Last updated on 2016-07-31

I counted seven Libertarians in the room, including party chair Ken Santema, at the beginning of the South Dakota Libertarian Convention in Aberdeen this afternoon. I interviewed more than half of the participating delegates.

First, the farthest-traveling conventioneer, Dick Shelatz of Rapid City, talks about why he likes Libertarian Gary Johnson for President and tries to apply his Libertarian principles to state-level races:

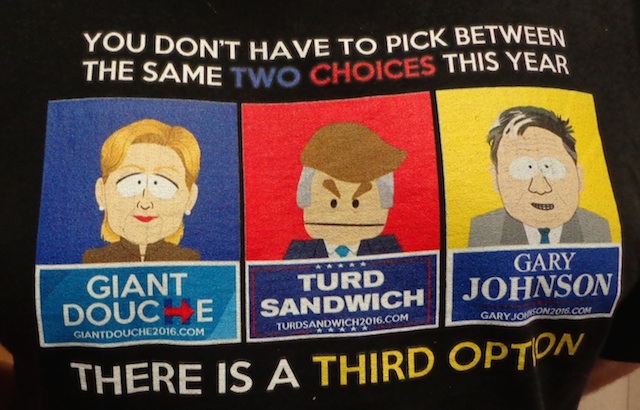

By the way, here’s a full view of Shelatz’s shirt:

Next, Jon Boon McNutt, a Tennessee transplant to Aberdeen who keynoted the convention, talks about what he hopes the Libertarian Party can achieve in this year’s election and describes a Libertarian federal government (no IRS, no tax loopholes for the 1%, and no “victimless crimes”):

Finally, the Baldwin brothers—Scott from Aberdeen, Greg from Wakonda—talk about Gary Johnson and give their nutshell explanations of the Libertarian Party (note: the small person in the background is not a voting Libertarian delegate):

“Out of your pocketbook and out of your bedroom,” says Scott—how’s that for an interesting synthesis of Republican and Democratic positions?

The Libertarians are choosing three electors for Gary Johnson today… and maybe, just maybe, a PUC candidate.

Update 2016.07.31 07:43 CDT: According to a post on the party website from outgoing party chair Ken Santema, the Libertarian Party nominated Shelatz, McNutt, and Elain Kub of Ipswich as electors for their Presidential ticket. They also elected new party leadership:

- LPSD Chair: Jon Boon McNutt

- LPSD Vice-Chair: Richard Shelatz

- LPSD Treasurer: Daryl Root

- LPSD Membership Director: Scott Baldwin

- LPSD West-river At-Large member: Sean Metz

- LPSD East-river At-Large member: Ken Santema

The Johnson on the tee shirt looks to have an H shaved in his head.

No IRS? Are we going to take up a collection to fund the federal government? People will just send in what they owe knowing the IRS won’t be there to audit them?

While the Libertarians are at it, I was hoping they could abolish other things like wars and terrorism and mean people. I will think of some more stuff they can get rid of in an ideal world.

“This is the real world we live in.”

-Bernie Sanders, 2016 Democratic Convention

Very true, but not a popular statement in this particular election cycle.

Even though these guys are a little rough around the edges, I do not find them offensive in any way. I actually think conservatives can learn a thing or two from them.

I’m pretty sure we will always need the strong arm of the IRS to collect taxes from the pocketbooks of folks who want to use roads and have police protection and such, but everything else these guys mentioned is quite alright with me.

Hello Darin

To answer your question, without an income tax and other similar taxes there would be no need for hordes of tax lawyers employed by the federal government.

Please read this article linked below

Thank you

https://www.lp.org/news/press-releases/libertarian-party-dont-waste-time-investigating-irs-abolish-it-now-along-with

What is this, the Libertarian version of Duck Dynasty?

Ok Jon McNutt– I reviewed your link which says:

“We can end the personal income tax, the corporate income tax, the death tax, and all federal payroll taxes.”

This doesn’t answer my question of where the remaining tax revenue would come from to fund the federal government. Even if you cut the federal government by 90% as your link suggests(hello Russian and Chinese military agression) and payroll taxes (I guess no more social security or medicare) where is the remaining revenue coming from to keep the doors open. And what about paying for the national debt. I guess we just monetize the debt. Great, there goes the value of the dollar.

Sorry to be blunt, but this is crazy. The numbers don’t add up and please inform everyone that they will be living a life as Hobbes noted, “nasty, brutish and short.” But, oh man the freedom!

Hello Darin,

To answer your follow up questions, the short answer would be a consumption tax similar to the Fair Tax Plan https://en.wikipedia.org/wiki/FairTax

Also, please feel to read https://www.lp.org/issues/taxes and the other issues to become an informed citizen on all aspects of the Libertarian Party. It is laid out quite nicely and can probably answer all the simple questions you may have.

Thank you.

Thanks for the info Jon, but I have to say yikes after reading your wikipedia link. To make a regressive sales tax into a less regressive tax, it appears the Libertarian plan is quite complicated. Color me skeptical. In addition to the arguments identified in the link such as the problem of tax avoidance, I would question how our economy is going to be affected by discouraging consumption. We are a consumer society which fuels our economy and has been the economic engine that keeps our economy numero uno. We have not choice but to grow our way out of the constraints of our national debt with a strong economy.

Speaking of which, how do you pay the $20 trillion debt back while reducing taxes 50-90% and fund a strong military?

Don’t forget our issues with infrastructure, climate change, public education, and health insurance that need fixing besides keeping a strong military.

Oh, I agree Mr. McTaggart, but I was just accepting the Libertarian premise of just funding the military and the absolute bare minimum services of government.

Not addressing those problems reduces our freedom in many ways, particularly when the ride on the cost-shifting merry-go-round stops. Seems their bare-bones government plank may be in conflict with their freedom plank.

I happen to agree with you. I also don’t think people are willing to go back to a life without things like healthcare, good roads, student loans, medical research, medicare, social security, not to mention food that is inspected, water that is tested for lead and safe to drink, drugs that are regulated and tested, banks that are not too big too fail, insiders not manipulating your stock, monopolies not fixing prices, to name a few.

A flat income tax or a consumption tax alone to fund the Federal govt’ would disproportionately impact the poorest Americans who, for example, struggle to feed their families. I like the idea of a much higher tax rate on the income a person makes over – let’s say – $1 million per year.

The Bush tax cuts for the wealthy wrecked our Federal budget. Conservatives even promoted the idea that war would really stimulate our economy. Neither Bush’s tax cuts nor hands off approach to regulation stimulated squat – it left everything in shambles.

We should tax the people who can afford it, and pretty much leave everyone else alone in that regard.

Great interview, Jon, and congratulations. I’m glad to see the LPSD chair passed from good hands to good hands.

The first IRS 1040 form wasn’t filed until the United States was more than 135 years old (in 1913), and a strong case could be made that the nation was improving more rapidly before that.

Darin, We are on the same page on this one.

Adam, Instead of an absolute zero tax for some, I would rather have more energy efficient and affordable housing. That would reduce energy bills and free up some money for other things, which would help the economy.

Donald has this because of the sacrifices he has made and stuff. http://abcnews.go.com/Politics/donald-trump-father-fallen-soldier-ive-made-lot/story?id=41015051

Hey now, Roger, this blog holds whiskers in great esteem. ;-{D}

National Review responded to Ted Cruz’s campaign-trail call last year to abolish the IRS by saying the proposal “probably isn’t feasible and has almost no merits as a public policy.”

The thrust of the LP pr Jon submits seems to be very Grover Norquist: starve the government of money by abolishing the income tax. Individual income tax provides 47.4% of federal tax revenue. Corporate income tax provides another 10.6%, down from the 20% to 30% it provided back in the 1950s.

Abolishing the income tax would advance the concentration of wealth at the top: the upper quintile pays 69% of federal income tax. And, as has been expressed by others here, we still need some level of taxation to provide for some level of government, and taxes don’t collect themselves.

Drumpf’s tax plan,according to Fact Check, Cuts taxes across the board-especially for the wealthy and adds over 11 trillion to the debt over 10 years. HRC’s policy raises taxes on the wealthiest and 95% see little change in theirs. Her plan adds around 350 billion over 10 years to the debt.

Wingnuts know how to starve gubmint, but they create an insatiable revenue scarfing debt monster.

Consider the Libertarians on the background, experience, and success of the 2 two-term governors who are running for president and vice. Both were republicans states with democratic majorities – yet won their re-elections by landslides. Johnson and Weld are imminently reasonable public servants.

Also consider that more and more well-placed republicans are ready to put a fork in their modern party: http://www.vox.com/2016/7/25/12256510/republican-party-trump-avik-roy

Cory: as a student of rhetoric, consider “Dilbert” creator Scott Adams admiration of Trump’s power of persuasion – likening Trump to taking a flame-thrower at a stick fight. Put aside the policies for a moment.

http://blog.dilbert.com/post/131749156346/the-case-for-a-trump-landslide-part-1

http://blog.dilbert.com/post/131806160106/how-persuasion-hides

http://blog.dilbert.com/post/131878285426/talking-like-a-fourth-grader-part-of-my-trump

http://www.realclearpolitics.com/video/2016/05/28/dilbert_creator_scott_adams_to_bill_maher_donald_trump_will_win_election_in_a_landslide.html

Amazon-up”, “Propaganda”, by Edward Bernays. Invented here in the Great War era, improved in the old world emerging from the Great Depression, and perhaps perfected by Trump. As Scott Adam’s lifelong study of persuasion reveals – the crowd falls for it every time.

Exactly John. Gary Johnson was nominated after a contested convention. He defeated people who unyieldingly subscribe to libertarian philosophy. He knows how to compromise. He knows how to listen to both sides. That’s what I want. That’s what I think we need right now.

Cutting income taxes on the rich is another Trump plan to aid Putin.

The crowd does fall for it, John: that’s a big part of why policy-oriented Libertarians won’t fare as well as a demagogue like Trump in front of many crowds. I will teach students about the power of Trump’s rhetorical techniques, not because I want them to bring flamethrowers to stick fights, but because I I want them to be able to see through the flames to the emptiness and danger of what the flamethrower offers and still vote for good policy and principles.

John does rightly note that Johnson and Weld are both more qualified by experience to be President than Trump. Libertarians should hammer that point as much as they hammer their party philosophy,.

Maybe I missed it, but who’s in charge of collecting the flat income tax under the LP plan?

Is J B Weld plagiarism? How do Libertarians feel about plagiarism?

Libertarians appear to recognize that the federal government will need funding, but disagree with income tax as a source for any of that funding, and argue that before the 16th Amendment the feds needed no income tax to function. Does that mean libertarians believe we must rely primarily on increased tariffs and excise taxes to meet the funding needs as did our pre-income tax federal government?

Who pays these tariffs and excise taxes? If Americans pay them, then how does it support the liberty interests of these Americans who will have to pay the tariffs and the excise taxes when all other folks are let off the hook by the elimination of the income tax?

If foreign companies have to pay tariffs and excise taxes won’t they pass on the cost of such tariffs to American consumers with increased prices? How is the liberty interest of American consumers benefitted when they become responsible for indirectly paying tariffs through higher prices, when other earners don’t have to pay any taxes?

It seems as if the libertarian philosophy on taxes favors some groups over others, without regard to earning ability, need, or even incapacity. If I need a wheelchair and there is a tariff on wheelchairs that means I cannot afford one, is that good public policy? I have a difficult time understanding how libertarians can seek liberty by favoring one group of Americans over another group of Americans on tax policy.

Another question that comes to mind is whether libertarians have even considered exactly how much tax revenue is necessary for our nation. Again, they seem to recognize that some amount is need, but they never tell us how much revenue is needed. Without information about how much revenue is needed, how can we arbitrarily end the income tax as a source of revenue and blindly expect tariffs and excise taxes to cover our Country’s admitted needs?

Dr. Stein, is a quack http://www.slate.com/blogs/moneybox/2016/07/29/jill_stein_continues_pandering_to_anti_vaxxers.html

[further feigns illiteracy]

Kris: I don’t speak or read jive, dude.

https://www.youtube.com/watch?v=fXSLcYQHqFQ