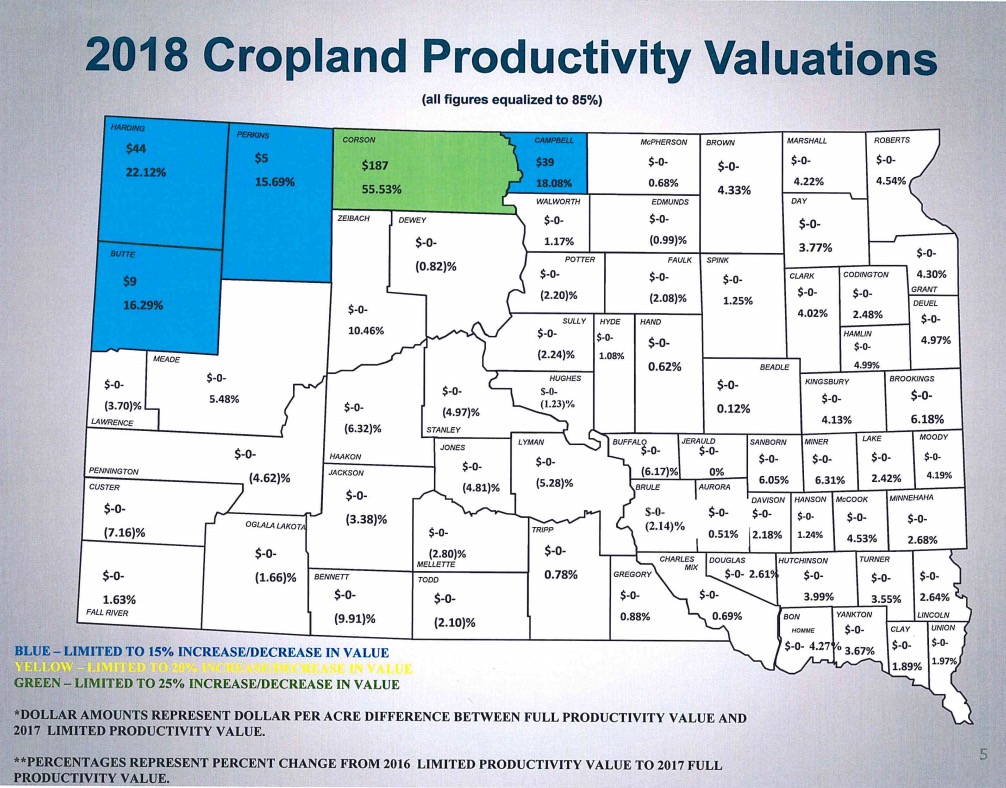

The Legislature’s Ag Land Assessment Task Force heard received a report Monday from the Department of Revenue on 2018 land assessments. That report shows that 2018 cropland productivity values are booming in northwestern South Dakota, dropping along the Missouri River and in much of the rest of West River, and showing single-digit growth on the wet side of the 100th Meridian:

Remember, we’re not taxing farmers and ranchers on what they are actually producing. We’re taxing ag producers based on South Dakota State University’s calculation of what they could make if they put their land to its highest and best use.

Is your ag land taxed that way because farmers and elevator owners can’t be trusted to tell the truth about their crop yield? It sounds like when a drug dealer is arrested and the IRS looks at his lifestyle and assesses a tax on what he probably took in, illegally.

I mean, seriously!! No agency ever came to one of my stores, looked around and said, “This is how much you could make from this location, so here’s your tax liability.” I had fellow businesspeople who paid rent by how much their gross income was per month. Prime locations were charged that way. But, the amount was based on receipts. Sure, they cheated and I’ll not justify lying to the landlord. wink wink But taxing ag land that way seems wrong. I’m probably missing something. e.g. If a farmer gets sick and doesn’t plant for a couple years does he still owe the same tax? That would be de-facto personal property tax, which I thought went away.

Mr. Lansing,

Our land is valued and taxed that way because our legislature should not be trusted to come up with a system that makes sense. They have adopted a very complex formula that includes a great many factors including value of crop production based on SDSU averages computed on a county by county basis. If a farmer has grassland they are grazing cattle on, but the land is judged as ground that could be producing a cash crop, the land is taxed based on that idea. The system is very complex but a lot of magic numbers are put into the formula to come up with valuations. We own land in eastern SD and land in central SD and see no real justification for comparison between the two. In a nut shell, we feel our taxes are fair in the eastern part of the state, but that we are highly overtaxed in central SD just based on what we can raise and what we can earn on each of the properties.

What kind of land exists in NW South Dakota? Is it paved with gold?

Thank-you, Caroline.

I’ve owned and been involved in many complex businesses. A factory making a widget is only different in that nature isn’t involved. But, your ag assessment system seems to favor the government unfairly. If it’s a bumper crop you pay what was designated to be optimum for the land and if it’s a crop failure you pay what’s optimum for the land, anyway? I would imagine a farm has to pay quarterly estimates, so the gov’t is holding enough money to pay your tax for a bumper crop and holds on to that money for the next crop if it’s a failure? I suppose there’s crop insurance income for a bad cycle.

It seems better to pay like most corporations do. Pay quarterlies or monthlies based on previous years and pay the rest when times are good. It’s not like the elevator pays you in cash and you can hide it, without a paper trail. Auditors can find tax cheats pretty easily. Caroline, if the best a farmer can say is it’s fair and other times it’s not fair, it seems it could be not so tilted to the gov’t. I’m sure I’m missing something because few groups will complain about a bad deal more than farmers. Are farmers generally unhappy with the system?

Mr. Lansing

Property taxes are payable two times a year. Production is only one factor of the formula. Other things include soils type, rainfall, and several other mysterious things. “They” refer to the “Olympic average” which is determined on a county by county basis. For geographically large counties, there should be a wide variation from one end to the other, but using the average gives some an advantage and others a big disadvantage. We need to move from property taxes to a state income tax. I could theoretically live in a small house and have several hundred thousand dollars in income but pay very little in property taxes to contribute to local government.

Thanks, Caroline. You answered another question I had which was … are these state taxes? I thought SoDak didn’t have a state income tax. Calling this tax “property tax’ when it’s a tax mostly on production is misleading. I’d say if it’s a tax on income, it’s a state or township income tax. Period!! Thanks for being so helpful.

Another thought. I can see why super corporations want to own farmland as they can fold this expense/profit into a large portfolio and get tax breaks the family farmer has been denied by these convoluted assessment valuations.

Thanks, again. Anyone else have something to add?

Mr Lansing- korporate land owners collect rather tidy sums of subsidies for being landowners. And pretty soon there won’t be any estate taxes owed on any farmland so they will make out like bandits some more. Then they will be allowed to repatriate billions from offshore accounts at less than 15% tax rate instead of the 35% they legally owe America.

If that isn’t enough goodies for them, Drumpf wants to get rid of the alternative minimum tax- the one that would have let him only pay 5 mill in taxes instead of 35 mill he paid on the tax returns he released.

I know, MFI. It seems, and why wouldn’t he exercise the selfish instinct he was taught as a boy from Dad and Roy Cohn; given the golden opportunity, Pres. Trump has only one agenda. He doesn’t care about Republicans or a wall or Obamacare. Those are just promises he has to keep to insure re-election. (Personally, I don’t see any way he can lose. Dem’s are discombobulated.) His thing is cutting his own taxes. Pure and simple. Every day he’s bogged down in the day to day protocol of the Presidency, I can see him saying to himself … “Damn, Don. Why the hell am I doing this crappy job? I don’t care about these people!!” And then he answers himself. “Because it’s going to make me more money than I’ve ever made in eight years at any job or any project, is why.” And that’s how I see our President and that’s why I say … MAOA (make America Obama again)

Caroline

Olympic average of what? Prior crop prices? The crop productivity index created by the NRCS for rheir soil survey and assigned to each soil is not based upon any measured yield data and there is no plant by date for the index number. Corey should I share my video?

Yes, Francis, share!

The Olympic average—Mercer mentions it in his report on the task force meeting. The Olympic average (eight years, drop hi and lo) is in SDCL 10-6-33.29.

Please mike from iowa explain the “tidy sums of subsidies for being landowners” that are paid on grassland?

I want to know the formula used to calculate the land value and the factors involved. Anyone know who has that? I wonder how legal it is to use 8 year old data in a current tax assessentment.

Meet the Business Owner

Precision Soil Management L.L.C. was officially formed by Jim Millar and Francis Schaffer in July 2006, and Francis began working full-time on the new company. In 2008, Jim transitioned to full-time as soil scientist for Precision Soil Management, and Garrett Rahm was added to the team to help meet the needs of an expanding customer base.

Francis- any SD county assessor has the formula. The trick is finding one who understands it well enough to explain it. Most counties, if not all, have been re evaluating the last few years. You may be paying a new higher rate and someone else in the county is still paying on an old lesser value because the assessor hasn’t gotten to that side of the county yet.

Here is a start …

Property Valuation for Agricultural Land Assessments in South Dakota:

http://dor.sd.gov/Taxes/Property_Taxes/Productivity_Valuation_for_Agricultural_Land_Assessments.aspx