On top of Revenue Secretary Jim Terwilliger’s fiscal pessimism, the Governor’s Council of Economic Advisors heard retired USD economist Ralph Brown’s assessment Wednesday of the Trumpistani economy. Short form: partly cloudy with a 35% chance of recession.

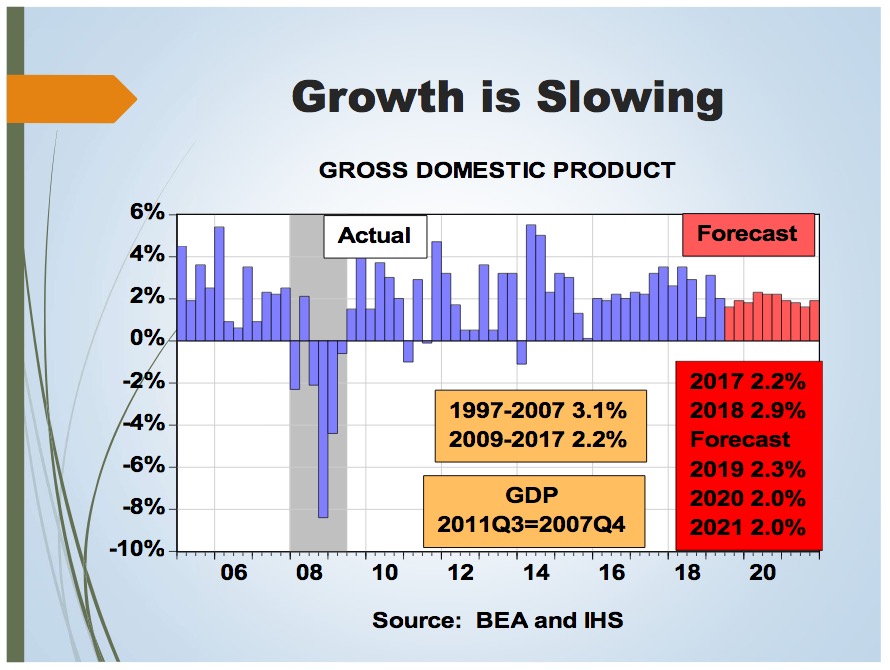

After a brief uptick that didn’t exceed some of the best spikes in the Obama economy, GDP growth in the next two years will fall below the 2.2% average of the Obama years, which included cleaning up the recession.

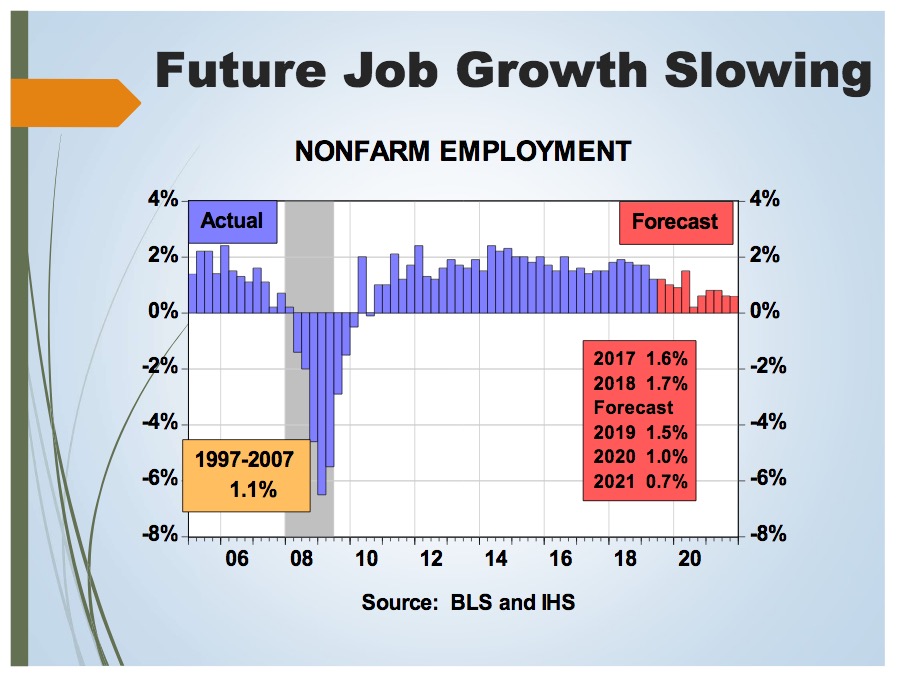

Job growth is declining to the lowest levels since right after the recession.

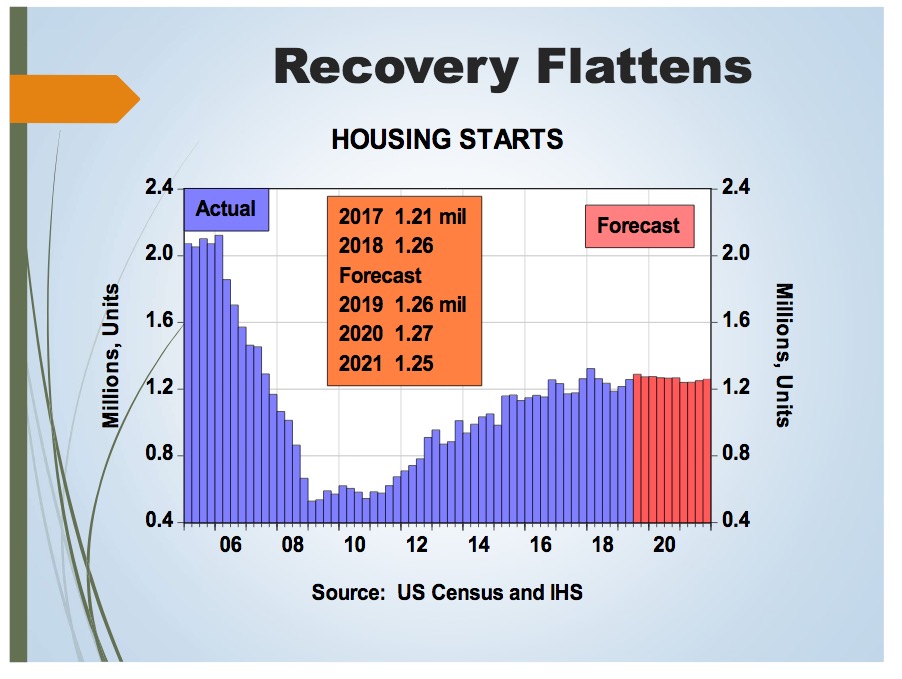

New housing starts, which drive all sorts of economic activity, are going to plateau after seven years of solid recovery, although they’ll still be well shy of the apex of the housing bubble (and that’s probably a good thing—we don’t need any irrational enthusiasm or frenetic house-flipping).

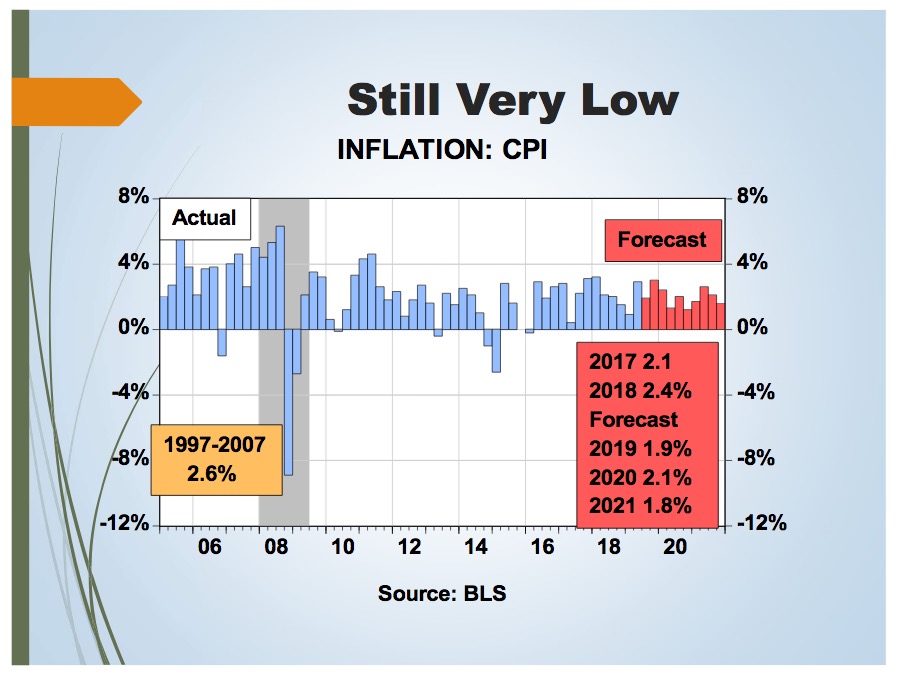

But hey, inflation’s going to stay low.

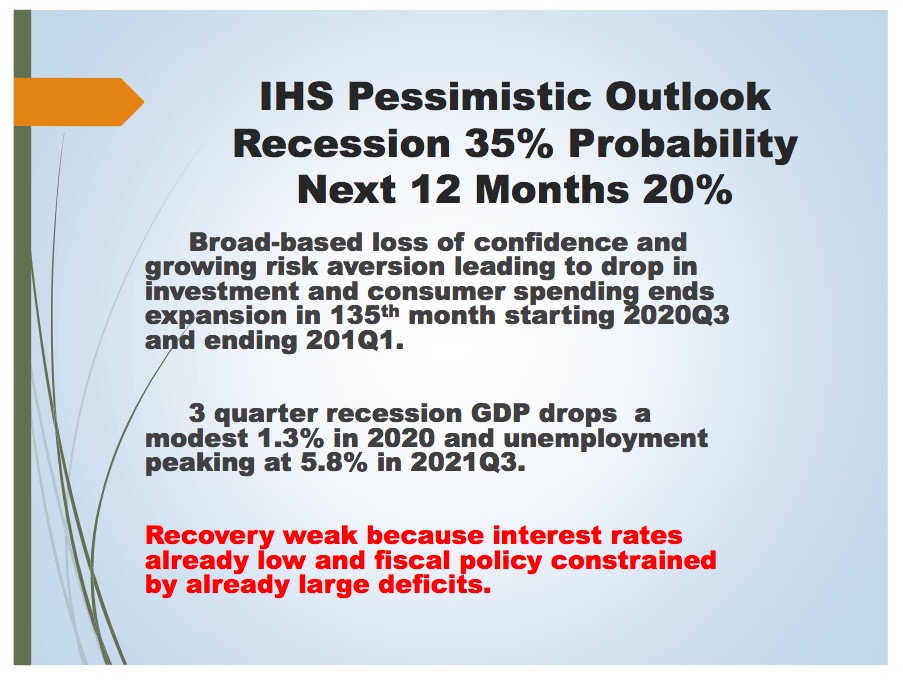

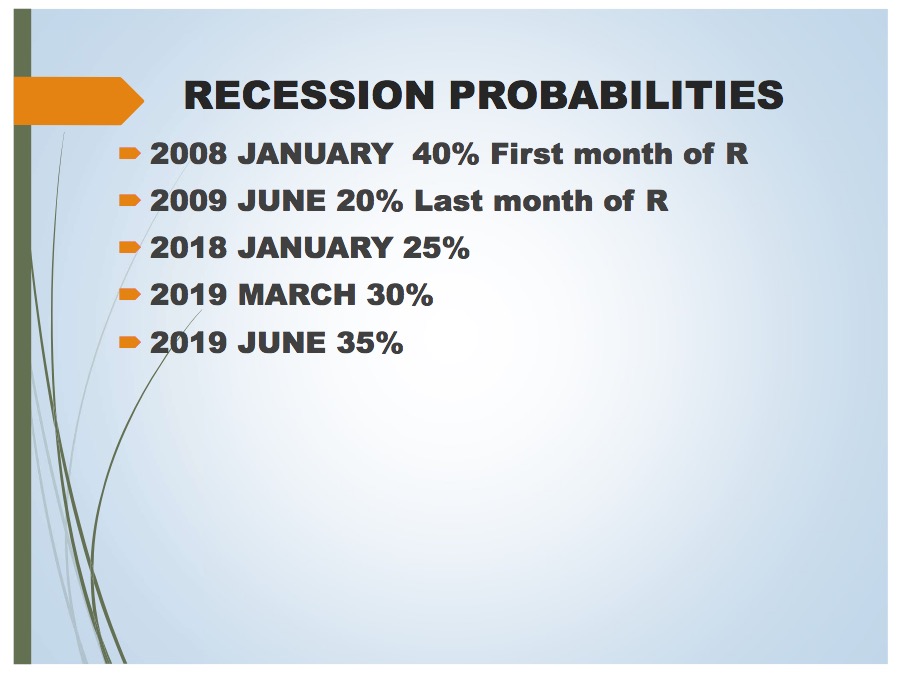

I’m trying to figure out of Dr. Brown’s slides on recession should inspire relief or fear. The chance of a recession is only 35%, and the most likely retraction would be mild, with only a 1.3% drop in GDP and an unemployment rate of 5.8%, both far less than the hits we took in the last recession. The recession would hit just in time for the 2020 election—not cause for optimism or pessimism, just something candidates will want to watch for. But while 35% doesn’t sound like a strong probability of a recession, Dr. Brown notes that probability has climbed steadily from 25% in January 2018 and stood at a mere 40% at the dawn of the 2008 recession.

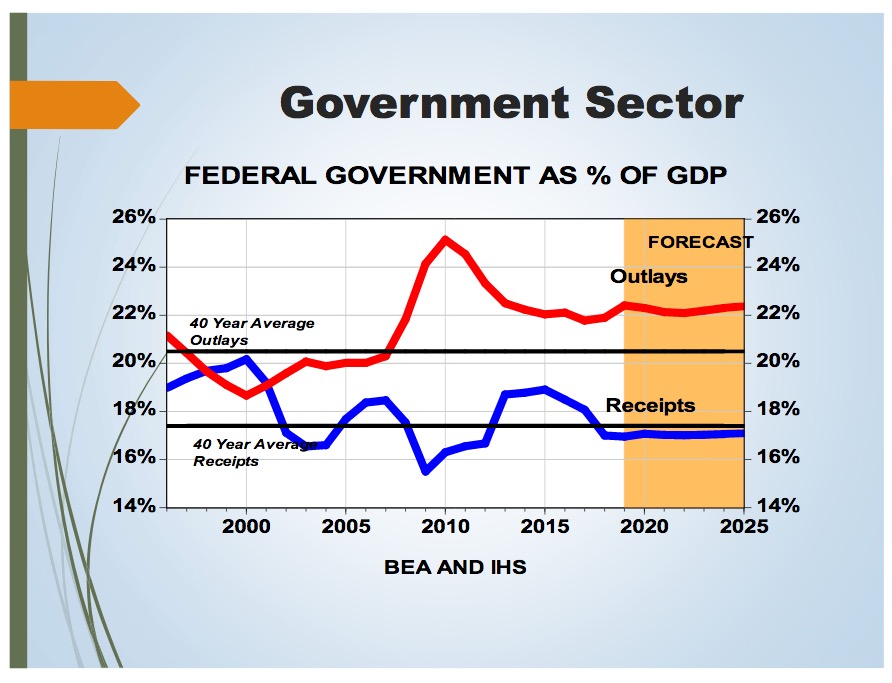

Dr. Brown notes that we’ll have trouble recovering from any recession because increased deficit spending has restrained the government’s ability to use fiscal policy to stimulate us back to growth. Check out this graph, which should be exhibit #1 in rational arguments against the small-government promises of the Republican incumbent, if he remains on the ticket:

After promising smaller government, the Trump regime has kept government spending at or above the percentage of GDP to which the Obama Administration was able to settle things down after the necessary response to the recession and clearly above the 40-year average. In other words: if you wanted smaller government, you got no change from Trump. Government as a percentage of GDP in recent years was lowest at the end of the 1990s, under the Clinton Administration.

Dr. Brown’s presentation indicates the economy may not take an swful downturn, but it’s not going to boom either. Like Trump himself, the economy appears poised to sit around and do nothing big.

Republicans see this as hoo hum. A walk in the park.

“WASHINGTON (AP) — The federal deficit for the 2019 budget year surged to $984.4 billion, its highest point in seven years, and is widely expected to top the $1 trillion mark in coming years.

The 26% surge from the 2018 deficit of $779 billion that the government reported Friday reflected such factors as revenue lost from the 2017 Trump tax cut and a budget deal that added billions in spending for military and domestic programs.”

After all, it’s only money and China and Mexico are paying for it…right?

For everyone’s sake, I hope Professor Brown’s forecast is wrong. Recessions are nasty things that ruin people’s lives even if they may be milder than the last.

Not to worry. South Dakota does not have peaks and valleys regarding economics, we are always in the valley. Even when times are good here, they are still very low. When times are bad here, you cannot tell the difference.

Nobody in the GOP can manage an economy. They screw it up every damn time.

Looks like China has picked a super winner for something that works to make money even in a downturn. Wonder why we don’t consider doing something similar, even here in South Dakota as another feed line from Rapid City through Sioux Falls?

“The company that operates the Beijing-Shanghai section of China’s high-speed railway network has submitted a formal application to float on the stock market, and in doing so revealed details of its lucrative operation.

According to the filing, published by the China Securities Regulatory Commission on Friday, Beijing-Shanghai High Speed Railway, which operates the 1,300km (807 mile) line, booked a net profit of 9.5 billion yuan (US$1.3 billion) in the first nine months of the year.”

Denver and Minneapolis are about that same distance and both are serious economic hubs.