But No Statewide Depression Yet?

The Black Hills Knowledge Network notices new Bureau of Economic Analysis data that show personal income in South Dakota grew $480 million last year. If we had spent every penny of that additional income on taxable goods, that would have generated $19.2 million in additional sales tax revenue under the old 4% state sales tax (not counting the new half-penny passed last year for teacher pay). The state budget passed in March 2016 assumed we’d see those revenues increase by $33 million.

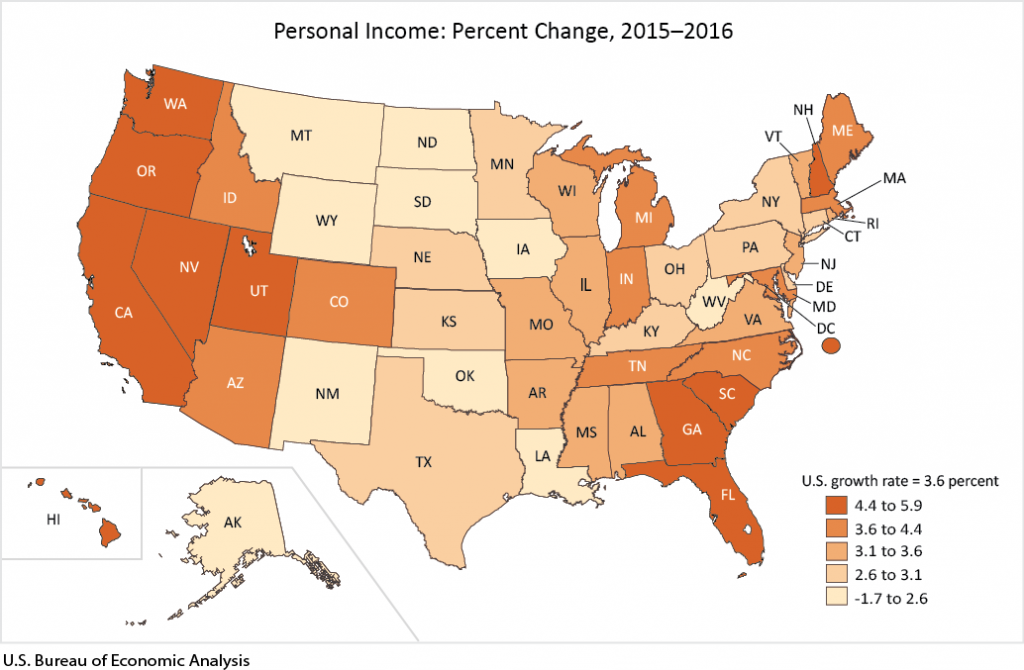

That new $480 million—about $565 per South Dakotan—translates into 1.2% growth in personal income. That puts us 45th in the nation: West Virginia and Oklahoma saw weaker increases, while folks in Alaska, North Dakota, and Wyoming (think oil) actually made less money in 2016 than in 2015.

Nationally, personal income grew in 2016 by 3.6%. Personal income grew most in Nevada (5.9%), Utah (5.6%), Florida (4.9%), Washington and Georgia (4.8%), New Hampshire (4.7%), and Oregon, California, Hawaii, and the District of Columbia (4.5%)

Killing South Dakota’s growth was farm income. Absent the farm income drop, and without trying to get creative and figure out all the spillover effects of the farm economy, South Dakota would have seen net earnings grow 3.27 percentage points.

| Contributions of Earnings to Percent Change in Personal Income by Industry, percentage points, US and Plains Region, 2015 to 2016 | ||||||||

| State | US | SD | ND | MN | IA | NE | KS | MO |

| Total Earnings | 2.91 | 0.70 | -3.05 | 2.77 | 1.66 | 2.18 | 1.93 | 3.06 |

| Farm | -0.07 | -2.57 | 0.43 | -0.33 | -0.95 | -0.36 | 0.28 | 0.13 |

| Forestry, fishing, related activities | 0.02 | 0.05 | 0.05 | 0.01 | 0.03 | 0.03 | 0.04 | 0.02 |

| Mining, quarrying, oil & gas extraction | -0.15 | -0.01 | -2.17 | -0.03 | 0.01 | -0.01 | -0.20 | 0.00 |

| Utilities | 0.02 | 0.04 | 0.04 | 0.03 | 0.00 | 0.02 | 0.03 | 0.03 |

| Construction | 0.30 | 0.49 | -0.59 | 0.16 | 0.50 | 0.37 | 0.12 | 0.30 |

| Durable goods | 0.12 | 0.04 | -0.07 | 0.10 | 0.01 | 0.01 | 0.02 | 0.13 |

| Non-durable goods | 0.06 | 0.13 | 0.02 | 0.11 | 0.19 | 0.17 | 0.20 | 0.05 |

| Wholesale trade | 0.07 | 0.12 | -0.51 | 0.03 | 0.06 | 0.08 | 0.06 | 0.10 |

| Retail trade | 0.16 | 0.20 | -0.11 | 0.18 | 0.18 | 0.22 | 0.15 | 0.18 |

| Transportation, warehousing | 0.11 | 0.03 | -0.89 | 0.16 | 0.02 | -0.13 | 0.06 | 0.07 |

| Information | 0.16 | 0.04 | 0.09 | -0.02 | -0.07 | 0.16 | 0.02 | 0.03 |

| Finance and insurance | 0.22 | 0.33 | 0.15 | 0.00 | 0.27 | 0.26 | 0.22 | 0.24 |

| Real estate, rental, leaasing | 0.09 | 0.05 | -0.10 | -0.18 | 0.04 | 0.09 | 0.11 | 0.06 |

| Professional scientific, technical services | 0.37 | 0.18 | -0.10 | 0.96 | 0.25 | 0.13 | 0.37 | 0.38 |

| Management of companies/enterprises | 0.07 | 0.11 | -0.05 | 0.09 | 0.04 | -0.09 | -0.23 | 0.15 |

| Administrative and waste management services | 0.15 | 0.04 | 0.02 | 0.17 | 0.05 | 0.17 | 0.06 | 0.15 |

| Educational services | 0.05 | 0.00 | 0.02 | 0.04 | 0.10 | 0.02 | -0.01 | 0.03 |

| Health care and social assistance | 0.48 | 0.67 | 0.32 | 0.63 | 0.31 | 0.52 | 0.24 | 0.45 |

| Arts, entertainment, recreation | 0.04 | 0.00 | 0.01 | 0.03 | 0.03 | 0.01 | 0.01 | 0.06 |

| Accommodation, food services | 0.15 | 0.13 | -0.04 | 0.12 | 0.10 | 0.13 | 0.09 | 0.12 |

| Other services (except public admin) | 0.12 | 0.10 | -0.02 | 0.09 | 0.12 | 0.09 | 0.08 | 0.14 |

| Civilian federal gov’t | 0.09 | 0.11 | 0.11 | 0.05 | 0.05 | 0.06 | 0.06 | 0.11 |

| Military | 0.01 | 0.03 | 0.04 | 0.00 | 0.01 | 0.02 | -0.05 | 0.00 |

| State and local gov’t | 0.26 | 0.39 | 0.29 | 0.38 | 0.33 | 0.22 | 0.18 | 0.11 |

South Dakota was hit harder by the farm bust than North Dakota, Wyoming, and Alaska were hit by the oil bust. Farm earnings declined 13.23% nationwide, but in South Dakota, they dropped 56.95%. Only Montana (–70.93%) and Wyoming (–64.59%) got beat up worse on farm earnings. North Dakotans actually made 46.50% more at farming than they did in 2015, and Nebraska managed to lose only 6.71%.

Strangely, while our farm earnings did even worse than national and regional averages, South Dakota’s other industries often kept up or outperformed their counterparts in other states.

| Earnings Growth Rates by Industry, percentage points, US and Plains Region, 2015 to 2016 | ||||||||

| State | US | SD | ND | MN | IA | NE | KS | MO |

| Total Earnings | 4.06 | 0.97 | -3.93 | 3.69 | 2.30 | 2.87 | 2.67 | 4.22 |

| Farm | -13.23 | -56.95 | 46.50 | -25.26 | -22.89 | -6.71 | 15.62 | 48.01 |

| Forestry, fishing, related activities | 9.13 | 10.22 | 11.09 | 7.86 | 7.06 | 8.92 | 11.14 | 10.23 |

| Mining, quarrying, oil & gas extraction | -13.60 | -5.77 | -29.86 | -11.33 | 5.01 | -6.08 | -12.06 | -1.41 |

| Utilities | 4.39 | 6.31 | 3.48 | 4.89 | -0.14 | 3.03 | 4.52 | 4.57 |

| Construction | 7.28 | 10.10 | -7.14 | 3.56 | 9.75 | 7.60 | 3.07 | 7.38 |

| Durable goods | 2.85 | 0.97 | -2.44 | 1.64 | 0.18 | 0.31 | 0.41 | 2.75 |

| Non-durable goods | 2.56 | 3.29 | 1.28 | 3.18 | 3.57 | 3.94 | 4.65 | 1.59 |

| Wholesale trade | 1.88 | 3.07 | -9.43 | 0.54 | 1.52 | 1.82 | 1.51 | 2.36 |

| Retail trade | 3.65 | 3.73 | -2.22 | 4.43 | 4.39 | 5.31 | 3.89 | 4.08 |

| Transportation, warehousing | 4.45 | 1.56 | -16.39 | 6.79 | 0.64 | -1.96 | 2.33 | 2.54 |

| Information | 6.63 | 3.06 | 7.97 | -0.86 | -5.54 | 11.07 | 1.42 | 1.59 |

| Finance and insurance | 4.59 | 5.51 | 4.63 | -0.07 | 4.48 | 5.12 | 5.22 | 4.99 |

| Real estate, rental, leaasing | 5.28 | 4.18 | -4.55 | -11.86 | 3.55 | 8.42 | 5.66 | 4.56 |

| Professional scientific, technical services | 5.10 | 5.76 | -2.77 | 14.98 | 7.60 | 3.03 | 7.30 | 6.07 |

| Management of companies/enterprises | 3.55 | 8.44 | -3.86 | 2.23 | 3.10 | -3.33 | -9.45 | 4.93 |

| Administrative and waste management services | 5.04 | 3.22 | 1.34 | 7.07 | 2.53 | 6.70 | 2.25 | 5.55 |

| Educational services | 4.11 | -0.03 | 5.82 | 3.79 | 10.72 | 1.85 | -1.86 | 2.40 |

| Health care and social assistance | 6.15 | 6.84 | 3.81 | 6.65 | 4.30 | 6.55 | 3.09 | 5.12 |

| Arts, entertainment, recreation | 5.32 | 0.25 | 2.78 | 4.07 | 6.68 | 3.13 | 3.01 | 5.79 |

| Accommodation, food services | 6.38 | 5.58 | -2.08 | 6.83 | 5.58 | 7.43 | 4.72 | 5.36 |

| Other services (except public admin) | 4.40 | 3.94 | -0.82 | 3.43 | 4.86 | 3.47 | 3.68 | 4.92 |

| Civilian federal gov’t | 4.35 | 4.39 | 5.85 | 4.16 | 4.26 | 3.54 | 3.60 | 5.09 |

| Military | 1.61 | 2.84 | 2.60 | 1.71 | 2.72 | 2.44 | -2.37 | 0.66 |

| State and local gov’t | 2.85 | 4.79 | 3.32 | 4.44 | 3.30 | 2.30 | 2.05 | 1.31 |

Excluding farming, South Dakota’s net earnings grew faster than the national rate in 23 industries. Taking a sloppy average of the growth rates shown for the six other BEA Plains region states above, I find that South Dakota’s net earnings grew faster than the rest of the region in 18 of 23 industries. We lagged other Plains states’ net earnings growth rates in professional, scientific, and technical services; administrative and waste management services; educational services; arts, entertainment, and recreation; and civilian federal employment. Despite our abysmal farm income figures, we saw more earnings growth than the rest of the Plains in durable and non-durable goods manufacturing, wholesale and retail sales, and construction, areas this amateur economist would speculate would be hit hard by a bum farm economy.

Farmers making less than half of what they did in a rotten preceding year (make that years, plural, and no good years in sight) is bad all by itself for those farmers, the state economy, and the state budget. But I’m surprised to see the unusual size of the farm depression in South Dakota compared to other states, and I’m surprised not to see that farm depression spilling over more clearly into more areas of South Dakota’s economy.

Take DAPL out of iowa and it wuz prolly a dismal year.

I do not mean for this to begin a stone throwing session at farmers, but given the complexity of taxation, isn’t there a big difference between agriculture “earnings” and farm “income?” Farmers use the tax code to reduce “income” by purchasing equipment/seed/fuel . . ., so doesn’t much of the individual’s “income” stay stable except in the most dire years? Is there also a distinction between individual income and corporate income if the farm is a corporation? The effect seems to be on “earnings” which seems to be a measure of not only income but associated spending.

Again, I am in NO way saying or implying that farmers are doing anything wrong, I just ask if all this makes looking at and comparing the economics of income difficult (or impossible).

Two Comments:

Why our ag income drop is greater relative to others: My guess is likely related to product mix in both crops and livestock. Small grain prices (e.g. wheat, oats, etc.) are down more than other crops (corn, beans, etc.) and cattle/hog prices are down more than poultry/dairy.

Why we haven’t seen the spill-over into the rest of the economy: My guess is two-fold:

1) Net Cash Income (vs Net Farm Income) is stronger because farmers are selling off of inventory in storage. Because the lower net farm income has been happening for almost four years because of reduced exports these last four years, farmers will soon be running out of this cash cushion so it isn’t sustainable. I’d be interested to see statistics on the change in storage inventory in SD over the past four years.

2) Sioux Falls related industries are doing well, tourism is doing well, and the housing starts nation-wide have been good for the timber industry. All of these are unrelated to agriculture and thus to some degree counter-balance our agriculture dependence.

P.S. O, you are correct with regard to timing. Net Cash Income is obviously computed on a cash basis which includes sale of inventory from prior year’s production. Net Farm Income is computed on an accrual basis which computes the income generated from that year’s production whether sold or stored.

Well, you are right, Troy, on our mix. Cattle prices have taken a major hit while grains are down hard as well. That pretty much describes agriculture in South Dakota. The thing that has really amazed me is how so many of our so called learned leaders can’t seem to figure out why sales tax revenues are way down. All you have to do is stop farmers buying the big ticket items they need to be in this business and you are guaranteeing a big hit. As of now its looking really bleak for the future and if you think we are getting big subsidies to tide us over you are mistaken. Not far from land foreclosures for unpaid property taxes either.

I dread getting into the accounting details, but Troy, is that difference accounting unique to farming? On O’s thought, can other industries take advantage of timing their purchases?

On spill-over and selling off inventory: would South Dakota farmers be selling off inventory at greater rates than farmers in other states? Remember, the way I read these numbers, we’re not just not seeing spillover; we’re seeing South Dakota earnings growth rates outpace national and regional averages in several areas.

Ditto product mix: how different has South Dakota’s product mix been in the last few years from the product mix in other states? Did we somehow pick a uniquely bad product mix, then engage in unique compensatory measures like selling off inventory to drive other industries’ earnings to higher growth rates than other farm states saw?

Accounting unique to farming? Kinda in that agriculture has a higher percentage of use of cash vs. accrual as compared to most businesses. Both do so for good reasons and are likely to continue. You just can’t flip back and forth and over time they will equal.

Selling off at greater rates: Probably only because of higher drop in net farm income relative to others. It is why they use cash accounting (even out income year-to-year.

Earnings growth rates outpacing nation: The factors which impact other major sectors of our economy (mining, timber, tourism, Sioux Falls industries, manufacturing) are impacted by different factors than what is effecting Ag and this independence is good for us. True principle of economic diversification.

SD has for my entire life been heavy in small grains and cattle relative to neighboring states. Sometimes the difference works in our favor but now it is not. Evens out over time.

Last question: No. Especially with agriculture, you not only don’t react to quarterly swings but often annual swings can be misleading.

Regarding Clydes comment on why sales taxes are down: While that is a factor, it is only a small factor (10-15% depending on assumptions of tertiary sales) as evidenced by the reality on sales taxes in Sioux Falls. A bigger factor (degree I don’t know) is the recent acceleration of decline in personal debt (debt payments divert dollars from taxable items). It is largermthan what I would guess would occur with the prospects of higher interest rates and it seems oddly concentrated here.

It is unfortunate that the agriculture economy is in the crapper right now but it wasn’t a suprise to most people. While some people are quick to point out that commodity prices drive the states ag economy, they most likely are missing the real causes of the current problem.

The only reason the people in ag have been able to make ends meet is their efficency. Bigger machines, better chemicals., no till and the list goes on. While prices do go up and down, they average out to be about the same as the seventies. That means the sames prices being paid with a dollar that buys 1/7th what it did back then.

For all this time there have been warning signals, the farmers knew it, and the ranchers knew it, or should have. The bankers knew it but continued to make operating loans in spite of it. Lets cut to the chase, its about the cost of using ag ground.

For the most part, ag was shot in the foot by bankers that encouraged debt. A good part of that debt was through the purchase of or the leasing of ground. While the banks were not allowed by law to deal in real estate, that doesnt mean they didnt deal in land. At this time the banks hold more paper on ag land in SD then at any time in our history. That all looked great when land prices went up by leeps and bounds, but now the day of recconing has come. Ag productivity has about reached the efficiency that it is capable of. Here is where the problem is.

While comodity prices remain the same, the price of ag land didn’t. Clear back in 2000 we set down and figured out how much money could change hands running other peoples cattle. At that time the top price should have been $24 a unit, cow calf for a month. But it wasn’t. It would have averaged out to about $28 and the banks continued to give operating loans knowing that the only way ag could turn a profit was through slight of hand, subsidies, and insurance.

And now here we are. Land with value that is way way over valued for what it is being sold for. A correction is coming folks. When banks start to worry about defaults on ag loans the purse strings will tighten and it will again mean fewer people in agriculture then today. It wont be as easy as it was at one time. I saw big, huge farmers and ranchers that had federally backed loans forgiven for the amount that it would take to buy more ground because they no longer carried that debt. I was at a farm sale south of Wamblee some thirty years ago when a man came driving up. He was looking for a neighbor, and I found him. There were papers signed five minutes before the land sold. The neighbor bought that land with money he didnt spend to pay an agreed opon debt.

It would be hard for that kind of thing to happen today, loans dont just disappear any more. Those cow calf units that couldnt turn a profit at $24 back in 2000, pale in comparison to over $40 today. Meanwhile ground prices and taxes went up driven not by more productivity, but just plain old hopes and dreams, nothing else.

How are those 20% teriffs looking right about now? If it happens it is my opinion that we will loose 20% of the people in ag right now. When ag land values begin to correct, some will have to eat a bunch of debt, who do you think that will be?

The Blindman

Blindman, that is about as accurate of a description of ag land and those who utilize that I have seen. As Cory noted with a meeting in Aberdeen with some smart ass producers saying more or less, when do we sign up to be Democrats. These guys that will have lost it all to the nothingness of Thune, NOem, Rounds and Daugaard will be the new Tom Berry Democrats. They will start to look at the nothingness that the west river republicans have provided and ask themselves how they believed in all the crap that was being shoveled to them. As you note, the day of reckoning has already been achieved, we are all just waiting for the announcement on who will bail us out. Sure will not be the putin trump regime, maybe China again, who knows. Maybe we just load up and move to California like the Depression days. We will all be Tom Joad’s driven from the land by the drought of poor judgement as was the case of the 30’s.

Bill D, excellent commentary. What will that correction look like? Will land lose value? Will farmers end up upside down just homeowners in 2008? I assume that an ag land correction would hammer South Dakota’s economy far harder than did the 2008 recession… but what will happen nationally? Will the rest of the U.S. notice?

Mixed signals: an Ohio farmer says agriculture is on the cusp of a depression like the 1980s, but the Environmental Working Group’s Anna Weir says farmers’ economic situation isn’t so bad:

However…

Is the market failing to support an industry that provides a basic life essential?

CAH,

Regarding your last question, huh? Just a few years ago, you were clamoring for a decrease in federal support because farmers were making too much money.

1) As Bill D said, the cost of this “basic life essential” has gotten cheaper because the producers have gotten better at producing food. Granted Bill thought it was a bad thing because per unit prices haven’t gone up. But, I remember when a desktop computer less powerful than my phone cost $2,000. Now I get a computer 10X more powerful for less money. Industries which are becoming more efficient and providing product cheaper are good things, not bad.

2) Debt levels are near historic lows. Even with the decline in income, debt service coverage ratios are not alarming.

3) The underlying asset (land) is retaining its value because debt service coverage ratios are manageable. The assertion there is a major correction coming is not supported by a single piece of credible evidence.

4) We are producing more food than ever and, despite a growing world population, we have closed the gap on world hunger.

When you look at the above items, the assertion this is an industry in trouble is ludicrous.

Well, Troy, if farmers are making enough money, then no, they shouldn’t have subsidies. If farmers aren’t making enough money to make it worth staying in the business of producing food, then we might need to intervene. I take no absolute position on farm subsidies, yea or nay. I’m just responding to what Bill D and a variety of commenters and experts have said and trying to figure out where the market stands. If you are right, if the ag industry is plenty wealthy, then sure, drop the subsidies, crop insurance and all. Let them live or die by the market.

But I remain uneasy that the market appears to be leading us to monopoly, especially in production of a basic product essential to life. We may not need subsidies, but we may need some trust-busting. (One way or the other, Troy, I will have my socialism, and you will like it! :-D )

To make a farming ranching enterprise work, there has to be at least two incomes for a cash flow. “Most farmers depend on off-farm income,” Weir said, pointing to USDA data showing that despite declines in farm incomes, farm households are expected to earn more this year, thanks to money from other jobs, such as those held by farmers’ spouses”. So given what we know, the family farm and ranch is just an extension of the bankers whims. When the banks fail, as they did in 2008, taxpayers will be forced to bail out the banks with farmers and ranchers getting the same as they are connected. To Troy’s dismay towards Cory’s Socialism observations, Cory is correct. Farming and ranching is as close to absolute socialism as it gets, and even needs further help to withstand the storms coming.

There is some good news in that though as well. Ag spouses can get a better future with their Social Security by working off the farm/ranch. The ag business tends to write off too much to keep from paying taxes and this hurts both of them when it comes time to hang up the hoe. The wives need this income as it is the only thing they may have to survive when the time comes for them to go to the Medicaid provided nursing homes. Stop on into one of those places sometime and you can see for yourself how many are there on Medicaid and how many will be on the street when the socialist program fails thanks to NOem, Thune, Rounds and especially Daugaard. Medicaid keeps the nursing homes doors open for all.

Socialism is a much needed solution to grant an industry that sees itself dependent upon federal assistance. This industry does not only need a hand up, it needs a hand out to continue to supply the food we all need. In order for both to survive, they must be regulated much like the farming ranching operations in Europe. That would include leaving much of the lands in fallow for clean water drainage to go along with range management. More government? Better government solutions.

Two thoughts:

1. I have a bunch of bananas on my counter. A sticker on the bananas says Honduras. I also have a package of hamburger without a country of origin label. Does no one see the problem here?

2. I am a firm believer in government farm programs for many reasons. But on my crazy days when I start thinking about conspiracy theories I wonder if those subsidies are more about keeping a supply of grain available for

the grain marketing giants to play with. Does anyone remember when hogs got to 8 cents? Many smaller hog farmers were broken! The government stepped in to save the day by buying excess supplies from the packers for 50 cents and then pushed the pork into the school lunch programs. The hog farmer was still broke, but the packer was in high cotton. Now packers own most hogs from birth to slaughter. Where are the anti-trust people???

People want to see stickers on bananas because nobody wants bananas from Iowa or Oklahoma. I expect if they start labeling meat loaf with country or state labels they will need to pass a law that says 50% or 85% american beef or else people will mix the cheap Chilean beef in to water down the american beef.