The only good thing about the state waiting to bring its former EB-5 czar Joop Bollen to trial until next February is that I have time to review my EB-5 notes and polish up my understanding of who did what when to whom. As I piece previous coverage together with a new bit of information, I find that the Governor’s Office of Economic Development was willing to saddle Bollen with an unnecessary tax burden to protect its own shady slush fund.

Recall that one of the problems discovered in the official state audit of GOED issued in February 2014 was that GOED left two significant funds off state books for three years. Per its contract with Bollen’s SDRC Inc., GOED (then Department of Tourism and State Development) had access to two funds managed by SDRC Inc. GOED essentially required Bollen, its former state employee gone private, to pay a fee for the privilege of recruiting EB-5 investors for the state. The GOED–SDRC Inc. contract required Bollen to pay 10% of the origination/closing fees and 25 basis points (0.25%) on interest collected on EB-5 project loans. Those fees first went into an SDRC Inc. account called Indemnification Fund One. The contract required Bollen to move funds from Indemnification Fund One to keep an Expense Fund topped off at $350,000. The Expense Fund belonged to GOED; only the GOED chief (Richard Benda at the time the agreement began at the end of 2009; Pat Costello when Dennis Daugaard took office at the beginning of 2011) or his designee could authorize expenses from the Expense Fund to promote the EB-5 program and monitor SDRC Inc. The Department of Legislative Audit found five GOED disbursements totaling over $67,000 from the Expense Fund that GOED failed to properly document and justify.

Keeping these two funds out of state hands would have complicated Bollen’s taxes. The fees GOED required SDRC Inc. to pay are business expenses, which Bollen ought to be able to deduct. But if he doesn’t actually pay those fees to GOED, if he’s holding onto that money in an SDRC Inc. bank account, those fees aren’t expenses yet. Bollen can’t claim or deduct those expenses, and he’s stuck paying taxes on them.

You and I may not shed tears over Joop Bollen paying more taxes, but the state, his partner in the EB-5 endeavor, maybe should. Why throw financial grit in the wheels of their own EB-5 machine?

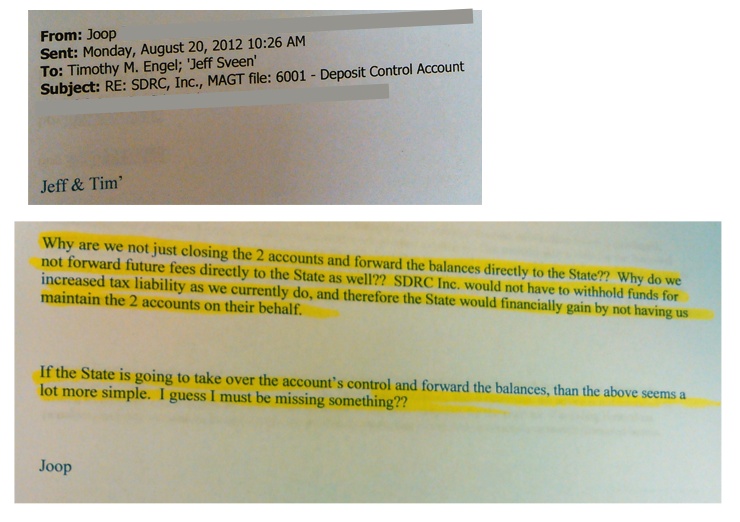

Bollen raised this concern to GOED counsel Tim Engel and his own lawyer Jeff Sveen in August 2012:

If it’s the state’s money, why not just give it to the state?

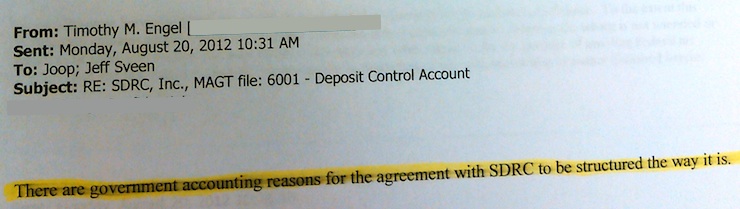

Because, says GOED’s lawyer Engel. Just because:

The state doesn’t benefit from making its EB-5 contractor pay more federal income tax (or, more accurately, defer deduction of his fees from the year when SDRC Inc. has income generating those fees to a year when GOED finally lays its hands on those fees but SDRC Inc. has no income from which to deduct those fees and lower its tax liability). During the first three years of its contract with SDRC Inc., GOED appears simply to have wanted to keep its EB-5 Expense Fund off the books and let its contractor eat the cost of doing so.

So they raised his taxes on one hand, and gave him an exemption from bank franchise taxes and regulations. All this after handing him a multi-million dollar revenue stream that should have gone entirely into state coffers, minus his salary as a state employee.

And the taxes they raised are federal, not state taxes, so it’s not as if the extra tax burden helped the state coffers make up for the bank franchise tax exemption.

Time for the IRS hammer to fall

If the dollars should have gone into state coffers, Mr. Rorschach, then the E-B5 thing must be a legitimate tool for raising dollars that could be used to pay good teachers more.

Yes grudz. EB-5 was a legitimate tool. Unfortunately the state has proven itself unable to manage or oversee the program. South Dakota cronyized it then let the crony rip off the investors and the taxpayers both. But the EB-5 cost is not just counted in dollars. In SD there is a body count.

Ah, Jerry, I’m not sure the IRS has a hammer to drop on this particular issue. Recall this little tidbit from my June 3 article on Bollen’s trial: Donald Kainz of Eide Bailly submitted an affidavit explaining that, while doing Bollen’s taxes in March 2015, he realized that maybe Bollen didn’t have to pay income tax on the funds he was holding for the state in SDRC Inc. accounts.

Demand transparency in SD government.