Sales tax provides by far the single biggest chunk of South Dakota’s general fund revenues. In Fiscal Year 2018, the 4.5% we pay on our peanut butter, pants, and other purchases generated $989 million dollars, or 62% of our $1.593-billion general fund.

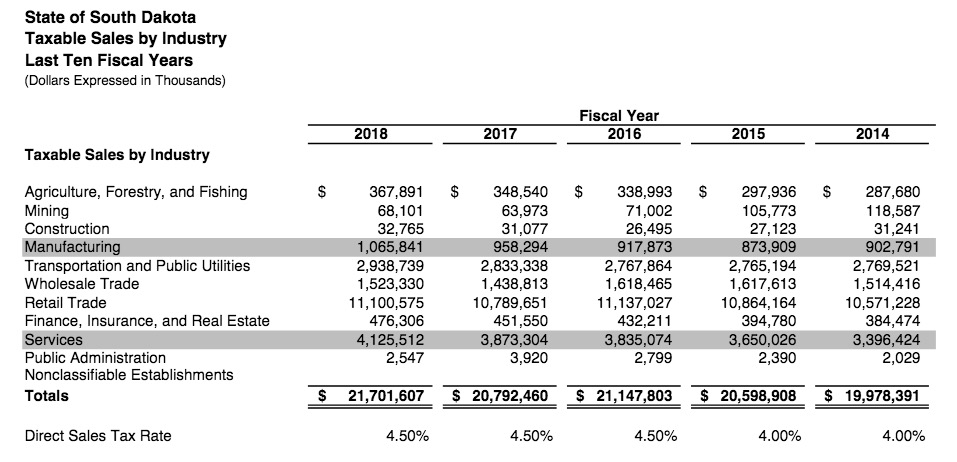

Which industries contribute the most to those sales tax revenues? According to the big, beautiful Comprehensive Annual Financial Report for FY 2018 (so much data! so many tables!), the most support for our public endeavors comes from retail, services, transportation and public utilities, wholesale, and manufacturing:

Those five sectors, the only ones with over a billion dollars in annual taxable sales last fiscal year, make up 95% of the taxable sales in this state. Our finance, insurance, and real estate sector generates 2.1% of taxable sales; agriculture, forestry, and fishing generate another 1.7%.

Our estimated sales tax exemptions in FY2018 were $1.092 billion. Divide that by the 4.5% state sales tax rate, and you get $24.3 billion in sales we chose not to tax.