We South Dakotans aren’t buying enough stuff to keep our state budget afloat. So says the Legislative Research Council’s latest report on general fund receipts:

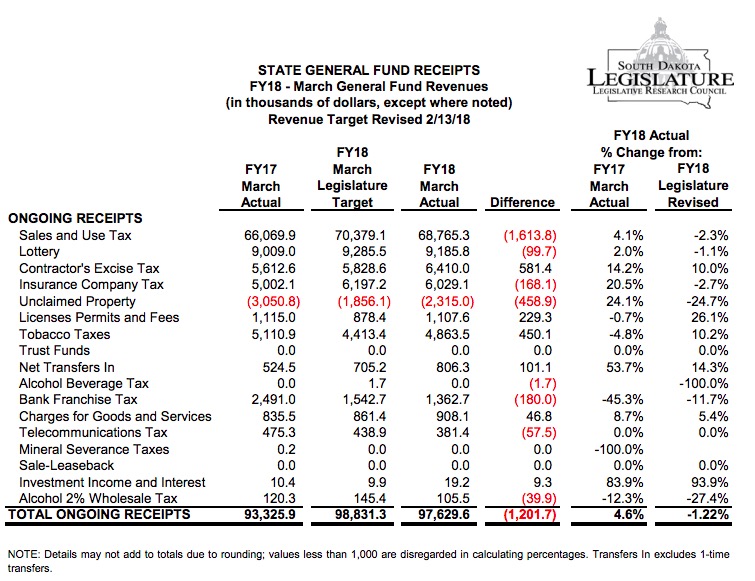

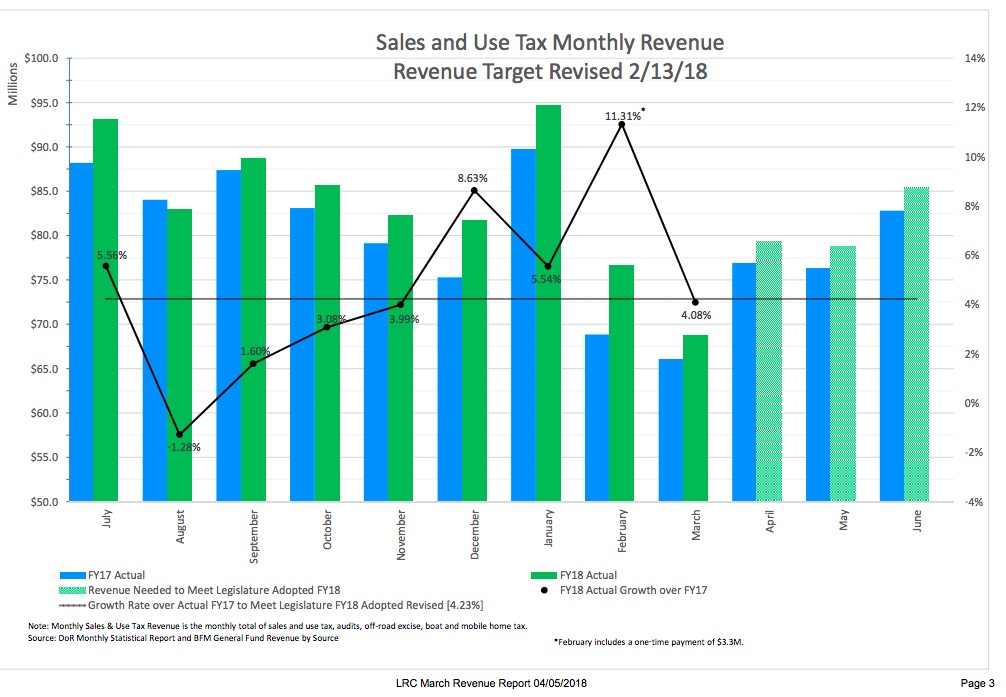

State general fund receipts in March fell $1.2 million short of the revenue target that the Legislature revised in February. The shortfall was largely due to the state collecting “only” $68.8 million in sales and use tax in March. That’s 4.1% better than sales and use tax collected in March 2017 but 2.3% below what the Legislative was hoping for.

We had a stronger February, collecting $1.9 million more than the revised target, but that was only because a one-time payment of $3.3 million kept our heads above water.

For Fiscal Year 2018 to date, we’re up 3.0% from the first three quarters of FY 2017, but we’re still short of the revised revenue target by 0.14%, or $1.7 million. We can make that up by selling 10.5 million Big Macs—that’s one extra Big Mac a week for the next twelve weeks for each South Dakotan. Come on, team—yes, we can!

March’s numbers aren’t all that bad: that 4.1% growth rate over March 2017 is just about the rate we need to post in the remaining three months of this fiscal year to pay our bills.

Here are the five states with the lowest teacher pay, according to U.S. Department of Education data from the 2016-17 school year. All are below the national average pay of $58,951.

Colorado: $46,506

West Virginia: $45,701

Oklahoma: $45,245

Mississippi: $42,925

South Dakota: $42,668

You win again, South Dakota. Better raise taxes or teachers will walk….hopefully for better pay.

There’s a simple cure for what ails SD’s budget, a fair progressive tax system. Which is exactly what the SDGOP does not want.