Maybe one check on our bloated consumerism will be the decrease in homeownership.

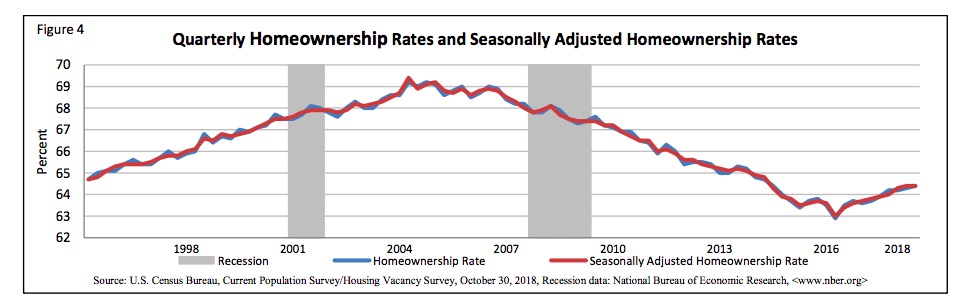

The Census Bureau says homeownership rates have climbed a bit since 2016 but remain well below their 2004 peak of 69%:

Interestingly, homeownership in the United States is notably higher than in Germany and Switzerland and comparable to homeownership in Canada and France but notably lower than in Mexico, Italy, and Spain.

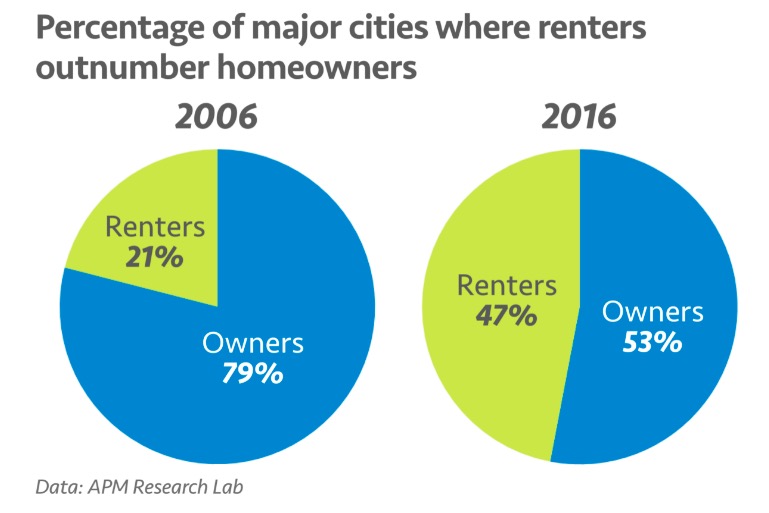

Marketplace this morning noted that the percentage of major cities where renters outnumber homeowners more than doubled from 2006 to 2016:

I like having a permanent place to keep all my stuff. But break out the mock quotes: how “permanent” is any residence when the economy seems to count on our changing jobs (even if not as much as conventional wisdom might suggest)? I owned a house, then moved to four different cities for four different jobs in three and a half years. That first house actually complicated those moves and job searches. Sure, homeownership sends us to Menards to buy more stuff than renting does, but could homeownership add some grit to the economy by tying people down and making harder for them to respond nimbly to market forces and opportunities?

Moving around was one of the factors that led me to buy fewer things. Everything I buy is something I might have to pack someday; why invite that extra hassle? Live light, pack light, and don’t accumulate some massive estate that someone will have to dust and auction off when you’re gone.

I invite your discussion of the merits of homeownership versus renting. How much does happiness in America really depend on owning (or going into debt for thirty years while the banks owns) your own home? Can we be equivalently happy, healthy, and productive if we always pay rent to a landlord?

I’d say the answer is: it depends. Conventional wisdom has held that home ownership is a key driver of wealth creation in America. And that’s true for some, but not everyone. There is a lot of risk.

– Buy a house in a declining neighborhood, and you could end up losing value.

– Fail to maintain the property (which requires ongoing expenses, updates, etc.) and you will lose value.

– Buy in a good market/sell in a bad one and you will lose a lot.

If you move a lot and try to buy/sell frequently, you will lose a lot.

I’d say that home ownership is still a worthwhile investment for many, and can be a wealth driver. It just isn’t for everyone. Policies that encourage home ownership for those whom it isn’t sustainable are bad for the owners, neighborhoods, banks, and the economy, as we saw in the last recession.

There are plenty of other places to invest your money that can provide wealth creation without many of the same inherent risks of real estate, so it’s not like people have to follow one path.

For me, I like the control I have over my investment. I choose the house and neighborhood. I get to increase the value with home improvement, landscaping, property maintenance, etc. It’s like flipping a house in slow motion.

I know nothing about the stock market, so I leave that stuff to others. I have a standard 401k, and that’s enough for me. Home Improvement is a hobby that provides some financial return, if you do it right.

Right now we have young kids, so we don’t have any plans of leaving the neighborhood. That might change when we are empty nesters.

A lifetime ago my spouse and I bought our first house because we could no longer afford to pay rent in the college community where we lived. We had a new baby and a toddler and had been living in a crappy subsidized housing unit while I worked for minimum wage and my spouse attended college. I landed a job at $2.50 per hour (double the minimum wage at the time) and suddenly our massive income increase was too high – we now made too much to qualify for our housing subsidy and got an eviction notice. We looked and looked but rentals were in high demand and cost more than we could afford, even with our new found wealth.

A young real estate agent encouraged us to look for a place to buy, rather than rent and helped us find an older home for sale that needed work. If we could come up with $500 down our monthly combined mortgage, tax and insurance payment would be substantially lower than market rents. Plus, part of these house payments would go toward building equity in the home, rather than just disappear as rent payments do. We got lucky and were able to borrow the $500 from a relative and we became young home owners.

We moved in the place, repaired and improved it when we could, enjoyed having our own little home, and stayed there a couple years until my spouse finished school and it was my turn to go back to college in another state. We moved out and put the house up for rent.

We again got quite lucky. For about two years our first tenants took care of it, paid timely rent that we used to pay the mortgage, insurance and taxes, which helped build more equity. Then our luck began to run out as the second tenants took over, trashed the place and stopped paying rent after a few months.

But by that time we had accumulated enough equity to sell the place as is, pay off the debt, and retain enough money for a down payment on our next home. We repeated the process in a new town with a second home that needed work (one banker wouldn’t give us a loan despite our down payment because he thought the asking price for the house meant it must be “substandard”) while I finished college.

We accumulated even more equity from improvements we made and gradually rising house prices, and when we sold it we had enough for a down payment on our third home in another city.

This was many years ago, but it was the best financial thing that happened to our young family. Plus we were extremely fortunate, as housing prices were gradually increasing and we did not experience any tragedies that could have caused us to lose the place to foreclosure. But we could also have used the money to pay rent all those years and ended up with nothing to show for our investment.

Prices today are incredibly higher, but rent too is awfully high. And interest rates today are relatively low, compared to unsubsidized rates of over 10% in the old days. If someone can afford rent, manage a down payment or qualify for a loan with no or reduced down payment, they should be able to afford the payments for a modest home. And with such low interest rates, a substantial portion of their monthly payment will go toward equity if they don’t buy too big or get in over their head.

From the above experience I would say that buying the house to live in is a smarter use of money than paying rent. Either way, you have to spend a substantial part of your income for housing. Why not build equity and be your own landlord?

grudznick believes in ownership and recommends you buy as many homes as you can. Rent some of them to people who can make your note payments for you then buy office buildings. Buy a couple of fancier houses in different places that you save for yourself. grudznick says “don’t rent, buy.”

A good steady job with a long term commitment, is a requirement for a loan

https://www.amortizationtable.org/mortgage-costs/150000-home/ Add to that about $300 bucks a month for taxes and about $500.00 a month for utilities and insurance. On this $150,000.00 home, you’re looking at north of $ 1,500.00 a month for ownership. Add that to the car payment(s) and you and your’s better have a decent job(s) with no childcare costs and little healthcare benefits costs as well. Home ownership is now a dream that cannot be afforded. With renting, you can pull up stakes and move to where the work is. With ownership, you’re at the mercy of the market, the same market we saw a decade ago, go belly up. After reading FedEx’s outlook report today, maybe a tent would be a smart investment.

It depends on a lot of factors. What type of home are you talking about owning? A condo in the city, which is a lot like what people think of as an apartment, except that you own it? Or a detached home with lawn and garage in suburbia, which didn’t become the “American Dream” type of home until about the 1950s?

It depends upon your personal situation, too. For some people, owning a home is kind of a burden. If you travel a lot for work, you have to make arrangements for lawn care and snow removal in your absence. If you’re older or have a disability, maybe you’re unable to do all the maintenance, lawn care, and snow removal. Or maybe you just don’t want to bother with it, and instead would rather live in an apartment and use the public park when you want green space.

We own a detached, single-family home because it’s right for us in our current situation. However, it’s incorrect to assume that a home in 1950s-style suburbia is right or even desirable for everyone. The important thing is, regardless of where one lives, to have an adequate supply of housing, and if you rent, good landlords and good renter protections.

Our broken cultural nonsense has us living with fewer people in ever larger houses. The waste is breathtaking. Yet, it’s rare for a theft to occur of a house fixed to the land. Unlike what occurred here. https://www.washingtonpost.com/nation/2018/12/20/she-spent-two-years-building-tiny-house-then-thieves-wheeled-it-away-when-she-wasnt-watching/?utm_term=.228a7e56bb4b

Not only is housing getting larger – yet our blatant consumerism is causing a boom to the consumer storage nonsense. Our culture has no self-discipline.

http://best-moving-companies-las37159.blogstival.com/431623/self-storage-how-storage-facilities-for-individual-junk-became-a-56-billion-market

As is often the case, my original post was probably too long and may have obscured my main point: When you are buying a home, your payments are going to a type of savings account – home equity – that can be available to you if you decide to move on or cash in. Many factors, including market conditions and personal circumstances, might devalue this savings account and you could lose everything you put into it.

With rent, your payments are guartanteed to be gone and you are guaranteed to have no equity in anything once you decide to move on. There will never be anything that you can later cash in.

Which is the better choice for an investment (especially an investment that you are pretty much forced to make) – guaranteed loss by paying rent, or a possible return on the investment by making house payments?

BCB … Your posts are almost always the proper length. Well researched, timely, thorough and welcomed. Merry Merry, non-contrary. 😊

For most people a house isn’t a great investment—even though we’ve made it a de facto investment in our country—because of a lack of money to buy a dwelling that will also function as an investment; or having to buy an “investment” that requires a huge influx of money to improve its value; or because everybody has to live someplace, even if there isn’t a suitable dwelling/“investment” for them in that town/neighborhood; or because there’s absolutely no guarantee that your forced “investment” won’t crater in value if the neighborhood or the real estate market go bad.

Granted, being a rentier is usually a good way to make money, while being a renter can feel like throwing away money, but that says more about our housing markets and (lack of) renter protections than it does about the general merits of home ownership.

Porter, Gracias! Felix Navidad para ti y tu famila!

I do enjoy putting pictures and shelves where I want on the walls here. I enjoy the prospect of building a front porch.

But I wonder: if we added up all my time and money I spend maintaining and enhancing its resale value, might I find I could make as much money exerting myself in other money-making ways—overtime at the office, more freelance writing—that would set me up just as well for retirement?

What I see is the $1,000,000 homes and then the fixer-uppers and not much in-between for beginning home owners. Unless you can do home repairs and building yourself, it becomes very costly to own. The other factor in owning is taxes which continue to go up. Other factors play into buying like HOA’s and the cost of utilities. Some rentals offer part-pay for utilities, garbage, sewer and water. It is all where you are at in your stage in life as well. I also believe in “buying” if you can because it is not throwing money out the window however, as I age, I need less and less and less to exist.

Keep in mind that the Great Recession never really ended. The same players are still playing and if you look at the markets, you can see that the roller coaster we are on is still slipping. The fraudulent tax cut just has the few companies still on Wall Street buying up their own shares to make you think this thing is real. It ain’t, and housing is showing problems. Commercial real estate and building due to TIF’s, is going, but the housing end of it is not. Why, more renters and less buyers as Cory notes. We will need those tax dollars that we unwillingly gave these guys when we fall on our arse once again.

If I could have the same results that I have from buying our house when the prices were low, I would do it again. I would not even think about it today.

While all the concerns and dangers described for home buyers are very real, I still haven’t seen anyone directly address the elephant in the room, namely, rent payments that are absolutely, unconditionally, guaranteed to go completely away with no chance to give anything in return other than a temporary opportunity to occupy a building, at the discretion of the landlord on any month to month rental (and at the end of any agreed longer term).

And obviously every person’s situation is different. If the monthly mortgage payments or down payment requirements for buying a house are substantially higher than paying rent, that may be the controlling factor for someone on a tight budget. If maintaining your home will take so much more of your time than complying with your obligations to care for a rental unit, that certainly is another factor, especially if all that extra time cuts into your earning power. Or if you value your free time more than whatever effort it might take to accumulate equity in a home.

Even in such a case you will need to find a responsive landlord actually willing to make needed repairs in a timely manner, if at all. Buying and renting out cheap property while intentionally neglecting repairs has been a money making strategy for some investors for many years. Many tenants simply cannot afford, or do not want to take the trouble, to hold the landlord accountable, hence the profit margin often exceeds the risk.

Down payment requirements make a huge difference. If you have to make a large down payment to buy, then you are gambling whether you will get that investment back if you sell. If you qualify for a subsidized or guaranteed loan with no down payment, however, then you aren’t risking as much.

And your credit will be on the line if you default on the home loan and lose the home to foreclosure. You might be sued for whatever deficiency exists if the house is sold for less than you owe on it. Of course if you fail to pay rent, that too can adversely affect your credit and result in a judgment against you for damages, back rent, and unpaid future rent if you have a long term lease.

Ultimately, buying a home is not risk free and is not for the careless or for those unable or unwilling to protect the investment with careful planning and whatever time is necessary. And you are hoping, at best, for creating equity with your monthly payments and labors.

Unfortunately, renting is also not risk free, and you have no hope of creating equity. Rent payments are simply gone. No equity. No increase in value. You have no security from being evicted or forced to move even if you have always paid rent on time and took excellent care of your unit. Nothing belongs to you. You just pay and pay, month after month.

Given all of the above considerations, I would still say that in most cases a responsible person who can either comfortably afford a reasonable down payment in light of current property value, or who can qualify for low to no down payment, will be better off in the long run financially and emotionally than by paying rent.

https://thelendersnetwork.com/4-no-money-down-payment-mortgages/

I don’t think one should ever buy a house for investment.

Buying a home assumes a certain amount of faith in the stability of one’s life, and a desire to maintain the house. You don’t buy a home if you are likely to move jobs, especially if that might require a move outside of commuting distance. You might now want to buy a house if your job requires a lot of travel. You shouldn’t buy a house if you don’t have time to put into maintaining the house, lawn, etc., or have minimal skills to do simple repair work. If you calculate all the work a house requires, the investment may not pay off, depending on what paid work you might otherwise do in the time it takes to take care of the lawn, for example. If you don’t like the maintenance of a house, or have the money to hire someone to do it, it is not for you.

A down payment and mortgage payments have opportunity costs. That money is no longer available for other investment, and, depending on how it is invested, it may be an appreciable cost.

I’ve known people who buy a house, and figure out a year later that they might have done better to buy a condo, where you can get the benefit of an investment, but not have to do as much maintenance. Others, have owned a house, lost jobs (during the Great Recession), had a failed small business, lost equity value in their home due to falling property values and depressed markets, went through bankruptcy and failed to pay the mortgage after which they, of course, lost their house. They did have free rent until all the equity they had put in was drained out. But they would have been ahead if they had just rented.

When jobs were more stabile and marriage was more stable it made sense to buy a house. As workplace has became volatile, family life has been destabilized and housing size has increased along with the price, it seems home ownership is less the American dream than the American nightmare.

Donald, while I might not agree with your conclusion, I agree that the dangers you describe resulting from buying a home as an investment are real.

Do you agree that the dangers of renting that I described in an earlier post also are real, or do you think I overstated the case? Especially the loss of all rental payments and lack of security in being able to stay in a rental?

And one comment you made is interesting – you seem to suggest that buying a condo might make more sense than buying a house, due to the liklihood that an association will take care of maintence. For what it is worth my argument is consistent with buying a condo. That too seems like an investment rather than merely spending rent for a guaranteed loss of every dollar paid.

What kind of list of companies can you count on to stay with you for a 30 year mortgage? Every day, there are mergers and the grand theft of the equity in the business for the CEO’s and the hedge funds. Nothing for the workers.

Wall Street is a racket, and that racket has ruined many a homeowner time and time again. I think the best surest way to buy a home these days, is one on wheels. If it is just you, think about building your own tiny home.

A friend of mine in Montana just built one of these to live in. https://www.lowes.com/pd/Best-Barns-Common-12-ft-x-24-ft-Interior-Dimensions-11-42-ft-x-23-42-ft-Lakewood-Gambrel-Engineered-Storage-Shed/1000406187?cm_mmc=SCE_PLA_ONLY-_-LumberAndBuildingMaterials-_-SosOutdoorStorage-_-1000406187:Best_Barns&CAWELAID=&kpid=1000406187&CAGPSPN=pla&k_clickID=go_625849125_34614214270_111133222990_pla-263592203692_c_9020641&gclid=EAIaIQobChMIv8bd3dax3wIVxrrACh0dKgzOEAQYAiABEgLCnvD_BwE

He did his own work and did the interior with salvaged wood and lumber. As a homeowner, he did his own plumbing and electrical. As owned his land, he was able to get the whole thing done for well under $20,000.00. Now that is the way to buy a brand new home with upgraded windows and an exterior that never needs a shingle or a paint brush.

I don’t want to make any false assumptions, or ageist assumptions, but I think that younger generations are increasingly unable to perform simple home repair/maintenance/improvement.

I’m not as good as my dad is at carpentry, wiring, plumbing, mechanical repair. But whenever I have a project like that, I bring him over and I learn a little more. I don’t get the same reaction or desire to learn those things from my son. Maybe it’s my fault for not trying harder to teach him, but I feel like there is just less interest in general in that kind of thing from younger kids.

It takes time and experience to learn how to use tools safely and effectively. Power tools can be very dangerous in inexperienced hands. I fear that he will either hurt himself one day, or become reliant on paying contractors for every little repair. That costs money, and we aren’t rich enough to throw money at things we can do ourselves.

I hope I am wrong. Maybe homes in the future will accommodate Americans’ lack of maintenance skill. Maybe home repair will go the way of driving a stick shift, or changing your own oil, home car repair, etc. Homes might be so technologically advanced, non-technicians won’t be able to repair anything anyway. Like cars and combines are now.

TAG, I’m certainly less capable of home repair than my dad, who can build a house from scratch, soup to nuts, basement to roof to electrical to plumbing. Dang, now which should Interim Education Secretary Jones promote more, civics or carpentry?

Renting: guaranteed loss; buying: possible gain—BCB’s analysis there is hard to refute. You gotta live somewhere, you gotta spend X for that place; why not take a chance on getting some of that X back?

The problem is that, here in the house I “own”, I’m paying X for the house but also Y and Z to the bank for interest and mortgage insurance, and I’ll never see Y and Z again.

Cory’s X (rent or Xr) versus X (mortgage or Xm) +Y+Z analysis has merit. If Xm+Y+Z is substantially > Xr, that would be a key factor in deciding whether buying makes sense, since as with Xr, Y and Z are never recoverable, and Xm+Y+Z may add up to more than Xr and make the purchase unaffordable.

Likewise, if Xm+Y+Z substantially = Xr (which was our personal experience), then buying offers a potentially better financial outcome.

Indeed, I still have not seen an argument (omitting very unusual circumstances) that justifies giving up any chance to recover all of Xr versus the possiblity of recovering some of Xm. For example, the desired flexibility to move for a better job seems a weak reason as a house or condo easily and quickly can be offered for rent or sale, and many of the better rental deals require a lease for a year or more anyway. Likewise, the desire to avoid regular home maintenance is not feasible in many rental circumstances – a landlord is only obligated to do so much, and many, if not most, landlord obligations can be extinguished by a typical standard adhesion lease agreement.

Ultimately, my argument is that there is a stong, albeit rebuttable, presumption that purchasing a place to live is financially (and emotionally) preferable to renting a place to live, especially for young singles and families.

Gee, Cory’s analysis and my response almost sounds like algebra. Next thing you know we will be looking to quantum mechanics for the answer – core theory here we come!

I have no reliable variable for the emotional side, BCB. When I moved from Lake Herman, I killed off that variable in my personal calculus and accepted that I couldn’t build my sense of place on real estate.

Sorry to hear that – what happened in and after Lake Herman?

We left our 1st 2 home purchases behind with no emotional connections other than some pleasant memories of a temporary “sense of place” when we pass through each old town and drive by the old places (meanwhile, our main rental home was demolished long ago). We have been in home #3 for decades now, so that “sense of place” still exists.

My grandparents bought a home in the early 1930’s in Spearfish that is still occupied by family members long after their passing. My grandmother had an annual X-mas family get together at the place and the current owner, my aunt, has continued the tradition. As she enters her sunset years she plans to transfer ownership to her daughter and a niece that have agreed to continue that family get together for the indefinite future. I don’t know how many years after she passes that it will continue, as I expect to be also long gone, but it provides an example of a “sense of place” that was built on that foundation of real estate hace muchos años.

bcb,I forbid you to be long gone. Your voice and wisdom is needed here now and in the forever future. You are stuck with us whether you like the idea or not. Leave us not have to speak of this again, okay? :)

mfi, Well that won’t be a problem as we never really go away, we just change forms.

(click BCB’s link here!)

Or as someone else put it, “while we can destroy the complex energy structure we are always left with the pieces that made up the “thing”. It is like emptying a jar of marbles on the floor.”

So maybe I’ll just lose my marbles, but I’ll still be here! Happy holidays mfi!

Happy holidays, bcb, to you and yours.

The Lake Herman community ripped out the core Mr. H’s heart, and squished his heart down to the size of a beating peanut, like a grinch, and made him forever forswear becoming part of a community like that again, is what I am told by others. And grudznick, being another grinch, still wishes Mr. H and all of you the happiest and most belly-filling holiday season you can afford.

BCB, I’d invested a lot of my youthful self-image in being tied to Lake Herman. Then professional interests intervened. It wasn’t awful—it’s just that when I took the job teaching French in Spearfish, I headed out there worried I’d suffer some great existential crisis being separated from my lake. Instead, I woke up my first morning there, hit the blog, had the same conversations as usual, and realized pretty quickly my sense of community could evolve and had already evolved to a broader geographical realm than would ever be covered by any one plot of land I might own within it.

Sense of place: anyone here read Chuck Woodard, or have him as an English prof as SDSU? He got me thinking hard about sense of place once upon a time… before the Internet brought up crazy questions about community transcending geography.