The Augustana Research Institute (picture two Lutherans with a graphing calculator) has issued a weighty report on affordable housing in Sioux Falls. The report brims with concept maps showing the messy web of services meant to help low-income people put roofs over their heads. ARI concludes that complexity and redundancy of services create inefficiencies that favor the big guys in housing:

In development, complexity and competition have resulted in a system where scale wins (e.g., two major developers build tax credit properties because regulatory requirements are too burdensome for others). Faced with limited resources, developers cannot afford to cash flow sufficient units for families at the lowest income levels. Instead, new construction caters to higher income levels and reduces costs by buying property on the outskirts of town, where it is less accessible to low income families. In short, housing development is driven by financing constraints more than client needs [Suzanne Smith and Susan Bunger, Sioux Falls Affordable Housing Needs Assessment 2016, Augustana Research Institute, January 2017, p. 5].

As a primary solution, ARI advocates coordination among all actors in affordable housing: the city, state, non-profits, and developers.

But remember: collectivism is a response to market failure. Even amidst 2.3% unemployment, Sioux Falls employers are failing to provide their scarce workers with the wages they need to support the renovation and construction of decent cheap houses. Since our captains of industry and bumper-car owners are being stingy, we have to run around drawing cooperation lines on concept maps and pouring tax incentives and federal grants into housing efforts.

The market isn’t failing for everyone. ARI finds the middle class is draining upwards as well as downwards:

Overall, median income in Sioux Falls has remained steady since 2010, but this apparent stability masks change in the distribution of income. Since 2010, Sioux Falls has seen an increase in the number of highincome households ($100,000 or more) and low-income households ($25,000 or less). At the same time, the number of moderate-income households has been static. Over the next five years, Sioux Falls is projected to lose 1,900 moderate-income households with incomes between $35,000 and $75,000, dropping the proportion of the population in this income range from 35% to less than 30%. In both the city of Sioux Falls and the MSA, there is a pattern of income polarization; the area is adding households with higher incomes and lower incomes but losing households in the moderate income ranges [Smith and Bunger, p. 11].

I don’t mind folks getting rich, but they aren’t building houses that will ever resell to folks working their way up from starting wages to middle income. A smaller middle class means fewer modest but nicely kept homes in walkable neighborhoods.

Treading sensitive family-values ground, the report does make the point that whatever the bosses may pay, an important step toward affordable housing for families is having two people around to support the kids:

Children living with single parents are more likely to experience poverty and insecure housing. In Sioux Falls, 12,865 (63%) of households with children are headed by a married couple, while 7,606 (37%) are headed by a single adult. Of families below the poverty level, more than 72% were female-headed with no spouse present. Median income for married couple families with children is $83,198 compared to $25,938 for families headed by single mothers and $39,569 for those headed by single fathers [Smith and Bunger, p. 12].

It’s a lot easier to get and keep a job and put in lots of hours if you have a partner in chasing the kids around.

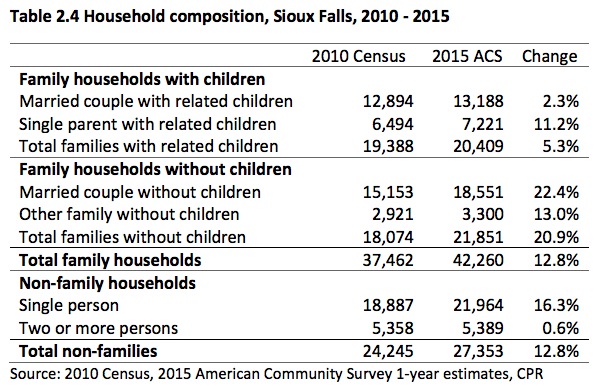

But for an increasing number of households, kids aren’t a concern. From 2010 to 2015, the number of family households without children grew four times faster than the number of family households with children. The number of single-person households grew three times faster than family-child households. There are now more households without kids than with in Sioux Falls.

Growth among the 55-and-older set has outpaced growth among younger folks. ARI predicts that over the next five years, aging-boomer in-migration will stay steady while shifting older, but growth in young folks will catch up:

If the market works, workers will bring skills and sweat, employers will pay living wages for skills and sweat, and everyone will have a decent place to live. If the market doesn’t work, we’re going to have thousands more Sioux Fallsians relying on complicated public-private sector collaboration to subsidize that market failure.

Pew has some similar work looking at the nation.

The hollowing of the middle class is biased towards upward mobility:

From 1971 – 2014:

The middle class shrank from 61% of households to 50% (-11%)

The lower class grew from 25% to 29% (+4%)

The upper class grew from 14% to 21% (+7%)

So while I’d rather see the lower class shrinking, the silver lining is more people are moving up into the upper class than are losing ground and sliding into the lower class.

But let’s also remember these are snapshots in time. A household may start middle class, lose an income and wind up lower class for a year or two, then get back into the middle class. Then mamma gets a promotion and winds up in upper class. Whether and how long they stay there is worth studying, too.

@cah: “collectivism is a response to market failure. Even amidst 2.3% unemployment, Sioux Falls employers are failing to provide their scarce workers with the wages they need to support the renovation and construction of decent cheap houses.”

Market failure? Hardly. The Sioux Falls housing market hasn’t failed. It’s operating under the Laws of Supply and Demand whereby housing costs are rising due to increasing demand because of population growth. Much of the “cheap” housing in Sioux Falls is disappearing due to 1) the very renovations and reconditioning you are demanding that Sioux Falls employers pay for with higher wages and 2) the purchase and demolition of entire neighborhoods of moderate houses by Sanford and Avera Hospitals. However, if all the people in the lower income levels were paid wages adequate enough to purchase housing, the inflationary effects would quickly outstrip those wage increases as the additional money in the market would push housing prices higher and out of reach.

However if you want to point to a “market failure”, than look no further than the multitude of government and NGO programs creating countless duplications of services and inefficiencies in the housing market.

The interesting thing about this study is who financed it. According to the study itself, it was financed by:

“This project was funded with grants from Forward Sioux Falls (a joint venture of the Sioux Falls Area Chamber of Commerce and the Sioux Falls Development Foundation), Sioux Empire United Way, and the Sioux Falls Area Community Foundation and with a matching grant from Augustana University. Additional funding was provided by the City of Sioux Falls.”

So, this study does more than identify the “obvious,” it also identified who worked in collaboration with the culprits, in my opinion, due to its funding. The fact that this study was partially funded by the “Forward Sioux Falls” crowd is laughable at best.

The recommendations this study suggests are all good intended ideas, but they are also enabling ideas that never have us as a community addressing the real problem, which is wages, and which the “Forward Sioux Falls” crowd (Chamber and Development Foundation) are for a large part to blame for, I would argue.

There is obvious wage collusion going on in this town among employers and the business community as a whole, I would allege. If we truly have one of the lowest unemployment rates in the country, then why is there not a “wage war” going on in this town?… If there is no collusion, that is.

A few years ago during the oil boom in North Dakota, we saw a “wage war” due to low unemployment numbers. So to a lesser degree in intensity, however, should we not be seeing the same thing right now in this town as well, given our extremely low unemployment numbers compared to the rest of the country?

Granted, such a “wage war” could stimulate greater housing cost inflation, which would then negate some potential gain for employees from increased wages, but I would rather have that problem in the future, than a greater never ending and enabling dependency upon government programs; while the wealth in this town continue to laugh all the way to the bank and their workers never become homeowners, and get a head of the game, nor become members of the “American Dream”…

It is time we admit that there is wage collusion in this town and call the business community out for it instead of working with them as known or naive enablers.

Now, that is the study or investigation we need to see!….(But who is going to fund it? ;-) )

I’ve been in Metro Sioux Falls for over 20 years and it has consistently added to its population a Madison every year. No let up in good or bad times. The national housing bubble was barely a blip. I have a friend whose parents sold the family farm, moved to Sioux Falls, and invested the money in two large apartment buildings. It was filled in 90 days vs. an expectation of 270 days.

The challenge is two-fold:

1) Developers buy land at it is roughly two years before houses or apartments can go up because of the time to go through the permitting process and get infrastructure built. In short, the process is about 4 years before a new development has substantial housing available.

2) The cost of new construction of housing is over $100 a square foot making a small starter home $200,000. Metropolitan areas which have slower growth have older homes come on the market at affordable prices but the demand from new residents has prevented these houses from being more affordable. The lack of these homes coming on the market is what makes this language in the report pertinent: “In short, housing development is driven by financing constraints more than client needs.”

The reason we are losing the quantity of lower income people is they are moving up. A double income family with both people making $20 an hour are over the $75,000 threshold. When teens are making in excess of $10/hour at fast food restaurants, the number of skilled workers making less than $20 an hour is diminishing. The main people who are in poverty as this study identifies are single parents with children which is a challenge deeper than related to whether we have sufficient housing or not. When we launched a war on poverty the largest correlative factors to being in poverty was education and race. Today it is whether the household has both parents living together. The problem is still here but the nature of the war has changed.

I don’t expect anyone outside Sioux Falls to feel sorry for us as we deal with strong, steady growth but the lack of housing (all types) is real. And it will take all Sioux Falls stakeholders to work together and find solutions.

To me the most interesting information is the % of the growth in families without children. But if you look at the numbers it is more than “old folks” moving in but also young families without kids as the trend to delay childbirth continues and more significantly single people who I presume are heavily younger. Before this study, when I look at all the elementary schools we have added in Sioux Falls and surrounding school districts, I thought all the migration was families with kids. The school building boom appears not likely to recede anytime soon.

A two income household is going to put a lot of couples in the upper middle class range but if they’re both saddled with a hefty college loan to pay back then that income is deceiving the stats.

If we live in a world where we can assume that couples each make $ 20 per hour, then why can we not also assume that unmarried individuals, who are head of households, are making that same hourly wage, too? Thus, relieving the problem altogether, right?

In fact, the study claims that single fathers make $ 39,569 per year, while single mothers make $ 25,938 per year, which definitely identifies wage discrimination based on sex and the often “breadwinner” reality, which culturally favors men, but doesn’t it also prove most likely that it is ill conceived to think that there is wage parity between a married couple, too?

My guess is that most couples at $ 75000+ per year have one of them as the main breadwinner (Most likely salaried). Else, where are these $ 20 per hour jobs in Sioux Falls at? And why are single people not getting them too, which could then buck the trend of the alleged continual decline in the middle class in Sioux Falls through 2021, based on the study?….. Which blames the growth of single parent families as the cause of lower household incomes and housing affordability….

The real culprit is wage collusion within the Sioux Falls business community. It is an assertion, but an assertion which also quacks, looks, and walks like a duck……..It is not the marital status of our citizens in Sioux Falls. Else, our economic development slogan should be “Try Sioux Falls: If you are married…. You will make $ 20 per hour!”

Hmm.. maybe the market failure is the failure of labor to negotiate wages that reflect the full value of the skill and liberty they sacrifice to their employers. That failure is, of course, artificially exacerbated by the state’s intrusion on labor rights with “right-to-work” laws, which, as we know, are really “right-to-fire” laws.

What would build more houses more affordably more quickly: streamlining all of the programs and agencies and tax incentives into a new Rube Goldberg machine, or simply putting more money into workers’ paychecks?

Wayne, if the middle class gets smaller because more of us get rich, that sounds great. But if more big winners are complemented by more big losers, we still have a problem. Growing economic inequality means growing political inequality: more poor people are disenfranchised by their more dire economic conditions; more rich people are removed from their neighbors in economic and social concerns, have less common ground, and see less need to advocate for community solutions. Wider splits in income also mean more folks are locked into their economic class: the poor can’t get traction via education and capital for economic mobility, while the rich have advantages that keep them where they are.

I don’t want to wish financial losses on anyone, but a U-shaped distribution is worse for the economy and democracy than an A-shaped distribution.

John KC, remind me to cite that gender-wage differential the next time I hear Rep. Pischke and other aggrieved men griping about the child-support system being rigged against fathers.

Troy, do wages ever keep up with housing prices? Why in a tight labor market aren’t more workers getting the wages they need to build, buy, and renovate houses?

John KC,

I confess I haven’t dug into the demographics for Sioux Falls. The single parent income disparity by gender is significant ($14,000!!!). I wonder if they break down educational attainment for single parents; my hypothesis is single dads in the Sioux Falls region have higher education than single moms, which should account for some of that disparity.

Nationally, full time women earn 80% of men; that would explain roughly $5,300 worth of that discrepancy.

Perhaps the distribution is dramatically different:

a) more full-time single dads (and more single moms stringing together part-time work)

b) more single dads with degrees

c) a greater age differential (older single dads vs younger single moms)

In any event, it’s something we should be aiming to fix.

Cory,

The hollowing of the middle class looks more like an “M” than a “U”. A double-humped camel’s back is a good visualization.

The humps have gotten larger, but at different rates.

– the hump for the lower class grew to almost 30%

– the hump for the upper class grew to 21%

From a societal standpoint, the fact that the middle-middle class on upwards can have a positive net effect on their children’s ability to climb the economic mobility ladder is a GREAT thing.

1) they’re better able to ride out economic shocks

2) they’re better able to help their children continue in prosperity

3) they’re less likely to rely on social safety nets for long durations

4) they’ll contribute more to the nation’s taxes

We shouldn’t begrudge the advantage half of households are able to provide their children to succeed. We certainly shouldn’t try to take away that advantage.

If affords us the ability to focus on the other half who don’t have that advantage and figure out how to help them get upward mobility.

And remember, all that wealth and income earning power of half of American households still doesn’t translate into 100% retention in the same or better income bracket for their children. Pew shows that at about 65% retention, so there’s 35% of children who still slide down the economic ladder. Anecdotally I’ve watched that happen in our extended family; my uncle (who earned far more than my dad ever dreamed of) watched both his children make poor life choices and squander the support my uncle and his wife continue to give.

I’m definitely concerned by the hollowing of the middle class – I’d much rather we have a distribution curve that’s more upwardly biased than a dual-humped distribution (especially one that has a larger hump at the bottom of earning).

But this is a national trend, and education is one of the root causes.

There are fewer middle skilled jobs available in our knowledge economy. So the focus on high quality education is right-minded; to help people develop the specific technical skills, and the broad critical thinking / adaptive skills necessary to work in this new economy. Unfortunately we have too many folks without those aptitudes and without a clear pathway to gain them.

To pivot a bit:

Cory, I’d challenge some of your assumptions about societal mingling – it may be less about economic status than it is about societal / political values. The Big Sort is an examination of how our communities are self-sorting based on political lines (and how that’s detrimental to our society). It may have less to do with economic status (though that’s definitely a factor in Sioux Falls, with those very fancy developments), and more to do with whether you get along with your neighbor.

Cory, definitely “Ten-Four” on that one!

Wayne, you make some very valid comments, which I cannot disagree with. But I would add one point to this income inequality between the sexes in Sioux Falls, however. And that is that, although, I believe there is true income inequity between the sexes in Sioux Falls, and even the entire nation as a whole, some of the income inequality shown in this study might be caused by the fact that women are more likely to become single parents from day one, usually in their late teens or early twenties, causing a spiral of poverty for them and their dependents, while men tend to walk into that reality later in life due to divorce or spousal death, like in their late twenties or thirties. And since, most acquire better paying jobs later in life due to developed skills and employment longevity, that that employment reality thus helps to favor single fathers in their employment situation, because they usually become single parents later in life..

CH,

You asked the question what would get us more houses more affordably more quickly? Lower zoning, permitting, and building standards. I’m not advocating that and I assume you aren’t either. All real estate development inherently requires a long time period. When the growth of Sioux Falls in housing substantially requires new land acquisition, infrastructure design, permitting and construction, and then sale of lots, there is not alot of things to realistically and materially change these realities.

Do wages ever keep up with house prices? Yes, overtime it is one of the strongest economic links there is. People can only afford to dedicate so much of their income to housing and it limits the price. The issue you identify is new homes cost more than existing homes on a sq. ft. basis. And, with the growth in population, the impact of new home pricing (hold up/increase price of existing homes) is currently outpacing wage gains. It is a condition which can not continue and was likely the motive of why the study was commissioned- the current pressure on demand relative to supply must be relieved or growth will be stalled.

I didn’t read the report so I don’t know if they made any mention of this but there is a consequence being created with regard to the housing issue. Normal transition of older, family homes (normal source of non-apartment housing) to be affordable housing for lower income housing isn’t occurring. I’m very familiar and intimately associated with such a neighborhood in Sioux Falls. They would be ideal housing for this category as they are currently occupied by older people who could move to apartments or smaller homes. However, the only options for these people are to move to some form of new construction which is at a price which discourages the transition.

I’m not sure of this fact but I think we have had 3-5 years in a row where the number of new apartment units added exceeds the prior year and current permits indicate we will do so again in 2018. While my personal speculation, the first “relief” on all fronts will be when Sioux Falls gets ahead of the demand for new apartments so existing older apartments become a more affordable option for a myriad of people, including those I mention who are staying in houses in this particular neighborhood and their housing becomes available to lower income families.

For an additional nugget to chew on:

Internal discussions with Sioux Falls planners is it costs the city $30 million to install infrastructure on a new development (road, water, sewer). This is more economical than little additions, so the city has moved to only allowing development of larger sections of ground (I believe a quarter section is the minimum). Since the city only has so much cash on hand, their ability to install infrastructure is also a limiting factor to growth; they can only afford to develop so much per year.

Wayne,

Good point but I think there are other merits to only allowing large chunks at a time, primarily the development is better planned with regard to the mix of use (individual homes, apartments, and sometimes commercial.

However, I’m not sure “cash on hand” is a significant detriment as the infrastructure can be financed/bonded via a myriad of options. But, it does speak to why some of our recent non-housing/development bonds have strained our capacity lest we lose our high credit rating.