Last updated on 2018-09-30

Senate Bill 141, the unnecessarily beleaguered update of our child support laws, finally passed Senate Judiciary yesterday. Prime sponsor and Child Support Commission member Senator Arthur Rusch (R-17/Yankton) brought an amendment that decreased the increases in child support obligations for a fair swath of income brackets.

The amended formula keeps the significant breaks for parents making less than $1,050 in joint net monthly income. The amended formula keeps the new increasing scale of obligations for parents netting between $20,000 and $30,000 monthly. The amendment keeps the important change to the definition of primary full-time income that removes some confusion and subjectivity and makes clear that teaching is a full-time job.

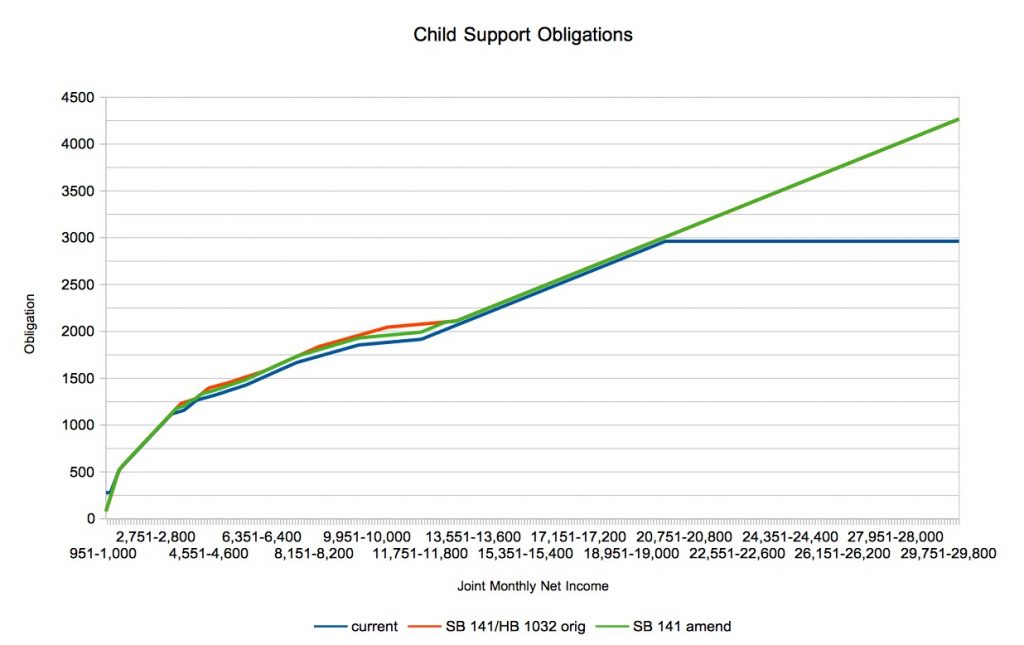

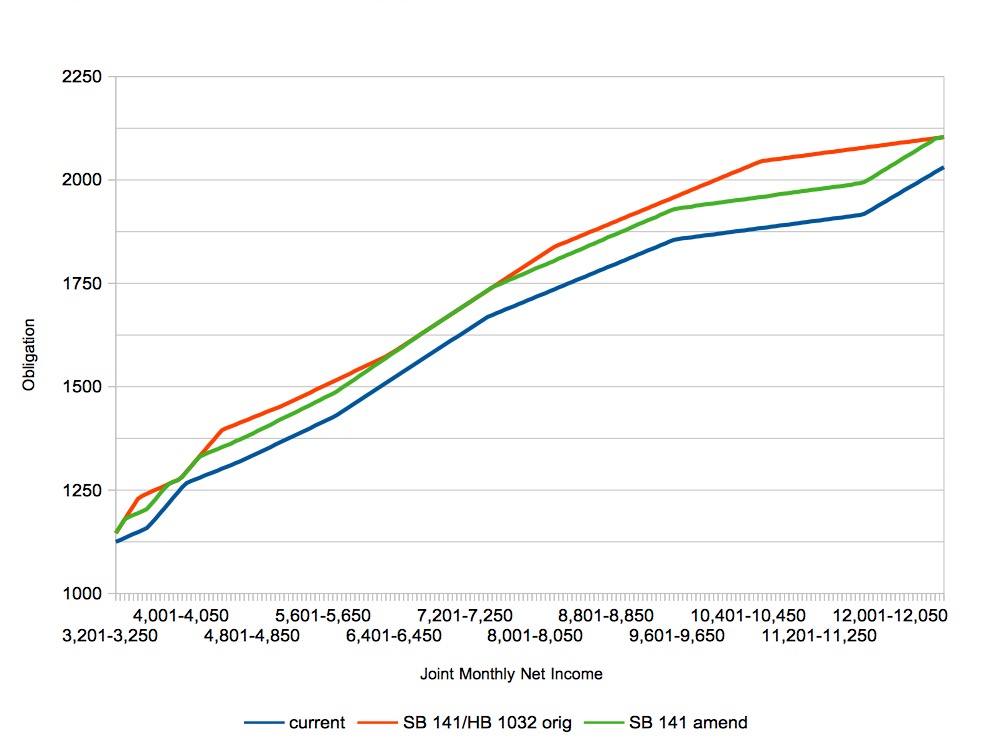

The big change comes in the new formula’s smoothing out of a couple of bubbles in three monthly income ranges: $3,351 to $3,800, $4,151 to $7,100, and $7,451 to $12,500. As you can see in the charts below, everybody in those ranges will still have higher child support obligations upon passage of SB 141 (the green amendment line is above the blue status quo line), but not as high as prior to the amendment (the green line is below the red original SB 141 line).

Basically, the Rusch amendment grinds down those increase bubbles to 4%.

Recall that since we last updated the child support formula in July 2009, the Consumer Price Index has risen 10.73%. Neither the original formula in SB 141 nor yesterday’s amendment imposed that big of an increase on any parent pairs making less than $22,151 per month ($265,812 per year). For parents of two children, the original formula imposed an average increase of 3.13% on parents making $20K or less per month and 22.90% on parents making more. Yesterday’s amendment still soaks that upper bracket, but the average increase on parents supporting two kids on $20K or less per month (the vast majority of parents) is now 2.17%.

Under the original SB 141 formula, 13.44% of parents netting $20K per month or less saw their child support obligations increase 7% or more. Now the only parents in that income range who see increases greater than 4% are parents supporting six kids on $15,401 to $15,450 a month… and their anomalous 10.9% increase arises from a typo in the current statutory formula (LRC typed “3,360” instead of “3,630”).

Senator Rusch included an automatic cost-of-living adjustment to the obligation formula in his amendment has compensation for the fact that the immediate increases created by SB 141 are lower than inflation over the eight years since our last adjustment. Senator Kris Langer (R-25/Dell Rapids) expressed concern that wages might not keep up with the cost of living and moved to strike that automatic annual increase. That amendment passed (4–2: Langer, Netherton, Kennedy, and Russell aye; Greenfield and Rusch nay).

Senate Judiciary then passed SB 141 as amended (5–1, only Netherton nay; Nelson excused). The child support update thus heads to the full Senate with two days to spare before the crossover deadline Thursday.

Senator Arthur Rusch (R-17/Yankton) ignores the “elephant”. A bill/law to increase surveillance of parents who work under the table to avoid child support is what would level the field for recipient parents.

I have to disagree about this bill. It WILL hurt poorer women. If you do not believe that there are parents who work 2 or more part-time jobs ON PURPOSE, then you should spend time with family attorneys in smaller communities. If John Doe’s works full time for min. wage at WalMart or Burger King, but has a 2nd part-time job at a much higher hourly wage, he is probably making more at the second job. I did the calculations and most women (who are usually the caretakers) and who need child care will have to take a second job even after child support and their first job, just to NOT lose money under this bill.

So Caitlin, is there a way to split the difference, avoid gamesplaying in the designation of primary and secondary employment, but still preserve the legal status of teaching and other irregularly scheduled work as full-time? Could a child support referee read “primary employment” to mean “the job at which the parent makes the most income” and thus deny the gaming?

@CAH Why isn’t a contributing parent’s support payment to a custodial parent based on net monthly income not primary job income or secondary job income? Custodial support should be based on the entire package of income. That’s how you avoid gamesplaying and give a child what’s due.

Also, in CO if the noncustodial parent’s monthly gross income is between $900 and $1,900 s/he may be eligible for a low-income adjustment to the amount of child support paid.

Whatever happened to family values?

Cory, your suggestion would be a good start. Unfortunately, the whole Child Support review committee has been anti-woman for some time. I experienced this during one of their tours through the state. The problem is that we really need LESS anecdotal stories and MORE actual

fact-based decision-making. Whether people like it or think it is a good idea, it is mostly women who are the primary care-takers. This is not to say that there are no good fathers who are actively involved with their children. There are. But actual controlled and science-based surveying of primary caretakers who receive child support and parents paying child support would quickly identify the actual problems that exist for parents.

I’m all about data, Caitlin.

I do need to note that it’s fascinating that you tell me the Child Support Commission is anti-woman, while Rep. Pischke and the angry dads say Cutler and the Commission are anti-man.

Porter does ask a good question: why do we count only primary income and not net income from all work? Why don’t we just ask each parent to show us Line 37 or Line 43 from their 1040s and do our calculations from there? Do we exclude any other income along with secondary jobs from the child support calculation?