on Tuesday, also found that the mRNA vaccines created by Pfizer and Moderna were more than 96% effective in protecting against COVID-19 infection.

The study “shows that those that are vaccinated are far, far less likely to get the disease than those who aren’t,” Donald Dumford, MD, medical director of infection control for Cleveland Clinic Akron General, told the Akron Beacon Journal.

“The way for us to start to get back to normal life is to have as many people as possible be immune from the virus,” he said. “The vaccine is the best way to do this.”

Among the 4,300 COVID-19 patients admitted to Cleveland Clinic hospitals between Jan. 1 and April 13, 99.75% were not fully vaccinated.

The study also looked at 47,000 Cleveland Clinic employees who had received one shot, two shots, or no shots. Among those, 1,991 tested positive for the coronavirus in recent months. About 99.7% of those who contracted COVID-19 weren’t vaccinated, and .3% were fully vaccinated.

Yeah, Rand Paul does not take the right conclusion from the only fact he presents from that study. I’ll make it plain for you, Mr. Dale. You can get Covid-19, lose a week to months of your life in a sick bed/quarantine, risk hospitalization and death, and have a similar low chance of being re-infected as getting couple shots in the shoulder. That seems to be a fairly easy decision. Of course, it also leaves out the obvious: GREAT NEWS:

people who died of Covid-19 were not re-infected at an even higher percentage than people were vaccinated!!!

Jeez Mr, Dale, Randy Paul? I love the people you quote, I’ll never call you libertarian again.