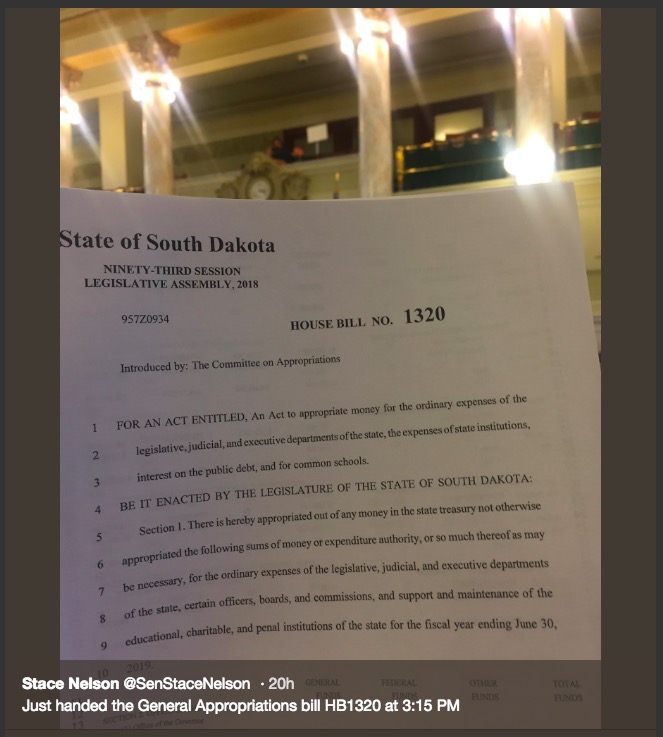

Heading into the final day of the 2018 Session, the Legislature had dealt with 534 bills. They suspended the rules yesterday to add one more bill, the most important bill: the budget.

House Bill 1320 appropriates $4.69 billion to conduct the various affairs of the State of South Dakota. 36.0% of that money comes from the federal government, 34.9% from the state general fund, and 29.1% from other fees and receipts.

The Legislature approved spending $32.7 million more than Governor Dennis Daugaard asked but still $1.3 million less than all state departments asked for.

House Bill 1044 adjusts the FY2018 budget upward by, according to my morning spreadsheeting, $35.5 million. I may have missed something, but hey, I’ve looked at these numbers longer than legislators not on Joint Appropriations did before they voted for them.

So using those figures, let’s see how the eight budgets enacted under Governor Dennis Daugaard have grown:

| Budget | General | Federal | Other | Total | annual change |

| FY2011 | $1,145,136,264 | $1,678,698,764 | $920,260,624 | $3,744,095,652 | |

| FY2012 | $1,146,794,851 | $1,499,882,570 | $954,585,373 | $3,601,262,794 | -3.81% |

| FY2013 | $1,221,722,313 | $1,452,121,871 | $1,018,744,079 | $3,692,588,263 | 2.54% |

| FY2014 | $1,285,901,715 | $1,396,106,343 | $1,039,767,205 | $3,721,775,263 | 0.79% |

| FY2015 | $1,360,860,291 | $1,347,807,566 | $1,142,967,124 | $3,851,634,981 | 3.49% |

| FY2016 | $1,406,363,358 | $1,365,281,645 | $1,221,694,108 | $3,993,339,111 | 3.68% |

| FY2017 | $1,554,021,368 | $1,651,067,371 | $1,377,780,256 | $4,582,868,995 | 14.76% |

| FY2018 | $1,585,113,625 | $1,630,562,445 | $1,333,796,323 | $4,549,472,393 | |

| FY2018 adj | $1,591,226,544 | $1,640,093,227 | $1,353,690,694 | $4,585,010,465 | 0.05% |

| FY2019 req | $1,640,495,298 | $1,687,254,148 | $1,361,542,845 | $4,689,292,291 | |

| FY2019 gov | $1,615,672,243 | $1,681,171,355 | $1,358,479,949 | $4,655,323,547 | |

| FY2019 en | $1,633,828,342 | $1,687,947,992 | $1,366,203,561 | $4,687,979,895 | 2.25% |

| average annual change | 4.54% | 0.07% | 5.06% | 2.85% | 2.25% |

The final budget Governor Daugaard will sign is 25.2% larger than the last budget Governor M. Michael Rounds signed eight years ago as the state spent the remaining stimulus dollars with which President Barack Obama hauled the nation out of the Recession. The negative growth in Daugaard’s first budget year was due entirely to the post-stimulus 10.7% decrease in federal funds to the state in FY2012.

Each year under Daugaard, the total state budget increased at an annual average rate of 2.85%. Federal funding dipped significantly through Daugaard’s first term; federal cash has bounced back but still hasn’t matched the FY2010 stimulus peak of $1.72 billion. Daugaard has approved a general fund that grew 4.54% each year and other funds that grew at 5.06% each year.

Dennis Daugaard’s final budget signature will authorize over a billion dollars more in spending than his first one did.

Cory writes:

And financial supporters of South Dakota’s Christian schools are suffering under the strain of trying to pay teacher salaries competitive with the increased teacher salaries in the government schools, which they also pay for through higher taxes.

But at least Governor Daugaard’s office recommended a return to the original language of HB 1286, which he’d better sign because our attorney and his wife are going on a well-earned ten-day vacation.

(https://www.argusleader.com/story/news/politics/2018/03/08/lawmakers-restore-ballot-access-bill-third-parties/407590002/)

The majority of SD’s $ comes from the Washington swamp? There’s that SDGOP rugged individualism, pull yourself up by your bootstraps, personal responsibility mantra.

Not the majority, Debbo, just that 36%. “Other” funds come from park stickers, user fees, and other in-state sources.

Kurt, our Christian schools can’t blame the state for their woes. They can blame the same market forces that force the public school system to raise its pay to attract top talent. Their taxes not only pay public school teacher salaries but sustain universal education for everyone’s benefit, including their own.

Christian school parents have an easy way to save money: stop paying private school tuition and send their kids to public school. Choices have consequences.

I should have said D.C. is the single largest source. Am I reading that correctly?

“Largest single source”? Yes, that’s the accurate language we’re looking for, Debbo. Uncle Sam funds more of South Dakota government than any other single source of revenue.

I’d written:

Cory writes:

When the state forces Christians to pay ever more exorbitant taxes for the support of atheistic government schools we oppose, the state dramatically distorts market forces in a way that favors atheism and disfavors Christianity.

Government “education” has now indoctrinated two full generations of Americans into believing the Bible isn’t true and the earth is billions of years old. You’re an atheist, so you regard that as “everyone’s benefit”; I’m a Christian, so I regard it as everyone’s great harm.

https://biblicalscienceinstitute.com/origins/creation-101-radiometric-dating-and-the-age-of-the-earth/

I have no inherent right to educate the children of atheists, and you have no inherent right to educate the children of Christians.

And many do, but it’s a moral abomination that the government uses financial coercion to restrict parents’ freedom to educate their children in the way they’d prefer.

Yes, that’s my point, and it’s especially true of choices the government forces on hundreds of thousands of taxpayers.

Thanks for helping me get that right Cory. Speaks poorly for the professed independence of the SDGOP and their disparagement of DC.

Kurt, education is a vital public function that cannot be left to the whims of market forces, which will not support democracy. We have an obligation to educate every child for citizenship. The free market will not serve every child, or every child equally.

Government education does indoctrinate anyone into denying Christianity. I have never included “God does not exist” in any lesson plan, text, or test as a fact or learning objective.

The government requires everyone—not just Christians, but everyone—to pay taxes to support a universal public education system to support democracy. Is it possible to oppose government schools without opposing the necessary democratic function those government schools uniquely serve?

Or, to reword that last question, what do you Christians want, madrassas?

Debbo, yes, as has been the case throughout our state’s history, Republicans practice the opposite of their preaching.

Cory had written:

I’d replied:

Cory writes:

Market forces will continue to support democracy as they always have.

Neither will atheistic government schools.

In the tenth chapter of Mark, Christ refers to the first chapter of Genesis when He says that “from the beginning of creation God made them male and female.” If God had made humans male and female billions or millions of years after the beginning of creation, that would mean either that Christ was wrong or that we have no accurate record of what Christ taught. In either case, claiming to be a Christian wouldn’t make much sense.

Of course it is. If children started school at six months old and their teachers gave them walking lessons, within a single generation people would probably come to believe that humans couldn’t learn to walk without going to school. There’s no function government schools “uniquely serve” that couldn’t be served in some other way.

I’m not sure what Muslim schools have to do with your last question, but Christians generally—and I specifically—want Muslim parents to have the freedom to educate their children in the way they’d prefer.

“Market forces will continue to support democracy as they always have.”

Don’t businesses more often than not resist democratic action within their workspaces?

Did market forces bring us Trump… and if so, is that a counterexample to Kurt’s claim?