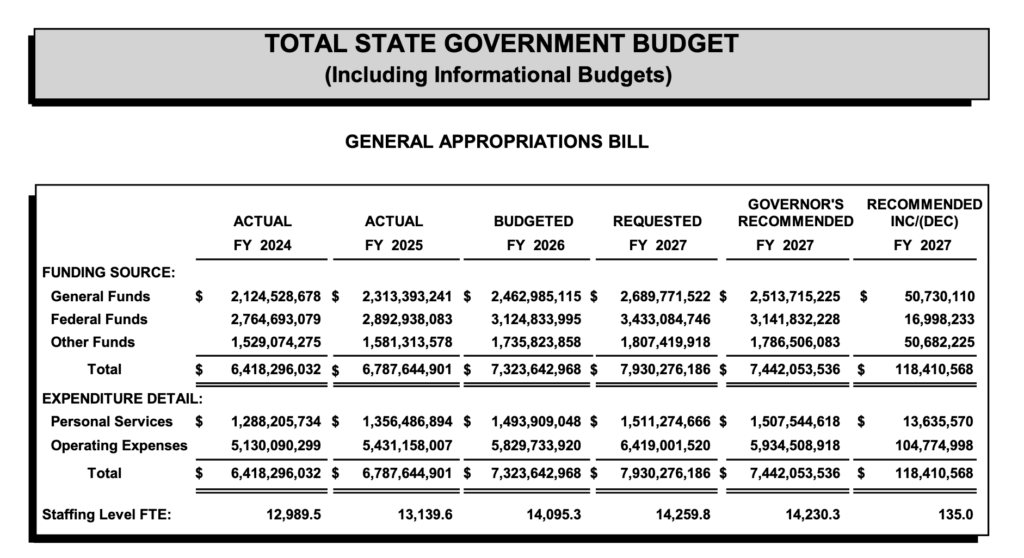

Governor Larry Rhoden continues his predecessor Kristi Noem’s tradition of keeping South Dakota dependent on the federal government. Rhoden’s budget proposal for Fiscal Year 2027 relies on federal dollars to cover 42.2% of South Dakota’s general appropriations:

Rhoden’s 42.2% is a slight decline from the 42.7% that Uncle Sam is providing for this year’s state budget. However, like every Noem-Rhoden budget, the FY 2027 proposal relies on the federal government to provide more dollars than South Dakotans (and visitors paying sales tax!) pay into the state general fund. State general funds haven’t exceeded federal handouts since FY2019, the last budget of the truly conservative Dennis Daugaard.

A collapse of the agriculture sector, $650 million plus cost overruns for a prison, $240 million plus cost overruns for the Platte-Winner Bridge rebuild, $150M plus cost overruns for a Capitol remodel and at least $2 billion for a boondoggle West River water pipeline but just a $65 million surplus, the end of property taxes and TIFs galore? How are 66 county seats and their bureaucracies either conservative or sustainable? They’re not; but, it is the way Republican cronyism and patronage built barricades to democracy by providing benefits of the public dole to those who say they deplore big gubmint in a state that hates poor people. South Dakota Democrats need to run on a corporate income tax, ending video lootery and reducing the number of South Dakota counties to 25.

Larry, I would love to see the counties go to 25. It would be like a gigantic male refractory period for the state. Shrinkage of the tiny country seats would follow. It will be a scramble, sad but seemingly necessary.

Hear hear. grudznick’s close personal friend Lar is championing a great cause to reduce the count of counties to 25. However, the Democratic Fellows in South Dakota need to run on only 2 things; reducing the number of counties in South Dakota to 25, and curing Cannabinoid hyperemesis syndrome, or as the young people call it, scromiting.

When the Republicans speak of Civil War 2.0 or succession, I come back to this issue and wonder who they will get to to pay the bills if all of the US becomes Red-state moochers?

Does this qualify SD as a “welfare queen?”

Alcohol withdrawal syndrome (AWS) in chronic heavy drinkers features severe nausea, vomiting, and abdominal pain similar to scromiting (cannabis hyperemesis syndrome, CHS), often triggered by stopping or reducing intake after prolonged use.

AWS affects a broad range of heavy drinkers upon cessation, unlike CHS which occurs during ongoing cannabis use; both can send users to emergency care but AWS risks seizures or delirium tremens. Treatment for AWS parallels CHS short-term care with fluids and anti-nausea meds, but long-term requires abstinence.

The gov. Larry needs to install tariffs immediately. There is no reason that towns and cities should not be able to tariff one another and, if one gets lippy, put another 10% on them. See, in red states no one knows that a tariff is a tax so no one gets hurt. Ask Krusty NOem, she knows all the ways.

I’m not a Republican but I do miss Governor Daugaard. He seems like a saint after Noem and Rhoden. He wasn’t shady like Rounds, and he certainly drove slower than Janklow.

How do we compare to our bordering states for dependency on the feds?

That’s a complicated question, VM. I haven’t dug into other state budgets. I’ll look around.

The federal government does offer USASpending.gov, which allows us to look up federal expenditures by federal fiscal year (Oct 1–Sep 30) and location of spending. I’m not sure how to limit the search to federal spending directed toward state budgets (rather than grants to non-profits, normal federal agency expenditures, etc.). But when I search for all federal expenditures by place of performance in each state over the last five fiscal years, FY 2021–FY2025, I find the federal government doesn’t spend nearly as much per capita in South Dakota as it does in Minnesota and North Dakota:

That’s federal spending per person over five years.

Ah! Here we go: the National Association of State Budget Officers produced this report on state expenditures for Fiscal Years 2022–2024.

Nationwide, in FY 2024, federal expenditures made up 34.2% of state budgets, down from a covid peak of 40.8% in FY 2021.

In FY2024, NASBO estimates the federal share of South Dakota’s budget was 42.97%, the fourth-highest in the nation, behind Louisiana, Mississippi, and Indiana. Our neighbors depended on Uncle Sam for less of their budgets:

Your earlier comparison (for FY 2024) had South Dakota at ~ 42.97% federal share of its budget.

• By contrast, Colorado’s share — in the ~ 30% range — is significantly lower than South Dakota’s (and lower than many of your other small-population/rural-heavy states).

• In other words: Colorado depends less on federal transfers (as a % of its total state budget) than states like South Dakota or Montana — even though federal funds still constitute a large and important slice.

⸻

Why exact comparison is tricky.

• States define and organize their budgets differently (general funds, cash funds, appropriations, pass-throughs, local vs state, re-appropriated funds, etc.). Because of that, “federal share” for one state may not map 1:1 to “federal share” for another.

• Some services are funded directly by the feds (e.g. Medicaid reimbursements, education subsidies, highway funds), others via pass-throughs to local governments — which may muddy comparisons.

• For Colorado specifically, there’s a structural constraint under the Taxpayer’s Bill of Rights (TABOR) that limits state-level tax revenue growth. This has historically made the state more reliant on “non-general fund” revenues (cash funds, fees, federal funds) for many services.