Speaking of the South Dakota Retirement System, the state pension program’s FY2016 financial report breaks down beneficiaries by county:

Statewide, 2.61% of South Dakota residents received SDRS benefits in FY2016. In 13 counties (Brookings, Campbell, Sully, Fall River, Bon Homme, Clay, Potter, Faulk, Hyde, Aurora, Spink, Stanley, and Hughes), SDRS beneficiaries make up more than 4% of the population. 6.65% of Stanley County residents and 7.55% of Hughes County residents draw state pension.

SDRS paid out $19,500 per beneficiary in FY2016. Spread that money out across the total population (and those retirees do, buying groceries, lumber, etc.), and pension checks added $509 per South Dakotan to the economy. That per-capita impact is far lower in reservation counties ($202 in Dewey, $22 in Oglala Lakota, $15 in Buffalo). Per-capita SDRS impact is also notably low in Lincoln County, only $114. SDRS beneficiaries make up only 0.69% of Lincoln County’s population. Those two numbers indicate that state/public employees don’t make up a large portion of the Lincoln County workforce to start with and don’t pick Lincoln County as their retirement destination.

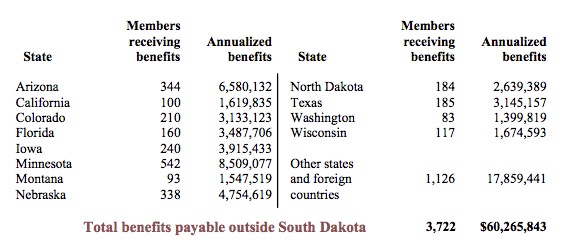

14% of SDRS beneficiaries live out of state and collect 12% of SDRS benefits:

Of all states where SDRS beneficiaries can move, the largest number choose to pay state income tax on their hard-earned benefits to Minnesota. The next four biggest states for SDRS beneficiaries also tax income.

Just throwing out a hypothesis, Lincoln County is a rapidly growing county and as such its population skews younger and has yet to reach retirement age.

According to the site linked below; Lincoln County has the 6th highest cost of living (by county) in the state. The 5 highest cost of living counties are:

1. Clay

2. Pennington

3. Custer

4. Meade

5. Lawrence

https://www.niche.com/places-to-live/rankings/counties/cost-of-living/s/south-dakota/

@cah: “Spread that money out across the total population (and those retirees do, buying groceries, lumber, etc.), and pension checks added $509 per South Dakotan to the economy.”

Nope. You are looking at only one side of the equation. You forget to factor in that public pensions are funded by taxes which weren’t spent in the economy because they were put into the pension funds. Pensions are just a form of compensation but deferred. Instead if those same dollars had been paid to the employees increasing their pay each month, the employee would have had a higher income and would have spent a portion of that income adding to the local economy at that time. Actually the net gain to the economy is probably closer to zero.

Coyote droppings, Don. SDRS is not funded by taxes. Read the FY2018 Budget: in normal years, more money comes from investment income than from employee/employer contributions. Nothing from the general fund goes into SDRS. The state has invested SDRS money about as smartly as anyone else in the state, meaning they’ve squeezed a great return on that money. Snap your fingers, make SDRS and all that investment income disappear, and communities with SDRS recipients see less money in their local economies.

Turn those SDRS contributions back to paychecks? Funny—do you have something against savings, Coyote, particularly savings that outperform Social Security and lessen the burden on public assistance programs? End SDRS, try boosting paychecks, and you get less effective individual savings (the state does not raid SDRS savings for budget emergencies; individuals will), less economic impact over time (returns on SDRS investments beat the returns on lesser amounts spent by consumers over time), and then a generation of state employees who have less to spend when they are older. You’ll also have fewer quality state employees, as job applicants will look at SD and say, “Where’d that great pension system go? Screw that—I’m going to Minnesota!”

But by all means, Coyote, come to District 3, recruit a Republican to run against me, and get that Republican to campaign on eliminating SDRS. Please.

Then the National Institute for Retirement Security (which advocates for public employee pensions) must be full of it when it states:

“This study measures the gross economic impacts of pension benefit expenditures only, rather than the net economic impacts. Pension payments are a form of deferred compensation, meaning that employees and employers contribute to the pension trust over the course of an employee’s career as a portion of the employee’s total compensation. Had that employee received that compensation in another form—for example, a slight increase in gross pay each month—s/he would have seen higher disposable income, and presumably would have spent a portion of that income in the local economy at that time.”

NIRS isn’t full of it; you’re not addressing the real issue. Sure: if I take a higher paycheck instead of having some cash set aside for retirement, I have more money in my pocket right now to spend. NIRS is not saying that such immediate spending adds up to better local economic impact than deferred compensation and spending that gets multiplied by SDRS’s really good investment decisions.

NIRS draws this conclusion from the study to which you appear to refer:

The limitations of their own study don’t stop NIRS from offering the same conclusion I do, that SDRS benefits and similar pension programs offer valuable economic support to local economies and to retirees, with no indication that everyone would be better off with fatter paychecks and no savings.

I can spend an extra X bucks a day downtown right now for 30 years, or I can save up and have an extra Y bucks a day to spend downtown during the 20 (10? 30?) years of my retirement. I contend that 20Y later will do more net good than 30X now… and the state and tens of thousands of SDRS members who leave their money in SDRS instead of cashing it out each year appear to agree. Nothing you cite from NIRS appears to refute that.

But again, I invite you to offer me up an opponent in the 2018 Legislative contest who advocates cashing out and shutting down SDRS.