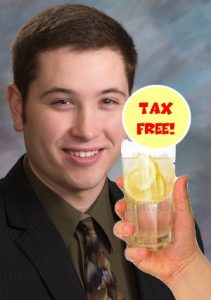

Representative Drew Dennert (R-3/Aberdeen) finally got kids the lemonade tax exemption he promised them. After failing to get a similar measure through the House last year, Rep. Dennert brought back House Bill 1204, which will exempt anyone under 18 who sells less than $1,000 a year in goods and/or services from having to pay state sales tax.

Dennert told us at our March 2 Aberdeen crackerbarrel (scroll to 2:00 mark) that his bill was prompted by an instance where a young Aberdonian who hawked items at Crazy Days on Main Street received a sales tax notice from the Department of Revenue after the Crazy Days organizers submitted the young vendor’s name along with all the other participants’ name to the state. Dennert pushed his bill out of House Taxation and the full House with just one vote to spare. Dennert found the Senate just a bit more confirmatory: HB 1204 passed Senate Taxation 4–1 and got out of the Senate with two votes to spare.

The lemonade stand tax break awaits Governor Kristi Noem’s pen.

Well, yeah, even a liberal thinks this bill is a no brainer. I’m a sucker for these lemonade stands, and I don’t want to have to pay 26.15 cents for a 25 cent drink of kid-made lemonade.

Babysitting and lawn mowing that kid’s do to make money for music, movie and clothes purchases, as well as college savings, won’t have to add on sales tax.

One of our friend’s kids was an artist who had a business in high school. He designed covers for phones. He made quite a bit over the $1,000. I asked him about whether he had to report it under Wisconsin’s sales tax law. His answer, “Sssshhhhhh.” I asked about income tax. “Sssshhhh.”

Donald, how about we increase the Dennert exemption to apply to all vendors of all ages on their first $100K of sales, just like we offer our out-of-state remote-vendor friends?

I like your amendment Cory. $1000 is paltry and definitely not a business person trying to scam the state.

How do they compute taxes on Etsy, Ebay and similar sites?

Gov should veto it. The example , in terms of tax collection, didn’t happen. Everybody wants an exemption, and then wants to claim to be a budget balancing conservative. This is a foolish spender

Says the one that voted against farmers growing hemp.

Senator Schoenbeck.

Please elaborate. What’s going to make this a “spender”?

Just how much money does the state collect from kids under 18 selling less than $1,000 in goods and/or services? How many kids under 18 are paying sales right now?

$1000 should be across the board for everyone

This would include juniors lemonade stand

I’m not sharing the sentiment on giving just kids a break on this. If kids want to earn and prepare for life then, they should learn about taxes and insurances that go with running a business.

Anyone that dabbles in less than $1000

Should be exempt, or did I read this incorrectly?

T, you’re reading it right: the Dennert lemonade exemption applies only to vendors under age 18 with less than $1000 in annual sales. And as I read HB 1204 again, a couple of complications strike me:

(1) When Junior hits his thousandth dollar, Junior has to go back and pay sales tax on the whole $1,000. Junior would thus have to send the state $45, leaving him with a net $955. Meanwhile, Janey down the street who hustled a little less and made only $990, pays no tax, leaving her with a bigger net than slightly harder working Junior. If Junior pays attention to the law and the math, he faces a hard choice: slack off at $999 or push to sell $1,047.13, at which point 4.5% tax brings up back to $1,000 net? If summer is yet young, Junior keeps selling lemonade, but if Brown County Fair is done and school’s just a couple days away, Junior may decide a final push to break even past sales tax isn’t worth it.

(2) What happens if Janey turns 18 on July 1? Suppose she makes $800 in June and $400 in July. How much sales tax does Janey owe the state?

Spender? In testimony to Senate Taxation on Feb. 27, Rep. Dennert said that Revenue told him his bill will have insignificant impact on state revenues.

Rep. Dennert also told Senate Taxation that his younger siblings sold pumpkins last year and never got a notice from Revenue. He said they told him they wouldn’t have sold pumpkins if they’d had to collect sales tax… which makes me think about another aspect of what T said: sales taxes shouldn’t deter young people from engaging in business any more than income taxes deter kids from engaging in work for pay.

Did the young Dennerts include their pumpkin sales revenue on their parents’ income tax returns?

Aberdeen teen Kira Goldade told the committee young entrepreneuers shouldn’t be penalized for trying out business… but taxation isn’t a penalty; taxation is the fair price we all pay for participating in society. As T suggests, shouldn’t young people learn all the aspects of participating in business and public life?

Listen to Dennert and Goldade testify to Senate Taxation Feb 27 here (audio starts at 1h 4m):

http://www.sd.net/blogs/archive/2019/02/27/the-south-dakota-legislature-day-31/

CH

Exactly!

Interesting dialogue! Meanwhile, as always in SD the beat goes on: ADVERTISING continues its freedom to annoy the hell out of us, encourage us to buy what we don’t need, create babies by pregnancies that this government doesn’t wanted ended, entices people to gamble (give) their cheap wages away to the rich in hopes of getting rich–all without adding anything toward the benefit of society, Advertising being taxed @ 4.5 % would allow SD heck-of-a bump in funds.

Maybe when Noem vetoes this bill and Drew has to bring this bill back next year, that’s the trade we can offer: no one under 18 pays tax on anything, but advertisers pick up the slack by accepting the taxation of their brainwave dampers.

Hmm… if we had passed the Dem hijacking of SB 86 to repeal the food tax, would that have spared all the lemonade standers from collecting any sales tax? Or is lemonade a soft drink that would still be taxed?