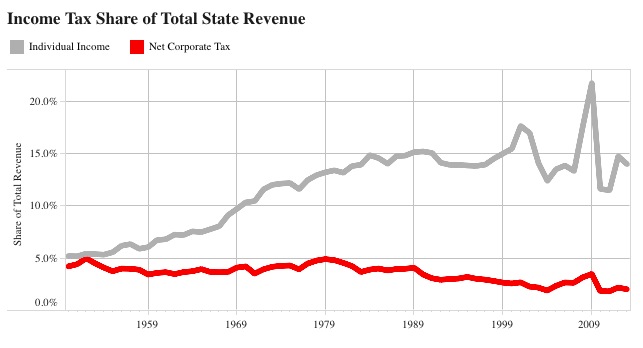

Mike Maciag of Governing posts this really instructive chart on the share of state revenues borne by individuals and corporations paying state income taxes:

Back in 1950, individuals and corporations were within a percentage point of each other on the state revenues they provided via income tax: 5.2% from individuals, 4.2% from corporations.

Corporations’ share of state revenue through income tax floated around that 4.2% level until the Reagan years, at the beginning of which that share began a three-decade decline to 2013’s 2.0%.

Meanwhile, states spent forty years piling more of their fiscal needs on the shoulders of individual income tax payers, whose share of state revenues reached 15.2% by 1990. Some spiky stuff happened (which I’ll guess is recessionary shrinkage of other tax revenues thus boosting the percentage that income taxes provide of the remaining total), but by 2013, individuals were carrying 14.0% of the cost of running their states with their income taxes.

These tax burden trends run opposite the trends for corporations’ and individuals’ share of the national wealth. From Truman to Obama, after-tax corporate profits rose from 5.6% to 9.3% of GDP, while employee compensation (what most of us pay our income tax out of, right?) went from 53.6% to 53.2% of GDP (with a mild hump under Nixon of 57.4%).

Corporations are pulling in just about twice the share of annual wealth, but they’re bearing less than half the burden they used to in keeping their states running. Individuals’ share of the wealth is about the same, but they’ve taken up nearly three times as much of the cost of state government.

Could it be that corporations have more influence in state capitals in ensuring that they get favorable tax treatment?

R.I.P middle class – Americans For Prosperity (aka Koch Bros.) are doing very well, thank-you.

Republican governments favor business with corresponding tax breaks for the rich(er) and increased burden on the working classes. As Clinton says, do the arithmetic. And keep using your ignorant fearful votes to keep them in office.

Corporations are people. People are animals. All animals are equal but some animals are more equal than others.

Excellent, John. The Clintons beat millionaire Romney with that very phrase about his plan to save the economy after the Republicans drove it deep into a ditch. “Your numbers don’t add up. Do the arithmetic.” They’ll beat Jeb Bush with the same down home logic.

We don’t have to worry about the ratio between corporate income taxes and personal income taxes within the state of South Dakota though because for some reason we don’t feel we should tax income.

Perfectly ok to tax bread, band-aids, and mittens however.

By the way, if “corporations are people” then why aren’t they taxed like it?

Trump wanted to hire Rmoney to haul Trump’s dog around the country on the roof of Rmoney’s biggest vehicle,but it wasn’t sufficiently large enough for Trump’s yoooooge dog.

The long-term analysis of corporate and personal income taxes should always be adjusted to accommodate tax changes in the 1980s that prompted many small businesses to move from corporate to individual taxation (e.g., so-called “Subchapter S” corporations).

Excellent observation, Mr. Wyland. I rolled into chapter-s in the 80’s, three times

We can beat up Mitt on a lot of issues but the unspoken Republican reason he lost is because he’s Latter Day Saints. The born-again faction of their party don’t believe Mormons are Christian and wouldn’t turn out strong for him. Ted Cruz is courting that voter block with all he’s got. The last Texan in the White House miraculously became born again and it won him the election…that and the Supreme Court.

Interesting, Michael! Did those tax changes in the 1980s prompt those moves right away, or did they accumulate over time? Can we estimate what percentage of corporations made that move? And that move would apply the same at the state income tax level as at the federal income tax level, right?

Cory:

I don’t know the speed with which they affected corporate vs. individual reporting, but I know that university researchers critiquing Thomas Pinketty’s “Capital” cited this oversight as a flaw in his methodology. One might look at the changes in numbers of Sub-S filings, LLC filings, etc., in the few years following the 1985/1987 tax code overhaul.

Starting in the ’60s and early ’70s, eleven states added a personal income tax, many of them large population states like Illinois, Ohio, Pennsylvania and New Jersey which would increase the personal income tax revenue share with a broader base. Also keep in mind that in addition to the increase in S Corp revenue that Michael mentions, the individual ownership of stock has increased dramatically since the 50’s increasing personal income tax revenues with the taxation of dividends and/or capital gains.

http://taxfoundation.org/blog/when-did-your-state-adopt-its-income-tax

Five Things Tribal Leaders Can Do in 2016 to Reduce Taxes on Tribal Members:

http://www.jdsupra.com/legalnews/five-things-tribal-leaders-can-do-in-46887/

This topic requires deep analysis as corporate capitalism holds the key to 1%’s hoarding world wealth resources and income w/o risk and “not building it”.