The Legislature’s Government Operations and Audit Committee meets this Thursday. Among the documents on their agenda is the 2019 report of the Obligation Recovery Center, the state’s relatively young debt collection program. We contract with Québec-based international informaticiens CGI to make all those calls and send all those letters trying to get folks to pay their outstanding state bills.

In Fiscal Year 2019, CGI and its third-party collectors spent $650K, just a bit more than 90% of what we budgeted to them, to recover $3.42 million in outstanding debts. That’s close to the $3.47 million collected in FY2018 and up from $1.81 million in the program’s inaugural year of operations, FY2017.

CGI and other collectors also secured $10.26 million worth of payment plans.

Getting that $3.42 million in hand and $10.26 million in the chute required sending 73,352 letters sent, making 41,273 calls, and taking 40,212 calls. It also required withholding or suspending 3,150 driver’s licenses, 3,165 motor vehicle registrations, and 18,456 hunting or fishing licenses. Those enforcement actions are down from the first two years, particularly the hunting and fishing license suspensions: ORC hit 40,655 such licenses in FY2017 and 23,638 in FY2018.

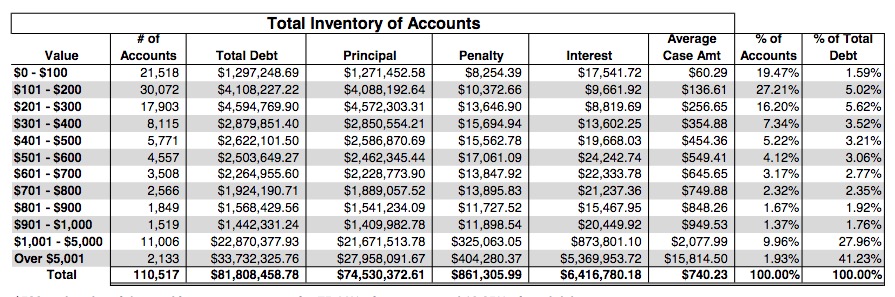

The state’s debt collectors aren’t running out of work to do. There are still over 110,000 outstanding accounts owing South Dakota $81.8 million:

South Dakotans hold 76% of those accounts and 70% of that debt.

A third of the total owed our fair state sits in accounts that have been delinquent for ten years or more.

Is there a breakdown by category of the money owed? Is it unpaid traffic tickets, uncollected child support, fines for criminal offenses, I am sure there are others.

Gonna need all the money we can muster. We are in deep doo doo with a crappy economy that is failing daily.

“U.S. corporate debt is now at an all-time high of over 45% of GDP, which is even worse than the levels reached during the Dot-com bubble and U.S. housing and credit bubble”

Nick asks a good question. Without knowing the nature of the debts owed, as well as the circumstances of the debtor, it is difficult to assess the value of the collection program. In addition, it would be helpful to learn the method of collection – voluntary payment after a demand letter, civil judgment collections, wage garnishment, other?

Taking what minimal resources a debtor has left or garnishing his or her wages can cost the county or state more in the long run than the value of those resources or wages. For example wage garnishment can lead to an inability to pay rent or mortage followed by eviction, inability to afford child care, loss of job, loss of insurance, and ultimate dependence on state and county programs for survival as well as medical expenses, in addition to the human cost to the debtor and his or her family.

Nick, the 2019 annual report does break down collections by agency. Top recipients of old debts from ORC (and appropriate acronym for debt collectors):

NSU is at $99K; Social Services is only $63K; every other named agency is five figures or less. At the bottom, Veterans Affairs recouped $281.86.

How much did the state lose in licensing fees for autos, hunting and fishing fees? Let’s see the true costs of collecting debts from people that can’t pay versus those who can and choose not to.

Is this a good time to complain about tariff’s and trade wars and how much it takes away from South Dakota state coffers?

“Despite repeated assurances from Trump administration officials that U.S. consumers are not bearing the brunt of its tariffs on China, a new JPMorgan analysis predicts that the average American family will shoulder $1,000 per year.

According to CNBC, the firm estimates that the administration’s newest round of tariffs ― 10% on $300 billion of Chinese goods ― will result in a $400 increase in costs per household. Roughly half of the new tariffs are due to take effect on Sept. 1 and the other half are set for Dec. 15. The Chinese tariffs already in place are expected to cost the average household $600 per year.”

In total, the impact of tariffs are predicted to effectively wipe out tax breaks from President Donald Trump’s 2017 tax overhaul, which JPMorgan estimates to be $1,300 per year.”

So, I guess this means that trump is a lying liar and that Rounds, Thune and Dirty all are happy with living the lie.

I hadn’t thought about that lost revenue, Mike, from not issuing or renewing licenses of poor debtors. It’s hard to calculate any actual loss, since the report doesn’t break down how many of those suspensions resulted in debt payments and thus were lifted.

Ruh oh, more losses ahead from the trump recession and from an old adversary that’s baaaaack.

“Banking regulators in the United States on Tuesday eased trading regulations for Wall Street banks, giving them one of their biggest wins under the administration of US President Donald Trump but drawing criticism from consumer activists who warned of potential risks to taxpayers.

The Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) approved the revamped version of the so-called “Volcker Rule”, which aims to ban lenders that accept US taxpayer-insured deposits from engaging in proprietary trading.”

2008, welcome back!!

I owe South Dakota $14,980.00 which they will never get. Before, if you didn’t pay court fees a warrant was issued for your arrest. I had a arrest warrant for 12 years. They have since ended that practice of arresting you for unpaid debts and now have douche bags calling with threats if I don’t pay. Threat of arrest didn’t scare me in the past…what are going to do to me? You already took my driver license, car registration, hunting and fishing. Suck it South Dakota… (middle finger emoji)