New research from Federal Reserve experts shows that, for the most part, state taxes undo some of the efforts the federal tax code makes to reduce income inequality. That’s to be expected: states rely more heavily on sales tax and gasoline taxes, which take a greater proportion of income and utility away from low-income folks than from high-income folks.

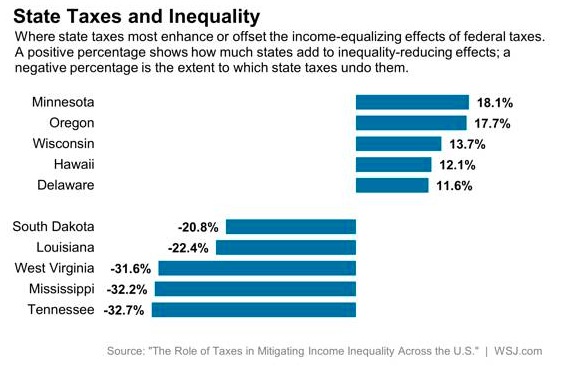

Wonkblog converts the data into a fun hover-activated map. The Wall Street Journal provides a handy chart showing the five states who tax policies actually do the most good in fighting income inequality and the five states whose tax policies undermine that good fight the most. As is all too usual, Minnesota beats South Dakota:

Minnesota is the best state in the nation for fighting income inequality. South Dakota is the worst in the region and fifth worst in the nation.

Look, we don’t have to Harrison Bergeron everyone and make sure every citizen gets the same fixed income. We can let some people settle for teacher pay while others choose doctoring and lawyering to get rich. The state doesn’t have to give everyone a touchdown, but it should at least work for a level playing field. Let’s stop roughing the poor and giving the rich a pass. Let’s work toward a more progressive South Dakota tax system.

Hah! South Dakota trounces Mississippi this time. Way to go South Dakota.

Taxes / fees resultant in furthering income inequity is one of the many reasons we should repeal the recent 100% increases in motor vehicle registration and the gas tax increases. Those tax / fee increases should apply to the heavy vehicles which create exponentially (as in virtually all) highway wear, tear, and road damage. Instead our non-representatives chose to subsidize the road breakers and the expense of 95% of the voters.

If our legislature or politburo would ever become curious, they should read this fine article to see how not to govern. It is not hard to notice that the progressive states are the fairer and richer states driven towards more equality for all. Of course, members of our politburo already know what is in the article as they have embraced this scam with a bear hug. Legislators see nothing wrong with punishing the low income of our state, as it makes them feel powerful. I call this republican ownership but some would call it racketeering as they both walk hand in hand.

Let me point out something. This seems to indicate that states create their own poverty, helplessness and dependence through tax policy. States with more progressive tax policies are also the states paying more federal taxes than they get from the federal government. Meanwhile, the states with regressive taxation also are states taking more money from the federal government than they kick in.

Under Walker, Wisconsin is starting to go backward. His policies have cut corporate and personal income taxes for higher income folks in the state. The result has not been job growth, but increased income disparity and reduced personal income.

Every month we liberals reach into our paychecks and send money to the conservative

states that don’t raise enough taxes to pay their share. We don’t demand they raise

taxes and stop suckling the USA but we do request they stop being so greedy that

seniors can’t get a free meal delivered, anymore.

Hang on, Porter—are the Senior Meals reductions a matter of decreased funding or just a lack of participation?

@Mr. Heidelberger … The idea of asking those no longer participating seems doable. Income inequality is scoffed at by conservatives as just begging for welfare and another increase of the Nat’l debt. As an aside, USA’s balance sheet this quarter shows we are worth $225 trillion and we are $18.5 trillion in debt. Does that sound like a fiscal crisis to you? Not to me. It’s just “yelling squirrel” (I love that phrase I picked up on your blog) We’re in debt because taxes are too low not too high.

“Welcome to the Monkey House”

I love living in MN. MN definitely has problems, and they are dragged out in the light of day where everyone argues about them.

Democracy is a beautiful thing. SD Republicans ought to give it a try.