WalletHub ranks the states for dependence on federal government funding and jobs. In our region, Minnesota and Nebraska are the least dependent on Uncle Sam, ranking 4th and 9th, respectively, for paying their own way. South Dakota ranks 42nd, with only Montana (46th) more dependent on federal money. Here’s the full chart for all 50 states:

| Rank (1 = least dependent) | State Name | Return on Taxpayer Investment (Category Rank) | Federal Funding as % of State Revenue (Category Rank) | Federal Employees Per Capita (Category Rank) | Number of Civilian Non-Defense Federal Employees per Capita (Category Rank) |

|---|---|---|---|---|---|

| 1 | New Jersey | $0.48 (4) |

26.87% (10) |

0.00382 (5) |

0.00178 (2) |

| 2 | Delaware | $0.31 (1) |

25.61% (7) |

0.00768 (17) |

0.00194 (3) |

| 3 | Illinois | $0.45 (3) |

26.41% (8) |

0.00550 (14) |

0.00272 (11) |

| 4 | Minnesota | $0.54 (7) |

26.88% (11) |

0.00353 (4) |

0.00295 (16) |

| 5 | Kansas | $0.54 (6) |

25.22% (6) |

0.01460 (37) |

0.00342 (25) |

| 6 | California | $0.68 (13) |

26.44% (9) |

0.00886 (24) |

0.00279 (12) |

| 7 | Connecticut | $1.04 (30) |

23.43% (4) |

0.00442 (8) |

0.00175 (1) |

| 8 | Massachusetts | $0.74 (16) |

29.68% (17) |

0.00490 (11) |

0.00335 (22) |

| 9 | Nebraska | $0.41 (2) |

32.71% (24) |

0.00917 (26) |

0.00356 (26) |

| 10 | Ohio | $0.51 (5) |

34.64% (34) |

0.00513 (12) |

0.00231 (6) |

| 11 | New Hampshire | $0.81 (21) |

30.71% (20) |

0.00441 (7) |

0.00283 (14) |

| 12 | Iowa | $0.85 (24) |

32.33% (22) |

0.00304 (2) |

0.00246 (10) |

| 13 | Arkansas | $0.62 (10) |

33.07% (25) |

0.00681 (16) |

0.00359 (27) |

| 14 | Colorado | $0.64 (11) |

28.14% (14) |

0.01489 (38) |

0.00537 (40) |

| 15 | Utah | $0.66 (12) |

29.06% (16) |

0.01166 (33) |

0.00526 (39) |

| T-16 | Michigan | $0.89 (27) |

33.14% (26) |

0.00326 (3) |

0.00205 (4) |

| T-16 | Nevada | $0.86 (25) |

27.01% (12) |

0.00866 (22) |

0.00364 (30) |

| 18 | Wisconsin | $1.79 (41) |

28.59% (15) |

0.00296 (1) |

0.00236 (7) |

| 19 | Washington | $0.75 (17) |

28.12% (13) |

0.01756 (44) |

0.00401 (31) |

| 20 | New York | $0.58 (9) |

43.39% (49) |

0.00469 (9) |

0.00286 (15) |

| 21 | Rhode Island | $0.75 (18) |

34.18% (31) |

0.01033 (30) |

0.00280 (13) |

| T-22 | Alaska | $0.96 (28) |

22.43% (3) |

0.04829 (49) |

0.00987 (49) |

| T-22 | Pennsylvania | $1.41 (37) |

30.70% (19) |

0.00544 (13) |

0.00332 (21) |

| 24 | Texas | $0.79 (19) |

33.28% (29) |

0.01033 (29) |

0.00361 (29) |

| 25 | Virginia | $1.27 (34) |

24.21% (5) |

0.03402 (48) |

0.00663 (41) |

| 26 | Hawaii | $1.46 (38) |

21.54% (2) |

0.05437 (50) |

0.00446 (35) |

| 27 | Oregon | $0.85 (23) |

35.05% (36) |

0.00553 (15) |

0.00441 (34) |

| 28 | Oklahoma | $0.72 (15) |

34.42% (32) |

0.01592 (42) |

0.00411 (32) |

| 29 | Indiana | $1.81 (42) |

33.64% (30) |

0.00390 (6) |

0.00213 (5) |

| 30 | North Carolina | $0.88 (26) |

33.15% (27) |

0.01639 (43) |

0.00237 (8) |

| 31 | Vermont | $1.06 (31) |

33.22% (28) |

0.00783 (19) |

0.00679 (43) |

| 32 | Florida | $2.02 (44) |

31.96% (21) |

0.00805 (20) |

0.00312 (18) |

| T-33 | Idaho | $1.17 (32) |

34.62% (33) |

0.00780 (18) |

0.00453 (36) |

| T-33 | Maryland | $1.02 (29) |

29.69% (18) |

0.02787 (47) |

0.01519 (50) |

| 35 | North Dakota | $3.83 (49) |

19.51% (1) |

0.01945 (46) |

0.00668 (42) |

| 36 | Wyoming | $0.55 (8) |

39.11% (44) |

0.01568 (41) |

0.00818 (45) |

| 37 | Georgia | $0.69 (14) |

38.08% (43) |

0.01526 (39) |

0.00432 (33) |

| 38 | Missouri | $0.83 (22) |

39.37% (45) |

0.00930 (27) |

0.00512 (38) |

| 39 | Tennessee | $1.30 (35) |

39.78% (46) |

0.00478 (10) |

0.00337 (23) |

| 40 | South Carolina | $5.38 (50) |

32.50% (23) |

0.01274 (34) |

0.00242 (9) |

| 41 | Maine | $1.58 (40) |

35.42% (38) |

0.00873 (23) |

0.00304 (17) |

| 42 | South Dakota | $0.80 (20) |

39.78% (47) |

0.01442 (36) |

0.00869 (46) |

| 43 | Louisiana | $1.37 (36) |

42.21% (48) |

0.00840 (21) |

0.00315 (19) |

| 44 | Arizona | $1.47 (39) |

36.26% (39) |

0.00934 (28) |

0.00495 (37) |

| 45 | West Virginia | $1.91 (43) |

34.91% (35) |

0.00891 (25) |

0.00766 (44) |

| 46 | Montana | $1.24 (33) |

37.49% (41) |

0.01351 (35) |

0.00874 (47) |

| 47 | Alabama | $2.46 (48) |

36.64% (40) |

0.01036 (31) |

0.00319 (20) |

| 48 | Kentucky | $2.18 (45) |

35.26% (37) |

0.01538 (40) |

0.00361 (28) |

| 49 | Mississippi | $2.34 (47) |

43.68% (50) |

0.01061 (32) |

0.00341 (24) |

| 50 | New Mexico | $2.19 (46) |

37.89% (42) |

0.01850 (45) |

0.00903 (48) |

| State Name | Return on Taxpayer Investment (Category Rank) | Federal Funding as % of State Revenue (Category Rank) | Federal Employees Per Capita (Category Rank) | Number of Civilian Non-Defense Federal Employees per Capita (Category Rank) |

Worth noting is WalletHub’s calculation that South Dakota only gets 80 cents back for every dollar it pays in federal income taxes. (Minnesotans get 54 cents back on each federal tax dollar they pay.) We’re #20 out of 28 states paying in more than they get back. That’s an anomaly among the bottom ten moocher states, which generally get back more than they pay in. That’s also a diversion from a previous Tax Foundation report that calculated that, from 1981 to 2005, South Dakota received $1.25 to $1.58 in federal funding for every dollar it paid in federal taxes.

Our worst category for dependence is our state budget. WalletHub shows federal dollars making up 39.78% of our state budget. Only Louisiana, New York, and Mississippi get a larger portion of their state budget from Washington, D.C.

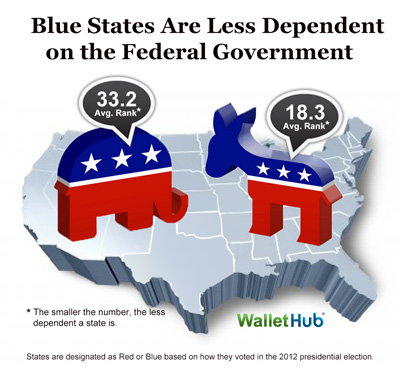

Nationwide, WalletHub finds continuing support for the red-state moocher thesis. WalletHub’s numbers show that states that voted Republican in 2012 tend to be more dependent on the federal government. The average rank for Romney-voting states is 33.2, while the average rank for Obama-voting states is 18.3 (and remember: smaller numbers mean less dependence). Economics professor David C. Parsley, one of the experts WalletHub consulted on this analysis, notes that this red-state-dependence pattern persists through the 2000, 2004, and 2008 elections.

“We have always balanced our state budget!” “That darn Federal Government!”

Alaska always balanced their budget until wingnuts decided Big Awl needed more tax breaks and gave the companies about 2 billion in royalties back each year. Now Alaska is looking at it’s first income tax ever-15% because wingnuts weren’t smart enough to see that giving revenues away would shrink revenues in the treasury. Silly wingnuts.

Meanwhile that dagblasted liberal socialistic repressive bad for business state Minnesota which is ranked #4 in being the least dependent on federal funding and just happens to be ranked a terrible # 48 according to ALEC has to help pay for it’s neighbor to the west Red state South Dakota so it can balance it’s budget.

South Dakota’s budget this year is around $4.3 billion. Over half comes from the federal government. This years South Dakota legislature passed a resolution calling for a balanced budget amendment to the US Constitution. I not sure that they thought this through.

Mike Rounds, John Thune, Kristi Noem and Dennis Daugaard…welfare queens driving Cadillacs.

I think the Feds should do to poor states what Kansas just did to limit what people receiving SNAP can do in their state…no more ‘luxuries.’

Mike, John and Kristi…no more franking privileges. Greyhound buses will get you home to raise more money than you need so no more commercial airlines for you. Until you can have the personal responsibility to fund your state, you should have to clean your own offices and work in the lunch line in the Capital.

Dennis, you live in subsidized housing and have your healthcare paid for by the taxpayers…seriously?!?!? Wait!…What!…You have a driver and your own body guards? Does maid, lawn and snow service come with that? Yep!

You all bow down to the fiscally irresponsible “balance the federal budget” crowd while pushing for another unfunded war in the Middle East.

You’re all pandering ‘Scolds’ when it comes to money for healthcare, food and safety nets for those not as fortunate as your campaign donors, yet become blind, deaf and mute when it comes to spending billions on an F-35 that the military doesn’t want and subsidies for your friends.

Each one of you should have the honest courage to tell South Dakotans what ‘luxuries’ they need to give up to stop the citizens of South Dakota being branded as welfare recipients.

So what will it take for SD to stop being a welfare queen?

That’s a good question for Michaels, Mickelson, Jackley and the whole of the legislature!

What part of colonization and apartheid escapes you, Cory?

http://www.abqjournal.com/561955/biz/nm-no-1-in-dependency-on-federal-funds.html

Statehood for…oh, you know the rest….

Paul said: “This years South Dakota legislature passed a resolution calling for a balanced budget amendment to the US Constitution. I not sure that they thought this through.”

They think some things through?

They think?

Every week we liberals reach into our paychecks and dole out to pay for the conservative largesse across USA. We don’t complain or demand a federal tax on these “moochers” to pay us back. BUT, when we propose a pittance to help the poor, elderly and disabled we’re met with the divisive term “entitlements”. Well conservatives, USA citizens are entitled to a police force, public schools, roads and bridges, a modestly funded military, a small check each month for those to old or frail to work and now affordable health care insurance. Entitlements are why we pay taxes not to overfund a military that’s not even fought an enemy possessing an airplane in decades. It’s time for these Republican states to belly up and pay their fair share and realize that their selfish overpriviliged lifestyles are paid for by liberals.

Does South Dakota fall in the ranks of the welfare cheats and abusers?

People having children so that they can claim them as tax deductions and receive a tax refund?

Some view those who receive public assistance as horrible people, so when South Dakota receives more benefits then what we pay to the feds, is our state government, and citizens being horrible lazy people?

If we did pass a “Balanced Budget” amendment and Federal monies became scarce South Dakota could not compete for any of those funds with one member of Congress vs. California, Texas, Florida and New York with tens of members. How many people in Florida think Ellsworth AFB is vital to American defense? Who in California thinks the Spearfish fish hatchery counts for a hill of beans in this crazy mixed up world?

It is time to recognize that our Nation will always be able to pay its bills. Most American are in debt. Most corporations are in debt. The real question to ask is America getting value for the dollars it spends? Are people getting value for the money they borrowed. Are corporations making the right call when they invest borrowed money on new production facilities or workers?

Are we spending our money in South Dakota on the right priorities?

It gets real simple real fast. Wingnut control-fiscal and personal responsible get tossed with the baptismal water.

“Facts are stubborn things; and whatever may be our wishes, our inclinations, or the dictates of our passions, they cannot alter the state of facts and evidence.” – John Adams

Fact: The Federal income tax is a direct tax. (Pollock v Farmers Loan Trust). The US Constitution requires that all direct taxes be apportioned (Art I, Sec 9, Clause 4 and Art I, Sec 2, Clause 3). However the 16th Amendment making the income tax constitutional, explicitly exempts the income tax from this requirement. “The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

Fact: Apportioning an income tax by population is impossible since the tax base is uneven per capita among the states. With apportionment, the tax rates would have to be higher in poorer states or in states with a smaller population but that would be in violation of the Constitution. The Uniformity Clause states, “… but all Duties, Imposts and Excises shall be uniform throughout the United States.”

Fact: The population of South Dakota is 816,463, not even .3% of the US population of 309M. Because of South Dakota’s small size, under apportionment we would have to provide $5B of the of the $1.7T of the total Federal income tax revenue. Instead we are in the $327M range. Is it no wonder we receive more in Federal benefits than the bigger and richer states? It’s the nature of the beast.

I agree with you 100%, DC. Doesn’t mean the non thinkers with the constitutional amendment talk, those with their hand out have any concept.

Farm subs, alcohol subs, road subs, eb5 subs, ed subs but no Medicaid subs.

I love it when Don comes and shouts “FACT!” thinking it makes him sound smarter. Shouting “FACT!” does not, however, change the fact that he is once again trying to drag the conversation where he prefers instead of intelligently addressing the topic offered. South Dakota is dependent on the federal government, more so than most other states. Don’s anti-federal government “philosophy” would destroy this state’s economy if enacted. (I’d write “FACT!” in front of each of my sentences, but I don’t need to.)

Jeff Barth is spot on. Debt is not a bad thing as it makes the world go around. Without debt, why the hell would you get up in the morning. The problem is if we are spending it correctly, why on earth do we need to keep giving money to Israel to help complete its genocide against the Palestenians for one, the other would be the military industrial complex budget in its entirety.