Last updated on 2019-02-18

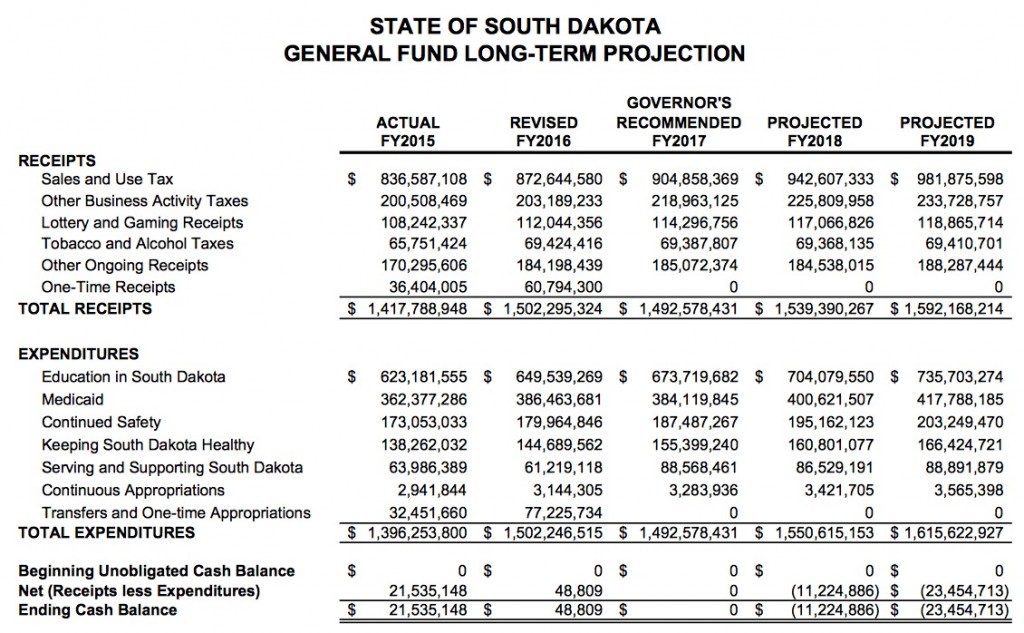

Uh oh: Is Governor Dennis Daugaard headed for the same ignominious fiscal failure as his predecessor, M. Michael Rounds? The Bureau of Finance and Management released budget projections this week for the next three fiscal years indicating that, based on mathification of twenty years of fiscal and economic data, South Dakota is headed for a budget deficit in FY2018 and FY2019:

What?! Daugaardonomics was all about a new norm, and we end up with deficits just like Mike? All that austerity for naught!!!

Well, not just like Mike. $11.22 million short in FY2018, $23.45 million short in Daugaard’s last fiscal year—that’s not nearly as bad as Mike Rounds’s record of running a structural deficit for seven out of eight years and leaving Daugaard with $127 million budget hole to fill in his first year on the job (a hole that turned out to be only $55 million, thanks to the growing Obama economy, but still worse than BFM’s projections for Daugaard’s fiscal legacy). But could the D-word scare our Governor Grandpa Cheap into backing away from his big spending proposals this year?

If Governor Daugaard and the Legislature can keep their wits about them, these projections should actually encourage them to expand Medicaid and raise teacher pay. The numbers above do not appear to include any costs or cost savings from the Governor’s proposed IHS-Medicaid swap. Governor Daugaard would offset the state cost of expanding Medicaid with savings from the feds picking up the tab for all Indians currently charging Medicaid for health care expenses in South Dakota. That deal alone would actually save $39 million in FY2018 and $33 million in FY2019, enough to flip those deficits to surpluses. Expanding Medicaid could save even more under President Barack Obama’s proposal (how often does President Obama have to save South Dakota’s budget?) to make the first three years of Medicaid expansion absolutely free for adopting states, if Republicans in Congress quit trying to wreck the Affordable Care Act and Medicaid with their block grant nuttiness.

The above projections also do not include the additional sales tax revenues or general fund expenditures under the Governor’s teacher pay raise proposal. As presented so far, both the Governor’s plan and the superior Democratic proposal pay for themselves, so even including them here should not affect the budget projections. Both plans raise more money than necessary to raise teacher pay to the target levels, so both plans divert significant amounts to tax relief: the Governor cuts property taxes by $40 million; the Democrats give $97.5 million in tax relief by exempting food from sales tax. If the Koch Brothers can scare enough Republican legislators into voting against Medicaid expansion, either teacher-pay proposal would offer enough additional tax revenue to offset the impending deficits. We’d just have less tax relief to, in the Governor’s case, soothe cranky conservative voters, and in the Democrats’ case, ameliorate the regressive nature of the increased sales tax.

Of course, we may not need either plan to forestall the Daugaard deficits. The budget projection assumes that video lottery and instant and online lottery receipts go from a 3.7% increase this year to annual growth of only 1.52% in FY2019. That clearly ignores the enormous contribution that Lawrence & Schiller’s brilliant “It’s All Good Fun” advertising campaign and snappy new logo will make to boosting video lottery revenues. And when the lottery starts handing out chili dogs, well holy cow, video lottery should single handedly wipe out all of our deficits! What are we paying you $950,000 on your lottery contract for anyway, Lawrence & Schiller?

Is there corruption in those fudging the numbers to scare people into not voting for a plan that spends money on good things? They ought to check the numbers and if it is balanced now, do not use scare tactics about the future which is not here and could change.

To bad all the free money we taxpayers give to business and Ag is off the table in this discussion. Why is that?

“mathification”. I have penciled the word into my Merriam-Webster.

If this long, slow slide into deficitication continues will South Dakota end up living in a van down by the Missouri River by 2020?

Cory how can we lose 2018 with this kind of tongue-in-cheek HILARITY?

But if Voters can understand this tripe we Should Be Able To Sell The Complexity Of Rounds/joop/regents’ EB5 machinations And daugaard/regents’ mcec Flumox.

ALEC and their bosses, the Koch brothers. Nazi brothers in arms. http://www.salon.com/2016/01/12/koch_brothers_father_did_business_with_the_nazis_book_claims_just_like_prescott_bush_henry_ford_some_u_s_corporations/ When you go back on all of these anti government families, you see the trend. That must be why the adverting firm gets almost a million bucks for putting a different “L” in the spelling of lottery. This bunch is not to much different than the brown shirts a hundred years ago.

you diddnt say much to moses and his gathering yesterday,

Seems to me these budget people have probably already figured out the obvious solution. This is all a setup to just say “smaller raises for teachers” or maybe “only raises for good teachers.”

Fixes this problem.

Mr. Elgersma is probably right. This is a scare tactic to sway votes in the legislatures.

Moses, we clearly need a longer gathering! :-)

Roger E, fair question. I’d love to see some independent verification of the complicated formulas and inputs used to come up with these projections, but that’s asking for some serious economic analaysis about the budget of a state that isn’t on most economists’ radar. For now, I’ll accept these numbers as an honest projection of revenue and spending trends. But remember, the projections are based entirely on math, not on the choices we can make this year and in the next two fiscal years. Math is powerful, but in budget discussions, it is not destiny. With the right choices, with a willingness to look at all possible sources of revenue (as Tim suggests!) and prudent financial choices (not the bad anti-teacher-agenda-driven policy Grudz dredges up again, but there are alternatives), we won’t end up anywhere near that van down by the river.