Previous administrations promoted the EB-5 visa program to entice foreign fancy pants to pour money into economically distressed rural areas to promote economic development. Out of that deal, South Dakota got more polluting CAFOs, a beef plant that went bankrupt before reopening, a casino in court, an EB-5 czar convicted of shady money shuffling, and a dead former state economic development official.

Donald Trump has a poor record of helping the rural economy, and he surely wouldn’t to do favors for folks outside his gated America. But Congress did tuck into the Trump tax cuts some tax breaks to induce rich people to invest in poor places, called “Opportunity Zones.” The new tax break allows folks who invest in state-nominated Opportunity Zones to defer tax on their capital gains until they sell or until the end of 2026, whichever is earlier. If they hold onto their investments, they can exclude 10% of their gains from tax after five years, 15% after seven years, and more after ten years.

Notice that these tax cuts don’t go directly to the folks living and working in areas of economic distress. The folks with the money to spend to make those cuts worthwhile are largely the folks who least need more tax cuts:

The Economic Innovation Group, a policy group that played a key role in developing the concept, estimates more than $6 trillion of potential capital gains are eligible for the program.

But the program has been mostly dominated by institutional investors and high net worth individuals. Some 8,700 areas in all 50 states and the US territories have been designated qualified opportunity zones.

“The opportunity zone tax code is really built for the mega wealthy and the institutions and doesn’t really benefit the retail investors from a tax basis,” said Michael Weisz, co-founder and president of the investing website YieldStreet [Maggie Fitzgerald, “These Funds Make It Easier to Cash in on Trump’s ‘Opportunity Zone’ Tax Break That Favors the Rich,” CNBC, 2019.03.30].

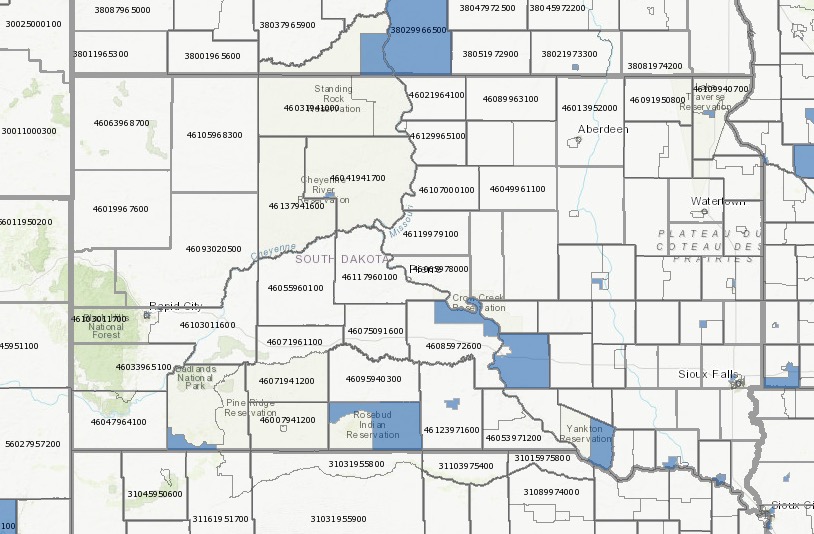

As of last December (the latest update to the IRS spreadsheet, South Dakota had designated 25 Opportunity Zones:

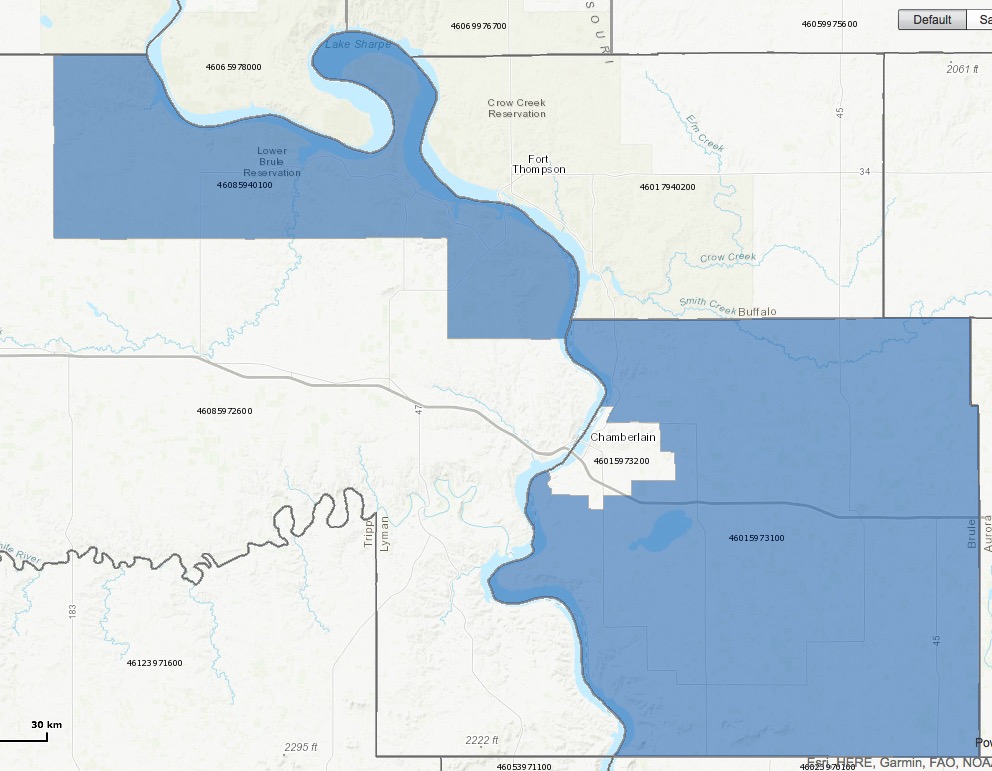

Several tribal areas are designated as economically distressed. Curiously, the Lower Brule Reservation gets this OZ designation but not the Crow Creek Reservation across the Missouri. Most of Brule County to the south gets an OZ but not Chamberlain:

One of the Opportunity Zones is a four-by-four-mile square centered on and encompassing all of Madison. That zone is helping the new Tru Shrimp plant get tax breaks.

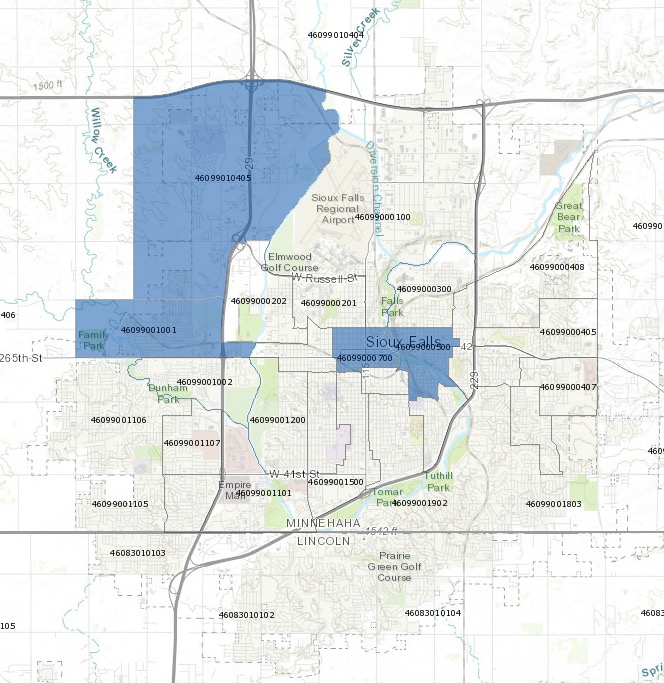

Central and northwest portions of Sioux Falls have been designated as economically distressed:

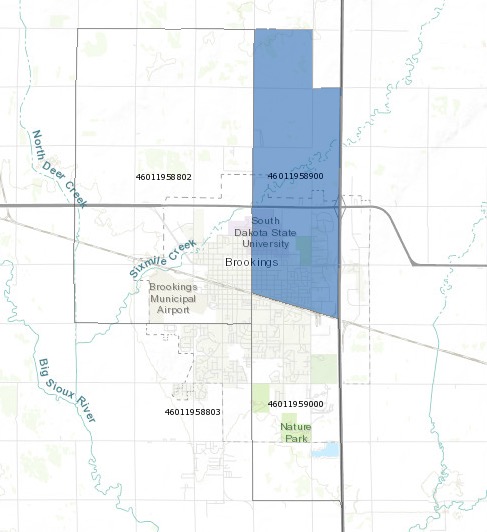

Up in Brookings, Governor Daugaard cleverly drew an economic distress zone around SDSU, where all those students sandbag the average income, creating the statistical appearance of poverty in a quadrant of town where business and real estate are pretty good:

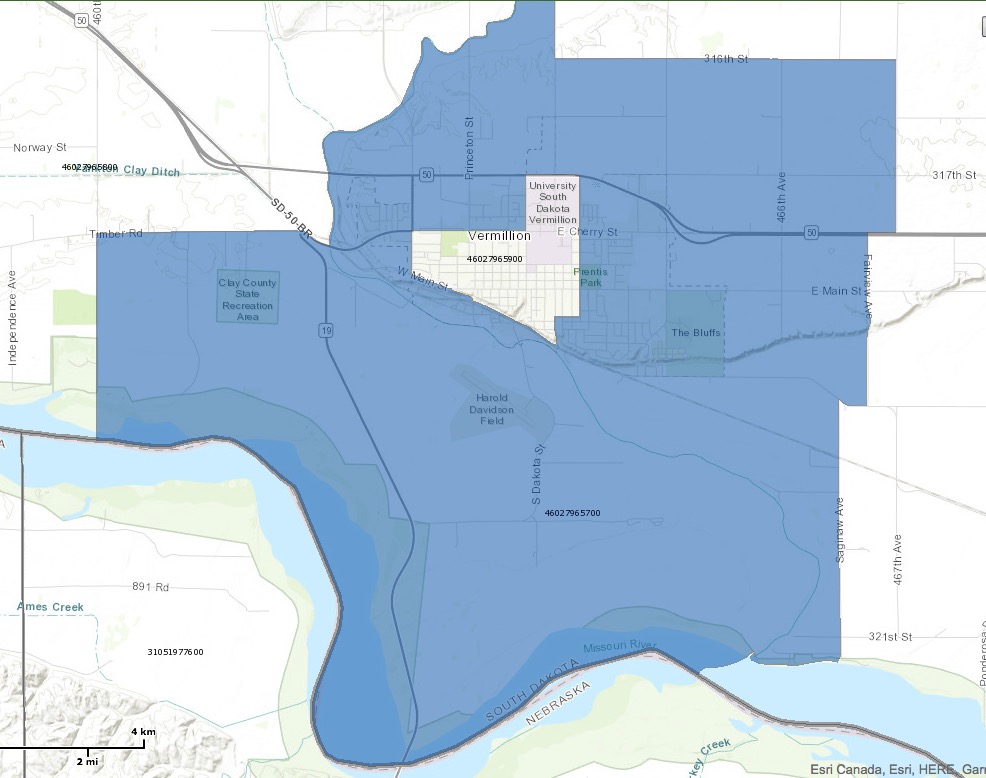

Strangely, the state did the opposite in Vermillion, drawing an economic distress zone that included everything but the USD campus:

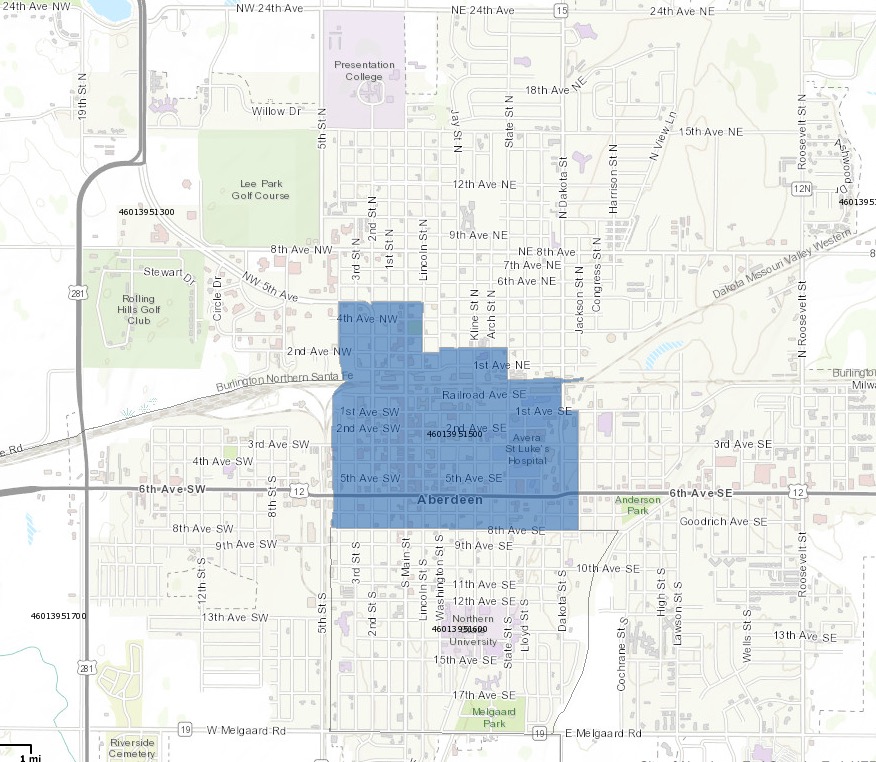

Aberdeen’s economic distress investment zone is reasonably focused on the downtown business district and surrounding lower-income housing:

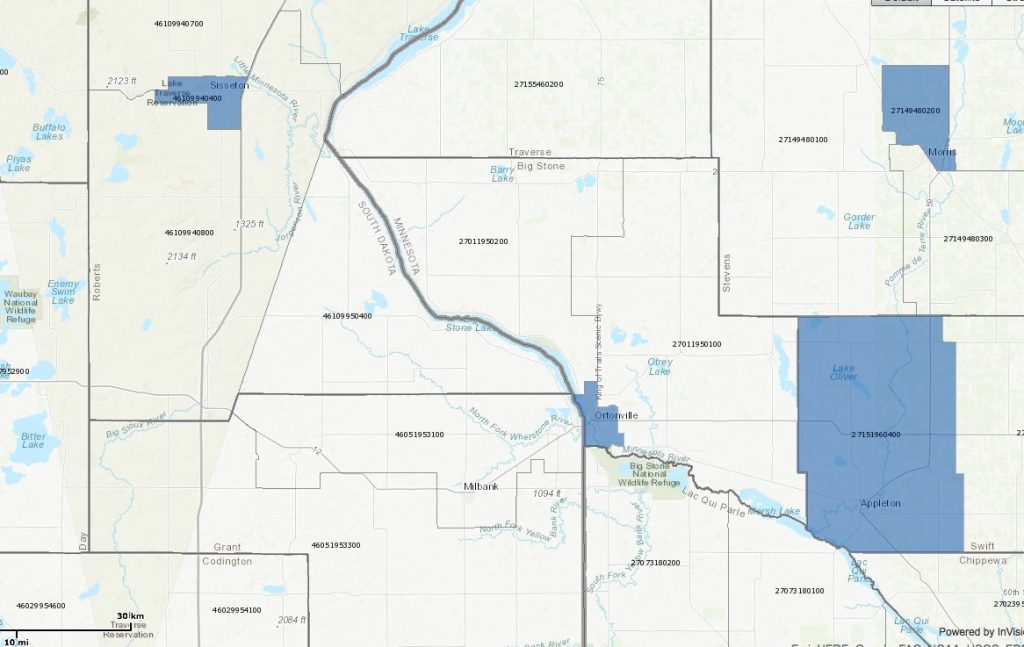

In the far northeast, Governor Daugaard sensibly zoned Sisseton for billionaire opportunity, as he did many tribal communities. But he missed an opportunity to so zone Big Stone City, the poorer sister town of bustling Ortonville, which Minnesota designated economically distressed along with nearby Appleton and Morris:

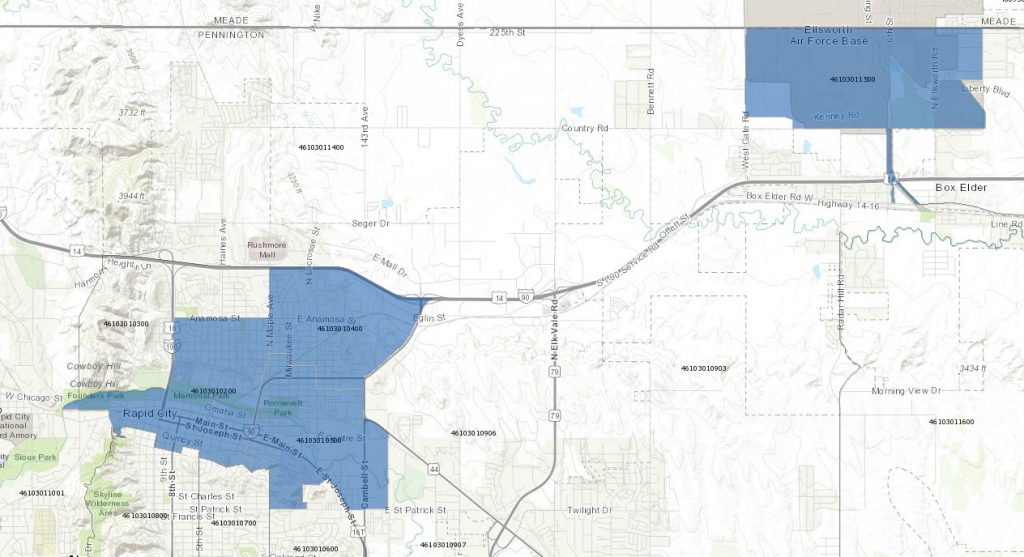

Out in Pennington County, investors can get tax breaks for investing in Rapid City’s Main Street and environs north and on the south side of Ellsworth Air Force Base:

So keep an eye out for more shrimp plants and other investments. According to trickle-down economics, billionaires will come a-flocking to share their wealth, South Dakota will boom, and we’ll all get rich again, just as we did from the EB-5 program, with minimal death and corruption.

I’m assuming the state had to justify these designations somehow with data? It seems at first blush, to be an opportunity for political gerrymandering of a sort. The motives aren’t very clear to me, but I assume there will be both winners and losers in this game. Leaving the designations and boundary-drawing up to each state is a recipe for disaster, IMHO.

Seems the potus SIL takes advantage of opportunities like this and cashes in. I’m sure. other wealthy individuals get their share of the largesse and probably don’t deliver on the other end.

I live smack dab right in the middle of the Eastern Square opportunity zone, which kind of surprised me because my neighborhood is single family homes with about 25% of them being rentals. I looked into this a couple of months ago to see if I could get some kind of Federal Tax break, but it looks like I would have to tear down my house and build rental housing of some kind. Anybody interested in buying my place?

I see my old neighborhood is included in the Rapid City Opportunity Zone. Most of that area is residential housing. What the area doesn’t need is more rich people dropping more crappy development in there. East North Street has always been a little tacky with lots of convenience stores and fast food outlets. That’s what rich folks and lack of proper zoning gets you. Then, of course, came video lottery, the riches way to soak the poor so they didn’t have to pay taxes on their income. Then came the opportunity zone (for them) in the form of casinos, followed by title loan, car loan, payday lending and pawn shops. Once the rich created more poverty in my neighborhood, the grocery stores and other retail moved out. Yes, the rich destroyed the area, and now they soak the poor so they don’t have to pay taxes in their effort to create “Opportunity Zones,” where they will once again go to work destroying the lives and neighborhoods of the lower middle class and poor folks. But, yeah, we’re certainly making America great again, ain’t we?

That Opportunity Zone by Ellsworth seems a little weird to me. I remember when the base was threatened with closure in the early 1990s, and all the big mucky mucks in the area were trying to prevent development in the area. They feared any development that might interfere with flight lines or anything else associated with the base.

The south side of I90 by EAFB is mostly trailer park and legitimately low income. I think it houses many Airwomen and men. They’re definitely not overpaid.

Not surprised to see the entire town of Winner surrounded by one of these “Opportunity Zones”. The town has fallen on really hard times with a dwindling population and businesses closing. After ShopKo closes, we will be down to just two dollar stores for the most basic necessities. We also have two grocery stores, but the prices tend to be rather high. With the impending loss of ShopKo, more people will go out of town to shop in Pierre or Mitchell because prices are far lower than local stores.

Winner has very little industry as well. No manufacturing jobs exist there to my knowledge, unless you count Mid Dakota Meats, a local meat packing store. Most of the jobs are at the hospital, the dollar stores, grocery stores, farm stuff, and local mechanics. I’m surprised Winner still has a McDonald’s to be honest. Lack of jobs is one reason why I moved away to Madison, a town I’m familiar with due to my years at DSU.

In the 90s, Winner did have a call center that helped people make reservations for national hotel chains. It folded in the early 2000s I think.

What were the data objectives, or factors used in determining the analysis ?

I’ve been all over this state, and there are a lot of depressed, oppressed areas

I’ve been wondering that, too, T. My initial morning Googling didn’t turn up any big press releases from the Daugaard administration, just mentions from the Madison, Watertown, and other papers of zones in their neighborhoods. I, too, would like to know more about the process and the decision-makers.

Wade: two grocery stores? Heck, better off than Madison, right? :-D

Cory: Funny thing is, prices of certain items at Madison Sunshine are cheaper than the two Winner stores, and both get stocked through Associated Wholesale Grocers. Sunshine is still more expensive than Walmart. Despite the constant newspaper/radio reminders to shop local, residents still drive to Brookings or Sioux Falls for cheaper food.

There is this constant rumor in Madison that the owner of the local Sunshine Foods vowed to close up shop if another grocery store managed to open here. I don’t know how true that rumor is, but Madison definitely needs another grocery store. If a shrinking town like Winner can have two competing grocery stores, so can Madison. The ShopKo building would be a perfect fit for a second grocery store, but I’ll place my bets that it would either be split up into two spaces or Campbell Supply will buy it. Too early to tell.

Smaller investors can however defer their capital gain proceeds into managed funds, similar to a REIT or mutual fund, rather than create their own fund as large investors can quickly do on their own. Because the tax change is so new the finance industry is just getting started on creating these types of funds and attracting capital.

So there might be good opportunities for small investors moving forward these funds will bring in capital that would otherwise go to Wall Street. TruShrimp (and similar) can make their pitch to these Opportunity Funds they have 30M to raise just for the first hatchery that’s not chicken feed.

https://www.cnbc.com/2019/03/30/retail-investors-can-get-a-piece-of-opportunity-zone-tax-breaks.html

https://belpointereit.com/news/

Sorry, left out a zero, 300M to raise. They have to go to institutional investors to get that kind of money.

Here’s an investment SD could make and it would be a local job creator too.

REBUILD BRIDGES ! The Strib has an article about our Gov. Walz urging the lege to appropriate $ for roads and bridges. An accompanying graphic indicates that 5% of the state’s bridges are in poor condition. The worst state is Rhode Island with 23.1% of their bridges in poor condition. SD is only 3 spots higher, losing even to Mississippi! 16.7% of SD’s bridges need to be repaired ASAP.

http://m.startribune.com/walz-administration-says-roads-may-be-ok-now-but-gas-tax-needed-for-future/508218512/

“Institutional investors”—i.e., not you, me, or that other middle class person behind the tree. Just the big players.

To some extent Cory, but mutual funds are institutional for middle class investors. Let’s say a couple had a rental house for 20 years and would have a huge capital gains hit. They could sell the house and put the proceeds into an Opportunity Zone Fund (REIT type investment), that fund will, in turn, invest pooled money into an Opportunity Zone and the little guy gets the tax break. It sounds like a pretty good idea.

Mutual funds—code for more trickle-down wealth. The institutions get first dibs, direct subsidies, extra furs and yachts. meager mutual fund holders maybe get pennies on the dollar. We’d get more bang for the bucks with direct assistance to the people working in those opportunity zones, people who would spend that money right away on stuff for their business and groceries for their families, at higher percentages right there in those opportunity zones.

I agree with happy. I’m a big believer in mutual funds and ETFs for the little guy. I picked a few great stocks on my own, but China took down AMSC with intellectual property theft and I lost a few thousand on that. So now I don’t choose stocks, but use Index Funds and various ETFs. A lot of people use a buy and hold approach. That’s not for me. I like to trade if a fund isn’t performing. You do have to pay close attention, set limits, etc. You can do this within your IRA or 401k, too. That’s the only way I was able to retire. I took a small hit in the downturn, but got out into cash for a before the bottom then got back in just as it took off. Huge returns since 2009.