Nicely done, Legislature! Yesterday the Senate cast the final unanimous vote for House Bill 1003, which corrects the Legislature’s omission of businesses and unions (“entities”, in South Dakota campaign finance parlance) from the list of donors candidates must itemize in their campaign finance reports. With not a vote against HB 1003 and no amendments, the Legislature can now send that bill to the Governor for a quick signature and immediate enactment.

But HB 1003 isn’t law yet, and today is the deadline for statewide candidates and ballot question committees to submit their 2017 year-end reports. So technically, any committee that wants to keep its corporate and union donors secret can legally do so.

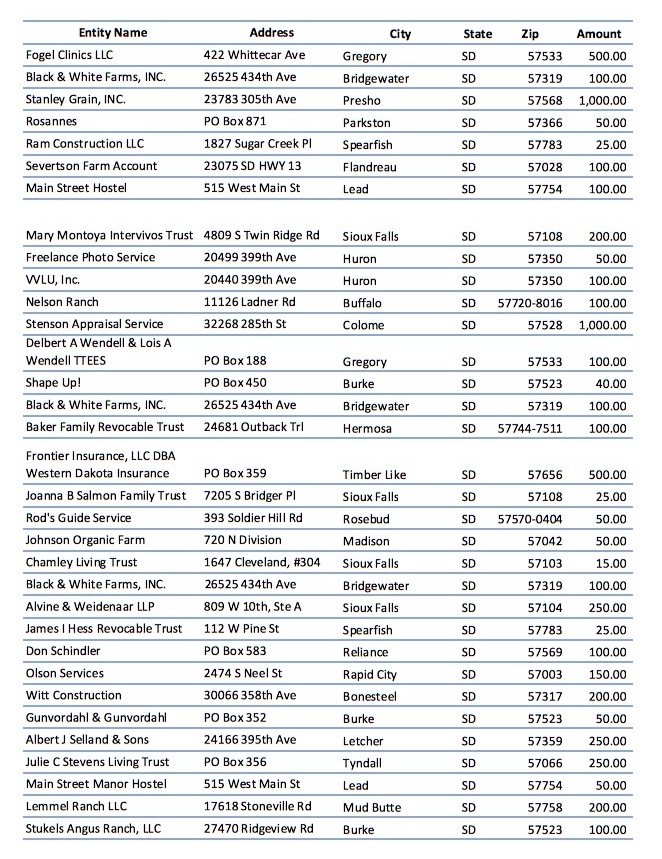

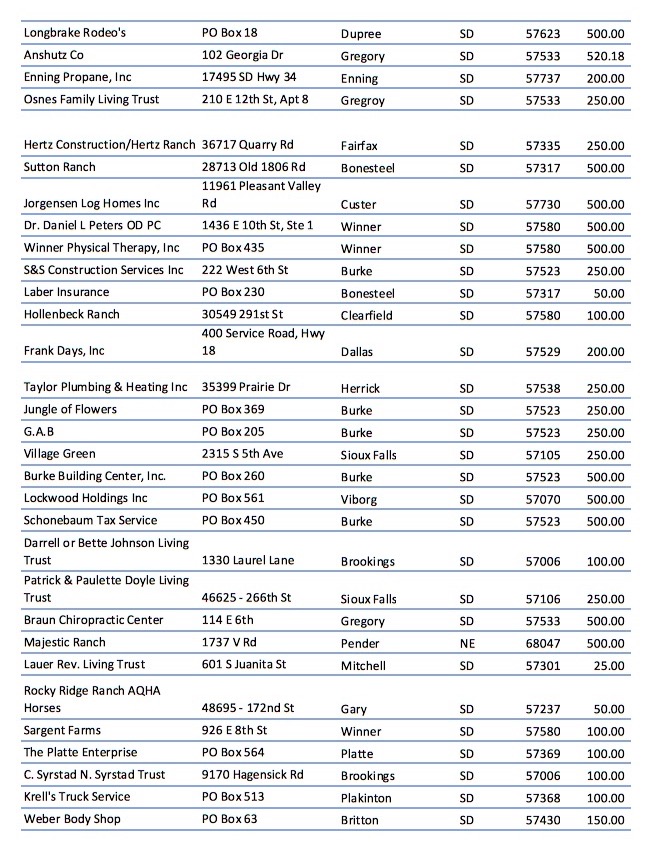

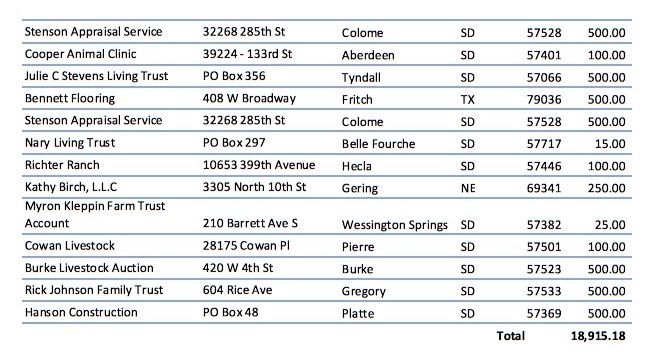

Senator Billie Sutton chose not to avail himself of this fun, fleeting loophole. His year-end supplement, submitted Monday morning, four days before today’s deadline, itemizes $18,915.18 in donations from businesses and trusts:

That’s 2.2% of the Sutton campaign’s total $829K income in 2017. The biggest single corporate donors are Stanley Grain of Presho and Stenson Appraisal of Colome, each kicking in $1,000.

The Platte Enterprise chipped in $100. I guess Sutton’s Republican opponents can take that as one more sign of the vast liberal media conspiring against Trumpism.

Sutton didn’t have to list any of those donors. Kristi Noem and Marty Jackley don’t have to, unless Governor Daugaard signs HB 1003 before they get their reports in today… and as of this morning’s check, neither Kristi nor Marty have filed.