Rep. Lee Schoenbeck (R-5/Watertown) dropped by the Dakota Free Press comment section yesterday to ask some reasonable questions about teacher pay, opt-outs, and South Dakota voters’ tolerance for more taxes. Rep. Schoenbeck and regular commenter Donald Pay got into a disagreement over the share of K-12 funding borne by the state, with Pay claiming the state picks up a mere third of the cost of educating our kids and Schoenbeck saying no, the state has covered just over half since the 1995 formula overhaul.

I’ve published Census data that says that in 2012, South Dakota state government provided 30.5% of K-12 funding. The latest National Education Association stats show a state share of South Dakota’s K-12 funding at 30.0% [see Summary Table I, p. 94].

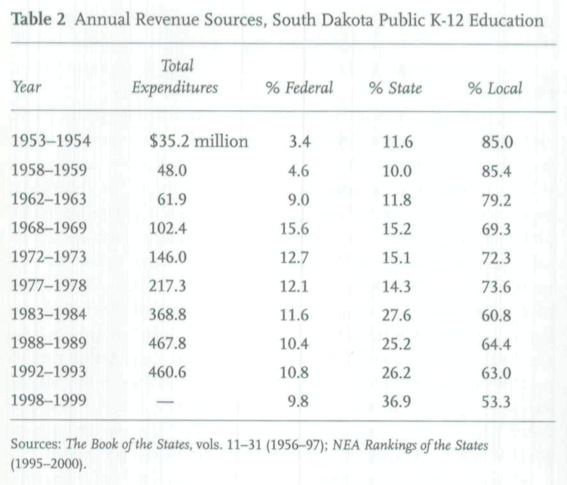

But historically, that one-third state share is relatively high. Check out this table from historian John Miller’s 2003 article on education in South Dakota:

Back when Lee and I were both mere glimmers (I don’t know about Donald), schools got barely a tenth of their funding from Pierre. Local property tax covered 85% of school funding. Throughout the postwar era, Pierre marched toward picking up more of the K-12 tab.

Don’t celebrate, though. Miller notes that South Dakota was still lagging behind other states:

Most other states increased their state aid for education much faster and more consistently than South Dakota, which by the 1970s and 1980s consistently ranked second or third to last in this category. Advocates of increasing state aid argued that doing so would raise funding to adequate levels, reduce inequities among districts that varied greatly in taxable real estate, and provide a less regressive source of revenues. Throughout the 1950s and most of the 1960s, state aid as a percentage of school revenue hovered between 9 and 12 percent. During this period, other states were raising their share of contributions, on average, to about 40 percent…. [L]ately [South Dakota’s state share] has begun to approach, bringing South Dakota into closer conformity with other states but still leaving it among the lowest-ranking states in percentage of state aid [John Miller, “Education in South Dakota Since World War II,” South Dakota History, vol. 33, no. 1, Spring 2003, p. 56.].

Only two states, Illinois and Missouri, kick in a smaller share of K-12 funding than South Dakota’s current estimated 30.0%. The current estimated national average for state share of K-12 funding is 46.3%.

And that jump of 10 percent between 93 and 98 isn’t really an increase in education funding. It’s mostly double counted property tax replacement money, not additional money for education.

I suspect this won’t change until our tax structure does, because our legislators value getting re-elected over paying teachers what they deserve… so they kick the can down the road as they don’t want to be seen as having to raise taxes to pay for it (and the options for cutting spending elsewhere are slim).

Since we can all admit the current system isn’t working, and since we can all admit that the campaign strategies Democrats have been using the past several decades are also not working, it is time for a change.

Democrats should lead the effort to pass comprehensive tax reform based upon income taxes rather than property taxes and use this to properly fund education. They should present this as an investment in our children (which appeals to anyone with a child), and they should also reference that a tiered income tax would result in more equality, with less impact upon the low and moderate income taxpayers. Also, if they adjust the property tax structure they can have a direct, positive impact upon the elderly who won’t have to fear for losing their homes due to the ever-riding levels of property taxes. Social security, pension, and retirement investment income could be tax exempt to ensure those who have worked their entire lives won’t bear the burden of our past mistakes.

They could also reduce or perhaps even eliminate sales tax on food, and ensure they propose reductions in agriculture land taxes to attract the farm / rancher vote. Done right, they can attract low income and middle class voters, much of the farmer / rancher segment, the elderly (who vote in droves) and those with fixed incomes. They would also attract the teachers, parents of school age children, any those who believe an investment in education now will provide greater returns in the future (although admittedly those with this understanding are most likely already voting Democratic).

If you wish to enact bold changes, you need bold ideas. Time for the Democrats to lead for a change.

As mentioned, it is time at least reform the school funding formula, if not reform the way the state taxes. The constant need for things such as opt outs keeps the issue in the public’s eye and under the microscope. In many ways, it can act as a wedge issue, which can be detrimental, especially in small towns. A modification to the default funding to make opt outs more of a nuclear option versus an everyday occurrence would help reduce the stress on school districts, voters, and ultimately our youth.

On a more grand scale, considering a state income tax may also be a wise idea. It never made a ton of sense to me to place such a heavy tax burden on land owners, especially farmers. While an income tax would create more regulatory hurdles, North Dakota seems to have a decent and simple state income tax system. They are able to combine it with the elimination of taxes on unprepared food goods to build a bit more robust of a tax environment.

Adopting something like that would not be a bad idea for South Dakota, what would be a bad idea though would be if we adopted North Dakota’s thoughts on not spending any of their extra revenue such as oil money. They are holding on ever so tightly to their purse strings while the environment and the public infrastructure is raped in the western part of the state. Now the boom is starting to bust and they are left with an infrastructure in shambles and a “we got burned again” mentality.

“Donald – you’re wrong about the revenue sources – in 1995 the state’s share of local education funding went up to just over 50%, where it has stayed consistently since then.” – Schoenbeck …

Just saying it demonstratively doesn’t make it TRUE, Mr. Schoenbeck. Good work, Mr. Heidelberger exposing this lie.

CH,

Looking at just “share” might not put things in full context. At least out East, many states get revenue from property taxes. The State of South Dakota leaves that revenue source exclusively to local government. If you were to “add back” State take from property taxes and subtract it from the “State Share” for education, many states would look like South Dakota.

Another thing, South Dakotans seem generally comfortable with the approach since increases in the sales tax seems to get more resistance to local bond elections and opt outs.

Finally, I think it appropriate to break education funding into two sections (capital spending and operational spending).* And, then from operational spending deduct that what is funded by the federal government (i.e. special education). If you did that, the State and District fund about equal amounts of the operational cost to educate a child in SD. That is what I believe Schoenbeck was referring to.

Schoenbeck isn’t lying and neither is Cory. It just a different perspective with how to look at the same information. And, in neither case do I think they are looking at it with an agenda. Perspective and context is often just that- coming from different places.

* The reason to do so is I dare someone to propose new school construction should be funded by the state and the decision of what is constructed is deferred to the state. I know of very few people who would give up local control (and thus funding) for whether or not Gettysburg or Sioux Falls builds a new school.

How is maintaining 66 county seats and 7+ public universities sustainable?

Mr. kurtz is right. Cut the number of counties by 1/3, close 2 or 3 of these colleges and then make one school district per county. That frees up enough money to give raises to the good teachers easy.

Close colleges? Support our President’s call for free Community College education!! As often witnessed within, a mind is a terrible thing to waste especially when a mission less conservative war wasted a trillion and a half $$$.

When Gov Janklow revised the funding formula back in the early 90’s it was set so the state contributed about 54% and the local district about 46% on average towards a per pupil amount. That amount does not reflect other funding sources like bank franchise tax (an income tax on banks), gross receipts tax, state fines (collected from speeders), federal funding (including impact aid which is huge for some districts), opt outs, and other sources of revenue.

There are problems with the way gross receipts, bank franchise taxes and state fines are distributed as most of those funds go back to the districts in which they are collected. Using that type of distribution method with sales taxes would put all the sales tax collected at the Empire Mall to the Sioux Falls School District.

Troy has concocted, I believe, a bogus argument. In reality South Dakota does the same thing as what he claims states “out East” do. It’s done a bit differently, but it amounts to the same thing. But he’s ignoring that adjacent states do it pretty much as South Dakota does, and it’s adjacent states that SD is competing with for teachers

States have many ways to accomplish equalization of property tax revenue. In South Dakota the local education taxing authority through the property tax is actually shared statewide because state aid is heavily reduced in property rich districts.

Second, breaking out capital outlay from operations makes sense from a district budgeting standpoint, but you have to consider both pots of money as necessary to education. You can’t have education happening without capital outlay, which funds buildings, heating plants, computers and, I believe, most curriculum. These things actually do cost money, and it is often left totally to districts to fund them.

What I don’t know is how the opt outs work in property tax rich districts in SD. In Wisconsin, property tax rich districts who opt out (we call it “going to referendum”) end up paying a good chunk of the referendum money to the state through reduced state aid. Does that happen in SD to property tax wealthy districts?

And I agree it is probably way past time to consider consolidating districts. That does not mean closing schools, but reducing the administrative overhead might have to be done. Good luck trying to do that, by the way.

Don,

I’m not arguing anything more than trying to get apples to oranges.

1) State Share: For example, State of New Jersey takes $10 from property taxes and sends $20 in state aid. SD takes nothing in property taxes but allows school district to have higher property taxes by $10. New Jersey looks like it is funding a higher percentage but in reality it is basically same pots.

2) % of funding: CH uses a source that measures all funding and says SD funds X% of the cost of education. Lee says it is 50% because he is looking at operational spending. Both are right and neither are “lying” as someone said.

3) Capital Spending: For the purposes of what CH is talking, I think capital spending should be separated.* For example, I live in the district spending the most per student in the state because in the last 15 years we have built a new high school, a new Jr. High, and 3 or 4 elementary schools (Prior to that we had a small high school, small middle school that is now another elementary, and a small elementary school) while there are districts that haven’t built a new building in generations. Makes apple to apple comparisons skewed.

* Again, I know that is local contribution to the cost. However, if the alternative was state funding, it would come with state control (can’t imagine open checkbook for anyone who wants a new school) and I think that would be unacceptable to the vast majority of South Dakotans. Its a different animal.

Regarding consolidation:

1) If Hoven wants to keep their high school and pay for it, why do those of us in Sioux Falls or Winner really care?

2) The cost of administration per student is less in Gettysburg than Sioux Falls. i’m not sure that consolidation has the budgetary impact everyone thinks it will. Size doesn’t always mean more efficient especially when the “product” is a service vs. a tangible product.

County seats in Brookings, Flandreau and Madison is ridiculous.

There may be a few property rich districts in the state that receive very little state aid due to the 54 – 46 scheme I mentioned earlier because they can raise enough locally to meet the per student amount. If they need more then they opt out like anyone else.

County seats in Philip and Kadoka equally dumb.

Ft. Pierre and its neighbor are county seats: how stupid is that?

This gives a nice overview of education spending: http://dakotafire.net/article/infographic-k-12-schools-get-money/

Direct link to the source of the information: http://febp.newamerica.net/background-analysis/school-finance

Troy,

Regarding your (2) and (3): Comparisons on a district basis versus on a statewide basis are different. Your examples regarding capital outlay involves differences in districts, but what we are discussing is comparison on a statewide basis. On a statewide basis those district differences average out, and thus you include all expenses in statistics such as expenditures per student. That’s how all of these statistics are reported. You seem to want to carve out a special exemption or make up a special statistic for the shirkers in SD state government.

Don,

If this is an argument that the state should pay a higher percentage of the operational costs of education, make that argument without gyrations which include comparing apples to oranges. I’m neither making an argument for or against it. Further, you’d be mistaken if you think I am not in support of greater state contribution (under certain conditions with regard to school management).

1) A state that gets revenue from property taxes and gives it back in state aid looks “better” in comparison to a state that doesn’t even though in reality the source of funding for education is essentially the same.

2) Unless this is an argument that this is about the State funding school construction (which I don’t think CH is asserting), including capital expenditure/bond issues skews the numbers. I do get that state-wide there is an averaging out but capital spending adds distortions and makes mean vs. median etc. relevant which I think distract from what I think is your central argument (more money for teachers).

Donald, rest assured the shirkers in state government will repeat all the arguments we’ve heard on this blog over the last few days, and even more that we have yet to dream up, in their effort to starve SD schools. Mr. Kurtz might be correct when he describes it as “red state collapse”.

Despite the efforts of any Blue Ribbon Panel, or maybe because of its efforts, the 2016 Legislature will fail to move SD out of last place in teacher salaries, young people will continue to move out of state for better paying opportunities, and our state will continue to dish out corporate welfare to businesses that would rather cry about not being able to find employees than increase the wages they pay to market rates.

Nick,

I know. I’ve heard it before from the best shirker of all, Bill Janklow. The shirkers want to compare apples to apples, except when statistics show them up to be shirkers. Then, with a straight face they try to invent another statistic, where they compare rotted cumquats to unicorn ova, and they expect us to swallow it.

Mainly, they want to feel as if they are being ever so magnanimous while maintaining their last in the nation status in supporting students. Troy’s trick is the trick the Republicans have always pulled: they shrink the argument down to “operating expenses,” when no one, absolutely no one else in the entire world does that. But if other states did that SD would sit at a little under 50% and other states would be at or over 100%. So, Troy and Lee lose no matter what phony statistic they concoct.

Nick,

Its always a pleasure to go someplace and get greeted with an accusation one has nefarious intentions to “starve our schools” without regard to even considering what one actually said and their true intentions.

Don,

The only statistic I think is relevant is how much a school district contributes to the cost of educating a child and what the State contributes. If a local school district has bloated administration or wants to build a football stadium that rivals that of a college (as Harrisburg did) is a matters for local voters to discern priorities. If that information is as you assert (under 50%) show me.

If people believe supplementary information is a comparison of other states, I just want that information normalized for differences with regard to “state share” in other states which comes from property taxes. To not normalize just makes it easy to confuse the primary issue- what is the correct mix.

Finally, the accusation of being motivated as a shirker is ridiculous.

1) I live in probably the highest education taxed district in the state. I have voted for every opt-out and bond issue in my district except for the construction of what I think is an over-the-top football stadium.

2) I was raised by a single school teacher mother and both my daughters in the workforce are educators.

3) When my children had the option, I’ve never sent my kids to public schools and relieved the local and state taxpayer of the cost of educating my kids. Yet, I’m willing to pay higher local and state taxes for education even though I know it will put more pressure on me and my faith community for greater donations for our private school system.

As I said in the beginning, what I haven’t decided on what the right mix should be with regard to State/Local mix on dollars to educate a child. I don’t want it skewed by expenditures for capital (local control it in bond issue/opt out votes). I don’t want it confused by attempts to compare it to other States where “state share” is inflated because the State gets a portion of its revenue from property taxes.

Weren’t the public schools good enough for your kids, Mr. Jones? They were good enough for my granddaughter and she’s sharp as a whip and makes more money than I ever could have imagined.

… kids and spouses???

So Schoenbeck going to save the funding .Right hah hah hah.

I am not sure but I think I like how this discussion has turned into an argument about where the money comes from that goes to school districts for them to spend on whatever they want. Instead of arguing about how much the fatcat administrators get and all the free parking spaces and frivolous buildings the concern is now how much of the money comes from where.

Let me tell you, Jack. It all comes from the taxpayers. Federal, state, local taxpayers. Pretty much that means it all comes out of your and my pocket one way or another.

Do you think maybe you should go back to arguing about how much should come out of your pocket to feed the school district monsters so the school boards can pay the fatcats more and stiff the good teachers in your district?

Troy,

I will not disagree that the difference of funding may be state based property tax added and allows the other states to do more of the funding obligation; however, that claim feels a little dubious to me and I would like to see some evidence on the issue, if possible.

I also don’t think that was where Schoenbeck was getting his 50% number. It felt like he was using the “50% of state budget goes to education” claim. That has been a commonly used claim to justify why there can’t be additional funds. The problem is that when revenue is not collected, it could be 75% of the funds and still be less in its total contribution of the education funding.

The issue of funding for building and capital choices (a football field, computers for every student) should be left to the local district and the use of property taxes is justifiable in my opinion. The problem is that minimum state contributions are forcing schools to go to the property taxes for other things like general funding to pay for teacher’s or programs like art, music, debate, and other educational offerings.

Grudz, that is just another excuse not to do anything. I know that some administrators are paid more than they are worth. That will happen with any business group or organizational group. The reality is that for most administrators, they have a heavy burden and work load and must manage an organization that is some of the biggest businesses in the state. How much money do you think the CEO of Citibank makes or even the Sioux Falls branch manager. How about Premier Bank?

The average in 2009 was $65,000. I know the bigger districts got much more than the smaller schools, but they have more people to manage. Don’t get caught up in that old excuse of blame shifting to administrator pay.

http://www.keloland.com/newsdetail.cfm/are-school-administrators-making-too-much/?id=111486

“Vik says he’s heard some lawmakers quote a statistic that South Dakota ranks in the mid-20’s in the nation for administrative pay, but a document from the Bureau of Labor Statistics says otherwise. It shows the annual mean wage for elementary and secondary administrators in 2009. South Dakota is ranked 48th at $65,590. The ranking is 47th, if you don’t count Washington, D.C., which Sioux Falls does not.”

Mr. Vik is a fatcat administrator. Of course he’s protecting his huge pay. Is there a website that tells us his pay like the Argus had the pay of the new Homan replacement?

New superintendent in Sioux Falls gets $220,00 a year I believe plus $750 a month car expense.

“Weren’t the public schools good enough for your kids, Mr. Jones? They were good enough for my granddaughter and she’s sharp as a whip and makes more money than I ever could have imagined.”

Glad to hear that Grud. Must have gotten that from your wife. Just proves that those whining teachers still do a profession job and do more with less.

Something stinks bad in SDs education system. MNs superintendents don’t even make $220,000/yr. Of course, MN has the ethics thing going on where they want their public funds going to teacher salaries instead of the fat cat administrators. Boy, the Sioux Falls school district must think they’re really special to pay their Superintendent $220,000. But as always, MN students are number one in the nation for test scores. Take a lesson from MN in how on how to win in education. SDs educ system will continue to go downhill with trying to fill teacher jobs, and the students will continue to suffer because of it.

http://minnesota.publicradio.org/features/2009/09/16-superintendent-pay/table.html

Troy, take offense if you wish but taking offense doesn’t solve the problem. We are fast reaching a crisis point here in SD, many teaching positions are going unfilled, there aren’t enough students in the teacher education pipeline to fill the current shortage let alone replace the teachers who will be retiring in the next ten years. For years the legislature has refused to address the problem, Governor Dennis Daugaard in 2011 actually reduced school funding and actually exacerbated the problem. It’s now too late to throw the car in reverse and avoid the cliff. So yeah what other logical explanation is there than an effort to starve the schools.

Until South Dakota abandons it’s “low wage state” policies our problems will persist. State government and the policies promoted by the Republican majority have caused a severe shortage of employees in all occupations, including teachers. Maybe someday someone will realize market forces always win, labor is a commodity, and commodities always end up being purchased by the highest bidder.

All the excuses we’ve read on this blog and others we have, or at least I have, yet to hear will be trotted out as reasons not to increase school funding. The Governor will fail to lead, the legislature will fail to legislate, excuses will be made, statistics will be shuffled, and South Dakota teachers will remain last in pay. At some point in the future student test scores will begin to drop and we’ll blame the teachers and our failed schools.

I never understood folks who criticized administrative salaries. Yeah, they are high, but school districts are big and complex organizations.

In most jurisdictions the school district employs the most people in that jurisdiction. Even in the big cities with their big hospital complexes and air bases, and banking institutions, the school district is one of the biggest enterprises in town. The Sioux Falls district is about the fourth or fifth largest employer in the city and I would bet it would crack the top ten in the state. In Rapid City, the school district is probably the second or third largest employer in the city.

Districts manage and maintain the largest amount of buildings and grounds in most jurisdictions. Districts that bus students probably have the biggest fleet of vehicles in their districts. Districts are providing direct services to students and parents, somewhere between a third to a half of the population of the district, and shaping the lives of many, many more. Running a school district takes someone with broad experience, knowledge and skill. You bet someone who does that is going to make big bucks, and they should.

http://extra.twincities.com/car/schoolsalaries/default.aspx

MN never has closed records either. Open salary records is what the voters deserve in knowing where exactly their tax money is going!! No hidden or missing records going on like SD govt

I checked a website and the administrator salaries seem to be not too far off from most of South Dakota’s administrators. Sioux Falls seems to be an outlier.

One political party’s obsession with smaller government needs to be scorned and ridiculed whenever these problems are discussed. Their goal is privatization. Too much suffering is swept under the rug of complacency by milquetoast liberals!

Isn’t it interesting though, Donald, that Twin Cities superintendents are making less than the Sioux Falls Superintendent? Trust me, MNs educational system knows their neighbor to the west is notoriously last in teacher wages, but yet the Superintendent is making more than MNs? Where is the social justice? I agree Superintendents should be paid decently, but when jobs can’t be filled because of piddly wages, man, something seriously is wrong.

I am not sure where this thinking that Minnesota Superintendents of schools the same size as Sioux Falls are getting paid so much less than Sioux Falls. Rochester is a town of about 100,000 people with a large immigrant/refugee population and a mix of affluent student base. The salary for the Rochester superintendent this year will be just over $200,000. They have about 6,000 fewer students in the district (three high schools though). The Rosemont-Apple Valley-Eagan school district in Minnesota has about the same size as Sioux Falls and will be making $200,000.

I am starting to sound like Troy, but we must be careful of making assertions without making sure they are equal.

Jenny, I agree that wages should go up, but focusing on Superintendents salaries alone is not a solution to the problem.

Just embarrassing.

I made some calls and it turns out that young Mr. Vik makes like $150K a year. That’s insaner than most. That the Democratic Party would hide their new ruler makes me think they are probably making some backroom deals that hide the money paid to this new ruler so it looks like she gets $15.50, well above the new minimum wage. I’m just sayin…

(this is why my good friend Bill eschews the new rulers of the libbie party)

MJL, doesn’t Sioux Falls have a growing immigrant refugee base also? And what does that have to do with Superintendent pay?

Douglas County is a school district taken over by the conservatives (Tea Party). The teacher’s union is now powerless and teachers are quitting which feeds the conservatives privatization agenda. It’s a sad thing to see.

– News

New Douglas County school superintendent’s salary raises the bar during tough times

Douglas County Colorado’s new superintendent will be Colorado’s highest-paid public-school executive — and entering a district that has cut 168 teaching positions, has frozen wages and will charge for bus service.

Elizabeth Celania-Fagen, from Tucson Unified School District, starts July 1, earning a compensation of $280,350, including retirement benefits.

The compensation eclipses the previous high held by Cherry Creek’s Mary Chesley, whose total annual compensation of $263,100 includes retirement benefits and a $9,000 car allowance.

Aurora’s John Barry earns $261,292 a year, including retirement benefits.

“The salary is in line with the demands of this position,” said Douglas County spokeswoman Susan Meek. “The district has gone through some severe fiscal challenges. In order to maintain our level of performance, we need to have the best candidate in that position.”

Limit to one school district per county and cut the number of counties by 2/3 and the universities to 3. Wyoming has roughly a similar territory and rural population as does South Dakota. Yet Wyoming effective and efficiently governs through 23 counties with one school district per county and one state university with a few feeder junior colleges. South Dakota republicans – its long past time to start ACTING like fiscal conservatives.

County seats in Belle Fourche, Sturgis and Deadwood? Watertown and Hayti? WTF?

Tax the agricultural multi-millionaires and pay the teachers and administrators and janitors and lunch workers what they deserve. Fiscal Conservative is just a buzz phrase for selfish greed monger.

Porter, do administrators deserve to be paid 24th in the nation while teachers are 51st?

Both careers deserve to be paid the best in the nation. Don’t you agree, Ms. Voleski? Every thing that’s wrong with South Dakota can and must be blamed loudly on the small gov’t policies of the conservative SOW’s (selfish overprivileged whites). They’re why students leave, no one moves in and why wages are substandard. Pick a problem and it’s the conservative politicians fault. When will the oppressed stand for their right to a well funded lifestyle? Hmm?

There is no occupation deserving of less than the other. All occupations are on the low end of the scale in SD and most of the graduates will enter those other occupations.

County seats in Murdo and Kennebec? Miller and Highmore? Why?

Wessington Springs and Woosocket? Whose insane idea is that?

Woonsocket and Huron? WTH?

County seats in Howard and Madison and a four-year college when a community college would be sufficient? Ridiculous!

Armour and Plankinton? Winner and Burke?

Sisseton, Britton and Webster?

Mr. Kurtz

Your plans to make government smaller is the problem. There’s plenty of funds to have county seats where they are. Consolidating would cost more for law enforcement, judicial services, Social Services, treasury expenses and remove local pride from liberals already beat down enough by conservative bullying. Do you know why Republican lobsters don’t share? … because they’re shellfish.

Bullshit, Mr. Lansing. Wyoming has 25 counties and one regental university for about 600,000 residents.

Your comparison is without validity. SoDak is an agricultural state and Wyoming is an oil and gas state. I know because I worked the patch as a roughneck in the ’70s. Texas has 254 counties and even they wouldn’t consolidate. It would be cheaper and more efficient if The Dakotas were given to Minnesota to rule??? Your idea is the bullshit, cowboy.

New Mexico has 33 counties for a little over 2 million residents.

South Dakota liberals will give no quarter and not reduce it’s government one worker so selfish corporate millionaires can have another tax break. Too much shoulder shrugging and “I guess that’s just the way it is here.” thinking has led to these dismal undervalued wages. Pay your share, SOWS. What did the buffalo say to his boy moving away for a job opportunity? … Bison

Consolidating County Seats might sound like a nice way to save money, but what is the true cost? The county building is often the central hub of a community and where the county serves the citizens.

Can you imagine the burden placed upon residents if Sisseton closed their facility and consolidated with Watertown? So now instead of walking or driving a few blocks East from Main street to pick up a copy of a birth certificate, or to file for a marriage license, or to register to vote, or to appeal a real estate valuation, or to pay the sales taxes and registration fees for a new vehicle, or to show up on time for jury duty… the person has to take half a day off of work and spend two hours in the vehicle to travel to Watertown to do their business?

Seems to me that is one sure fire way to separate the classes. Those who have the ability to take time off of work and who have the financial ability to travel to and from a facility 60 miles away can receive government services. Those who don’t have the luxury of vacation time or discretionary income are just out of luck.

Brilliant solution – but only if we forget that the government exists to serve all of the people… not just those who can afford it. We have plenty of inequality in government, so let’s not think we improve things by ratcheting it up a notch.

Hear, hear, Craig. You’ve hit the nail on the sweet spot. Smaller gov’t is subterfuge to separate the classes/races for nefarious benefit to the conservative greed merchants.it’s not about saving money. It’s about the wealthy not paying what they owe for the opportunities gov’t provides them.

The liberal but agricultural State of Oregon has 36 counties…should i go on?

Larry Kurtz is right, we have way too many counties. We need to regionalize into far less regions in our state to be cost effective. I am sure this will not be a popular solution with some but you have too change with the times. Our rural schools need to do some consolidation to be more efficient and free up teachers and money for higher salaries.

Larry Kurtz is wrong. Changing with the times means progressing towards better for all not shrinking to aid those already doing the best. LWIY …. (last word is your’s) with all due respect.

How about leaving those rural areas who pay their own personal way through property tax and opt outs, alone, Greg.

That sucking sound you would hear is those consolidation savings going straight into the revenuer’s pocket in Pierre.

Kurtz for Governor. The Republicans have bloated state government by hiring more Republicans.

I can already here the cries of liberals when it comes to long distances for voting because counties are combined.

Tara: living in Pierre is a fate worse than prohibition and a GOP South Dakota legislature would gerrymander new counties without looking back.